by Blaine Rollins, CFA, 361 Capital

I licensed this coin flip photo late last week thinking that it would be reflective of how tight the Presidential race had become. Between the New York Times stories on the Clinton Foundation, the 50,000 emails from John Podesta and the FBI re-opening of the Hillary email investigation, last week’s polls confirmed that the race for our next POTUS was going down to the final days. But as the weekend progressed, we received registration data on the early voters in the key swing states, followed by the FBI ending its re-opened email investigation and it looked as if Hillary would cross 269 electoral votes first on Tuesday. Then on Sunday night, the election-betting markets, the Mexican peso and the global equity markets began to reflect the rebound in Hillary’s chances.

I licensed this coin flip photo late last week thinking that it would be reflective of how tight the Presidential race had become. Between the New York Times stories on the Clinton Foundation, the 50,000 emails from John Podesta and the FBI re-opening of the Hillary email investigation, last week’s polls confirmed that the race for our next POTUS was going down to the final days. But as the weekend progressed, we received registration data on the early voters in the key swing states, followed by the FBI ending its re-opened email investigation and it looked as if Hillary would cross 269 electoral votes first on Tuesday. Then on Sunday night, the election-betting markets, the Mexican peso and the global equity markets began to reflect the rebound in Hillary’s chances.

While I may no longer be able to use the coin flip photo for the Presidential race, I can now at least use it for control of the U.S. Senate. Several key races have tightened in the last week giving nearly even odds to which party will control the Senate. If the GOP can hang on, then gridlock will be guaranteed for the next two years and only the best ideas, policies and Supreme Court nominations will make it through the D.C. gauntlet. Political horse trading at its finest would please the global financial markets. There is certainty to gridlock. And the markets like nothing more than certainty.

If you want to stay up and watch the election results on Tuesday night, a shortcut for you will be to follow the Florida results. With 29 electoral votes needed to win the state, there are not enough other close leaning states for Trump to grab to cross the 269 threshold if he doesn’t win Florida.

Good luck to all the candidates running and congratulations to all the voters for making it through this 2016 election cycle. Only 1,456 days until the next Presidential election.

As we noted Friday afternoon, market uncertainty has clearly affected the markets since the slide in Hillary’s poll numbers…

U.S. Stocks and the Dollar have been most directly affected, while Bonds have been volatile. Crude Oil seems to have its own problems with the internals at OPEC, but some of its slide will also be a result of Trump’s negative attitude towards global trade and the Middle East.

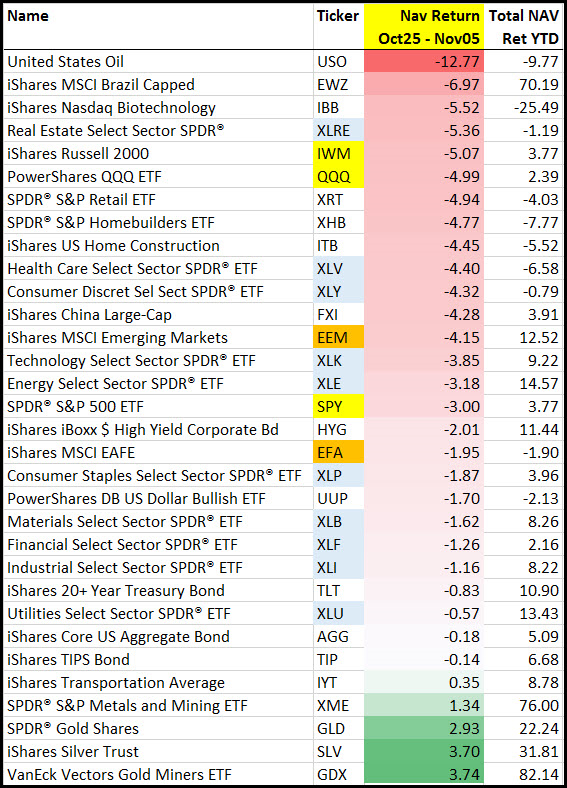

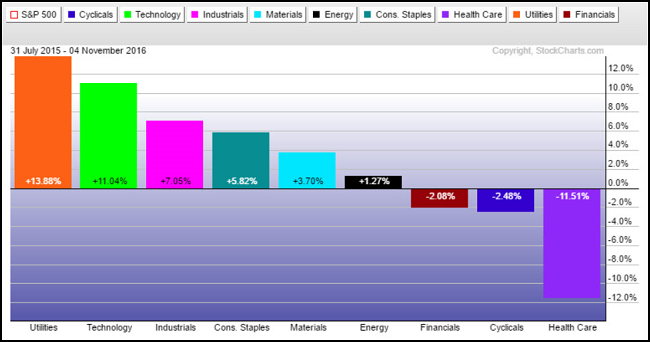

Here is a look at the major asset class results for the last nine-day slide in Hillary’s polling results…

The assets most hit should also be the ones to recover the most with a Hillary victory. I would look toward Energy, Emerging Markets, Consumer, and Technology to bounce the most, as well as Junk Bonds and the U.S. Dollar. While I see that Biotech and Health Care have had a sharp decline in part due to Amgen’s earnings and the DoJ price fixing investigations in generics, I have to think that the headwinds do not lighten under a Clinton presidency. The precious metals will also likely reverse some of their quick nine day gains as Trump financial market uncertainty dissipates.

The one sector that may have a difficult time bouncing is Health Care…

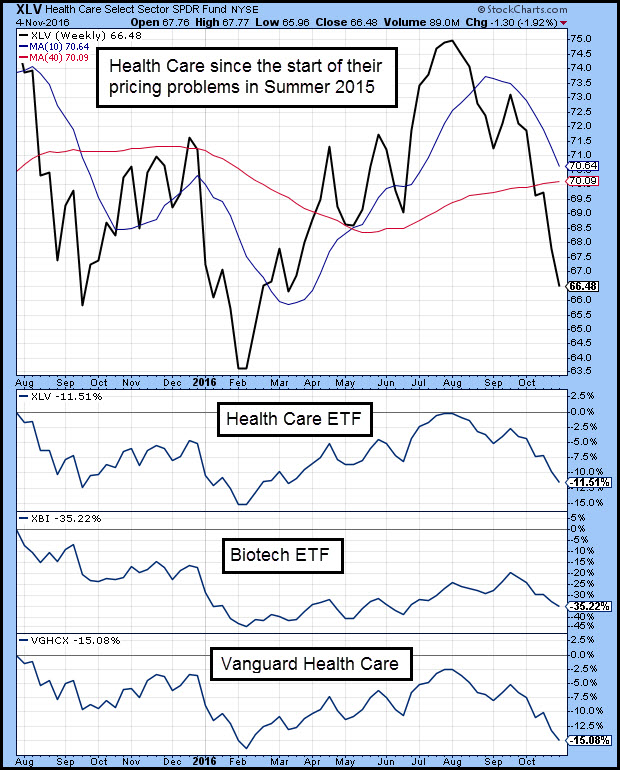

While the sector is clearly oversold on a short-term time frame and may have a relief rally, it is difficult to paint a picture for longer term gains given the many arrows flying at it from Washington, D.C. This chart shows the performance since last summer, which is when the pricing issues hit the front pages of all newspapers and CEOs began their treks to Capitol Hill.

Within the Health Care segment, it has been Biotech and Pharma which have been in the main cross-hairs of the politicians…

While the Health Care ETF is -11.5% since last summer, the broad Biotech ETF is -35%. This has made things difficult for active managers who were overweight drug stocks. The Vanguard Health Care Mutual Fund is the Godzilla in the space with over $40 billion in assets.

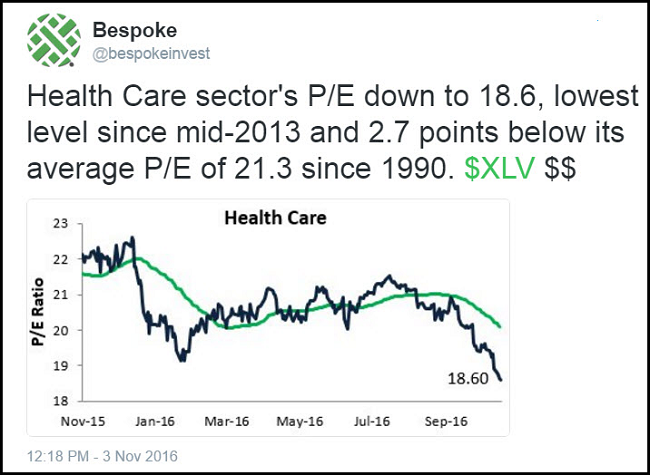

Bespoke notes that Health Care valuations are now below average…

But if you remember back to the early 1990’s when Hillary first wanted to dance with the health care system, many drug stocks traded into the low teens P/E multiples.

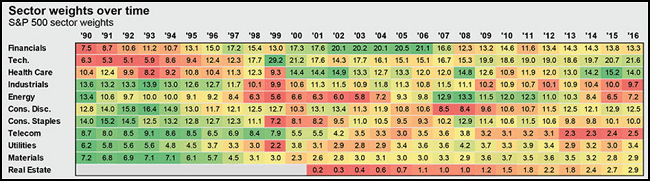

This chart also shows you that Health Care still has a top weighting in the S&P 500…

Looking at the weekly economic data, maybe it is just a fluke, but Jobless Claims have missed expectations for three weeks in a row…

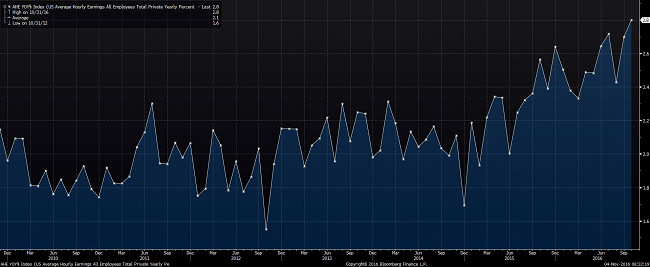

As for the all-important Friday jobs data, the most important item in the release was the +2.8% jump in wages…

A tightening job market is delivering the strongest wage growth for U.S. workers since the recession, likely keeping the Federal Reserve on track to raise interest rates next month.

Employers added 161,000 nonfarm jobs in October, with upward revisions to the two prior months bolstering the recent trend of job gains, the Labor Department said Friday. The unemployment rate ticked down to 4.9% owing to a dip in the number of people participating in the workforce.

The highlight of Friday’s report, however, was a 2.8% year-over-year jump in average hourly earnings for private-sector workers, the largest annual rise since June 2009.

(WSJ)

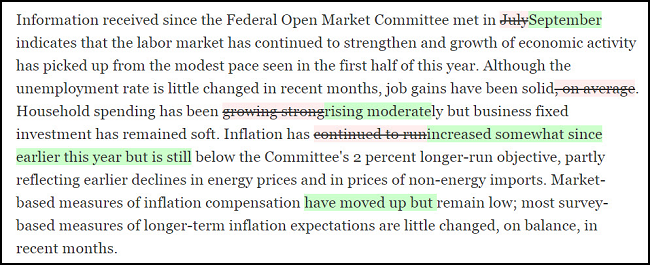

Can we combine this rising wage data with this slightly stronger FOMC statement and make a case for a December rate hike?

(WSJ)

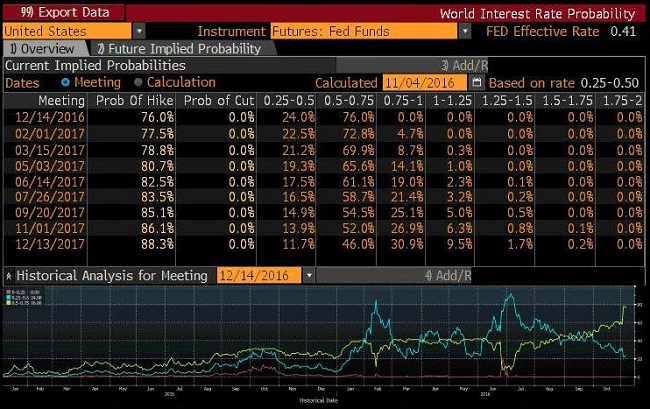

The market definitely thinks so, as it lifted the odds about 10% points on the week…

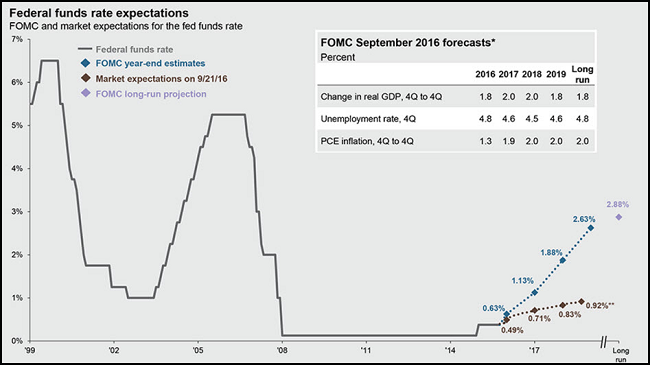

For a quick review of where Fed Fund rates have been and are projected to go…

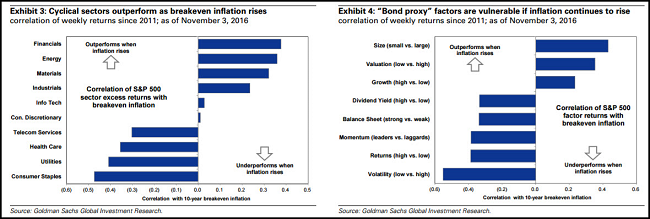

So if inflation and rates are on the rise, is your portfolio positioned properly?

If history is any guide, you want to own a small cap, cheap, growth, bank stock located in the oil patch. You might pair this long by shorting a low volatility, high ROE, large cap, consumer staples stock.

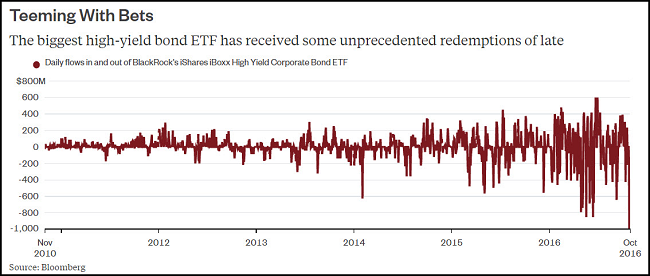

High yield bond interest has hit a headwind…

Granted stocks just fell nine days in a row and inflation thoughts have perked up, but high yield flows must be watched closely here. You don’t want to see this unravel.

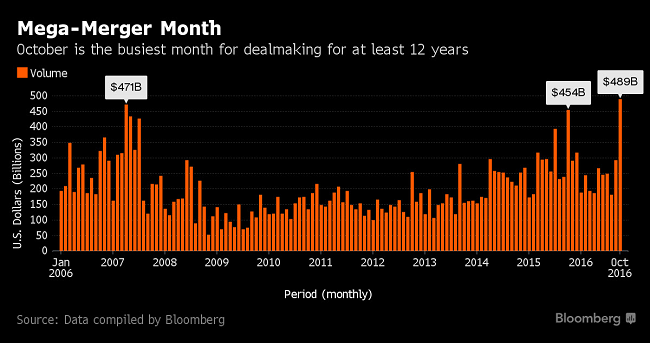

If high yield inflows do not continue, it will be difficult to keep the Q4 M&A train going…

“Every weekend recently has been busy,” Bob Profusek, partner and chair of the global M&A practice at law firm Jones Day, said in an interview Monday on Bloomberg Television.

“The fundamental drivers are still there,” Profusek said. “Low growth — which is bad for most things, but it’s good for M&A because that’s how you get growth — and very accommodating capital markets.”

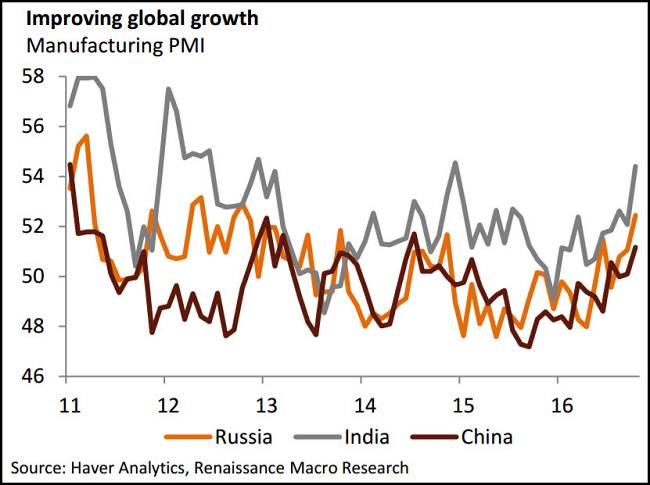

Back to the economic data, a new highlight is the monthly gains in the top Emerging Market PMIs…

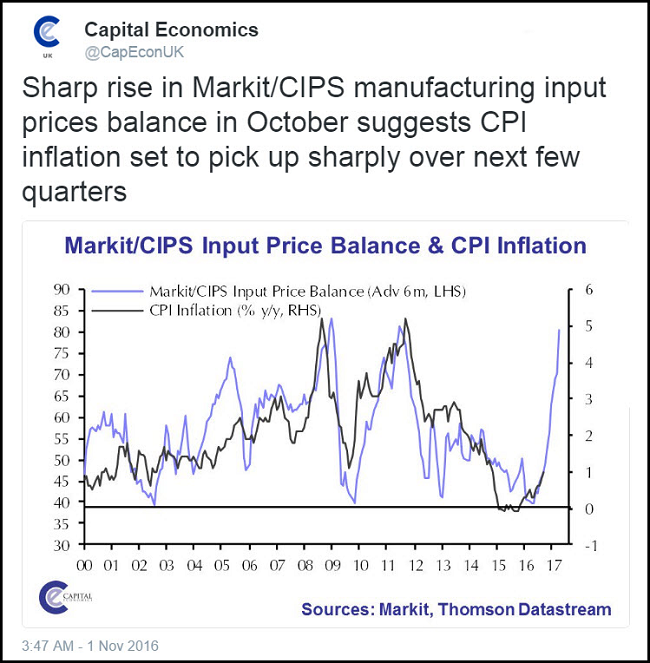

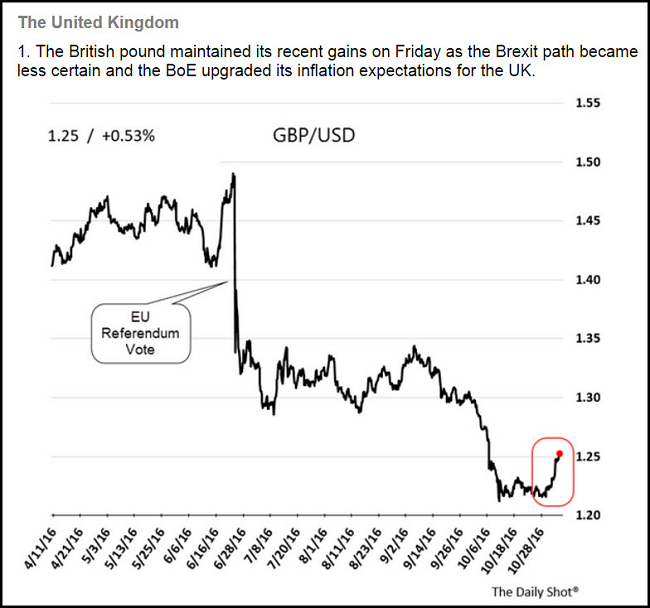

And over in the U.K., the post-Brexit economic collapse has not occurred…

As a result, the Government will likely cause a rip higher in inflation. So keep an eye on the British Pound which few think will recover.

Speaking of the Pound, approximately one in 30 £1 coins in circulation is a counterfeit. Starting March 2017, The Royal Mint is making a big change…

The new coin has a number of features that make it much more difficult to counterfeit:

- 12-sided – its distinctive shape makes it instantly recognisable, even by touch.

- Bimetallic – it is made of two metals. The outer ring is gold coloured (nickel-brass) and the inner ring is silver coloured (nickel-plated alloy).

- Latent image – it has an image like a hologram that changes from a ‘£’ symbol to the number ‘1’ when the coin is seen from different angles.

- Micro-lettering – it has very small lettering on the lower inside rim on both sides of the coin. One pound on the obverse “heads” side and the year of production on the reverse “tails” side, for example 2016 or 2017.

- Milled edges – it has grooves on alternate sides.

- Hidden high security feature – a high security feature is built into the coin to protect it from counterfeiting in the future.

Now that November is here, we are looking toward the skies here in Colorado…

The forecast tells me probably not a flake of snow in November. Not sure what it is like around the rest of the U.S., but if you are long ski resort stocks or condos, it might be an unprofitable November and December unless Jack Frost visits soon.

Finally, one more time, The Burridge Conference has a great lineup of speakers in a few weeks…

Come out to Boulder for the 2016 conference, where you can listen to experts in the financial markets, earn continuing education credits and enjoy lunch and a networking event in a fantastic venue.