Many investors, both professional and retail, have grown frustrated over the lack of growth within the U.S. equity market. There are probably several reasons for this, one being the over-confidence that’s been molded out of the lack of price-volatility like we saw on 2011 and 2009. But I think a large chunk of the frustration lies with investor’s recency bias.

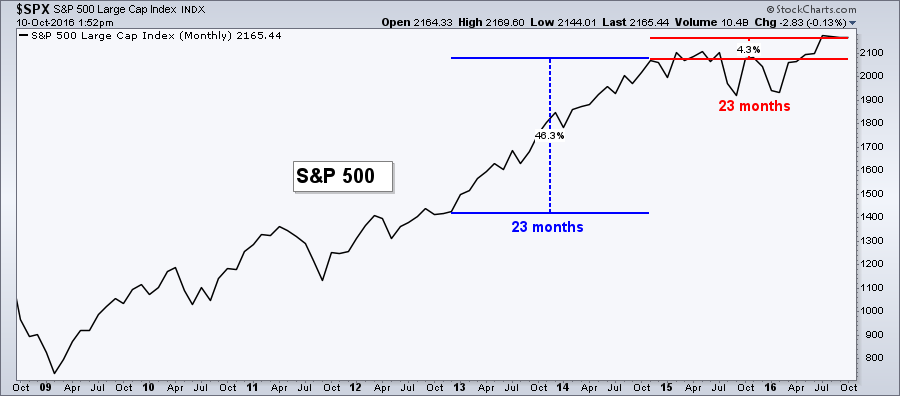

The chart below is a simple monthly line chart of the S&P 500 ($SPX). I’ve marked with a blue performance line the 23 month period that ended in October 2014, which shows the market rose 46% during that time period. While the last roughly two years has seen less than 5% growth for the U.S. stock market. Investors grew accustom to seeing double-digit gains on their annual statements, requiring practically no outside diversification away from large cap U.S. companies. That market environment has dissipated and a little more effect has been required. And if there’s anything Americans hate, it’s the need for more effort (which is why we’ve invented self-driving cars, shoes that don’t require laces, and voice-activated text messaging).

While the market lacks the heroin-like stimulus provided by the Fed, stocks must begin to learn to walk and grow on their own. Will we eventually breakout and begin seeing those double-digit returns once again? Or will things flip and those double digits will be to the downside? No one knows. But we must adjust our expectations and realize we may need to look outside simple U.S. large caps to find asset appreciation rather than sit and pout, sending Snapshats and answering Twitter polls waiting for something to happen in the S&P pits.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer. Connect with Andrew on Google+, Twitter, and StockTwits.

Copyright © Andrew Thrasher