by Greg Valliere, AGF Management Ltd.

October 26, 2021

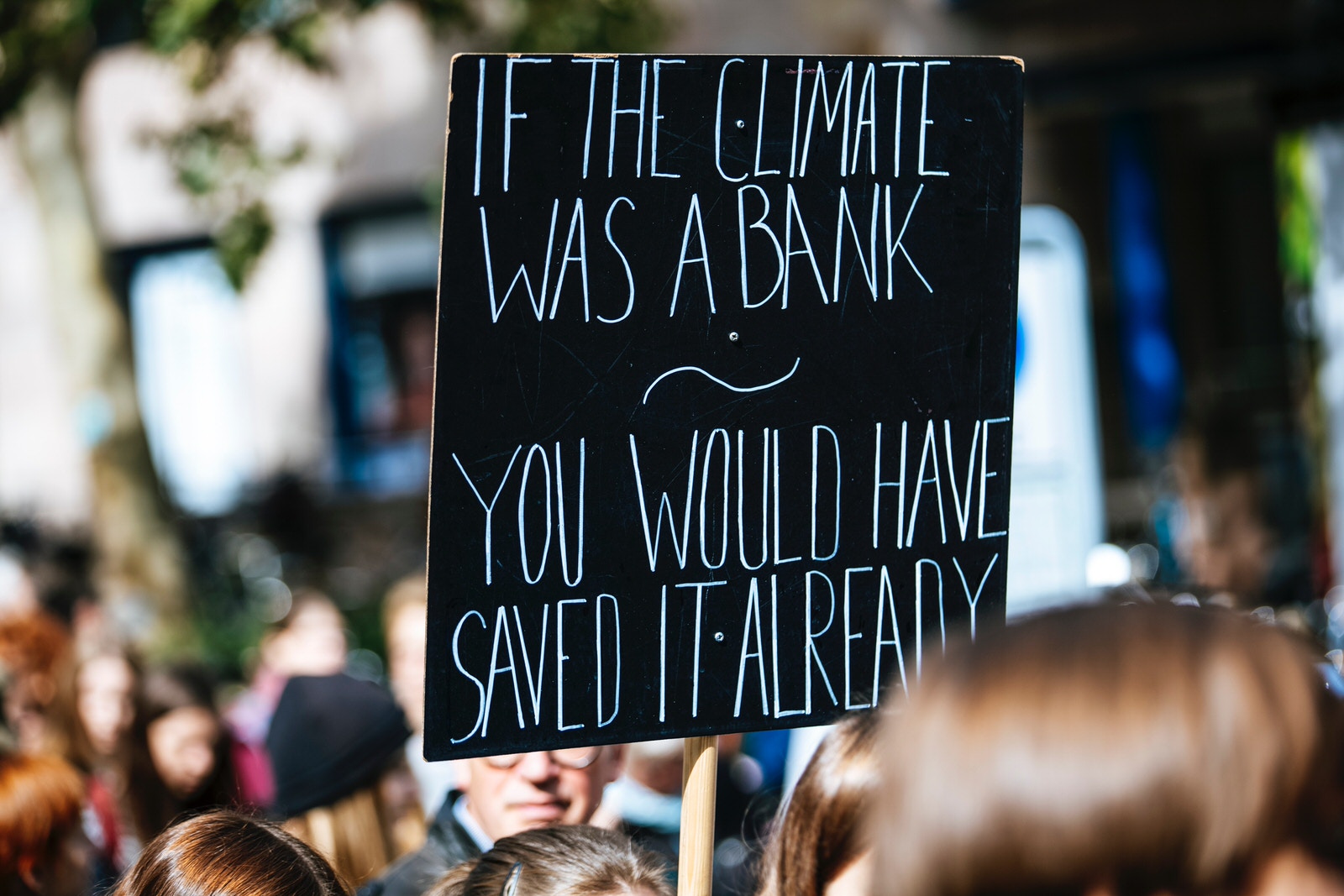

JOE BIDEN WILL CONTINUE TO ASSURE WORLD LEADERS that the U.S. is committed to radical climate change, but he may travel empty-handed to this weekend’s Glasgow summit.

THE GLACIAL PACE OF NEGOTIATIONS over infrastructure spending and taxes virtually guarantees that Biden won’t get a final deal any time soon. The most he can hope for on infrastructure is an agreement in principle, with details not finalized for another few weeks.

THE CLIMATE PROVISIONS in the bill may get watered down further. Sen. Joe Manchin prevailed earlier this fall in killing a $150 billion plan to replace gas and coal fired power plants with wind and solar power — and now he wants more concessions.

IN A LAST-MINUTE SHIFT, Manchin is demanding that tough new taxes on methane emissions should be killed or watered down. This is one of many issues — including Medicare benefits and new taxes — that are holding up passage of a bill.

COMPLICATING BIDEN’S TRIP is an internal dispute among his advisors on how to confront China, a voracious energy consumer that needs more fossil fuels, mostly coal, to keep its factories and citizens warm this winter. China is the world’s largest emitter of carbon, with one-half of the world’s coal-fired plants.

BIDEN CLIMATE ADVISER JOHN KERRY wants warmer relations with China, and is urging the president to talk to Xi Jinping. But the Washington Post reports this morning that national security director Jake Sullivan is opposed to any concessions to Beijing. Disputes persist on trade, the treatment of Chinese dissidents, and Taiwan.

IN ANY EVENT, XI APPARENTLY WILL NOT ATTEND the Glasgow summit, which may end with the adoption of lofty goals that won’t be met. World leaders will debate slowing the increase of emissions and global temperatures; no one is talking about reducing them.

BIDEN’S BELEAGUERED ADVISERS are hoping for a happy photo-op with Pope Francis this weekend, but they have scaled back their goals for the climate summit. Biden will pledge to push ahead on emissions and alternative energy, but a global shortage of fossil fuels is a greater crisis right now than emissions.

IF THERE’S MEANINGFUL PROGRESS on climate change, we think it will come from the private sector; surging Tesla will be a role model. The simple fact is that there isn’t enough wind or solar power to turn this around any time soon, but modest progress is coming.

THE POLITICIANS HAVE A MADDENING HABIT of setting deadlines that can’t be met — and as a result, Glasgow could be viewed as a failure, as countries scramble for more fossil fuels. Winter is coming.

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies.

The views expressed in this blog are provided as a general source of information based on information available as of the date of publication and should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities. Speculation or stated believes about future events, such as market or economic conditions, company or security performance, or other projections represent the beliefs of the author and do not necessarily represent the view of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies. Every effort has been made to ensure accuracy in these commentaries at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change and AGF accepts no responsibility for individual investment decisions arising from the use of or reliance on the information contained herein. Any financial projections are based on the opinions of the author and should not be considered as a forecast. The forward looking statements and opinions may be affected by changing economic circumstances and are subject to a number of uncertainties that may cause actual results to differ materially from those contemplated in the forward looking statements. The information contained in this commentary is designed to provide you with general information related to the political and economic environment in the United States. It is not intended to be comprehensive investment advice applicable to the circumstances of the individual.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is a registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

©2021 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.