by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

Turkey iShares $TUR moved below $20.43 extending an intermediate downtrend.

Solar ETF $TAN moved below $92.34 completing a double top pattern.

Technology sector ETF charting an outside reversal candlestick precisely around the upper limit to its rising trading range. equityclock.com/2021/11/22/… $XLK $VGT $QQQ

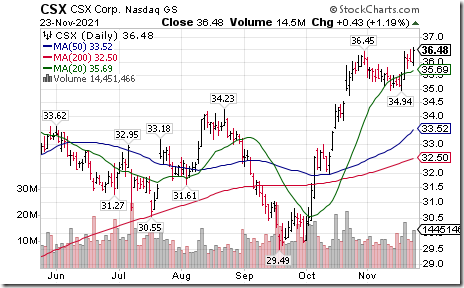

CSX Corp $CSX a NASDAQ 100 stock moved above $36.45 extending an intermediate uptrend.

DocuSign $DOCU a NASDAQ 100 stock moved below $241.95 extending an intermediate downtrend.

Check Point $CHKP a NASDAQ 100 stock moved below $112.57 extending an intermediate downtrend

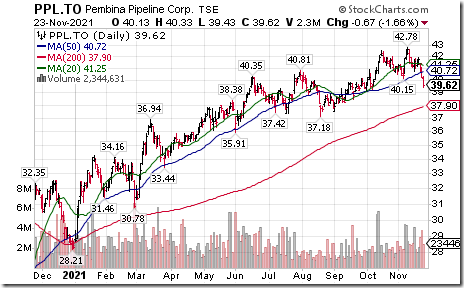

Pembina Pipeline $PPL.CA a TSX 60 stock moved below $40.15 completing a double top pattern.

Restaurant Brands International $QSR.CA a TSX 60 stock moved above $74.66 completing a double bottom pattern

Trader’s Corner

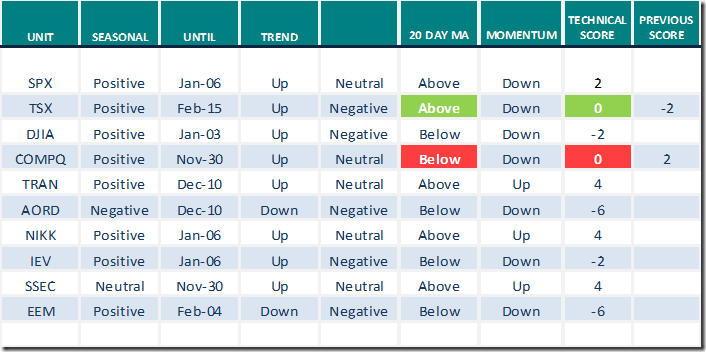

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Nov.23rd 2021

Green: Increase from previous day

Red: Decrease from previous day

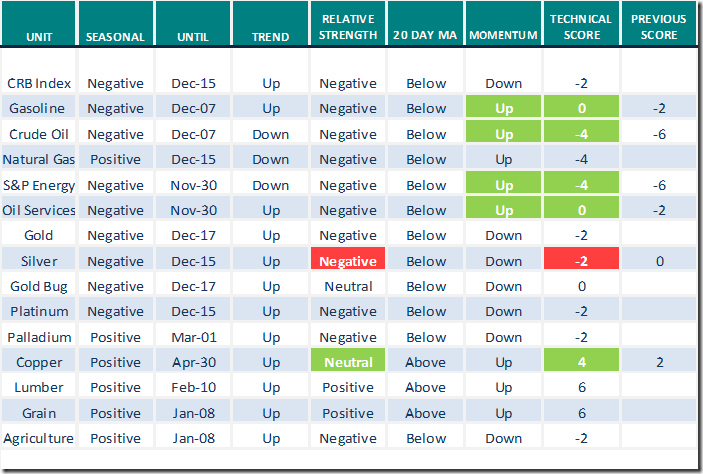

Commodities

Daily Seasonal/Technical Commodities Trends for Nov.23rd 2021

Green: Increase from previous day

Red: Decrease from previous day

Sectors

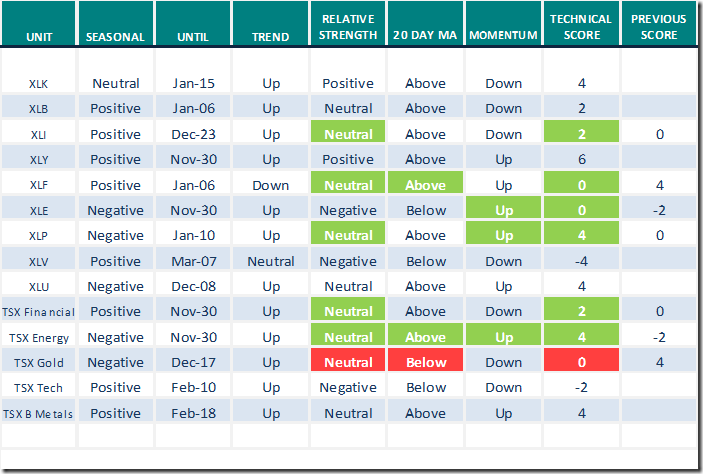

Daily Seasonal/Technical Sector Trends for Nov.23rd 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX).

Your Daily Five

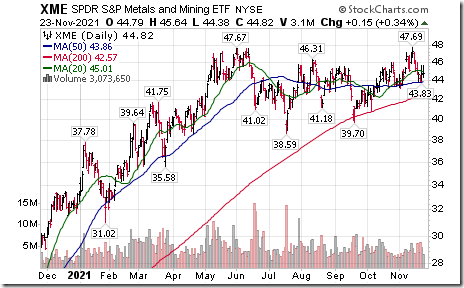

Greg Schnell discusses “Finding entries in Steels and Miners”. Following is a link:

Finding Entries In Steel And Miners | Greg Schnell, CMT (11.23.21) – YouTube

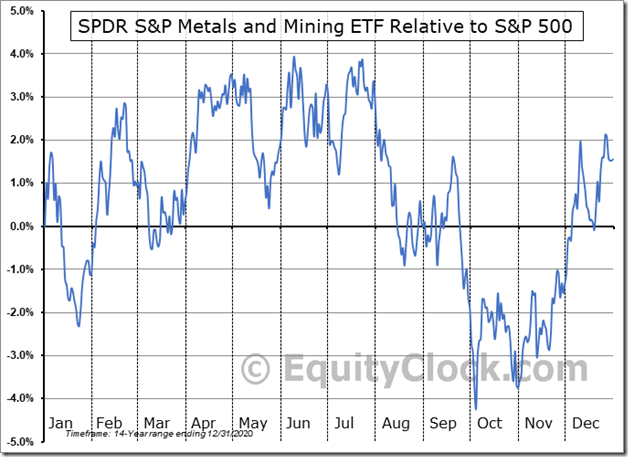

Seasonality chart of the day from www.EquityClock.com

Seasonal influence on a real and relative basis for the Metals and Mining SPDRs turns positive near the end of November for a seasonal trade lasting until at least mid-February.

Price chart shows an intermediate uptrend. Units recently touched an all-time high. Strength relative to the S&P 500 has just turned positive. Units recently bounced from their 50 day moving average Short term momentum indicators (Stochastics, RSI, MACD) are turning higher.

S&P 500 Momentum Barometers

The intermediate term Barometer added 3.61 to 68.34 yesterday. It remains Overbought.

The long term Barometer gained 1.00 to 73.75 yesterday. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 0.53 to 62.21 yesterday. It remains Overbought.

The long term Barometer dropped 3.71 to 64.98 yesterday. It remains Overbought and trending down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.