Elisabeth Kashner, CFA, FactSet’s Vice President and Director of Funds Research and Analytics recently honoured us with the pleasure of a candid and thought-provoking conversation about the evolution of the ETF industry, the proliferation of ETFs and the associated risks. We talked about cutting through the noise with actionable ETF research and analysis and having an essential framework for ETF due diligence and selection.

AA: What inspired you to pursue a career in ETF research and analytics and how did you get started in this field?

EK: It’s almost legend among people who are senior in the ETF industry that we all say we stumbled into the ETF business. The ETF industry was still very new when I started, and there wasn't really a deliberate career path to follow. I had a diverse career background, starting as a school teacher, then moving into derivatives trading, and later becoming a stay-at-home mom. When I re-entered the workforce, I got a Masters in Financial Analysis at the University of San Francisco and worked my way through the CFA program.

At graduation, in the summer of 2008, I took a job as a strategist in a wealth management firm. The team there had steered everybody’s portfolio into a whole set of actively managed mutual funds, and in the free fall markets of 2008-2009, the professional investment managers failed to provide any risk management – as well as mostly underperforming the benchmarks. It was then that our CEO tasked me with building an all-ETF portfolio. There were very few tools available for ETF due diligence, so I had to build the portfolio from scratch. I joked that I used paperclips, rubber bands, and glue. That was my 2009.

This experience prepared me to snap at an opportunity at what later became ETF.com, to build an ETF analytics system and to bring up a crew of junior quantitative analysts. We dove into writing and figuring out how to present data in a way that made sense to a variety of users.

AA: As Vice President and Director of Funds Research and Analytics at FactSet, what are some of the main responsibilities and challenges that come with your role?

EK: I wear several hats at FactSet. The bread and butter of my work is maintaining, evolving, and expanding our ETF classification and analytics capabilities.

...you may have noticed the metric I’m currently designing: a method to back out affiliated assets from the AUM of an ETF. If you’re an advisor and you notice that it has $7 billion in assets, well, on the surface that seems fairly robust. But if you uncover that six and a half billion of it came from elsewhere in its parent organization, you might come away with a different assessment of the viability of that product.

The backbone of everything is our classification system, which looks deeply into an ETF's definition of its investible universe, and then researches its strategies for selecting and weighting securities. The classification system’s purpose is to group together funds that are rightfully competing for the same track of investors.

The ETF world keeps evolving, so our classification system needs to evolve as well, applying across many different fund types. Maintaining the system and ensuring it stays relevant is a big part of my job.

It's also my job to maintain and expand FactSet's Library of Analytics, roll those up into summary ratings and rankings to be applied across a wide swath of competitors. For instance, we have a direct assessment of product viability called Fund Closure Risk.

Sometimes I create new fund metrics. If you read my most recent blog about LinkedIn guy, you may have noticed the metric I’m currently designing: a method to back out affiliated assets from the AUM of an ETF. If you’re an advisor and you notice that it has $7 billion in assets, well, on the surface that seems fairly robust. But if you uncover that six and a half billion of it came from elsewhere in its parent organization, you might come away with a different assessment of the viability of that product.

I also take the data and use it to tell more global stories focused on investor behavior and the industry, which you’ll find within FactSet's Thought Leadership.

AA: Can you tell us more about your work at ETF.com, specifically the research you conducted on strategic beta strategies and Robo-advisor portfolio exposures?

EK: A decade ago, the ETF conversation centered around smart beta products. I was getting so many queries such as, “What is the size and shape of the smart beta universe? How many funds are there? How fast is it growing? Is it faster in stocks than bonds?” In response, I developed a definition of what Smart Beta might be, which I relabeled strategic beta to highlight the importance of fund construction over the marketing message. It was essential to shift the focus away from marketing to the mechanics of ETFs, enabling investors to make informed decisions and understand how ETFs respond to market conditions.

My work at ETF.com involved conducting research on beta strategies, as well as analyzing the portfolio exposures of Robo-advisors to provide comprehensive information to investors to help them navigate the overall ETF landscape.

AA: What are some of the most important factors to consider when analyzing the performance costs and risks of ETFs and mutual funds? And how do you prioritize them?

EK: FactSet's ETF analytics system focuses on three distinct factors; the E, T, and F:

- Efficiency,

- Tradability, and

- Fit.

It’s a nifty acronym – easy to remember.

Efficiency is first, but it is the second most important. Tradability is the least important of the three. We saved the most important one for last — Fit, as it has the largest impact on investor outcomes. Fit assesses the degree of active risk taken.

Fit’s impact can be far larger. Sometimes, within a market segment, we see the best ETF performance come in 50% or 60% above the worst. Taking active risk can pay off, but it can also be quite costly. Fit measures the degree of active risk compared to the target investment universe.

For example, if you have a fund that is just focused on US small-caps, it would have little active risk if it's very broad in its selection of small caps and it’s using a market-cap weighting on them But if it then went on to apply an additional spin, such as equal weighting, or E.S.G., or dividend screen, or any number of things, that would be adding additional active risk.

Sometimes I like to give people a sense of how wrong something can go in each of those areas.

Efficiency is a forward-looking measure of the ETF’s holding costs and operational risks. The funds’ expense ratio gives you a ballpark idea of the friction between the index or the portfolio manager's ideal portfolio and the actual returns, but there’s often some additional slippage, Normal slippage might be 10 or 20 basis points per year. Really bad would be 100 basis points - above the expense ratio.

Tradability costs can be predicted, mostly by the spread. When trading costs come in higher than the spread, it’s generally by 0.05% to 0.10%. If you're intending to hold your ETF over a reasonably long period of time, you amortize all of those trading costs over your holding period.

Fit’s impact can be far larger. Sometimes, within a market segment, we see the best ETF performance come in 50% or 60% above the worst. Taking active risk can pay off, but it can also be quite costly. Fit measures the degree of active risk compared to the target investment universe.

AA: I think the device of having a conversation with ‘LinkedIn guy’ picking your brain about starting a new ETF was a great way of demonstrating what is actually going on in the market. So, what did you tell LinkedIn guy? What advice would you give someone starting a new ETF?

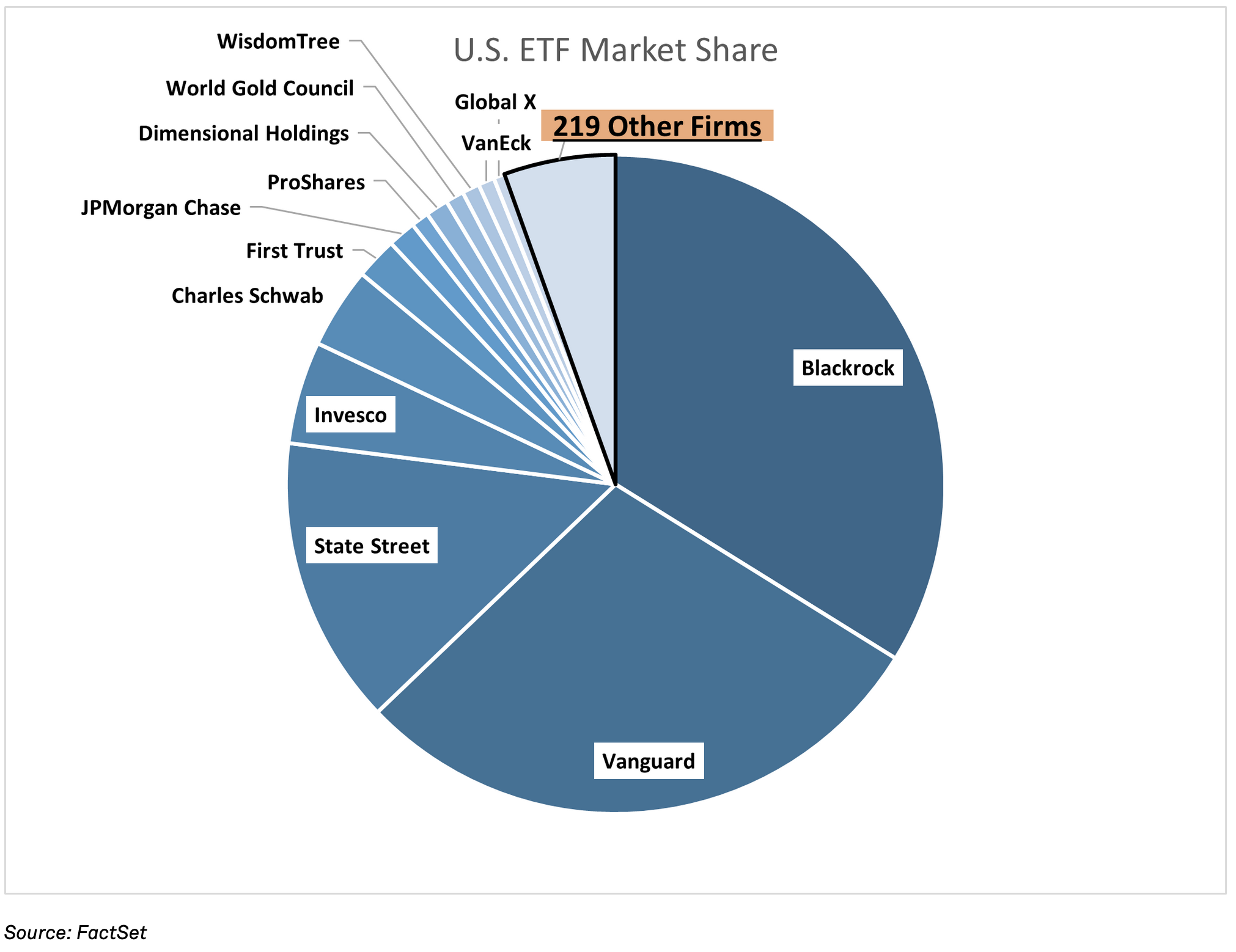

EK: ‘LinkedIn guy’ is a real person, I just didn’t say his name. Pretending to advise him turned out to be a great platform for illustrating that the ETF market is hyper-competitive. It is skewed towards the biggest players who were the first entrants to the business. It is also increasingly noisy as many new entrants are producing something different.

There's well over 3,000 ETFs trading in the US right now, and about 1,200 in Canada. The challenge for new entrants is to get noticed and to deliver long-term performance with a unique offering. To succeed, identify a niche or develop an innovative approach that sets you apart, and then communicate this effectively to your target audience.

AA: The tax efficiency of ETFs is one of the great advantages of using ETFs. Heartbeat trades are critical to tax alpha, but perhaps especially when considering the ‘Explore’ silo of ETFs. What are the key considerations when looking at low-turnover versus high-turnover ETF strategies?

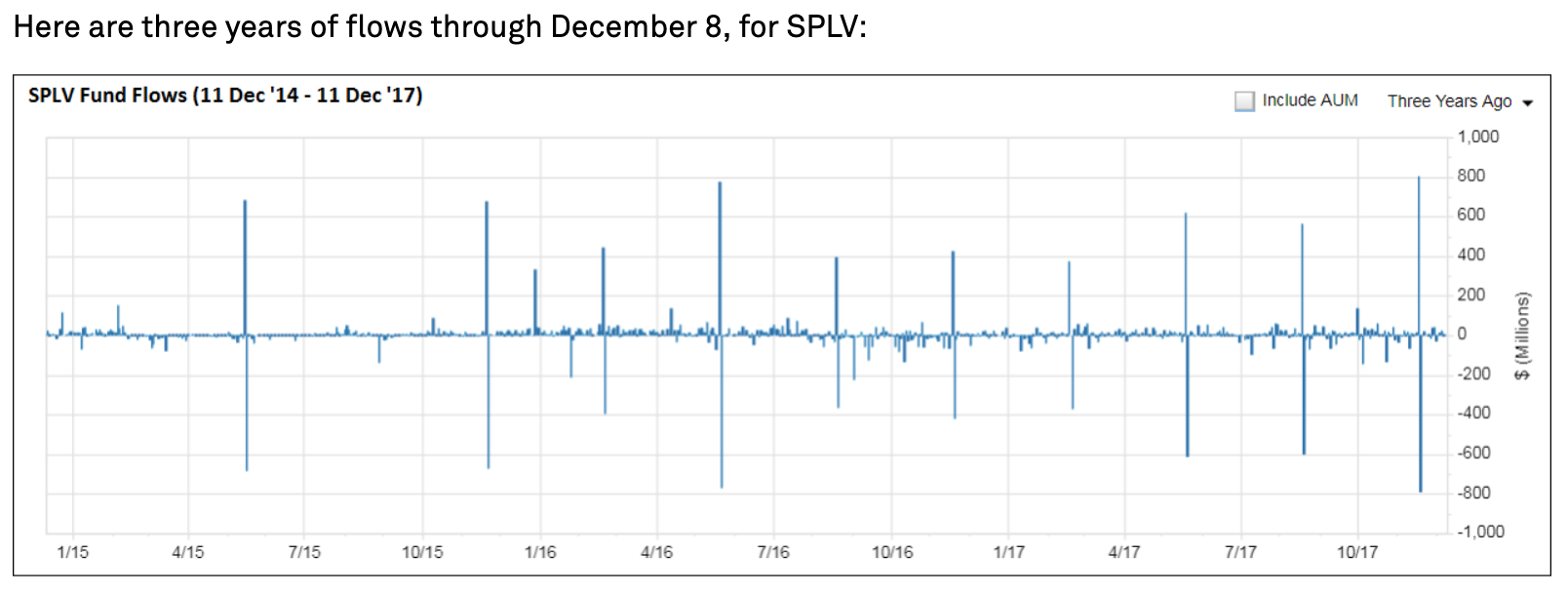

EK: I coined the term 'the heartbeat trade’ as I was doing the forensic analysis to understand the engine of ETF tax efficiency. I noticed that the charts of ETF flows at periodic index and ETF rebalancings looked uncannily like heart monitor readings – a big rise, a big fall, then a pause. In a heartbeat trade, an ETF portfolio manager is able to use the redemption process to put securities with the highest tax liability out in the redemption basket, and to give them to the Authorized Participant (AP). Rather than realize a capital gain with a portfolio turnover, the portfolio manager is able to remove those low-basis securities and create a tax deferral opportunity. It's not a tax avoidance strategy. That tax will become due upon sale of the asset unless the investor is, um, “lucky enough” to hold that asset at death. If that happens, the ETF can pass to the heirs with a step up in tax basis, at least according to US law. You know, I don't really want to have to drop dead to enjoy my assets.

Here's an example, illustrating the heart monitor during three years of flows in SPLV: Source: FactSet

Source: FactSet

AA: How do you approach the task of evaluating trading and other issues associated with ETFs? What are some best practices for mitigating potential risks?

EK: I'm such a DIY person, do it yourself. I try to cook my own dinner and do our own laundry and manage my own investments, as well as my mom’s, my sister’s and my kids’. But it’s wise to know your limits. When it comes to trading, and certainly when it comes to trading ETFs, DIY is not always the best approach.

Avoid a DIY approach to trading ETFs.

For all advisors who are trading ETFs: to the extent that your platform and relationships will allow it, I really recommend working with a third-party liquidity provider, or a market maker of some sort. When it comes to pricing ETFs correctly and executing in size, if you just go in there with a market order, you're not going to be happy with your execution because you're just going to get whatever is sitting there on the books.

Use limit orders.

Work with a third-party liquidity provider or market maker for better execution. At the very minimum, use limit orders instead of market orders, and leverage competition among market makers to get the best execution.

FactSet offers tools to help assess trading execution costs and risks. Our ETF Overview has a section on trading - plus so many more. There’s a write-up of the ETF’s strategy. There’s an assessment of costs and risks. There’s a dividend history and a performance chart. And there’s lots of ways to assess an ETF’s active risk.

Do your homework.

Another mistake that advisors make is building a portfolio that needs consistent monitoring.

AA: What common mistakes do advisors make when conducting ETF due diligence, and how can they be avoided?

EK: Thinking ‘I don't need to do ETF due diligence. ETFs are simple products. All I need to know about this is in the name, the expense ratio, and maybe the asset level.’

I think advisors don't always quite understand how important it is to do your homework deeply, to understand the fund on those three levels: Efficiency, Tradability, and Fit.

With Fit specifically, understanding what the portfolio looks like today, but also how it might change tomorrow due to the portfolio construction rules.

Another mistake that advisors make is building a portfolio that needs consistent monitoring. If the ‘explore’ portion of it is risky and needs a lot of attention for timing on the way in, and timing on the way out, you’ll be taking away from time you get to spend working on issues like tax planning, estate planning, asset allocation, which are much more meaningful ways to deliver value to clients.

My biggest advice is to think hard about what risks you can control and what risks you can't control, so that you're taking precisely the set of risks that you think are in your client's best interest. The mistakes we see are in not doing your homework enough, and not having a full understanding the capital markets.

AA: How many advisors actually know what goes into constructing an ETF, such as the engineering and creation?

EK: More than there used to be. FactSet’s ETF Analytics team started providing ETF education in 2010, but I still don't think ETFs are well enough understood in the industry. Between index construction methodology, ETF creation and redemption, I think there's more education to be done. For anyone looking at this and saying, ‘I think I understand that’, it might be worth another go-round because there's a lot in there.

AA: Elisabeth, thank you so much for your incredibly valuable time and insight!

*****