2016 Was Not a Particularly Volatile Year

by Clifford Asness, Ph. D. AQR Capital Management, Inc.

Maybe it’s just me but a lot of end-of-year commentary about financial markets in 2016, implicitly and sometimes explicitly, makes it sound as if it was a crazy year. It wasn’t. In fact, it was amazingly normal. This is true of at least the S&P 500 (I’m not going to be more ambitious here) which is what I think many of these commentators are talking about.1,2

Annualized daily volatility during 2016 came in at 13.1%. Based on rolling same-length periods going back to 1929 this falls at the 47th percentile.3 You say you don’t want to compare to the craziness of the Great Depression? Maybe that leads to everything else looking calm and you don’t think that’s meaningful. That’s reasonable. Well, that same value of 13.1% is at the 54th percentile since WWII and the 42nd percentile since 1990. Pretty darn normal. Maybe people are comparing to very recent times (I would argue in error) and have been lulled into a false sense of calmness now shattered by 2016? Nope, it’s still only at the 54th percentile when compared to the last five years. Realized daily volatility simply was not high in 2016 compared to pretty much any prior period (it certainly wasn’t exceptionally low either).

Now you say you don’t like quant geek measures like volatility? OK. How about looking at the biggest (up or down so we are talking absolute value) rolling one-month4 return in 2016? That was 10.4% (the bounce back from mid-February to mid-March). How does that compare to history? That is, every year you do this same calculation and look at the biggest up or down move. Well, from 1929 to the present that 10.4% figure for 2016 comes in at the 44th percentile (i.e., 56% of the time the biggest one-month move in a rolling year is bigger than we saw in 2016). Post-war it’s the 51st percentile. From 1990 to present it falls at the 48th percentile. Even over the last five years it’s a whopping 61st percentile. Move on, nothing to see here.

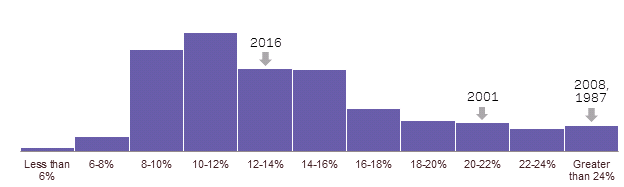

OK, one more. Let’s look at the high over the last year divided by the low of the last year (the full percentage range in prices).5 In 2016 that was +24.2% (the mid-December high divided by the early/mid-February low). Wow, you could’ve made a killing buying at the low! I’m not being snarky here. Actually, yes, you could have. But was that abnormal? You know what’s coming now don’t you…? Comparing that 24.2% to the same figure calculated each rolling year back to 1929 it comes in at the 42nd percentile. Post-war it’s the 49th percentile. From 1990 to present it’s the 50th percentile. And, over the last five years it’s the 66th percentile. Ok, that last one is getting very marginally high but only very marginally and only over the very recent period, which again I only looked at to see if people were looking at this too short a time horizon in error (yeah, that’s not a great sentence, I know). Really, again, nothing to see here.6,7

For those who think better graphically, here are each of the three measures presented both as a histogram (with 2016 and some notable years from the latter half of the sample marked) and simply graphed through time (when the relevant comparison is the far right end point of 2016 versus the whole graph):8

1-Year Daily Rolling Volatility (1946-2016)

Histogram

Time Series Plot

Source: AQR and Bloomberg using the S&P 500 index.

Max 1-Month Absolute Return Over Prior Rolling Year (1946-2016)

Histogram

Time Series Plot

Source: AQR and Bloomberg using the S&P 500 index.

Prior 1-Year High Divided By Prior 1-Year Low (1946-2016)

Histogram

Time Series Plot

Source: AQR and Bloomberg using the S&P 500 index.

Not surprising, the pictures send the same message as the percentiles: 2016 isn’t special at all.

OK, admittedly my impression that drove this piece may be wrong. Maybe some bias is making me think a lot of commentators are talking about the 2016 stock market as if it were quite a wild ride when they generally mean something else. If so, sorry about that, but hopefully the above stats are still interesting. But, if I’m right, and you see some similar commentary, tell whoever is congratulating themselves for surviving such a crazy 2016 market that they are mistaken and they just can't handle the truth. And, this all kind of matters as if you think 2016 was crazy, what are you going to do when something really crazy happens?

1Looking at Twitter hashtag #2016In3words, which seems to cover most of the crazy stuff, you see things from “PokemonGo Servers Down” to “Aleppo Trump Brexit” and “Fidel Florence Fisher”; but also a fair number of references to financial markets. If people are arguing that 2016 was a crazy year on other dimensions beyond just financial markets (e.g. populism triumphing, the Cubs winning) you won’t get an argument from me (and someone else is free to write a piece on how I’m wrong and making the same mistake that I chide others for regarding investing!).

2Another thing often discussed about 2016 as being perhaps abnormal or shocking is the failure of active management and hedge funds. I expect/hope to write a note also on this topic soon but the data are not all in, yet. My guess is these things are also less surprising than many would guess – that popular cynicism about these things in 2016 is more about the zeitgeist catching up to the long-term evidence than about 2016 being very shocking itself – but I have to reserve judgment until we get all the numbers.

3Using the S&P 500, I analyze rolling periods looking backwards using the same number of trading days as 2016. So I’m not comparing precisely to other calendar years except when they include the exact same number of trading days as 2016. This choice makes very little difference. Also, everything is done in price space, not total returns (i.e., no dividends), as it’s easier and looking at volatility over one year periods makes this a pretty innocuous choice.

4I use approximately a month as it’s again a rolling constant number of days.

5Keep in mind that this is always positive as it’s the high divided by the low but may be an up or a down depending on which price came first that year.

6“For the super-geeks out there, the only thing I found at all high was daily kurtosis, and then really only against recent times. 2016 came in at the 64th percentile on this measure back to 1929, 67th percentile post-war, 74th percentile since 1990, and 83rd percentile versus the last five years. So, you Latvian Orthodox Gaussians can feel very mildly perturbed by 2016. But, you do get the hats so it’s all fair. And the skewness last year was actually less negative than normal so maybe even the Gaussians can feel okay.

7I have focused only on measures of risk, volatility, or big cumulative movement. On the level of price return it’s also staggeringly normal (that is, just looking at how much money you made on the year, not a measure of “risk”). The S&P 500 was +9.5% in price return in 2016. That result falls into these percentiles: 52nd back to 1929, 51st since WWII, 48th since 1990, and 42nd in the last five years. The fact that I’m working in price returns likely affects this comparison more than all the other risk-like measures I examine above. 2016 likely looks worse historically on total return (as dividend yields now are worse than historical average and thus historical returns would go up more than 2016’s return if we included dividends) but better on excess return (as cash yields are also worse than history and differ by more than dividend yields do). I doubt this is a very big effect at all, particularly as the two effects, at least somewhat, offset.

8I don’t graph it, or do the histogram, back to 1929 as the very high figures in the depression tend to “squash” the relevant part of the graph too much.

This post was originally published at AQR Capital

Copyright © AQR Capital