by Greg Harmon, Dragonfly Capital

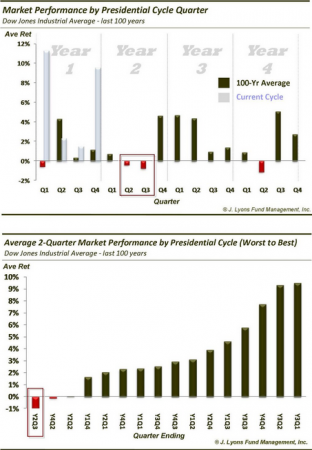

That is the tone in the market. That is limping into the end of the quarter. Traders and pundits alike are getting less optimistic about the near term and some about the longer term as they measure the length of the current bull market. At 5 years who can blame them. Out brains are wired to look for patterns and there are plenty of them out there that make the next 3-6 months look not so good. IBD (Investors Business Daily) has moved to a market in correction stance. The Presidential Cycle looks at the the next two quarters as being the worst over a 100 year period. My new friend, a follower

(courtesy of J. Lyons Fund Management, Inc)

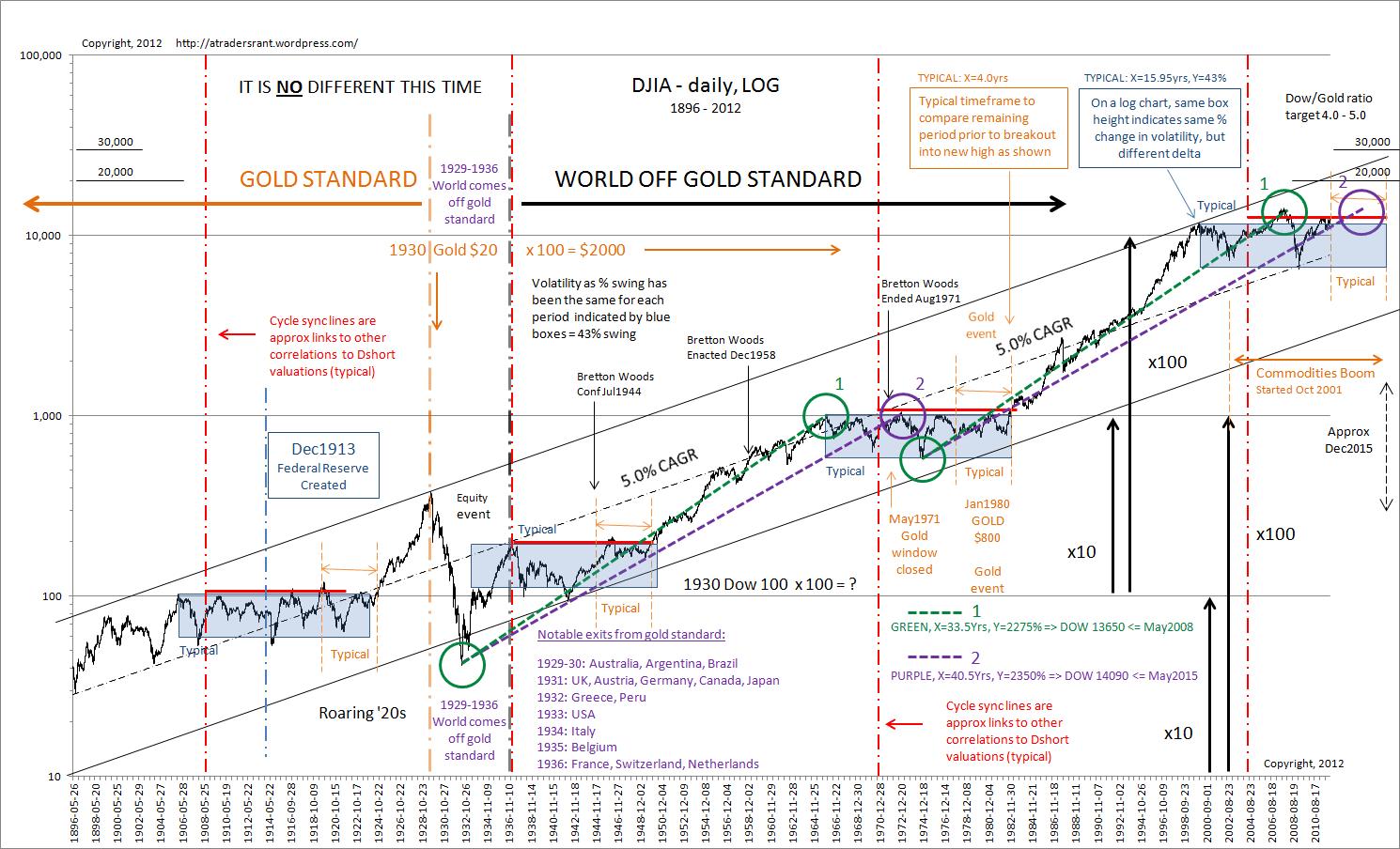

of W.D. Gann’s work, sees the next 6 months as a volatile topping period for a total 66 month cycle higher from the March 2009 lows. And there are others I am leaving out.

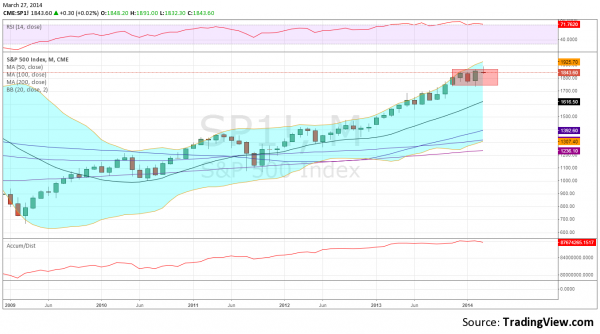

Add in the bitterly cold weather and snow over most of the country this winter and it is a recipe for down right depression. Until you step back and take a look at the monthly chart of the S&P 500. It certainly has not been parading forward leading all to great riches, but it is hardly very depressing either. Over the last 5 months the S&P 500 has moved in a range between 1750 and 1870, roughly, and sits within 2% of the top of that range as we end the Quarter. From a technical perspective it has some mixed characteristics. On the plus side the accumulation that has been seen since the 2009 bottom is continuing and the Relative Strength Index (RSI) is strong and bullish. in the caution camp the Index is a bit extended from the moving averages so the mean reversion crew suspect a pullback, and the monthly candlestick for March is a looking to form a potential reversal candle.

What do you do in the face of this? Be diligent in protecting your portfolio. Sharpen your stops. Add collars. Maybe trade smaller and or less often. What you should not do is panic and outright sell your positions. Let each stock tell you when it is time to sell it. And don’t get sucked into the depression. The picture is not that bad and still pretty good looking. It may have seemed like the market is limping into the end of the Quarter. But maybe a better perspective is that it is resting after running a long race, gaining strength to run again.

Copyright © Dragonfly Capital