by Benjamin Streed, Fixed Income, Raymond James

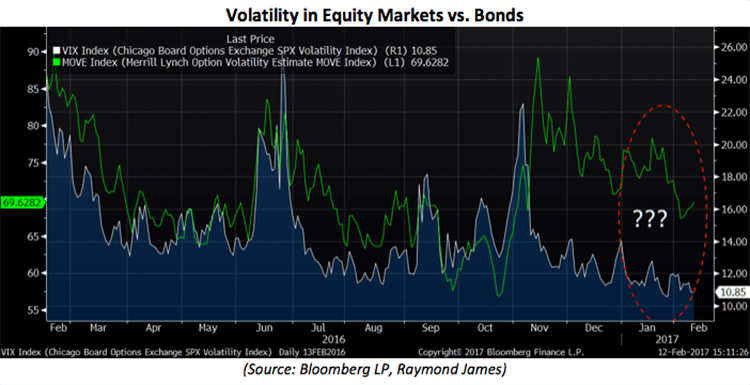

The market continues to show both a mix of optimism, thanks in large part to a strong earnings season and hope for pro-growth initiatives from the Trump administration, while also displaying heightened uncertainty regarding fiscal policy and the future of key metrics like inflation and wage growth. “Markets are set up for a one-direction trade” as Greg Peters from PGIM, a $600 billion fixed income manager, stated in a recent report. Furthermore, “What’s really interesting about this time is that it is so uncertain. But optimism is equally high. Those two things rarely ever happen together”. Well said, and sums up the current zeitgeist perfectly. For equities, look at the VIX index (blue line below), a measure of equity market volatility, as it now rests at only 10.85, the lowest level since 2014 and appears to be without a pulse. The VIX is dead, long live the VIX. Meanwhile, the BofA ML MOVE Index, a measure of bond market volatility has clearly diverged from their usual “hand in hand” trend since the November election. What this means going forward is unclear, but such a divergence is reflective of the broad equity euphoria and the unease surrounding portions of the Treasury market.

Bond markets remain focused on the continued tepid inflation data that continues to remind us that the Fed will have a difficult time raising rates three times this year as it intends to do. In fact, according to Bloomberg data the probability of a hike in March is only 28% and we don’t see a >50% probability for a hike until July. Obviously, much of the market’s perception of a rate hike will hinge on what (if anything) comes from the Trump administration and whether the proposals for both personal and corporate income tax rates meet the heightened expectations that have already been priced into much of the financial markets. In the next two to three weeks we’ve been promised a “phenomenal” tax plan, but details are nonexistent at this juncture and we’ll have to remain patient before we can understand the true implications of the plan or when/if it will be implemented. On this train of thought, BlackRock’s CEO, Laurence Fink, recently made remarks on Bloomberg television that took the fixed income world by surprise. He noted that we’re living in a “bipolar world”, one where the 10yr Treasury yield could spike to 4% or 2%, and both are equally as likely in his eyes. “There’s a greater probability that the 10yr Treasury is below 2%, and we’ll have a market setback of a considerable amount”. Why? He doesn’t believe that all of the assumed/expected fiscal stimulus measures and tax cuts will be approved/implemented, and even if they are, could take until 2018 to be put in place. Interesting thoughts from the head of a $5.1 trillion money management firm and worth contemplating over the next few weeks. Data provided by the Peterson Institute for International Economics via Bloomberg show that no US trade deal has ever taken less than 18 months from launch date to signing, with implementation taking anywhere from 20 to 100 months to be fully implemented. Seems like there’s a lot of work still to be done.