by Cullen Roche, Pragmatic Capitalism

The Dow Jones Industrial Average is a terrible index of “corporate America”. I don’t know why anyone still cites it. I know, it’s a relic of an era long past. But can we all just agree to let it die? Can we all just agree to stop citing it? We have much broader indices that are much better and more accurate representations of the health of corporate America. So why do we continue to cite this index of 30 random companies when we have indices that span such a broad swath of corporate America?

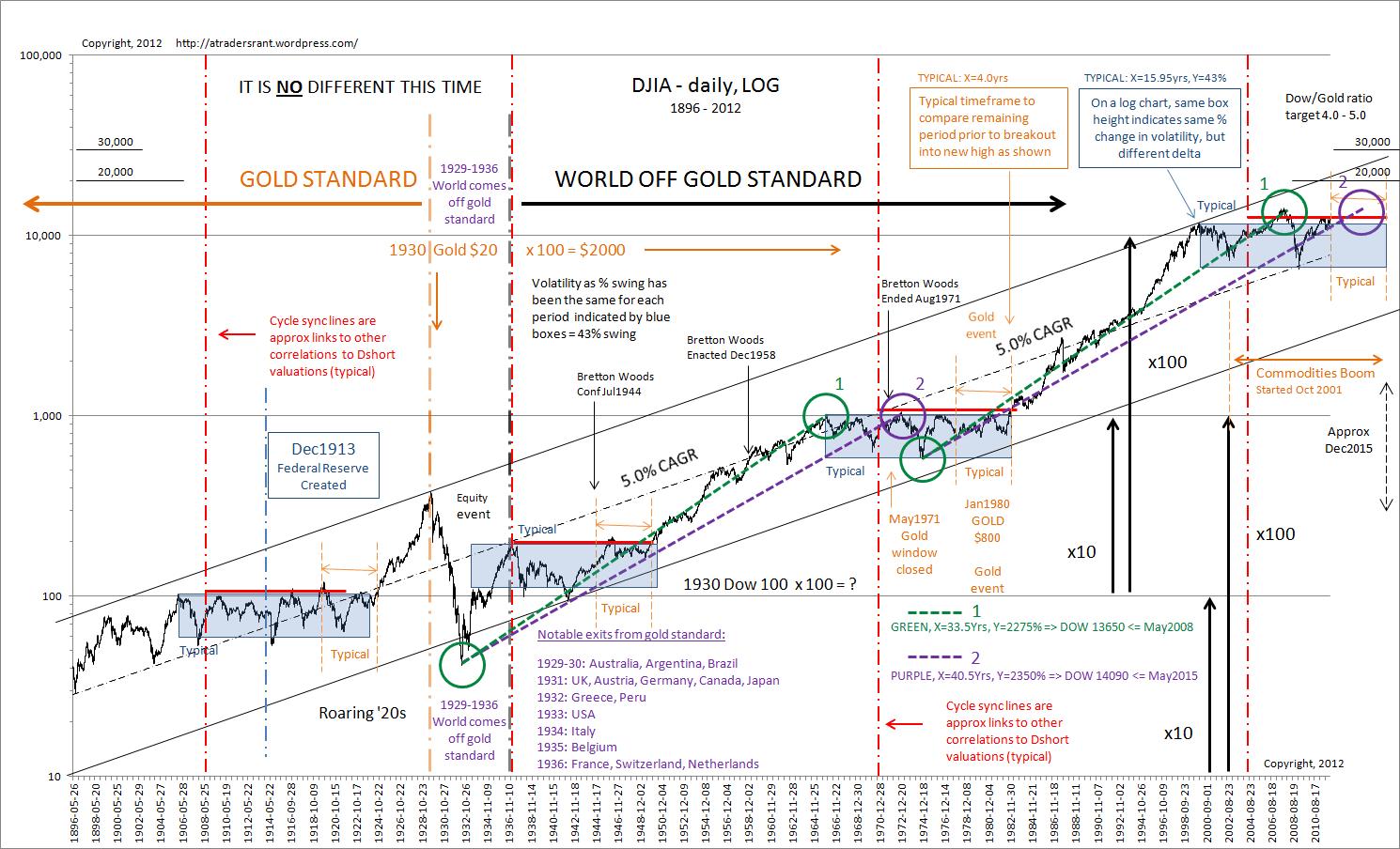

The reason I bring this up is because I was reading this piece on Business Insider citing Warren Buffett and how you shouldn’t assume that the stock market will grow just because the economy grows. And the piece cites a period from 1964-1981 when the Dow didn’t budge, but the economy expanded by 3X. It’s true:

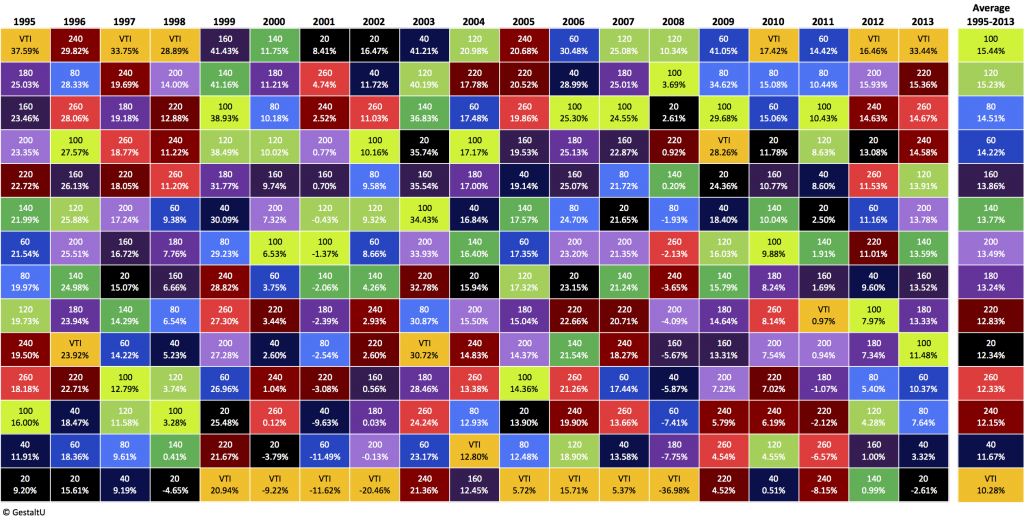

But the same thing isn’t true for the S&P 500 which expanded by 47% during this period:

Yes, I agree with the broader point – the stock market is not the economy. The stock market tries to front-run the economy. So there’s a difference in the cyclicality at work there and we should never assume that future economic growth means future stock market growth. But the next time someone cites the Dow please sit them down and tell them that the Dow Jones Industrial Average is an index that our grandfathers used because there was nothing better. And then let them know that there are much better indices that represent the state of corporate America. They’ll thank you when they realize how deceptive a 30 company slice of corporate America can make things appear….

Copyright © Pragmatic Capitalism