Clinton and Trump: Assessing the Economic Policy Visions

by Fixed Income AllianceBernstein

October 12, 2016

Both US presidential candidates—Hillary Clinton and Donald Trump—have presented their economic proposals to voters. How could each of these platforms impact the US economy—if they come to pass?

The economic policy visions of Secretary of State Hillary Clinton and Republican challenger Donald Trump are very different in both scope and scale. In the end, the success or failure of either proposal depends on how it’s translated into policy—or not—by working with Congress. Let’s look at how the stated proposals could impact the economy—and their odds of being enacted.

Clinton’s Economic Plan: Modest Scale

The economic plan of Democratic nominee Hillary Clinton is multifaceted, but it’s actually modest in its overall scale.

The tax proposals would raise an estimated $1.1 trillion in new revenue over a 10-year period. This revenue would help fund a wide range of programs and initiatives, including infrastructure (about $300 billion over five years), clean energy, education, healthcare and child care.

The changes in Secretary Clinton’s tax plan focus mainly on upper-income families. The plan includes a proposed 4% surcharge on income over $5 million, and a required floor of 30% in federal taxes for incomes over $1 million. The plan would also increase the required holding period to qualify for the lower long-term capital gains tax rate. Estate tax exemptions would be reduced—from the current $10.9 million to $7 million for a married couple. According to estimates from the Urban-Brookings Tax Policy Center, 95% of all taxpayers would see almost no change in their tax liability based on Secretary Clinton’s plan.

On the corporate side, Clinton would impose an “exit tax” on companies that attempt to relocate outside the US. The proposal also calls for rule changes that would make it harder for corporations to employ tax inversion—shifting legal domicile in order to reduce taxes—and would limit the deductibility of interest as a tool to lower tax bills.

Clinton would pursue a plan to create an easier path to citizenship for illegal immigrants living in the US. In terms of foreign trade, she plans to rework the Trans-Pacific Partnership (TPP) trade agreement that the current administration negotiated. Clinton would continue the regulatory policies of the Environmental Protection Agency, maintain strict regulations and capital standards for the financials sector, and include a public option for healthcare.

Bottom line: If the economy’s number one problem is low growth, this balanced program of tax and spending increases would not do much to lift that lack of demand, because private sector activity would likely be reduced by roughly the same amount as public sector demand would be increased. However, if the main problem is income and wealth inequality, this plan would seem to provide some remedy.

Trump’s Economic Plan: Ambitious—But Trade Is a Risk

Trump’s economic plan is expansive—but its balance is a question mark.

The main cog is a big, broad-based tax cut. The tax plan is estimated to reduce federal revenue by $9.5 trillion over a 10-year period. The proposal would consolidate the current seven tax brackets into three (10%, 15% and 25%). And it would eliminate both the alternative minimum tax and estate tax. According to analysis by the Urban-Brookings Tax Policy Center, upper-income taxpayers would see a smaller overall tax bill; 45% of all taxpayers would see little or no change in their tax liability.

For the business sector, Trump has proposed a reduction of the top corporate tax bracket from 35% to 15%, and the elimination of a wide range of business deductions.

Trump’s immigration policies would see a clear break from the current administration’s drive to remove the threat of deportation and enable illegal immigrants to obtain work permits.

Trump’s trade proposal would also be a major departure from the status quo. He has threatened not only to remove support for the TPP, but also to tear up existing trade agreements like the North American Free Trade Agreement. He would also impose large tariffs—in the range of 35% to 45%—on Mexico and China, two of the biggest trading partners with the US.

The Republican candidate hasn’t clearly specified his federal spending proposals. What he has said is that he would increase military spending and target the elimination of fraud and waste in government programs.

On the regulatory front, Trump’s proposal calls for the repeal of existing federal legislation on the health insurance industry. In addition, he would seek to relax—if not eliminate—current regulations for segments of the energy industry and finance.

Bottom line: If the economy’s number one problem is low growth, Trump’s plan would provide a big boost through big, broad tax cuts. But all the potential gains from lower taxes could be lost by anti-trade proposals. US multinational companies operate on a global platform, and nearly one-third of US imports flow from US foreign affiliates.

Any attempt to raise the cost of imported goods would raise the cost of doing business. That would put pressure on operating profit margins and hurt economic growth prospects in the process. And if income and wealth inequality are the main problems facing the US economy today, this plan seems unlikely to provide much help.

Congress—the Ultimate Decider

The media spotlight has certainly been focused on the presidential election. But congressional elections are equally important, since all tax and spending policies have to be legislated and passed by Congress.

Right now, Republicans hold a slim majority in the Senate and a sizable majority in the House of Representatives, but the ultimate makeup of the new Congress won’t be known until after the election.

Also, neither Clinton’s nor Trump’s proposals are fully in sync with party platforms. The Democratic platform is more aggressive than is Clinton’s in many areas: taxing upper-income groups, restricting companies and closing tax loopholes, expanding the federal government’s role in healthcare, and raising the national minimum wage. On the Republican side, Trump’s plan runs against long-held Republican policies like free trade and shrinking the role of government in the economy.

Incoming presidents have historically claimed an electoral mandate for their vision, but the odds of either candidate enacting more than half of their plan is quite unlikely, in our view. If there’s a common theme, it’s on infrastructure: both candidates agree that a substantial federal infrastructure spending program is needed. However, either plan would still need Congressional approval. History also suggests that any tax law changes almost always involve both individual and corporate taxes. If Republicans want corporate tax reform and Democrats want individual tax relief—especially for the middle class—there’s a good chance they could meet in the middle.

What Plan Can America Afford?

After the election, the focus will be on potential changes in fiscal policy and what the US can actually afford. That discussion depends largely on whether balance sheets or financing costs matter more.

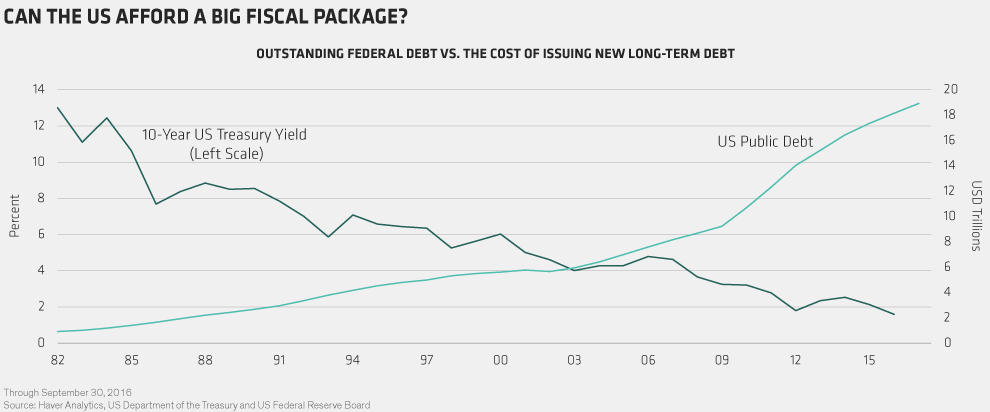

For example, outstanding US public debt is over $19 trillion, with more budget deficits projected as far as the eye can see. Taking on more debt to finance growth would seem prohibitive and costly. But with long-term (10-year) financing costs at 1.6%, the cost of new borrowing is less than half of nominal gross domestic product growth and projected revenues (Display).

That environment makes a new fiscal plan look relatively benign and attractive, especially if it can lift projected growth over a span of several years. The last time the US embarked on a major fiscal expansion was in the early 1980s. At that time, the cost of 10-year debt was 13%. Today’s trade-off seems much better, but it’s still not without risk.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein