by Carl R. Tannenbaum, Ryan James Boyle, Brian Liebovich, Vaibhav Tandon, Northern Trust

My children were home during the holiday season. It was wonderful to see them all, but the house was chaotic. There was eating at all hours in all places; clean and dirty clothes were commingled on the floor; and charging cords stretched across key walkways, waiting to trip unsuspecting passers-by.

To derive some tangible benefit from the presence of the next generation, I appealed to my son to help with some heavy lifting, citing his relative youth. “C’mon dad,” he replied. “Age is just a number.” I get that 50 is the new 40 and 60 is the new 50. But that doesn’t mean that age doesn’t introduce limitations.

As it is for people, so it is for business cycles, which can become more vulnerable as they continue. This theory will certainly be tested in 2018. The global economy enters this year with considerable momentum and lots of policy support. The latest boost will come from U.S. tax reform, which will act as a substantial fiscal stimulus.

The question is whether the world-wide expansion, soon to enter its tenth year, can avoid natural limitations. We think so, but the following risks will demand close monitoring.

-

- Inflation may emerge from hibernation. Growth across developed markets is in excess of long-run potential, which could stress the availability and cost of productive resources. Low levels of unemployment in the world’s largest markets may lead wage growth to break out of the range that has bound it for five years. If that occurs, central banks may have to remove accommodation more aggressively than they would prefer.

-

- Economic nationalism could restrain trade. Leaders in many countries are seeking to put their citizens first, a posture that can involve protectionism. Negotiations involving Brexit and the North American Free Trade Agreement promise to be difficult; trade friction between China and the United States is rising. Any curtailment of global exchanges would have substantial consequences for all participants.

-

- Debt may become a limitation. Borrowing has been reduced in some sectors and countries since 2008, but has continued to increase in others. Household debt in Canada and Australia is uncomfortably high, China is seeking to better control provincial and financial leverage and government debt in many nations has risen substantially during the last decade. Investor appetite for debt has been strong, but may not remain that way.

-

- Geopolitical risks are legion. The Middle East remains volatile, ethnic and religious tension is elevated in many regions, North Korea is armed for provocation and challenging European elections are on the calendar. The potential for “event risk” is higher than normal.

The following are our views on how key markets are positioned as we enter the New Year.

United States: Adding Fuel to the Fire

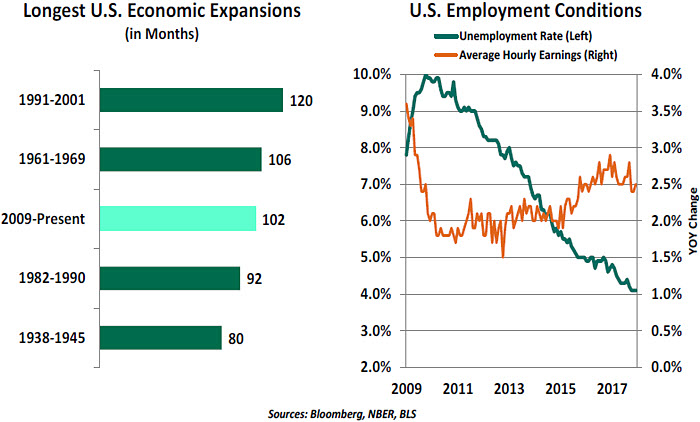

The U.S. economy is enjoying a prolonged recovery. Now in our ninth year of expansion, the natural end of this cycle might normally be in sight. However, there are two primary reasons to expect another year of growth. First, this recovery cycle started with slow growth from a massive recession. Key indicators like unemployment and median household income took six years to return to levels seen prior to the Great Recession. The slow start to this cycle gives us reason to believe it can expand for a longer-than-average interval without becoming overheated.

Secondly, 2017 ended with a surprise stimulus in the form of tax code changes. We expect the tax reform to make its impact by stimulating business investment and prompting heightened distributions to shareholders. Business investment was already starting to show recovery in 2017, and the tax bill offers additional incentive for businesses to make capital

Secondly, 2017 ended with a surprise stimulus in the form of tax code changes. We expect the tax reform to make its impact by stimulating business investment and prompting heightened distributions to shareholders. Business investment was already starting to show recovery in 2017, and the tax bill offers additional incentive for businesses to make capital

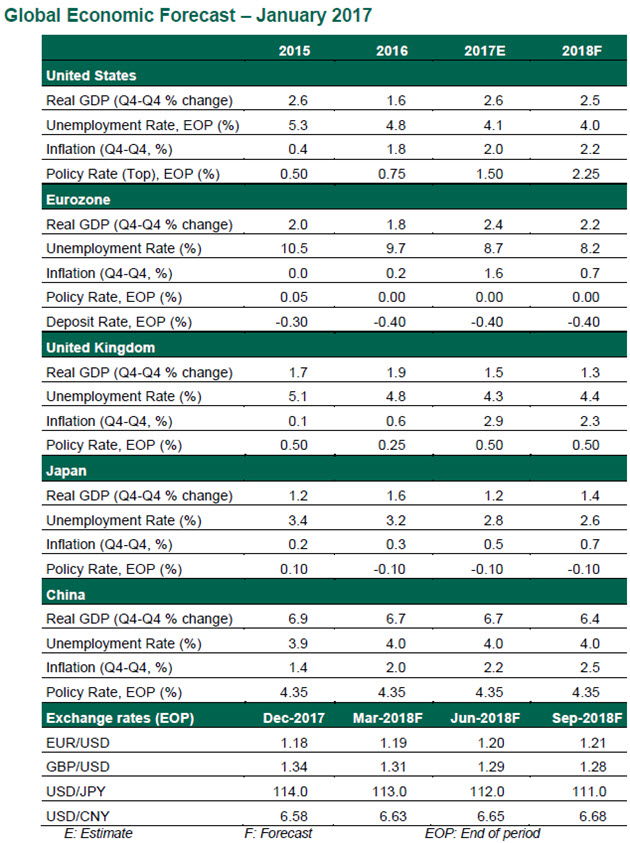

expenditures this year. This, plus the boost to consumption from strong hiring, wealth creation, and tax relief, should lead U.S. gross domestic product (GDP) upward by 2.5% on a fourth quarter to fourth quarter basis. We expect inflation to grow modestly, with prices rising around 2.2% this year.

The Federal Reserve will raise rates in pace with any signs of inflation. We expect the range for overnight rates to increase three more times, ending the year with an upper boundary of 2.25%.

Employment gains in the U.S. have been great news for the past few years. We do not believe there is much slack left to decrease the rate further from its current level of 4.1%, nor do we foresee any shocks that will increase it. We predict we will end the year at 4.0% unemployment. The dollar is expected to remain fairly stable against other world currencies.

Eurozone: In a Sweet Spot

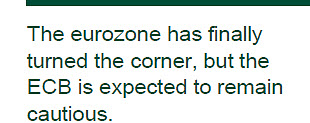

The eurozone performed quite well last year as political risks failed to materialize. We expect the growth momentum to continue through 2018. Domestic demand is strong, bank lending to firms is picking up and business surveys are scaling new heights. Real GDP in the common currency region is forecast to grow by 2.4% in 2017 and 2.2% in 2018.

Inflation in the eurozone remains well below the central bank’s target. Price gains may decelerate slightly through early 2018 due to technical factors (negative energy and food base effects) before starting to recover again in the middle of the year. Wage pressures are likely to remain subdued due to remaining labor market slack; though we predict the unemployment rate will decline to 8.2% by year-end, it won’t be enough to revive the Phillips curve. Overall, we expect inflation to average 1.4% in 2018.

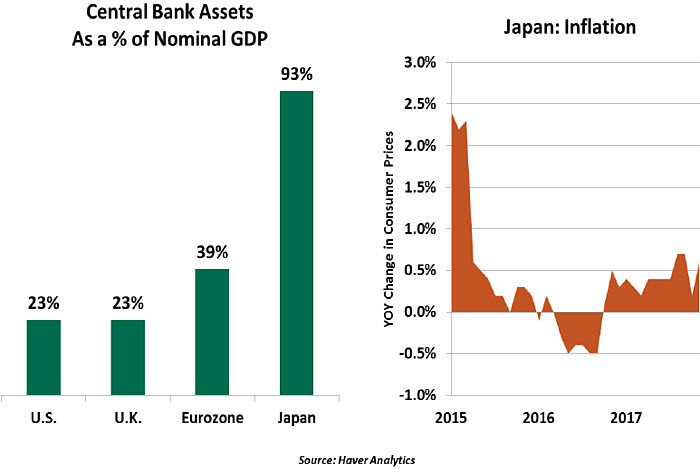

On the monetary policy side, the European Central Bank (ECB) is expected to continue with asset purchases through the third quarter of 2018. A weak inflation outlook despite strong economic growth will mean that the ECB will remain cautious. The central bank would also like to see performance between countries become more even. We do not expect the ECB to raise interest rates this year, although dissent within the governing council could increase.

On the monetary policy side, the European Central Bank (ECB) is expected to continue with asset purchases through the third quarter of 2018. A weak inflation outlook despite strong economic growth will mean that the ECB will remain cautious. The central bank would also like to see performance between countries become more even. We do not expect the ECB to raise interest rates this year, although dissent within the governing council could increase.

In terms of risks, political uncertainty in the eurozone has certainly diminished but has not disappeared. Italian elections are due in the first portion of the year and Spain is enduring ongoing political tensions. Germany is still working to form a governing coalition and the European Union (EU) has work to do to keep certain members in line. Nevertheless, the economic momentum in the eurozone seems secure.

United Kingdom: Bucking the Trend

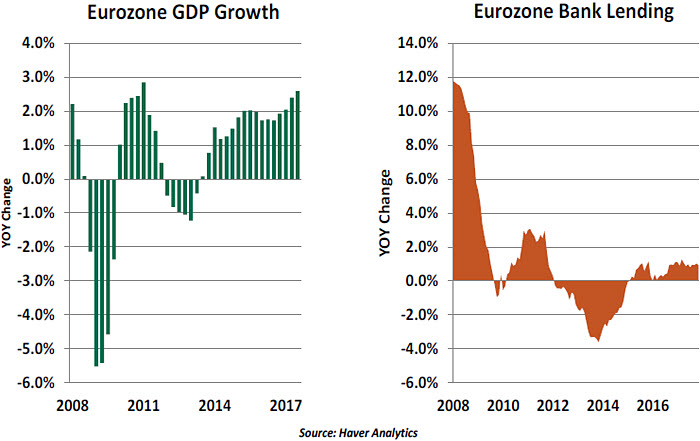

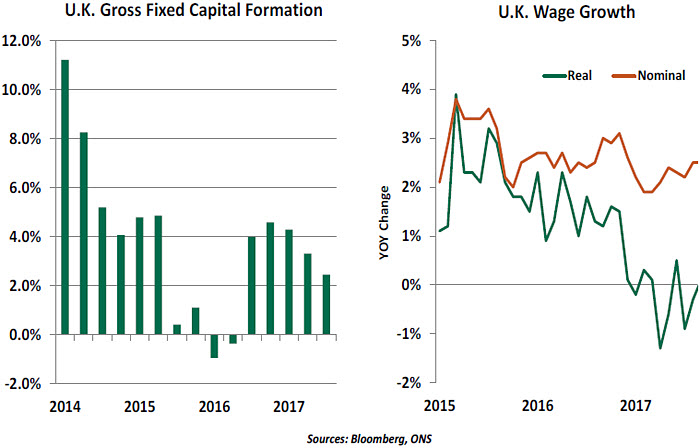

Brexit-related uncertainty is weighing on the U.K. economy. Real growth in Britain was only about 1.5% in 2017,its lowest level since 2012. Inflation is reducing purchasing power, and businesses seem to be holding back investments as negotiations continue. Some progress was achieved at the end of last year with agreement on separation payments and the rights of EU workers in the United Kingdom. But the next phase of discussions, which will surround the terms of trade between the participants, promises to be very challenging.

Looking ahead, we do not expect a “hard” Brexit; instead we see a “soft” Brexit that preserves substantial commerce between the U.K. and the EU. Although EU members may want to send a signal to discourage any further departures, we believe it’s to the EU’s advantage to maintain good relations with the U.K. The risk of corporate and worker flight from Britain will be respected.

There are certainly risks to the achievement of this outcome, not the least of which is the political instability that has plagued Theresa May and her Tory leadership team. If elections have to be called this year, the prospect of regime change could introduce immense uncertainty.

There are certainly risks to the achievement of this outcome, not the least of which is the political instability that has plagued Theresa May and her Tory leadership team. If elections have to be called this year, the prospect of regime change could introduce immense uncertainty.

Against this backdrop, we expect U.K. GDP growth to remain sluggish at 1.3% in 2018, thus bucking the stronger global growth trend. We are also of the view that inflation has peaked already and is expected to cool down to 2.3% in 2018, thereby improving consumer purchasing power. Weak economic activity, lower inflation and uncertainty around Brexit negotiations will lead to the Bank of England keeping policy rates unchanged throughout 2018, thereby driving the sterling lower.

Japan: Abenomics Onward

The Japanese economy performed better than expected in 2017, aided by stronger exports and associated increases in business investment. Stimulus measures boosted corporate profits and business sentiment to an 11-year high. Looking ahead, we expect fiscal and monetary policies to provide a much-needed impetus to domestic demand and lead the Japanese economy to expand by 1.4% in 2018. Preparations for the 2020 summer Olympic Games in Tokyo will bolster GDP.

Higher oil prices and recent weakening of the yen should underpin inflation over the coming months. However, sluggish wage growth despite tightening labor markets (owing to structural challenges such as ageing and declining population) means inflation will pick up only modestly to 0.7% this year. The consumption tax hike to 10%, originally scheduled for October 2015 and then deferred to April 2017, could have provided a welcome boost to inflation, but has been further rescheduled to October 2019 over concerns that raising the tax might derail the economy.

As inflation continues to fall far from the 2% target, the Bank of Japan is expected to maintain its benchmark policy rate at -0.1% and its yield control target of “around 0%” on 10-year government bond yields. The latter could be a challenging task amid rising global yields.

As inflation continues to fall far from the 2% target, the Bank of Japan is expected to maintain its benchmark policy rate at -0.1% and its yield control target of “around 0%” on 10-year government bond yields. The latter could be a challenging task amid rising global yields.

In our view, more needs to be delivered in terms of structural reforms (also referred to as the third arrow of “Abenomics”) to achieve sustainable longer-term growth with an inflation rate of close to 2%. Watch for a renewed commitment to these alterations to economic functioning.

China: Strength for Length

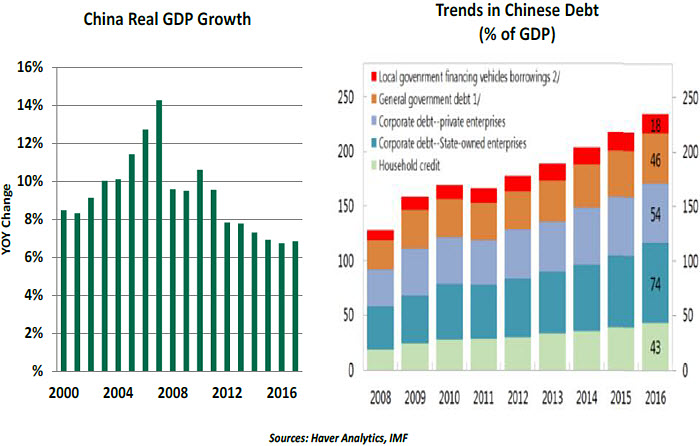

Despite growing concerns, the Chinese economy maintained its momentum in 2017. Growth stabilized, producer prices recovered (mainly driven by metal prices), money and credit growth decelerated, and the currency stabilized. In our view, these developments should help policymakers to further accelerate deleveraging efforts, in line with the message (from the 19th Party Congress) of an emphasis on quality rather than quantity of economic growth.

Other areas highlighted by the Communist Party’s Politburo include financial risk prevention, poverty alleviation and environmental protection. The housing sector, which has been on fire in recent years, has finally started showing signs of cooling. A pollution crackdown has led to closure of a number of factories and mines, weighing on growth in

Other areas highlighted by the Communist Party’s Politburo include financial risk prevention, poverty alleviation and environmental protection. The housing sector, which has been on fire in recent years, has finally started showing signs of cooling. A pollution crackdown has led to closure of a number of factories and mines, weighing on growth in

the near term.

China’s effort to reduce risks in the financial sector has led to higher borrowing costs, and as a result, growth is likely take a hit. Overall, we expect Chinese GDP growth to cool to 6.4% in 2018. Consumer price inflation, which remained benign in 2017 due primarily to softer food prices, should accelerate to 2.3%.

China’s wish to step forward on the global stage will cheer some and worry others. Potential recipients of investment under the Belt and Road Initiative will be eager for the support, while others may seek to call out China’s economic practices for criticism. Maintaining good economic relations with its trading partners will be an imperative for President Xi Jinping in the coming year.

Global Economic Forecast – January 2017

northerntrust.com

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2018 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/disclosures.

Copyright © Northern Trust