by Richard Bernstein, Richard Bernstein Advisors

Treasury bonds have long been considered the financial markets’ “safe haven” asset. That remains generally true, but investors should appreciate the risk of default is causing the financial markets to re-assess Treasuries’ superiority as a safe haven relative to other assets.

There is plenty of blame to be shared in Washington, DC, so one should not consider this report as some sort of a political statement. However, investors need to be dispassionate in their asset valuations, and it seems as though investors are somewhat sanguine regarding the possibility of the world’s safe haven no longer being quite as safe.

The current environment seems full of pseudo-safe assets: cryptocurrencies, smaller growth companies, and private equity and debt might be prime examples. So, Treasuries remain quite safe compared to these imposters.

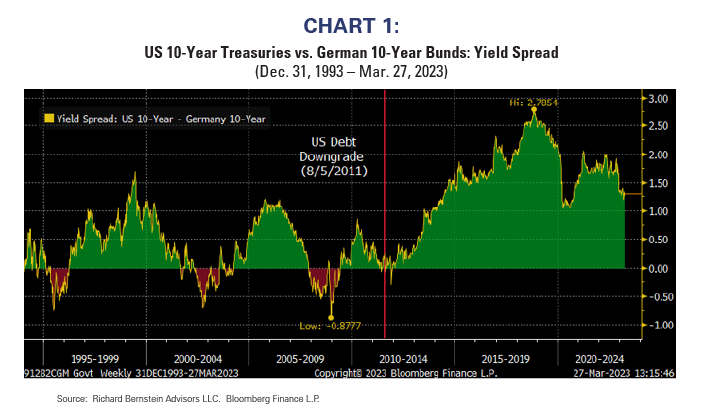

The risk of a US default should nonetheless be fully appreciated. The markets re-priced Treasuries to account for the downgrade of US debt by Standard & Poors in 2011. The cost to the US government has more consistently been between 100-200 bps higher yield relative to German Bunds than it was prior to the downgrade (see Chart 1).

In other words, the 10-year T-note yield has carried a consistent risk premium to German Bunds since the downgrade of US government debt in 2011. Because all US debt prices off US Treasuries’ yields, the downgrade and subsequent increased risk premium means US corporate, municipal, and mortgage debt has also had an imbedded risk premium and higher associated interest costs.

One should not downplay the potential damage of a growing risk premium despite generally lower absolute interest rates. US rates actually fell in absolute terms after the US downgrade because the economy weakened. The chart points out, however, that the US nonetheless experienced relatively higher rates which ultimately detracted from US competitiveness.

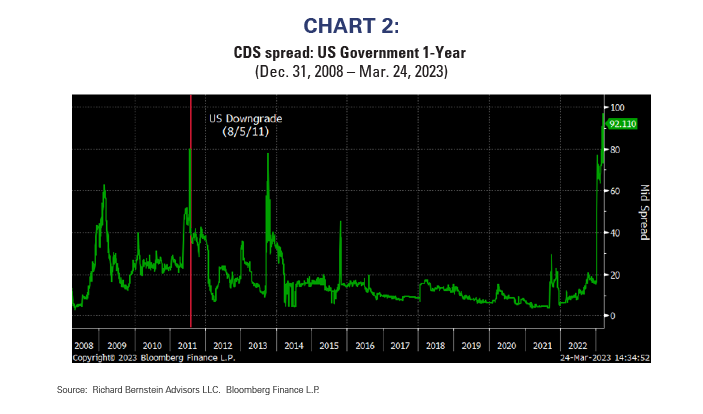

Credit default swaps (CDS) are market-traded insurance against default. Bonds considered more likely to default have higher credit default swap costs. CDS is priced in basis points (bps), so a CDS spread of 100 bps for a bond suggests the costs to insure against default will cost 100bps. The bond buyer agrees to pay the insurer 100bps in exchange for protection against the bond defaulting.

The US government 1-year CDS spread (i.e., insuring against default in the forthcoming year) is now higher than it was when US debt was downgraded in 2011 (see Chart 2), which suggests the markets feel the risk of default is higher than it was in 2011, and another US debt downgrade would likely further increase interest costs to the US government and to the overall US economy.

US government riskier than Financials?

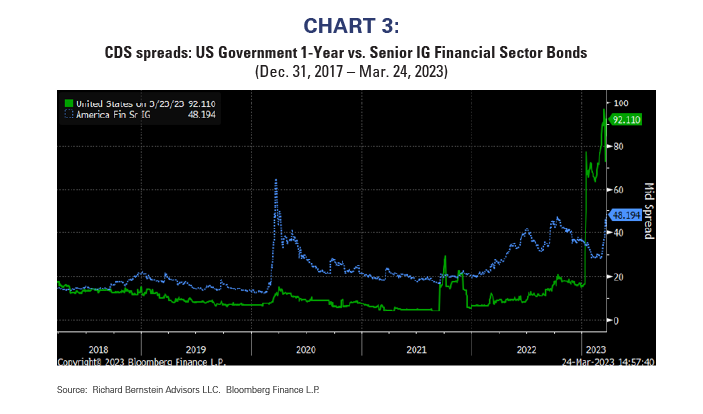

Despite all the attention currently paid to the Financial sector’s problems, CDS spreads currently suggest a US default is more likely than are senior investment grade bonds issued by financial companies.

Chart 3 compares CDS spread for the US government with those of Senior Investment Grade (IG) Financial sector bonds. At this point in time, the CDS spread for the US government is almost twice that of Senior IG Financial bonds.

Reality bites

Investors seem shocked by the recent bank failures, but there could be a significantly more meaningful financial event looming.

The notion that 2011’s near-default was a non-event has proven totally false. Of course, financing costs would have been much higher if there actually had been an extended government default, but the US economy has nonetheless paid higher interest costs and experienced slower growth because of 2011’s fiasco.

Investors should appreciate another near-default or actual default could similarly result in a meaningful secular relative increase in US relative interest costs and slower US relative economic competitiveness and growth.

We remain overweight long-term Treasuries based on our view that US nominal growth will slow through time, as a hedge against more economically-sensitive equities, and the structural difficulties of holding German Bunds.

However, US Treasuries are clearly not the same safe haven asset they were prior to 2011’s downgrade of US debt, and we fully recognize a US government default could not only further jeopardize Treasuries’ status, but could also result in still higher relative US interest costs and the associated further loss in global competitiveness.

Copyright © Richard Bernstein Advisors