Section

Monetary Policy

1148 posts

2 Investing Implications of Higher US Rates

2 Investing Implications of Higher US Rates Real U.S. rates have been climbing, while rates are falling in…

November 11, 2015

Prepare, Don’t Predict: Building Resilient Portfolios with Private Credit

For decades, investors climbed the 60/40 ladder with confidence. Now, every step feels less steady. High inflation that refuses to budge, interest rates that won’t come down anytime soon, and the growing correlation between stocks and bonds...

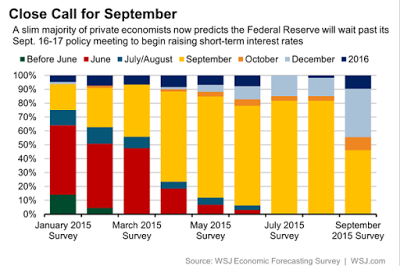

The Fed Rate Rise: Is the Wait Nearly Over?

The Fed Rate Rise: Is the Wait Nearly Over? October 29 -- Federal Reserve officials pivoted toward a…

October 31, 2015

Connecting the Dots (10/28/2015)

Connecting the Dots (10/28/2015) by Erik Swarts, Market Anthropology As much as we carry a long-term bias towards…

October 30, 2015

Federal Reserve vs Bond Market

Federal Reserve vs Bond Market The market has pushed off a Fed rate hike well into 2016 by…

October 29, 2015

Connecting the dots (10/08/15

Connecting the dots (10/08/15) Erik Swarts, Market Anthropology Expectations of a rate hike this year pulled back appreciably, following…

October 13, 2015

Why interest rates could stay lower (and longer) than commonly thought

Why interest rates could stay lower (and longer) than commonly thought by Erik Swarts, Market Anthropology Whether the…

September 30, 2015

The unterest rate, not an interest rate

The unterest rate, not an interest rate by Will Ortel, CFA Institute There was a lot riding on…

September 23, 2015

The dog that did not bark: Republican debate ignores economy

The dog that did not bark: Republican debate ignores economy by Brad MacMillan, CIO, Commonwealth Financial Network One…

September 18, 2015

The ghost of 1937: The fed stalls on rate hike

The ghost of 1937: The fed stalls on rate hike by Ron Rimkus, CFA, via CFA Institute The…

September 18, 2015

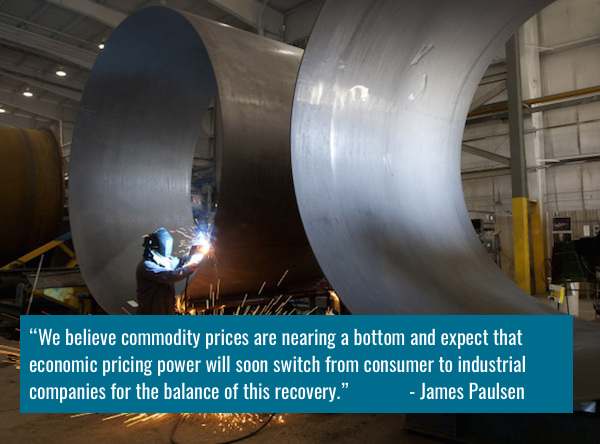

James Paulsen: A (stock market) leadership change?

A (stock market) Leadership Change? by James Paulsen, Chief Investment Strategist, Most investors are understandably focused on whether…

September 18, 2015

Ray Dalio: I don't care if the Fed raises by 25 basis points

Ray Dalio: I don't care if the Fed raises by 25 basis points Originally aired September 16, 2015

September 17, 2015

Does the FOMC decision matter much to markets?

Does the FOMC decision matter much to markets? by Cam Hui, Humble Student of the Markets This week,…

September 17, 2015

Don't sweat the Fed

Don't sweat the Fed by David Merkel, Aleph Blog This should be short. There are a lot of…

September 17, 2015

How Much, How Far, How Fast, Not When?

How Much, How Far, How Fast, Not When? by John Canally, Chief Economic Strategist, LPL Financial KEY TAKEAWAYS…

September 16, 2015

Not all interest rates are created equal

Not all interest rates are created equal by Ben Carlson, A Wealth of Common Sense All eyes are…

September 16, 2015