by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

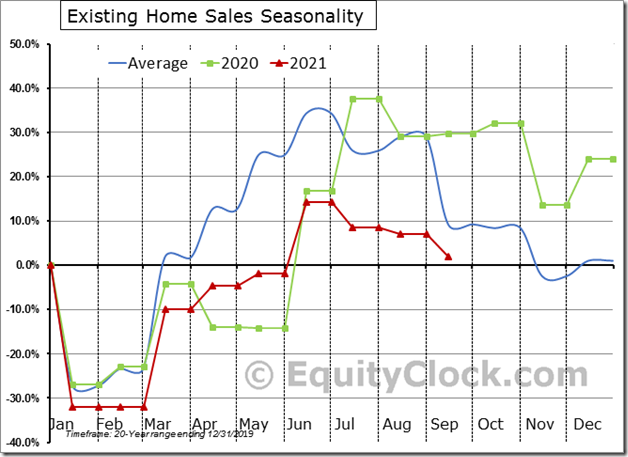

Existing home sales in the US actually fell by 4.9% in September, but there was a lot to be encouraged by in the results released by the National Association of Realtors. equityclock.com/2021/10/21/… $MACRO $STUDY $XHB $ITB $LEN $PHM $TOL #Economy #Housing

Global Agriculture iShares $COW.CA moved above Cdn$60.46 to an all-time high extending an intermediate uptrend.

Editor’s Note: Seasonal influences are favourable on a real and relative basis to the end of February. If a subscriber to www.EquityClock.com See: https://charts.equityclock.com/ishares-global-agriculture-index-etf-tsecow-to-seasonal-chart

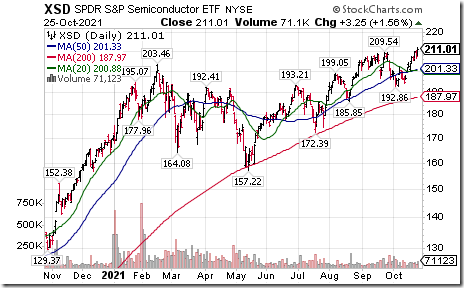

Semi-conductor SPDRs $XSD moved above $209.54 to an all-time high extending an intermediate uptrend.

Editor’s Note: Seasonal influences on a real and relative basis are particularly favourable to the end of the year. If a subscriber to www.EquityClock.com See: https://charts.equityclock.com/spdr-sp-semiconductor-etf-nysexsd-seasonal-chart

Mastercard $MA an S&P 100 stock moved above $362.72 resuming an intermediate uptrend.

Editor’s Note: Seasonal influences on a real and relative basis are particularly favourable to the end of the year. If a subscriber to www.EquityClock, see: https://charts.equityclock.com/mastercard-nysema-seasonal-chart

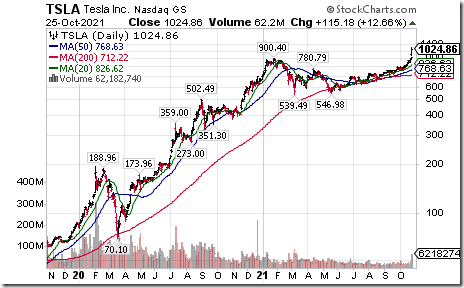

Tesla $TSLA a NASDAQ 100 stock moved above $900.40 to an all-time high extending an intermediate uptrend.

Editor’s Note: Seasonal influences on a real and relative basis are favourable until mid-February. If a subscriber to www.EquityClock, see: https://charts.equityclock.com/tesla-inc-nasdtsla-seasonal-chart

NVIDIA $NVDA a NASDAQ 100 stock moved above $230.29 to an all-time high extending an intermediate uptrend.

Editor’s Note: Seasonal influences on a real and relative basis are favourable until mid-February. If a subscriber to www.EquityClock, see: https://charts.equityclock.com/nvidia-corporation-nasdaqnvda-seasonal-chart

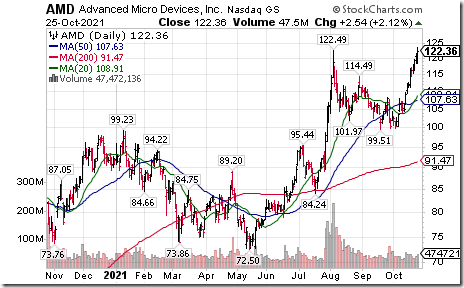

Advanced Micro Devices $AMD a NASDAQ 100 stock moved above $122.49 to an all-time high extending an intermediate uptrend.

Editor’s Note: Seasonal influences on a real and relative basis are particularly favourable until the end of the year. If a subscriber to www.EquityClock, see: https://charts.equityclock.com/nvidia-corporation-nasdaqnvda-seasonal-chart

Copart $CPRT a NASDAQ 100 stock moved above $152.75 to an all-time high extending an intermediate uptrend.

Editor’s Note: Seasonal influences on a real and relative basis are particularly favourable to the end of the year. If a subscriber to www.equityclock, see: https://charts.equityclock.com/copart-inc-nasdcprt-seasonal-chart

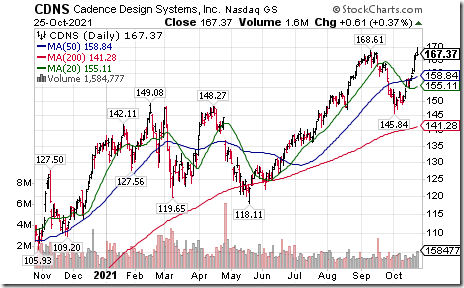

Cadence Design $CDNS a NASDAQ 100 stock moved above $168.61 to an all-time high extending an intermediate uptrend.

FirstService Corp. $FSV.CA a TSX 60 stock moved above $249.71 to an all-time high extending an intermediate uptrend.

Rogers Communications $RCI a TSX 60 stock moved below US$46.10 extending an intermediate downtrend. Dispute over control by senior executives continues.

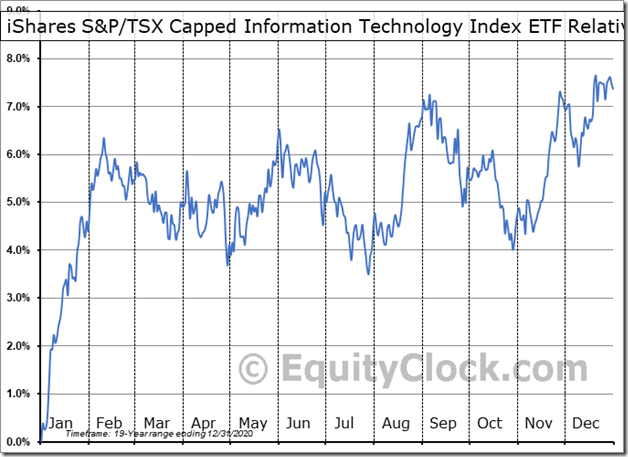

Seasonality Chart of the Day from www.EquityClock.com

Canadian Technology iShares XIT.TO enters into a favourable period of s seasonality on a real and relative basis this week for a period lasting to mid-February.

On the charts, units are in an upward trend, recently moved above their 20 day moving average and recently recorded positive momentum (Daily.Stochastics, RSI, MACD) indicators.

Trader’s Corner

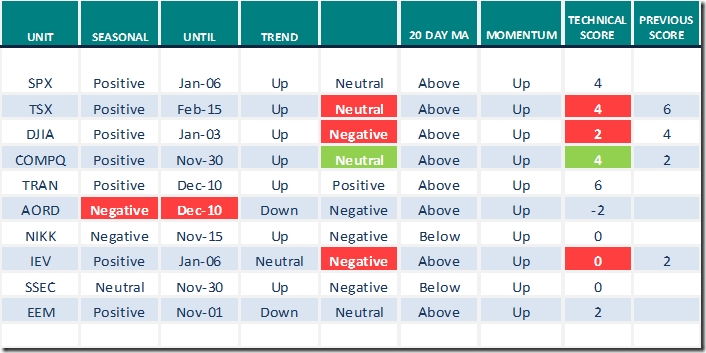

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Oct.25th 2021

Green: Increase from previous week

Red: Decrease from previous week

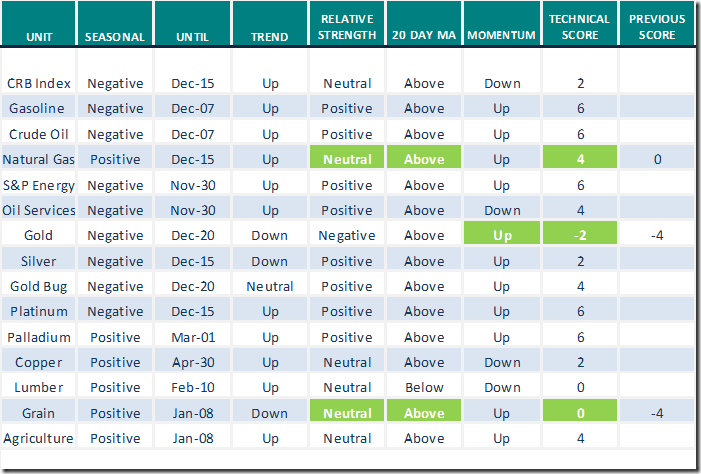

Commodities

Daily Seasonal/Technical Commodities Trends for Oct.25th 2021

Green: Increase from previous week

Red: Decrease from previous week

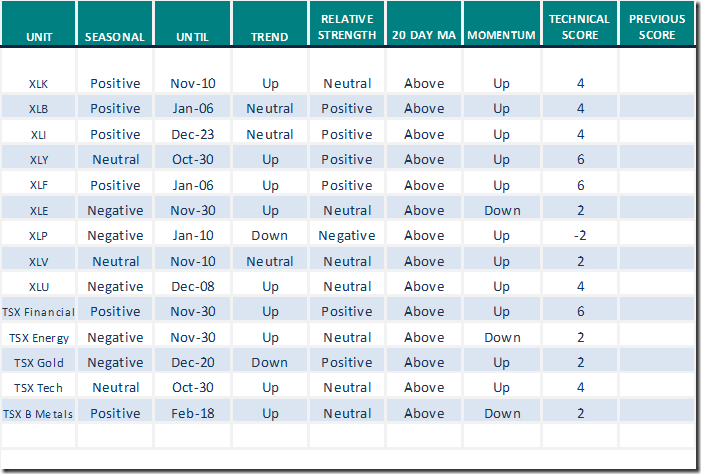

Sectors

Daily Seasonal/Technical Sector Trends for Oct.25th 2021

Green: Increase from previous week

Red: Decrease from previous week

All seasonality ratings are based on performance relative to the S&P 500 Index

(except TSX)

S&P Momentum Barometers

The intermediate term Barometer slipped 0.60 to 65.13 yesterday. It remains Overbought.

The long term Barometer eased 1.00 to 75.35 yesterday. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 4.83 to 71.50 yesterday. It remains Overbought.

The long term Barometer gained 2.90 to 68.12 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.