Section

Economy

4455 posts

Northern Trust: Global Economic Outlook January 2018

by Carl R. Tannenbaum, Ryan James Boyle, Brian Liebovich, Vaibhav Tandon, Northern Trust My children were home during…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

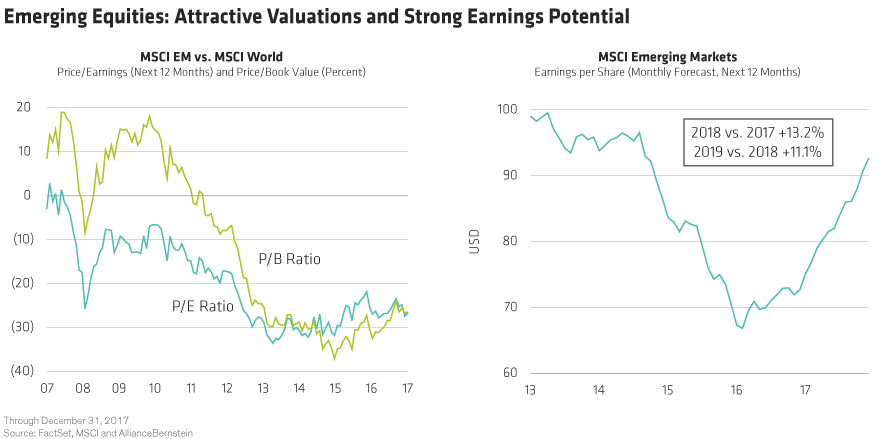

Five Reasons to Invest in Emerging Equities in 2018 - Context

by Equities, AllianceBernstein Emerging-market (EM) equities posted a strong recovery in 2017 after several tough years. But it’s…

Emerging-Market Debt in 2018: The View from Here

by Fixed Income AllianceBernstein Emerging-market bonds delivered strong returns last year, and we think the sector has more…

Better Than A Benchmark: Grassroots Research - Context

by Equities, AllianceBernstein Transcript: Unlike benchmarks, we think trends are forward-looking. And we think that if you’re looking…

'Twas The Week Before Christmas 2017

by Doug Drabik, Fixed Income, Raymond James Twas the week before Christmas, when all through the market Congress…

Is US Tax Reform Good for Stocks? - Context

by Equities, AllianceBernstein Equity investors appear to have voted in favor of US tax reform. But the optimism…

What Happened to Inflation? And What If It Comes Back?

What Happened to Inflation? And What Happens if it Comes Back? by Ben Inker, GMO LLC A year…

Fed Policy for 2018? If It Isn’t Broken ...

by Eric Winograd, Senior Economist—United States, Fixed Income AllianceBernstein With the US economy humming and the Fed seemingly pushing…

Fed maintains a slow and steady approach

Fed maintains a slow and steady approach by Brian Schneider, Senior Portfolio Manager, Head of North America Rates, Invesco…

Fed Stays on Right Hiking Path

by Brian Wesbury and Robert Stein, First Trust Portfolios LP The Federal Reserve did what just about…

Why I’m not worried about the Federal Reserve

The Federal Open Market Committee (the Fed) is set to convene its final meeting for 2017. It promises to be the event the markets have been waiting for since 2008.

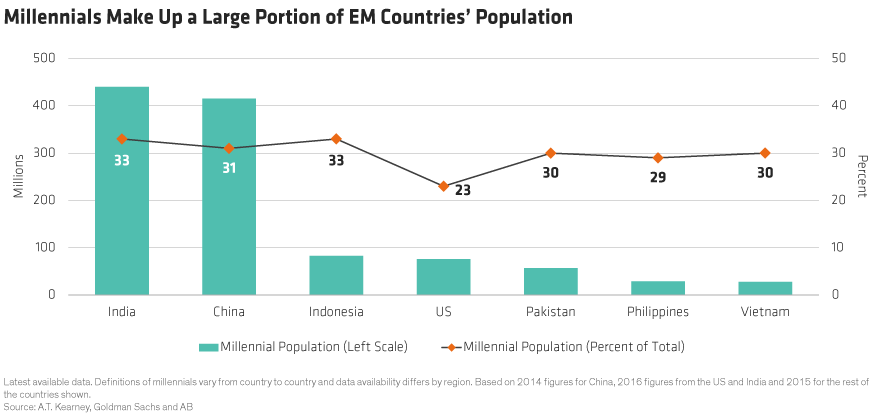

Investing in the Emerging Millennial Boom - Context

by Equities, AllianceBernstein Millennials are becoming a powerful force in emerging markets (EM). Understanding the social and consumer…

What Should Europe’s Bond Investors Be Watching in 2018?

What Should Europe’s Bond Investors Be Watching in 2018? by Markus Peters, Flavio Carpenzano, Fixed Income AllianceBernstein This…

Jurrien Timmer: Minus Inflation and Leverage, A Bear Market Doesn't Add Up

DECEMBER 2017 Minus Inflation and Leverage, a Bear Market Doesn’t Add Up Inflation and leverage are key drivers…

What’s the EM Story? It’s All About Growth - Context

by Equities, AllianceBernstein Transcript: We’ve had, finally, after many years, an acceleration in earnings growth, far faster than…