by Edward D. Perks, CFA, Franklin Templeton Investments

Stabilisation Amid Heightened Uncertainties

The new year started with a bout of volatility, driven by tensions in the Middle East. US forces assassinated General Qassem Soleimani, leader of Iran’s Revolutionary Guard Corps, which grabbed headlines and moved markets for several days. However, Iran’s measured response, avoiding the escalation that some had feared, allowed the initial phase of the crisis to blow over quickly.

The price of crude oil returned to levels that were seen before the initial attack on January 3, limiting the likely impact on economic activity. Global equity indices shrugged off the events and moved to new all-time highs. Overall, it appears that investors remain optimistic about the path of global economic growth, with easing trade tensions between the United States and China offering support.

Economic stabilisation seems to be occurring amid supportive effects of accommodative monetary policy in both developed and emerging economies. However, despite our proprietary indicators of growth momentum levelling off more recently, we don’t see evidence of a sharp rebound in activity or a high probability of governments delivering the fiscal measures that would support such a move.

Many of the concerns that we have discussed in our “Allocation Views” over the past year are still on the radar. Business investment faces headwinds from confidence and the lack of a full resolution to the US-China trade dispute. Economies like Germany that are more exposed to manufacturing, which remains in recession, are vulnerable to layoffs spreading pain to the wider economy. Geopolitical flashpoints such as North Korea, as well as the unresolved issues in the Middle East, could flare up.

As a base case, we expect continued global growth and moderate inflation over the long term. With relatively few imbalances, the global economy is less likely to see extreme swings in output. However, reflecting the balance of issues noted above, we are focused on the potential for the risks during 2020 to remain skewed to the downside. Recent equity market performance has been delivered without a matching boost to earnings, stretching valuation metrics. We remain optimistic that the probability of recession in the major economies is moderate, but the potential for a period of disappointment remains. Our dominant investment theme is fundamentally unchanged as “Global Growth Remains a Concern.”

Inflation Expectations Are Modest

Inflation developments have been less dramatic than any other element of our investment approach over the recent past. However, a lack of inflation concerns was a necessary precondition for the supportive environment that central banks have been able to provide to asset markets. It is also arguably one of the primary reasons for the longevity of this current economic expansion.

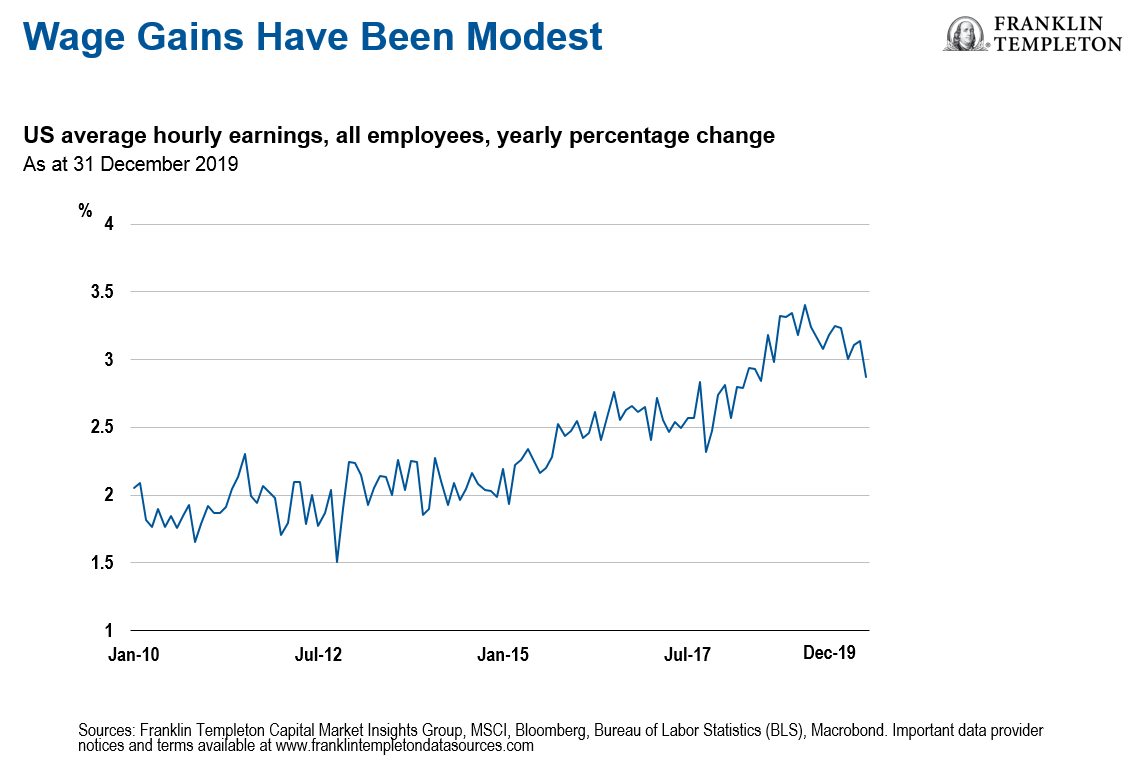

Despite being in the latter stages of the business cycle, we have seen only limited rises in wage inflation in most economies. In the United States, average hourly earnings growth has dipped back from slightly higher levels seen in late 2018.

Across developed markets, corporate fundamentals have remained relatively strong, but the ability to pass on higher costs to consumers appears limited and the willingness to keep increasing wages is similarly constrained.

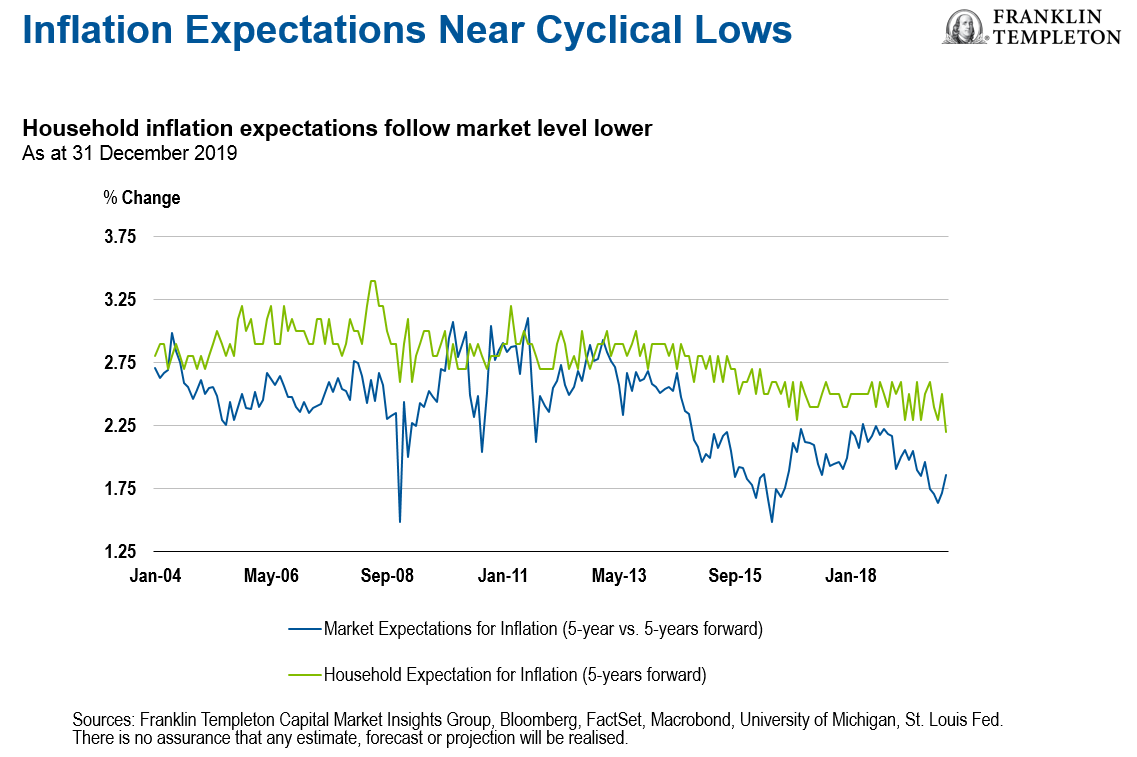

Market-based measures of inflation expectations, derived from the yields of nominal and real return bonds, have remained low. These so-called breakeven inflation rates (where the prospective return on nominal and real return bonds are equal) respond directly to headline inflation and any rise in commodity prices.

Looking more deeply, the level of breakeven inflation over the five-year period starting five years from now (5-year/5-year forward rate) has remained depressed. This may largely reflect a decline in the risk premium for inflation uncertainty, as government bond yields have fallen.

For now, we view the primary driver of inflation to be changes in demand. As a result, the deceleration in global growth that we have already seen is anticipated to cap inflation during 2020. This effect has been felt broadly, including in emerging markets, reinforcing our theme that sees “Subdued Inflation Across Economies.”

Nimble Remains the Watchword

When we reviewed events in the Middle East with our senior investment leaders across asset classes and with colleagues in the region, we found a wide range of opinions. As a broad characterisation, our equity investment teams were more sanguine about the outlook, while fixed income teams saw the potential for heightened risk premia in global markets. Broadly, from a Multi-Asset Solutions perspective, we are focused on the potential for the tails of the distribution of potential market outcomes (at the most negative and most positive ends of the spectrum) to become “a little bit fatter,” emphasising the importance of protecting the downside if events don’t follow the more likely benign path that we all hope to see.

Having scaled back our cautious stance on risk assets last quarter, we retain a modestly lower conviction on global equities. Our view reflects the balance between longer-term attractions and some reasons for concern over valuations, but we are not overly bearish.

In a multi-asset portfolio, we can aim to hold assets that provide the potential for diversification. Bonds traditionally fulfill that role but are also expensive, in our view. Global bonds—especially high credit quality and long-duration issues—appear vulnerable due low term premia and credit spreads for investment grade corporate issues. However, modest growth and subdued inflation balance this in our neutral overall view of the asset class.

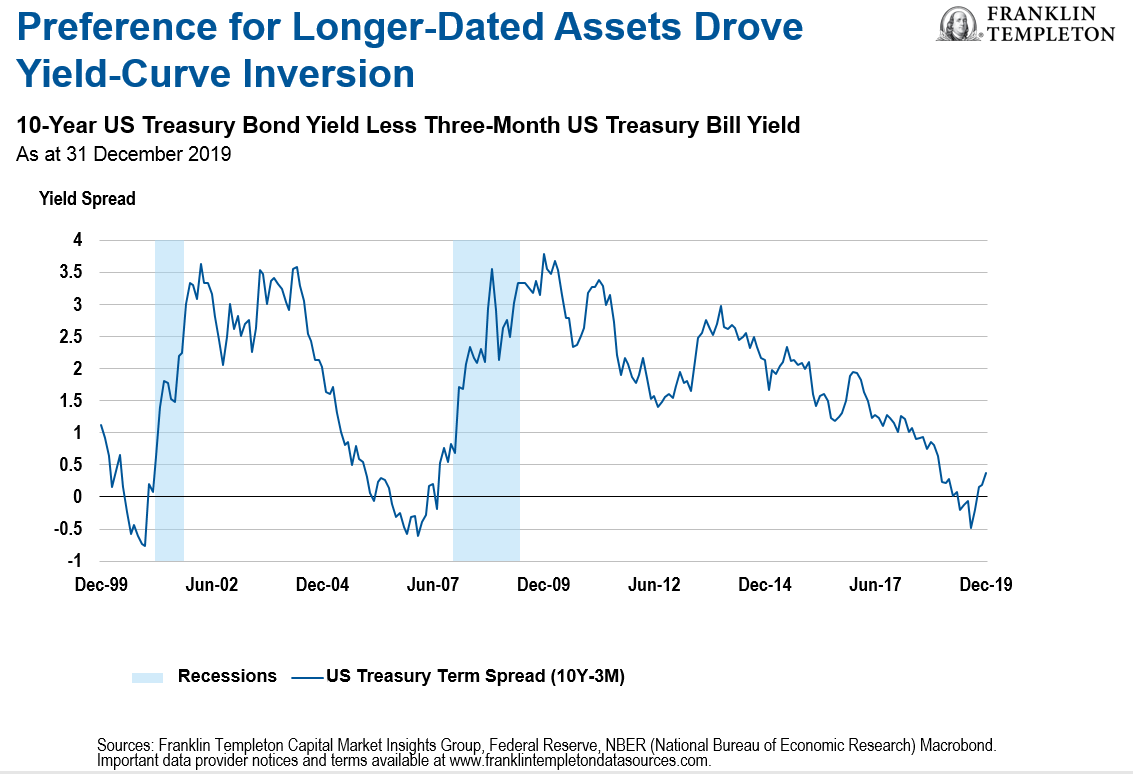

Investors’ preference for longer-term assets, perhaps in search of diversification, drove the yield curve inversions that occurred in 2019. This is often viewed as a bearish economic signal, that is, a harbinger that the prospects for recession in the year or two ahead have increased. This risk doesn’t unduly concern us, and many investors point to reasons why it might be “different this time.” However, the response of central banks will probably be key.

US Federal Reserve (Fed) Chairman Jerome Powell indicated that the threshold for further interest-rate cuts had moved higher. But the threshold for rate hikes was even higher still. Central banks in the developed world continue to show a policy response asymmetry, more broadly. This reflects a common concern that inflation is undershooting their targets and a fear that inflation expectations might become unanchored. This is at least part of the reason for relative calm in financial markets, despite the escalation in geopolitical tension, and is reflected in our final theme of a “Dovish Bias to Monetary Policy.”

This bias toward cutting interest rates, even from the low levels already reached, argues for a relatively evenly balanced portfolio of bonds and stocks at this time. We continue to believe that navigating the challenges the year ahead presents will require nimble management.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

*****

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of the publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FTI affiliates and/or their distributors as local laws and regulation permits. Please consult your own professional adviser or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. The positioning of a specific portfolio may differ from the information presented herein due to various factors, including, but not limited to, allocations from the core portfolio and specific investment objectives, guidelines, strategy and restrictions of a portfolio. There is no assurance any forecast, projection or estimate will be realized. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Derivatives, including currency management strategies, involve costs and can create economic leverage in a portfolio which may result in significant volatility and cause the portfolio to participate in losses (as well as enable gains) on an amount that exceeds the portfolio’s initial investment. A strategy may not achieve the anticipated benefits, and may realize losses, when a counterparty fails to perform as promised. Currency rates may fluctuate significantly over short periods of time and can reduce returns. Investing in the natural resources sector involves special risks, including increased susceptibility to adverse economic and regulatory developments affecting the sector—prices of such securities can be volatile, particularly over the short term.

This post was first published at the official blog of Franklin Templeton Investments.