The Return to an Era of Income Investing

by Alfred Lee, CFA, DMS, Vice President & Investment Strategist,

BMO ETFs & Global Structured Investments, BMO Asset Management

alfred.lee(@)bmo.com

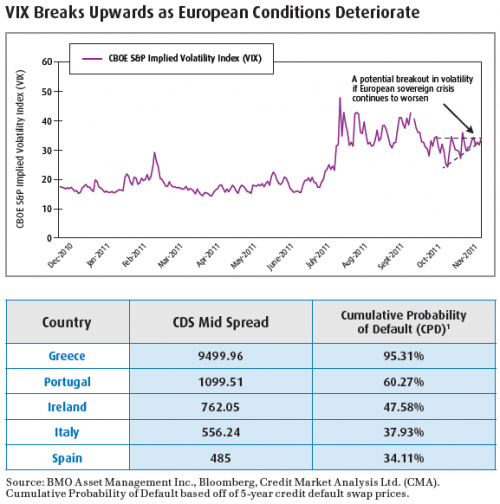

With the ongoing European sovereign debt saga dragging on and critical decisions being postponed, its impact continues to weigh on global equity markets. The earnings story at the company level, particularly in the U.S, that we’ve been bullish on throughout the year continues to keep stock markets moderately buoyant. Over the last several months, a tough battle between macro- and micro-economics has compounded volatility. The CBOE S&P Implied Volatility Index (VIX) and the S&P/ TSX 60 Implied Volatility Index (VIXC) currently sit at 33.98 and 28.89, respectively, well above their normalized ranges, indicating continued fear in the market place. From a global macro perspective, credit default swaps (CDS) or the cost of insuring a default on the sovereign debt of Greece and Italy recently hit new records. The positive developments over the month have been the stepping down of prime ministers from both Greece and Italy. With Mario Monti now the prime minister of Italy and Lucas Papademos the new prime minister of Greece, this changing of the guard as well as their deep economic experience may help restore some confidence with investors. As a result, the performance of global equities for the remainder of the year depends on whether this deadweight on investor optimism from Europe can be lifted. If so, the focus of the market can quickly shift to the earnings of companies, which continue to come in better than expected. If confidence is not restored however, markets may potentially fall below their October lows, leaving the possibility of the much desired year-end Santa Claus rally extremely binary.

Despite the uncertainty, which we feel will unfortunately continue to weigh on the markets, one of the few things that remains quite certain for the next two years is that we will continue to see a low interest rate environment. As U.S. Federal Reserve Board (Fed) chairman Ben Bernanke pledged to keep interest rates near or at historic lows until at least 2013, other central banks around the world will likely be forced to follow suit. Otherwise they risk causing their currency to rise with a higher relative interest rate, thus negatively impacting the country’s exporting industry. Dividend paying or income producing strategies are one of the themes we have recommended throughout the year, and one that we continue to recommend. As we pointed out last year, a 10-year Bank of Canada note now yields less than the dividend yield of the S&P/TSX Composite Index. Similarly, the yield on a 10-year U.S. Treasury note is less than that of the dividend yield of the S&P 500 Composite Index. Although this condition will likely not hold as the appetite for risk returns, the spread between the yield of government bonds and equities will likely remain well below historical averages. This is a recent key development which should lead investors to continue chasing yield oriented investments, causing these areas to likely outperform.

Back to the Old: Dividend Investing

The returns from a stock are derived from two components: capital gains and dividends (or distributions). Since the 1990’s chasing capital gains has been an effective strategy for investors – and for good reason. A perfect storm of rapidly evolving technology, baby-boomers entering their peak earnings age and deregulation were just a few of the factors which led a number of equity market indices around the world to see their most unprecedented rallies on record. Between 1980 and 2001, the Dow Jones Industrial Average Index and the S&P/TSX Composite Index gained 1186% and 393% respectively. Prior to this era, investing in solid companies that provided sustainable dividends was the key to a successful investment strategy, a key factor to the investment approach of investing legends such as Warren Buffet. In the current market environment where volatility has become (and will likely remain) more of a norm than an exception, the capital gains portion of a stock will become more unpredictable. The dividend portion of an equity investment, on the other hand, is more reliable.