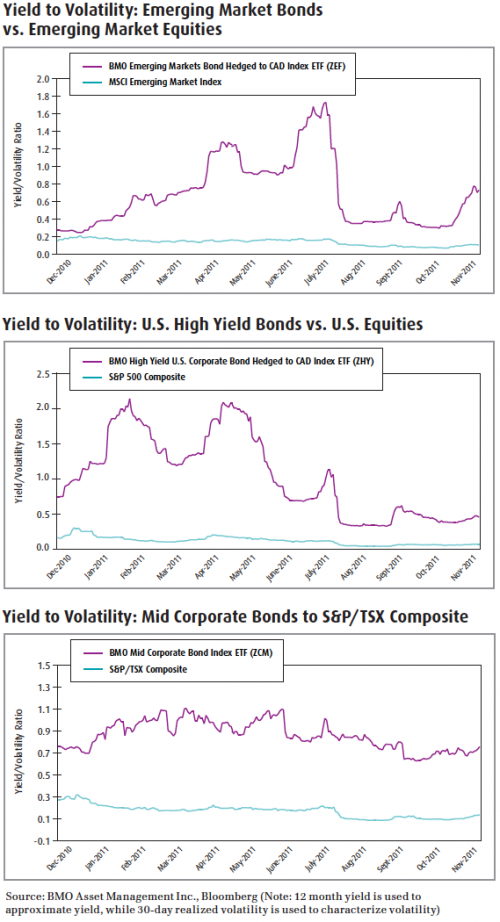

The following charts compare some yields to volatility ratios between some of our fixed income ETFs and some equity based indices. By switching from a security with a low yield to volatility ratio to one that exhibits a higher ratio, investors can potentially improve their overall portfolio yield and lower volatility. Although, these switches may reduce the opportunity for capital gains, yield and volatility reduction should be a paramount strategy in the current market environment.

Potential Investment Ideas:

- BMO Emerging Market Bond Hedged to CAD Index ETF (ZEF)

- BMO U.S. High Yield Corporate Bond Hedged to CAD Index ETF (ZHY)

- BMO Mid Corporate Bond Index ETF (ZCM)

Income focused investments will likely continue to show relative outperformance to the broad market as long as we remain in a low interest rate environment. The European Central Bank (ECB) which has had a tendency to take a more hawkish tone on monetary policy surprisingly recently dropped interest rates by 25 basis points, shortly after new ECB president Mario Draghi was inaugurated. Moreover, with many developed nations still struggling to kick-start their economies, interest rates will likely remain low in the absence of either higher inflation or growth in gross domestic product (GDP). In addition, several weeks ago, credit rating agency Fitch Ratings warned that the credit worthiness of U.S. banks would deteriorate if the European debt crisis worsens. This is a good depiction of how interconnected the global economy has become and how much hinges on the restoration of confidence in Europe. With the tug-of-war between the macro-economics in Europe and the improving micro-economics at the company level, market volatility is likely to remain, leading capital gains to show greater variability. Thus increasing exposure to income oriented areas should be an effective strategy for a market where expectations of economic growth is low and volatility is likely to remain high.

Footnotes

1 Cumulative probability of default (CPD) quantifies the probability of a country being unable to honour its debt obligations over a given time period. For sovereign CDS, this typically includes the probability of a restructuring of debt. Unless otherwise stated, all values are for the five year CPD. CPD is calculated using an industry standard model and proprietary credit data from CMA DatavisionTM. Reference to ‘risky’ is purely in terms of the probability of default derived from the price of the CDS.

Copyright © BMO Asset Management, BMO ETFs