by Richard Bernstein, Richard Bernstein Advisors

In contrast to earlier this year when 10-year Treasury yields were hovering around 3.5%, the recent jump in interest rates toward 5% has resulted in some attractive opportunities across several corners of the fixed income market. Below we highlight four compelling investments for the remainder of 2023 and into 2024.

1. Real Yield (TIPS): Treasury Inflation-Protected Securities (TIPS) currently offer compelling value with 10-year real yields at approximately 2.5%. This is the first opportunity investors have had to lock in real returns above 2% since the Financial Crisis and the top 25th percentile of yield since TIPS were first issued in 1997. Despite increased nominal yields and inflationary pressures — particularly given a 34% surge in oil prices since June — inflation expectations have remained relatively stable. If inflation expectations were to rise, TIPS could experience a significant increase in returns. Conversely, if nominal yields were to decrease while inflation expectations remain steady, TIPS returns could be on par with those of Treasuries.

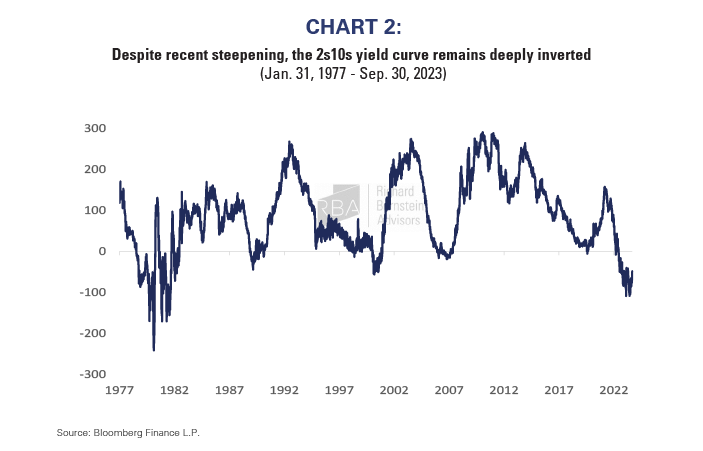

2. Yield Curve Steepeners: Given the nearly historic inversion of the 2s10s yield curve, we see a potential opportunity to benefit from either an economic reacceleration or a severe downturn, both of which would likely lead to a steeper yield curve. In the scenario of renewed growth and inflation, we anticipate further bear steepening, where long-term yields rise more than short-term yields as the long end of the interest rate curve is most sensitive to long term growth and inflation expectations. Conversely, in the event of an economic contraction, bull steepening would likely occur, with short-term yields declining more than long-term yields as the market prices Fed rate cuts.

3. Preferred Securities (1): Unlike corporate credit, where spreads remain remarkably tight despite credit stress and increasing defaults, preferreds “realized their event” when the regional banks underwent stress earlier this year. This has cheapened even high-quality bank preferreds and the overall market in general. A reacceleration of earnings growth, the potential for a steeper yield curve, and attractive valuations make these hybrid securities among the most attractive cyclical options in fixed income.

4. Agency Mortgages: Though still realizing structural selling pressure, agency mortgage-backed debt is beginning to look attractive. Although RBA remains underweight the asset class, we have been opportunistically adding as housing fundamentals remain very strong. The lack of new issuance, minimal default risk and positive convexity (2) are all tailwinds for these securitized products.

Opportunities are clearly materializing in Fixed Income.

(1) Preferreds: Preferred stocks are heavily issued by financial institutions and sit in between common stock and bonds in the capital structure, with senior claims on dividends and recoveries vs. common stockholders, but subordinate to bondholders. (2) Convexity demonstrates how the duration of a bond changes as the interest rate changes. If a bond's duration increases as yields increase, the bond is said to have negative convexity. In the case of mortgage-backed securities, this is a function of less mortgage prepayments at higher mortgage rates.