by Blaine Rollins, CFA, 361 Capital

These are the two best words to explain last week’s market. They also describe in “quick to the point” POTUS detail what the new government’s tax plan will achieve for Americans. In two-to-three weeks, we will get the “phenomenal” tax announcement that will “massively” reduce taxes. While many of us are very excited for a simpler and more fair tax plan, I do have some concerns when I read that Gary Cohn is needing to explain simple budget finance inside of the White House. Either Sal Khan needs to quickly narrate a U.S. Government accounting 101 course or the new administration is going to need to recruit an entire floor of the Goldman Sachs NYC Tower.

Speaking of 200 West Street, the experts at Goldman are keeping an eye on the upcoming significant uncertainty…

Exceptionally low volatility belies the uncertainty that continues to feature in our conversations with clients. The S&P 500 has moved less than 1% intraday for the last 39 trading days, the longest streak in at least the last 35 years. Meanwhile, the US Economic Policy Uncertainty Index last month ranked in the 82nd percentile since 1985. Three weeks into the new administration, clients continue to focus on the potential for tax reform, fiscal expansion, and deregulation as well as the risk of disruption to trade and the difficulty of predicting the implementation of proposed reforms.

(Goldman Sachs)

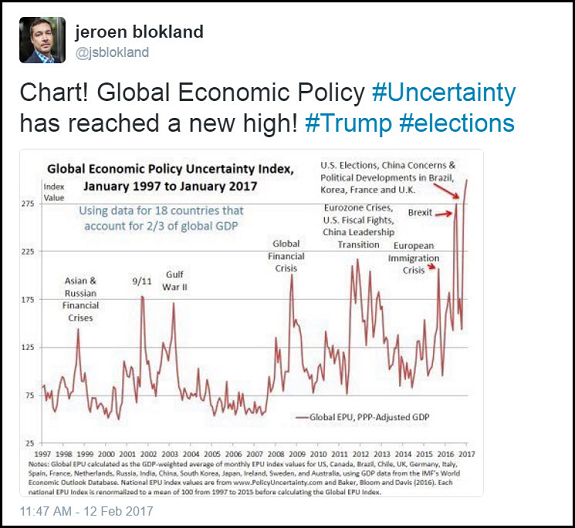

And economic policy uncertainty is not just bubbling in the United States. Take a look around the world…

A couple expert investors also had comments about the current environment last week…

“Looking forward, our continuing view is that the world is unusually uncertain, and perhaps even more so given the regime change in Washington and the questions surrounding the administration’s proposed agenda. ” (Oaktree Chairman, Howard Marks)

“I’ve been around long enough to have lived through all sorts of markets. I’ve learned to respect markets, while at the same time being skeptical of conventional wisdom. I’ve lived through a bond bear market and a gargantuan bond bull market. I’ve seen bond yields above 15% and below 2%. I’ve seen inflationary spirals, I’ve seen deflationary threats, I’ve seen deregulation and reregulation. I’ve seen the S&P 500 trade as high as 30 times earnings and I’ve seen the S&P trade as low as 7 times earnings. With all this experience, that comes with age I might add, here is what I’m seeing in the markets today. In the credit markets, spreads on the high yield securities are approaching historically tight levels, while key credit metrics such as leverage and coverage ratios are showing signs of weakening. The leverage loan market has been overrun by such massive inflows of capital that you could probably get a loan to buy a fleet of zeppelins at this point in time. With respect to rates, the 10-year treasury note is currently trading at around 2.5%, up from its recent lows, but still well below historic norms. In my view, the mood of these markets is in stark contrast with the many unknown from our current economic and political landscape, both here and abroad. For me, it’s a major disconnect, and it concerns me…The S&P 500 is trading at roughly 19 times earnings, 3 turns higher than the 50-year average of 2016. These valuations make me uncomfortable, especially given the unknowns in taxation, foreign trade, regulation and more…To sum up, in my opinion, the markets are priced for perfection, and they have been that way for quite some time, complacency reign supreme. However, my experience has shown me that this state of affairs won’t go on indefinitely. So why am I sharing these thoughts with you? Because I know that some of you have wondered why we brought back relatively few Loews shares in 2016 or why Loews hasn’t made an acquisition…It’s a tough market in which to be a disciplined buyer.” (Loews CEO, James Tisch)

It’s a tough market in which to be a disciplined buyer.” (Loews CEO, James Tisch)

(Avondale)

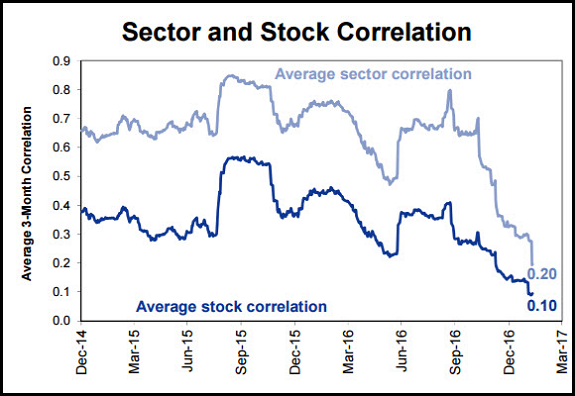

But as the experts scratch their noggins, Stock and Sector correlations continue to move toward 17-year lows providing an excellent backdrop for stock pickers…

(Goldman Sachs)

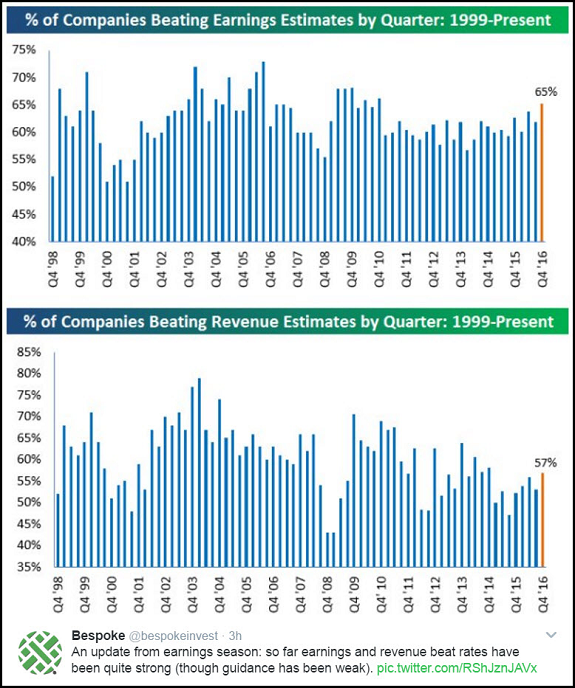

As the earnings season continues to wind down, it looks like corporate earnings beats will be the best in six years. Sales beats a bit more average no doubt reflecting the difficulty in estimating the U.S. dollar’s strength…

As we look forward, analysts are expecting solid improvement in S&P 500 earnings…

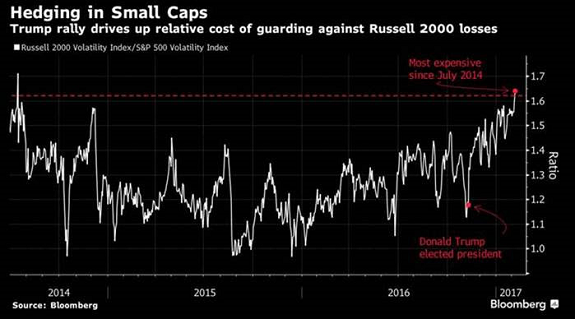

I was surprised to see how scared investors are of Small Caps…

This chart shows the price of protection for Small Caps versus Large Caps. I still see many fundamental reasons to take the opposite side of this bet and be long Small Cap stocks versus Big Caps.

Passive continues to take all of the flows…

Of the $533 billion of net flows into all mutual funds and exchange-traded funds last year, 54%, or $289 billion, went to funds managed by Vanguard, according to research firm Morningstar Inc. The fund company’s own tally for the year was even higher, at $322.8 billion.

The rush to Vanguard is largely the result of a push to embrace funds that mimic broad indexes for a fraction of the cost of traditional actively managed mutual funds. Vanguard, which started the first index mutual fund for individual investors 40 years ago, is No. 2 in the asset-management world behind New York-based BlackRock Inc., another money-management giant benefiting from shifting investor tastes.

(WSJ)

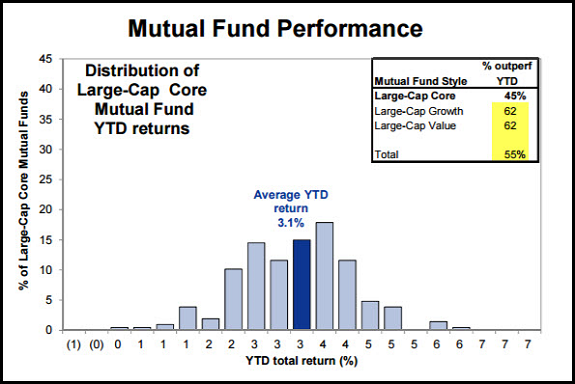

But look, Active is having a solid 2017…

The managers can thank their stock picking in this uncorrelated environment. Wonder what will happen to passive flows if active managers beat them silly this year?

(Goldman Sachs, 2/10/17)

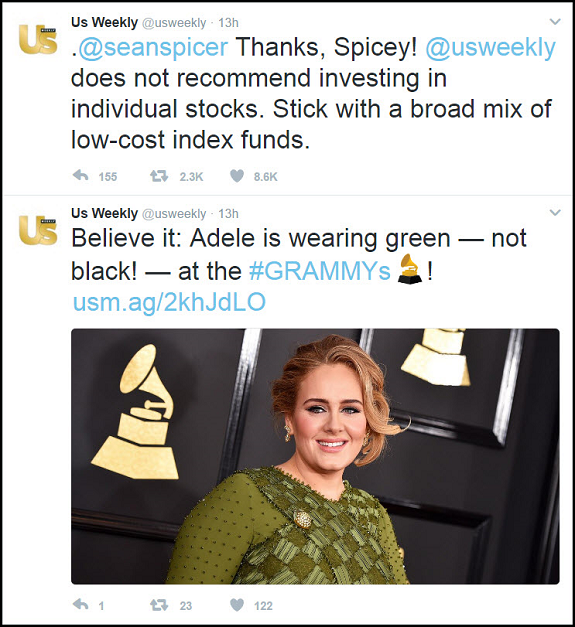

And if you were waiting for that bell ringing signal to shift all of your assets from Passive to Active, this might be it…

Probably a good time to reduce any exposure you have to Canadian mortgages and Zamboni loans…

(@PainCapital)

Time to add a line to your new client questionnaire…

Among the allegations in the proceedings is that Batista, acting on advice from a spiritual adviser named Ubirajara Pinheiro, tossed about $130,000 worth of gold coins into the Atlantic last year from the deck of a yacht festooned with flowers and perfumes for the occasion.

“All those riches that everyone talked about,” Pinheiro said in a phone interview from Rio, “I don’t think that brought him good fluids.” So, Pinheiro explained, he advised Batista to make amends with the sea goddess Iemanja by giving gold back to nature after his years of mineral extraction.

Batista’s lawyers didn’t immediately respond to request for comment on the gold-coin ceremony.

Disney inflation sighting…

Walt Disney Co (DIS.N) is raising the admission price for its U.S. theme parks by as much as $5 for some single-day tickets starting on Sunday.

One-day prices at Walt Disney World in Orlando, Florida, will stay flat or rise up to 4.9 percent, the company said.

A single-day, adult pass to the Magic Kingdom will cost between $107 to $124 depending on the time of year. Disney last year started using a three-tier structure that charges visitors more during peak periods to help spread out crowds.

The $124 price for peak season, which is over major holiday periods, spring break and parts of the summer, is unchanged.

(Reuters)

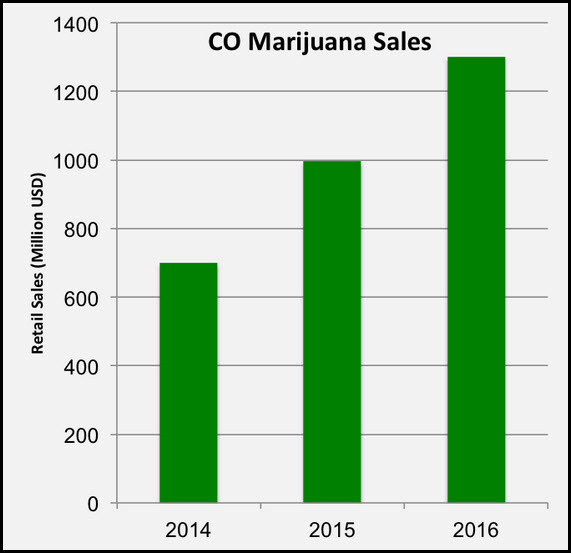

Could a border tax and a Mexico border wall make marijuana Colorado’s most important agricultural product?

Even without the tax and wall, pot is gaining quickly on beef, hogs, cheese and grains. And since it is not grown on a farm, it has absorbed nearly all of the loose industrial warehouse space in town.

(NewsInData)

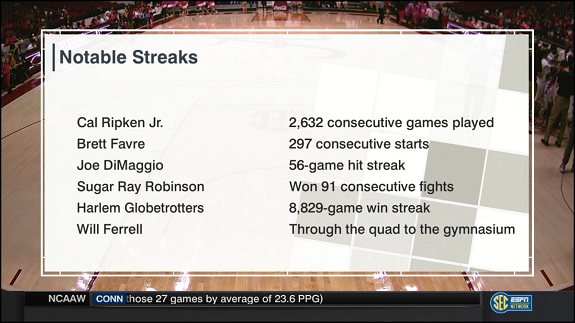

Sports graphic of the week…

(@BUTerrier2003)

Loved this book. Some great stories that will resonate with you in one way or another…

And I hope that during your lifetime, you come across some similar relationships that push you to be better, like theirs did.

The Undoing Project: A Friendship That Changed Our Minds

by Michael Lewis

Best-selling author Michael Lewis examines how a Nobel Prize–winning theory of the mind altered our perception of reality…

Forty years ago, Israeli psychologists Daniel Kahneman and Amos Tversky wrote a series of breathtakingly original studies undoing our assumptions about the decision-making process. Their papers showed the ways in which the human mind erred, systematically, when forced to make judgments about uncertain situations. Their work created the field of behavioral economics, revolutionized Big Data studies, advanced evidence-based medicine, led to a new approach to government regulation, and made much of Michael Lewis’s own work possible. Kahneman and Tversky are more responsible than anybody for the powerful trend to mistrust human intuition and defer to algorithms.

The Undoing Project is about the fascinating collaboration between two men who have the dimensions of great literary figures. They became heroes in the university and on the battlefield—both had important careers in the Israeli military—and their research was deeply linked to their extraordinary life experiences. In the process they may well have changed, for good, mankind’s view of its own mind.

Finally, congrats to an incredible supermom, and my former colleague, for being recognized in the New York Times this weekend…

Helen Young Hayes managed $50 billion in investments at a mutual fund in Denver while raising five children. She missed spending more time with them — she watched videos of them after they went to bed — and five children were a lot of work. So, at 41, she stopped working.

A decade later, she returned to the work force, starting a corporation to match low-income people with careers. The idea grew out of volunteer work she had done during her time away.

“I just have too much energy and too much intensity to not be engaged,” said Ms. Young Hayes, 54. Working for 20 years before she left made re-entry easier, she said. “It gave me the confidence to realize there were no limits to my career.”

Copyright © 361 Capital