Not all interest rates are created equal

by Ben Carlson, A Wealth of Common Sense

All eyes are on the Fed this week as everyone is focused on whether or not they’ll finally raise short-term interest rates. The game of will they/won’t they has been playing out for some time now as it’s been nearly a decade since the Fed last raised their benchmark Fed Funds Rate.

Forecasting the direction of interest rates is extremely difficult, mainly because there are so many factors and expectations to consider when making your forecast. But beyond predicting where rates will go in the future, most people don’t even realize how much of an over-generalization “interest rates” really is.

The rates most people pay attention to are the 10 Year Treasury yield, the Fed Funds Rate and maybe the 30 year fixed rate mortgage. But the debt markets have a fairly deep bench when you really start drilling down into the different maturities, sectors, structures and bond issuers.

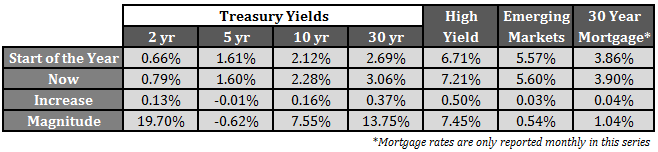

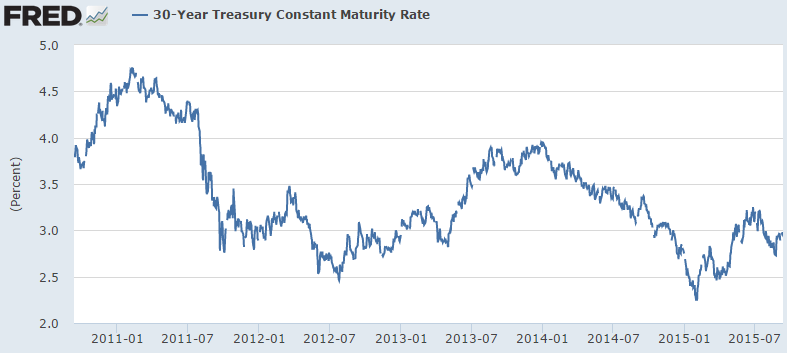

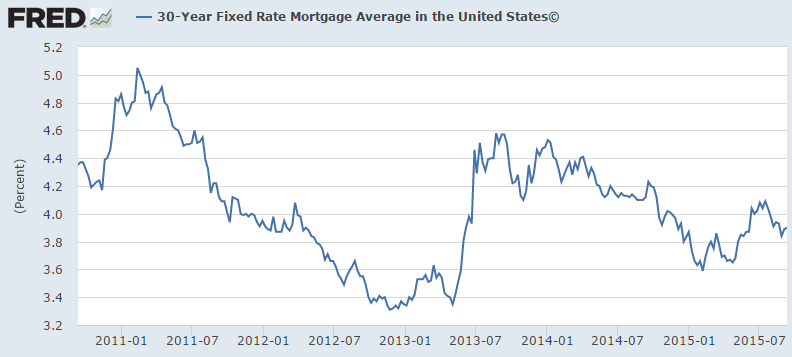

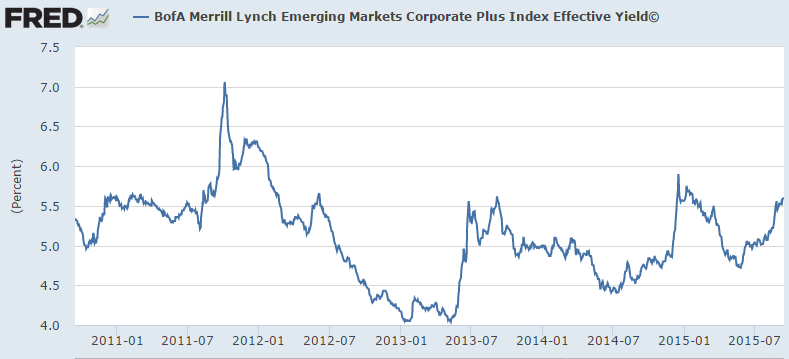

When people talk about rates rising or falling, they’re usually not taking into consideration the fact that there’s never going to be a parallel shift in all interest rates across the board with the same exact magnitude at the same exact time. The markets only work like that in textbooks or scenario analysis software. Just take a look at yield changes this year alone in some of the different treasury yields, bond sectors and mortgage rates:

By no means has there been an equal shift in either the amount of the increase in rates this year or the magnitude. For example, 2 year yields have screamed higher lately, while the 5 year is basically unchanged since the start of 2015. You could come up with plenty of narratives to fit your current viewpoint depending on which particular yields you’re focusing on.

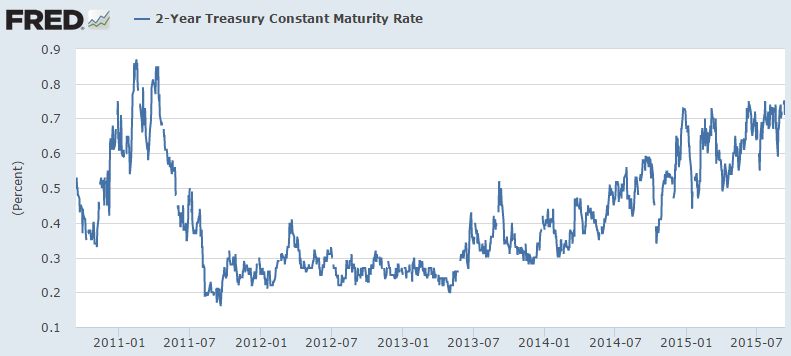

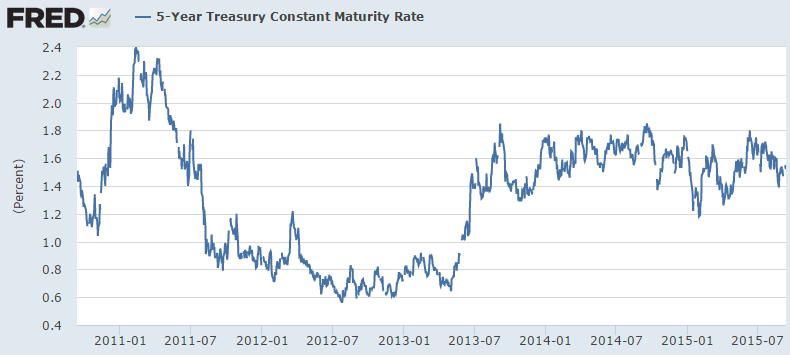

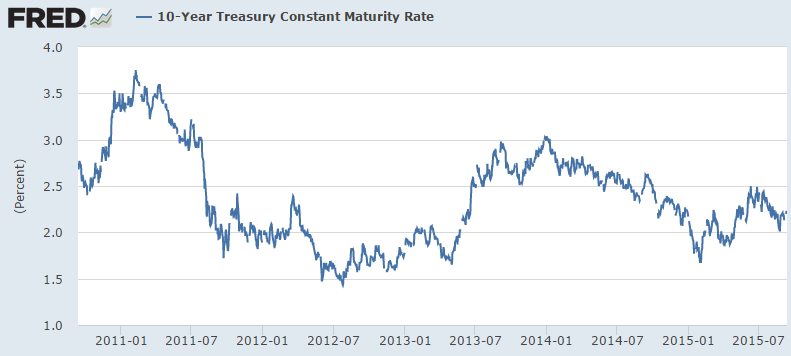

Now take a look at the path of each yield over the past 5 years:

The general direction in many of these yields is highly correlated, but it’s never going to be as easy as saying “rates will rise” or “rates will fall.” Not only do you have to get the direction of the move right when making these predictions (something most economists and forecasters fail miserably at), but you also have to get the magnitude and the change in the yield curve correct.

To do that you have to figure out not only the current economic conditions, but also the market’s expecations over various time frames along with good old supply and demand factors such as central bank pruchases or sales and investor allocation preferences. This also entails taking into account different risk appetites in terms of the spreads between the different yields.

There is a small group of brilliant people who can do this well. Everyone else should probably refrain from trying to make specific, binary interest rate bets one way or another.

Further Reading:

The Most Interesting Asset Class Over the Coming Decade

Subscribe to receive email updates and my quarterly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

My new book, A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan, is out now.

Copyright © A Wealth of Common Sense