by Jeffrey Saut, Chief Investment Strategist, Raymond James

The ultimate dream of market mavens is discovering a method that predicts the price movement of the major common stocks such as the 30 Dow Jones Industrials. Obviously, such a system could not make the perfect prediction, could not be 100% right all the time. But there have been prediction methods exploiting price discrepancies that gave investors an edge of perhaps 20-25% or more a year.

For instance, back in the 1960s, Edward O. Thorp, onetime university professor and mathematical whiz, discovered a hedging system for all kinds of convertible securities and their related common stocks that produced an average yearly gain of 25% for five years. But guess what? When he tried to interest wealthy investors in his scientific system for stock market profits, he ran into either rampant skepticism and/or an attitude that they would rather do it themselves.

One oil baron with an income of more than $1 million a year . . . was not excited when he learned that we were making 25% a year in the market. Suspecting the reason, one of us questioned him closely and learned he expected to earn 50% on his assets in the coming year. All his funds were committed to his oil business and he was hungrily seeking more cash. It was more profitable for him to invest his money himself.

One of our millionaire friends saw his equity in the market shrink from $1 million to $400,000 during the 1966 crash. He then invested $20,000 with us. After he got a glimmer of the method from the trade slips, he commented that it was a ‘sure thing’. He accepted our estimate that it would most probably take about four or five years to expand his $400,000 to $1 million again.

This was too slow for him. In his heart he believed that this market which had so quickly sliced his $1 million to $400,000 would just as quickly give it back again. He was not the owner now of a mere $400,000, but rather of $1 million that was whimsically imprisoned and that must soon be returned to him. To get his $1 million back he would have to invest his money himself, presumably by the same amazing methods that had recently been so costly.

We knew that he wondered how our abstract ‘system’ could produce better profits than his investments. The investments which dealt him such rapid, enormous losses were recommended by close friends on the inside of companies. Those tipsters assured him that they too had lost temporarily. But they were investing even more now that prices had fallen to such bargain levels. When prices rebounded soon, all losses would be wiped out, the originally expected profits would be realized, and the extra investments made at bargain prices would yield a fortune. Yes, he would rather do it himself . . .

. . . Beat The Market, by Edward O. Thorp & Sheen T. Kassouf

Now don’t get excited and start searching for the Edward O. Thorp Fund, because there isn’t one. He has since left the business after beating the market and averaging 19.5% per year from 1969 through June 1998 versus 9.8% for the D-J Industrial Average. Why? Well, initially, Thorp was way ahead of everybody else and was the ultimate in trying to get rid of risk. But he admitted upon retiring, “The ideas have spread, so that the lowest-cost producers are those that can operate the most profitably. They are the large private partnerships that can hold down expenses because they do their own clearing and trading.” “So,” Jeff, “What’s your point?”

Well, we wanted to emphasize there are so many big pools of money reacting to the same information in a flash around the world that everything trades like a pork-belly contract. The program players, low-cost producers, the triple-witchers, the Chicago option-futures crowd, the institutions, et al have taken over the markets, making it more difficult for you and me to beat the market. Yet the main point we want to emphasize is to beware of the attitude that losses are temporary and the belief the market will quickly give those losses back. When you find yourself thinking that way, either your market method is wrong and/or your emotions have taken over. That is when you are most vulnerable to even more mistakes and losses, trying desperately to get “your” money back! You must realize it is no longer yours. The market has it. And, you must regain your discipline and reexamine your market method that was so costly to you.

Having been there, we speak from experience. Our greatest losses, and our worst market frustrations, have been synonymous with the feelings that the market owed us our loss, and just as quickly as it took it, it would give it back. You have to deal with reality. Realize all of the sophisticated competition you face, and strive for a disciplined approach that works for you. When you are down, try for risk-adverse “singles.” Don’t try and hit home runs or do anything exciting or brashly brilliant, because usually when you do, you end up losing even more. Sooner or later those singles will add up to sizeable gains. And then you can become more venturesome, knowing that your slow, disciplined approach will produce profits.

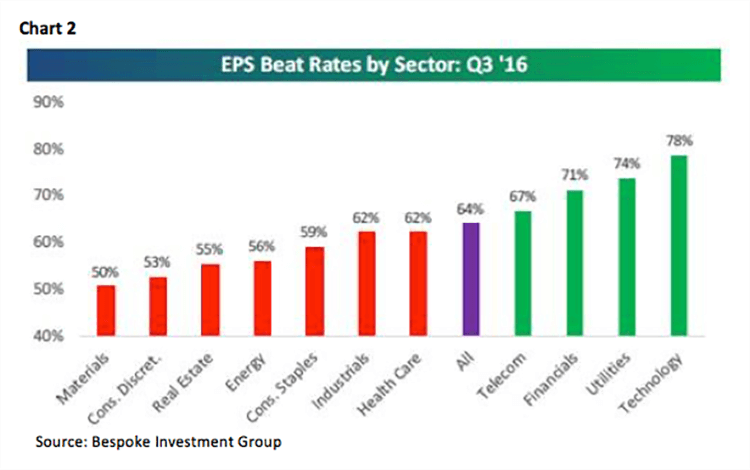

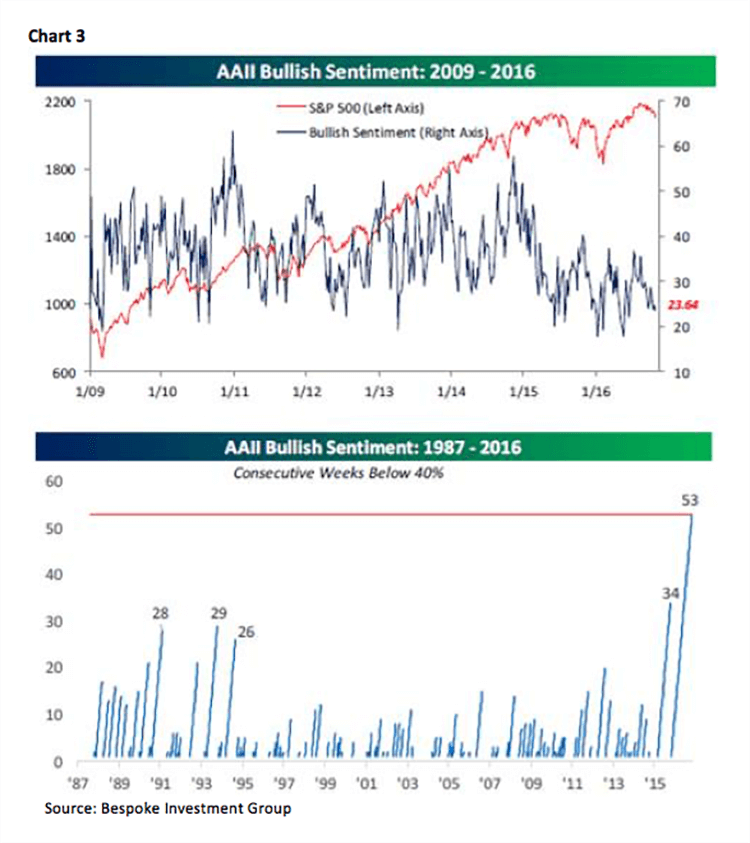

The call for this week: Clearly our “call” for a window of downside vulnerability in mid-/late September has played in spades. Our model that targeted the last week of October for the “window” to be over was wrong probably due to the election. So the SPX has been down for nine straight sessions. Since 1928, there has only been 12 such streaks! The result has left the SPX testing its 200-day moving average (chart 1) and massively oversold. Earnings continue to come in better than expected with our preferred sector of choice (Technology) showing the best earnings momentum (chart 2 on page 3). Bullish sentiment still stinks (chart 3 on page 3), and every macro sector except Energy, Financials, and Technology has broken down in the charts. This morning, however, the FBI’s Comey has cleared Hillary Clinton (again), leaving the preopening S&P 500 futures up a stunning 30 points at 5:30 a.m. Maybe we can make back some of our recent losses quickly...

Copyright © Raymond James