Federal Reserve vs Bond Market

The market has pushed off a Fed rate hike well into 2016

by Tiho Brkan, The Short Side of Long

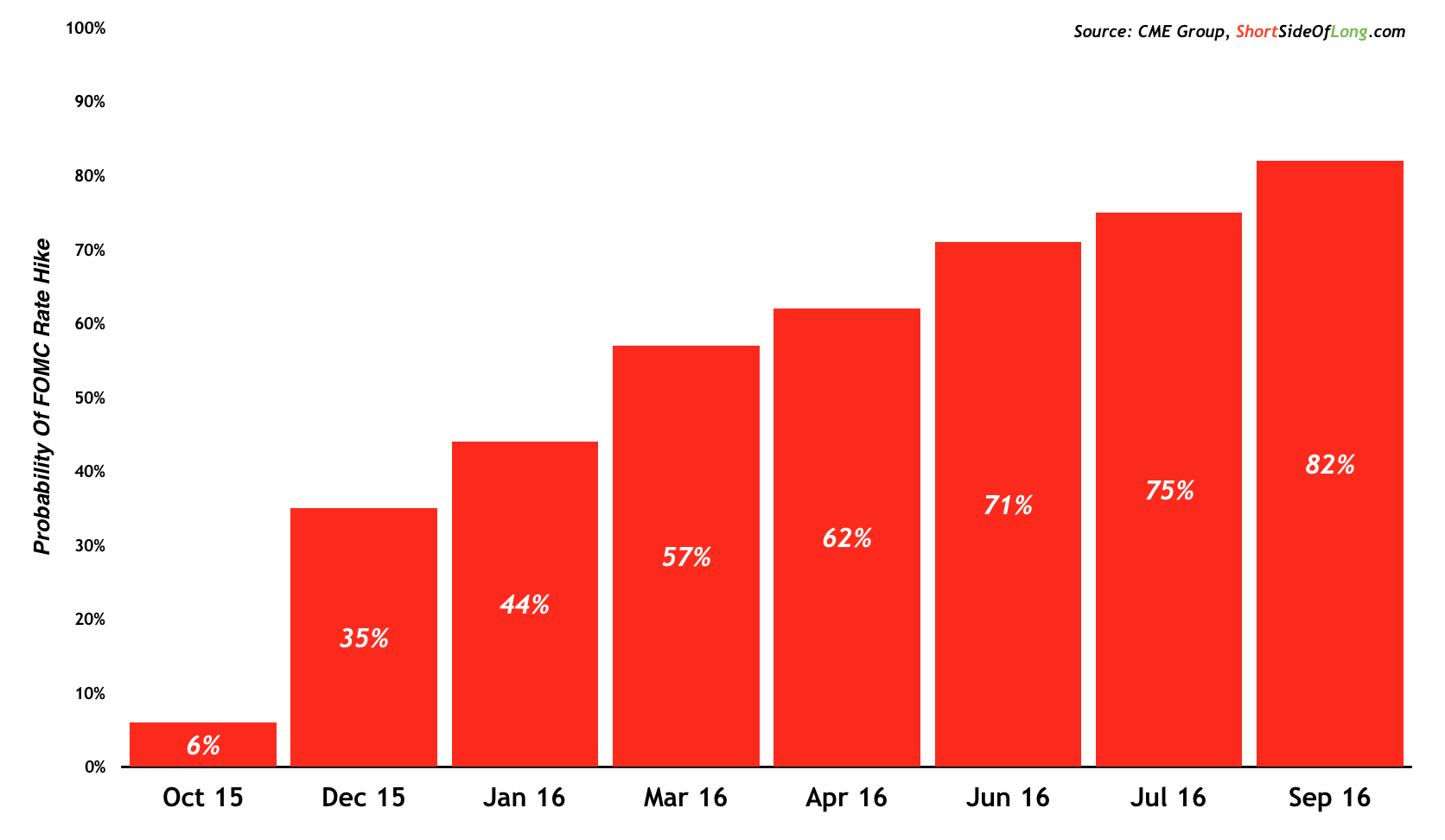

Market is pricing in a very slim chance rates will go up in 2015

The Federal Reserve Open Market Committee has been a bunch of busy bees this week, as they meet to discuss and decide future actions and progress on United States monetary policy. Bond market’s probability of a rate hike in October is only 6%, while probability for December stands at 35% or just slightly above 1 in 3 chance. Probability only rises above 50% as we look at March 2016 meeting, but one has to admit there is plenty of time in-between for a lot of market movements and data crunching. Finally, odds increase into the summer markets of 2016, where we can towards 75% probability.

Why are these probabilities important? They aren’t just gambling odds for market participants to bet on. These probabilities signal if the bond market is actually ready for a hike rate and if the Federal Reserve has correctly communicated their intentions. In other words, whether or not the bond market has discounted Fed intentions; and if the bond market agrees with the Federal Reserve based on the economic conditions. You see, the Federal Reserve doesn’t control interest rates, bond markets do. And when the Fed wants to hike, while the bond market doesn’t expect it (low probability), things don’t go smoothly. One of the worst FOMC mistakes was tightening rates in 1994, when the probability of a rate hike wasn’t priced in, which sparked a serious bond market crash.

Copyright © The Short Side of Long