by Stephen H. Dover, Chief Market Strategist and Head of Franklin Templeton Institute, Franklin Templeton

Term premiums have been on the rise, but should investors be concerned? Stephen Dover, Head of Franklin Templeton Institute, explains what term premiums are, and why they are worth paying attention to.

Originally published in Stephen Dover’s LinkedIn Newsletter Global Market Perspectives. Follow Stephen Dover on LinkedIn where he posts his thoughts and comments as well as his Global Market Perspectives newsletter.

Since July, bond yields have been on a tear. The US 10-year Treasury yield has jumped from 3.75% in the third week of July to a recent high of 4.81%.1 Rising government bond yields have pushed up new borrowing costs for companies and households. For instance, the conventional 30-year US fixed rate mortgage is about 7.3%, its highest level since 2000.2 Compared to its lows during the pandemic (closer to 4%) an American taking out a US$325,000 mortgage will today pay nearly US$10,000 more per year in interest.

Rising term premiums have driven the latest jump in bond yields. Rising term premiums represent the additional yield investors require to bear the risk of holding longer-dated notes and bonds relative to shorter term ones, and they impose higher costs on all borrowers—households, businesses, and the government. Indeed, if the jump in term premiums is maintained, it could prove terminal for the economic expansion, as well as for equity and credit markets.

Some basic bond stuff

Observed long-term interest rates (often referred to as nominal bond yields) can be decomposed into three components: 1) the path for the neutral real short-term rate of interest; 2) compensation for expected inflation; and 3) the term premium.

The neutral real rate of interest is the rate—adjusted for inflation—that neither stimulates nor hinders economic activity. It should prevail when the economy is in equilibrium, i.e., enjoying full employment and price stability.

However, when savers lend money to borrowers, they must also consider inflation. Inflation erodes the nominal value of their loans. Lending rates (whether in the form of loans or bonds) therefore embed an expectation of future inflation, which lenders tack onto the real rate of interest when extending credit.

Finally, lenders—whether individuals, banks, or bondholders—typically require extra compensation to account for uncertainty and for the likelihood that the value of long-term credits (e.g., bonds) will fluctuate more than that of short-term credits. For example, the price of a 10-year bond will move more in response to a given change in interest rates than the price of a two-year note. As compensation for both uncertainty and price volatility, therefore, long-term lenders also tack on an additional rate of return, commonly referred to as the “term premium.” The term premium explains why yield curves typically slope upward, reflecting higher interest rates for long-dated notes and bonds relative to shorter maturity borrowings.

Here’s the rub: Real interest rates, inflation expectations and term premiums are all unobservable. That doesn’t prevent clever economists and bonds specialists from trying to estimate them based on other pieces of data. Using various analytical approaches, it is possible to derive reasonable estimates for all three.

The term premium

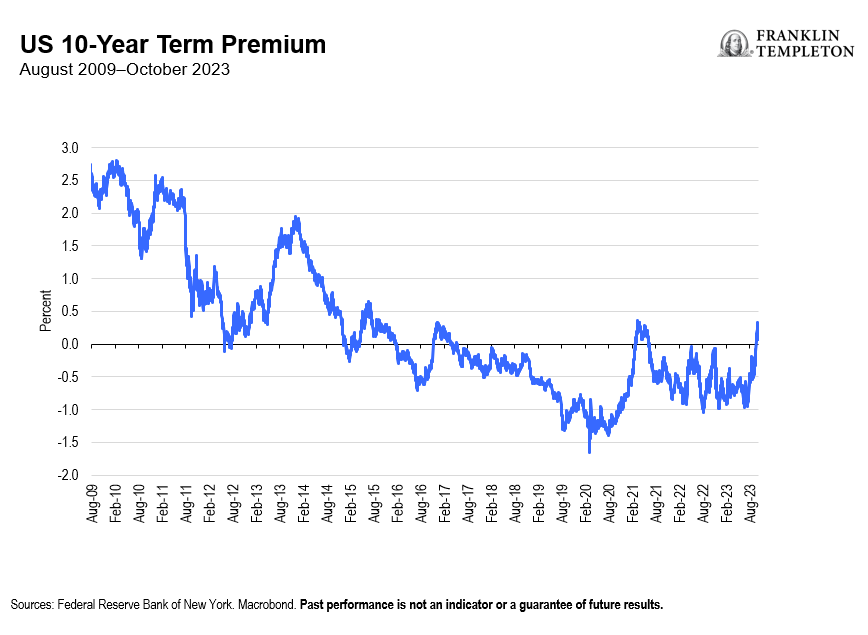

Armed with estimates of the real neutral interest rate and expected inflation, subtracting those two numbers from the observed bond yield gets you to the term premium. The following chart shows one such estimate of the term premium the Federal Reserve (Fed) Bank of New York developed, and how it has behaved since 2009.

Exhibit 1: The Term Premium Experienced a Significant Surge

Note that since mid-July, the term premium has spiked, jumping by 1.3 percentage points, a move that accounts for even more than the observed rise in nominal bond yields. That’s because measures of the real rate of interest simultaneously fell and expected inflation only increased a bit.

More noteworthy is the fact that term premiums were negative for most of the past decade. That flies in the face of theory, which says that lenders need to be compensated for longer-term lending.

The negative term premium of recent years reflects several special factors, of which probably the most important being the monetary policies of the Fed and other central banks. Those had two components: 1) large-scale asset purchases, dubbed “quantitative easing,” or QE for short; and 2) “forward guidance,” namely strong reassurances that super-low interest rates and QE would remain in place for considerably longer (i.e., until full employment and price stability had been sustainably restored).

Accordingly, lenders “knew” that interest rates would remain stuck at low levels. That removed uncertainty that in normal times probably would have prevailed. Lenders also didn’t have to fret much about the volatility of their long-term bonds, given that the actions of central banks firmly pinned down both short- and long-term interest rates. Extraordinary monetary policies effectively crushed term premiums—the extra compensation investors would otherwise demand for uncertainty and volatility.

As previously noted, the components of the nominal bond yield cannot be observed. That leaves open room for doubt. For example, using different methodology, the Fed Bank of Richmond has constructed a measure of the neutral real interest rate that—in contrast to the one the New York Fed produced—indicates that the neutral real rate has recently been rising. If so, then the term premium has not been the only reason behind the recent surge in bond yields.

In our view, however, the New York Fed’s approach to disentangling bond yields is more persuasive. To state it as simply as possible, if the Richmond Fed’s estimates of a rising neutral real rate were correct, it would imply that the economy’s speed limit would have accelerated.

That seems unlikely, as there is little evidence in the incoming productivity data to warrant that conclusion. For well-known demographic reasons, the growth of the labor force has slowed. And if trend growth were accelerating, why would it have suddenly jumped in mid-2023? Finally, and perhaps most importantly, if the US economy were suddenly embarking on faster, non-inflationary growth, the equity market would probably be leaping ahead. Instead, since mid-year it has stumbled.

In short, the New York Fed’s estimates of the real neutral rate and, by extension, of the term premium are more closely aligned with other data gleaned from the economy and markets. The term premium appears to us to be the primary culprit for rising bond yields in recent months.

Other factors

Some observers have argued that the latest jump in bond yields is tied to changes in the supply and demand for bonds. Little wonder: Just as the Fed (and other central banks) have stepped back from bond buying (and have shrunk the holdings of bonds by not replacing all of those that mature), governments around the world have run up big deficits, requiring heavier bond issuance. In the United States, the issuance calendar has become particularly loaded in 2023, as the Treasury had to also replace depleted cash levels from earlier this year when it was trying to prevent a US default stemming from Congress’ delay in raising the debt ceiling.

Yet all these things have been “known-knowns” for much of this year, even in the second-quarter of 2023 when interest rates were much lower than today. So those who argue that a combination of QT and big budget deficits are behind rising bond yields are left without an answer to “why now?” To us, the timing of the latest surge in bond yields is difficult to explain merely in supply/demand terms.

Finally, it is worth recalling that the US economy has proven resilient to the massive Fed rate hikes since early 2022. Fiscal stimulus, the ability of households to draw on savings, a tight labor market, and a greater reliance on fixed rate borrowing (insulating—for a time—households and companies from higher borrowing costs) explain that resilience. But consequently, the Fed has clearly signaled that its policy will remain tight for longer. The Fed’s resolve to see the economy weaken to assure its inflation target is met has probably contributed to the rise in yields because it has removed hopes for rate cuts in 2024. Still, it remains a mystery why 10- and even 30-year bond yields should have reacted so strongly to changes in interest rate expectations over the next few quarters. Hence, even “high for longer” cannot fully account for the observed rise in bond yields since July.

Investment implications

Our conclusion, therefore, is that rising term premiums are behind the rise in bond yields. For the economy, it is important to note that resilience is not forever. New borrowers and those who must roll over their maturing debts will soon have to pay much higher borrowing costs, as highlighted in the example at the beginning of this note. Moreover, there is some evidence that the labor market is showing signs of softening.

Studies from the Fed Bank of San Francisco show that household excess savings are almost depleted. And additional shots of fiscal stimulus are unlikely, given Washington gridlock. Accordingly, an economy that was almost certainly set to slow now runs a greater risk of recession. That matters for equity and credit investors, where asset values depend on corporate profits. Before the latest jump in interest rates, optimism was growing about the outlook for higher corporate profits later this year and in 2024. That optimism had helped to underpin strong 2023 gains in equity markets. Now investors must wonder if those expectations weren’t too rosy.

Higher US yields also boost the value of the dollar. All else equal, that tends to undermine commodity prices. And, on cue, oil prices have recently plunged. Meanwhile, a strong dollar is not welcome in some parts of the world. Japan is reported to have intervened to prevent the yen from sliding below 150 versus the dollar. Emerging fixed income and equity markets typically fare poorly when the dollar becomes too strong. Finally, no region has been spared higher yields stemming from rising US rates. Bond yields in the eurozone, which is already teetering on the edge of recession, are heading higher.

Summary

Bond yields have surged. Many explanations have been offered. We think it is mostly about term premiums. But whatever the cause, the effect is mostly unpleasant. Unless bond yields settle back into lower ranges, global growth is likely to be lower, profits expectations will come under pressure, and risks to equities and credit fixed income markets will be on the rise.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

The government’s participation in the economy is still high and, therefore, investments in China will be subject to larger regulatory risk levels compared to many other countries.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

____________

1. Source: Bloomberg. As of October 12, 2023.

2. Source: Freddie Mac. As of October 5, 2023.