by Sonal Desai, Ph.D., Chief Investment Officer, Franklin Templeton Fixed Income Franklin Templeton Investments

Inflation concerns have entered the mainstream; a bit of a shame, since I quite enjoyed being out of consensus. Now there is growing agreement that inflation will most likely move to healthier levels as the economy reopens; more interestingly, the risk of a sharper surge in inflation has become the topic of a heated public debate.

Ironically, this is happening in part because inflation concerns have been discounted so completely for so long. Many economists and market participants have long argued that inflation is dead for structural reasons, leaving deflation as the only plausible concern. Their mantra has been that no matter what policymakers do, inflation will never again rise to uncomfortably high levels.

Well, we are about to find out, because this conviction has paved the way for a proposed US fiscal package so large that it has given pause even to some long-standing advocates of large fiscal stimulus.

Can Fiscal Stimulus Be too Big?

Former Treasury Secretary and Harvard University President Emeritus Larry Summers sparked the debate with a Washington Post OpEd where he warned that the US$1.9 trillion stimulus US President Joe Biden’s administration has proposed could ‘set off inflationary pressures of a kind we have not seen in a generation, with consequences for the value of the dollar and financial stability’. Nobel Prize winner Paul Krugman strongly disagrees, and he and Summers went head-to-head in a recent debate. Former International Monetary Fund (IMF) Chief Economist Olivier Blanchard—who had pushed the IMF to a much more supportive view of fiscal stimulus—shares Summers’ concerns.

Note that this is not a debate between freshwater fiscal conservatives and saltwater Keynesian big spenders; all these economists are outspoken advocates of large government spending, and even among them some are asking, isn’t this going too far?

Some of the debate hinges on whether the fiscal stimulus is too large relative to the ‘output gap’; that is, how far economic activity is from its full potential. Some of it hinges on how much extra gross domestic product (GDP) you get from one extra dollar of fiscal stimulus, the so-called ‘multiplier’. Economists can argue forever on output gaps and multipliers, but let’s not get lost in the technicalities: the US$1.9 trillion stimulus is at least 2-3 times larger than any plausible estimate of the output shortfall for any plausible value of the multiplier (if you are interested in the details I recommend this post by Blanchard). The proposed unemployment benefits and tax credits are five times larger than the shortfall in wages and salaries, as Summers points out.

[Tweet ""Even Krugman agrees that the stimulus is overwhelmingly large, but he maintains that concerns of overheating and inflation are groundless. Are they?" asks Sonal Desai, CIO, Franklin Templeton Fixed Income"]These sums are staggering, and it’s worth taking a moment to let them sink in; last year, the government launched about US$2 trillion as the immediate response to the pandemic shutdowns (the CARES act), followed by another US$900 billion in December. Now we are contemplating a US$1.9 trillion package, to be followed, lest we forget, by about US$1 trillion in infrastructure spending. That totals close to a whopping US$6 trillion over two years—about 30% of US GDP (using 2020 GDP as a base). The 2020 US fiscal deficit came in at about 15% of GDP. In 2021, it would reach 24% of GDP if we add US$1.9 trillion stimulus and US$1 trillion in infrastructure to the latest Congressional Budget Office estimates. This is on a par with the World War II deficits; the largest since then was in 2009, and it was less than 10% of GDP.

Even Krugman agrees that the stimulus is overwhelmingly large, but he maintains that concerns of overheating and inflation are groundless.

Are they?

The Recovery Is Already Set to Accelerate

To judge the potential impact of the fiscal stimulus, we need to factor in the economy’s momentum—not just how far we are from full potential, but in what direction we are moving and how fast. And most indicators still suggest the economy is recovering at a robust pace, much faster than after the global financial crisis (GFC).

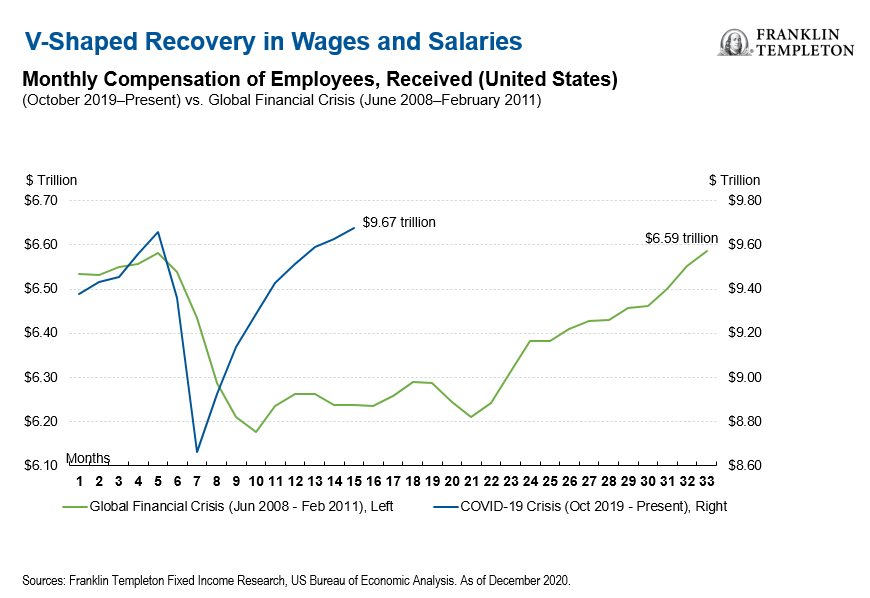

US employment has already staged a healthy recovery from last spring’s shocking job destruction; and wages and salaries have enjoyed a true V-shaped rebound.

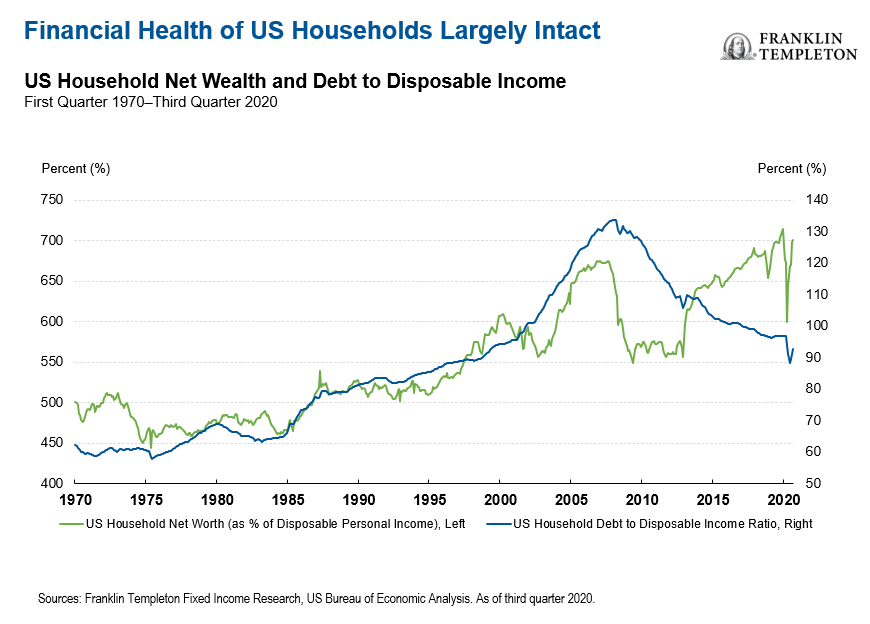

US consumers continue to enjoy good financial health, thanks to government support, with household net worth near record highs and the debt to disposable income ratio back around the 2000 level.

This all helps explain why retail sales have already jumped over 10% beyond pre-COVID-19 levels (with a marked shift from services to goods, for the time being).

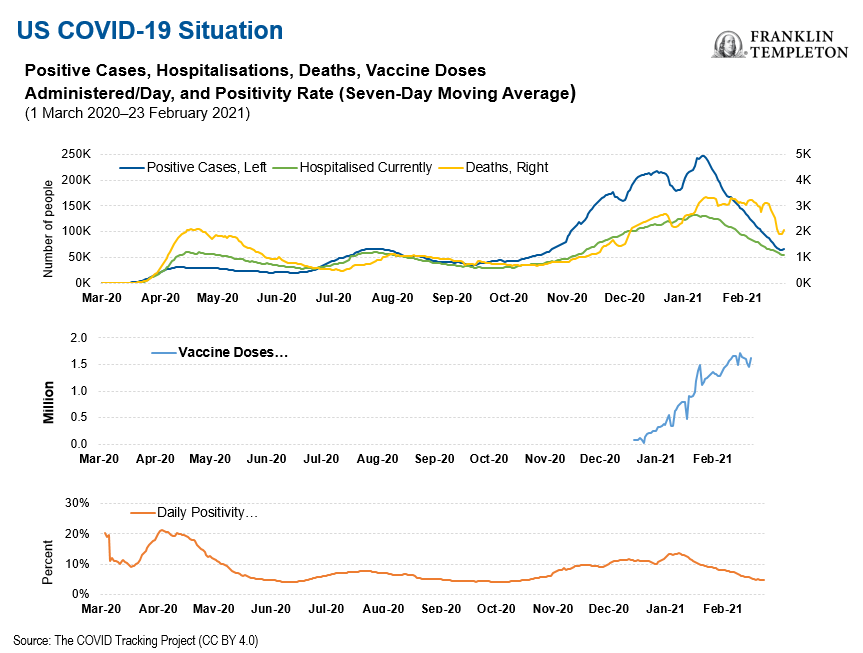

In a nutshell, households have a lot of pent-up desire to spend and the income and savings to satisfy it once the economy reopens. And, the health care data suggest that the reopening might soon accelerate: new cases and deaths have dropped sharply and hospitalisations have more than halved since the start of the year. About 60 million people have been inoculated already (over 13% of the population) in the United States, and the pace of vaccinations is accelerating, now at about 1.5 million per day (seven-day moving average).

Yes, but Will Wages Increase?

So, just as we get ready to lift restrictions on business and social activity, and with households already flush with cash, the US government will launch the largest peacetime fiscal stimulus we have ever seen. It does sound like that might generate some inflation. Even more so when you consider that supply-side pandemic disruptions and a global recovery are already pushing up commodity prices, from oil to copper to steel, and a variety of other input prices, from semiconductors to electrical and electronic components to corrugated boxes. Both the producer price index and the prices paid component of the Institute for Supply Management (ISM) Index have moved up sharply since the middle of last year.

The inflation sceptics counter that none of this will create sustained inflation unless wages accelerate, and Federal Reserve (Fed) Chairman Jerome Powell pointed out that wage pressures remained muted even when the unemployment rate fell to a record low 3.5% before the pandemic. So, there’s no reason to expect stronger wage pressures this time, right?

Well, not so fast.

The wage picture is quite interesting. Let me highlight a few key points:

- Yes, there is still substantial slack in the labour market. At 6.3%, the “classic” unemployment rate is still high, and it underestimates the true degree of slack to the extent that people have temporarily dropped out of the labour force (the participation rate stands two percentage points below its pre-pandemic level).

- However, the unemployment rate has already dropped quite quickly, and job openings remain high, at the 2017-18 levels.

- Enhanced unemployment benefits might force employers to boost wages to attract workers. In his Washington Post article, Summers calculates that over the next six months, a family of four with a pre-tax income of US$1,000 per week would earn almost 40% more if the family’s breadwinner were unemployed.

- The planned sizable increase in the minimum wage is another sign that the political and social tide has started to turn in favour of higher wages—witness also the broad wage rises granted by Walmart and other large employers.

- Last but not least, wage pressures also depend on how strongly workers press for higher wages. The lower degree of unionisation in the private sector has played a role in limiting wage demands, but so has the confidence in price stability engendered by a long period of very low inflation. What if this now changes?

The Soft Pricing Power of High Expectations

The Fed has made it abundantly clear that if and when inflation accelerates, it will at first sit back and watch. It has committed to let inflation run above 2% for some time, to make up for previous undershoots.

With accelerating economic growth, a massive fiscal stimulus, and the fastest growth in broad money on record—M2 is up 26% since February 2020, the biggest monetary expansion since 19431—inflation could easily overshoot under the approving eye of the Fed. Assuming that inflation expectations will nonetheless remain firmly anchored could be unduly optimistic. As an aside, one-year ahead consumer inflation expectations in the University of Michigan’s consumer sentiment survey released in mid-February have already jumped to 3.3%, partly because of higher gasoline prices.

This Time Is Different

When the Fed launched its quantitative easing programmes in response to the GFC, some economists also warned that loose monetary policy would result in inflation. It famously did not. So why should it be any different this time around?

There are two critical differences: First, this time monetary policy plays second fiddle to a massive fiscal expansion. Second, the economy is already primed for a rebound as vaccinations make it likely that a broad-based reopening will materialise later in the year.

After the GFC, firms were reluctant to invest and hire, the job recovery was painfully slow and households were saddled with debt and unwilling to spend. The money the Fed created simply sat around in banks’ reserves, offsetting the desperate deleveraging of the financial system.

This time, jobs have already started to come back, and households are in a strong financial position and eager to go back to normal spending habits. And on top of this, an unprecedented fiscal expansion will take care of putting the money to work, directly fueling a surge in spending.

After the GFC, with consumer spending missing in action, the Fed’s monetary expansion translated into asset price inflation. This time, with fiscal policy boosting aggregate demand, it is much more likely to result in good old-fashioned consumer price inflation.

The Devil They Knew

Central bankers insist that they don’t fear inflation; it’s the devil they know. They’ve defeated it before and are confident that they can bring it under control with minimal economic cost once they decide the time is right.

Maybe.

The last time the Fed slayed the inflation dragon, it did so by sending the Fed funds rate soaring to 20% and caused the 1982 recession, which remained the deepest on record until 2009. That was quite a steep price to pay. In today’s environment, it would be considerably harder for the Fed to muster the resolve to plunge the economy back into recession. Moreover, higher interest rates would impose a very high cost on a government saddled with much higher public debt and still running a large fiscal deficit—something even an independent central bank would find hard to ignore.

In his debate with Krugman, Summers stressed that the US$1.9 trillion fiscal stimulus would push us into uncharted waters (and that’s before we talk about the additional US$1 trillion envisioned for infrastructure). We’ve never deployed such a massive fiscal stimulus on an already recovering economy, with the Fed committed to maintaining an extraordinary supportive monetary stance. Maybe it will work out well, but there is no guarantee. Similarly, a central bank that has persistently failed to meet its inflation target from below should not be overly confident in its ability to meet it from above.

To make things more interesting, there is some structural uncertainty to add to the cyclical one: in a book published last year (The Great Demographic Reversal), Goodhart and Pradhan argue that population aging in China and other parts of the world will replace a structural deflationary force with an inflationary one. In other words, whereas over the past 20 years, China and other emerging markets contributed a massive increase to the global workforce that boosted supply and helped contain price pressure, they will now be adding more to the ranks of retirees, boosting demand more than supply and creating inflationary pressures. If they are even half right, any cyclical upswing in inflation would be lifted further by a long-term tailwind.

Fixed Income Investment Implications: Reduce Duration, Pick Yield Judiciously

At the end of last year, 10-year US Treasury yields were hovering at about 0.91%, and the expectation implied by market pricing was for them to reach merely 1.12% by year-end. Yields have quickly blown past that target and have already reached 1.55%, with most of the increase in the past month. Markets have been forced to revise their pricing for year-end, and now expect 10-year yields to reach 1.75%.

We should be prepared to see year-end rates exceed even these revised projections if the vaccines deliver on their promises and the government launches the fiscal stimulus discussed above. Thus, despite the recent rise in long-term yields and the subsequent steepening of the yield curve, it is hard for me to be positive about the duration outlook.

At the same time, spread sector valuations are becoming increasingly stretched on balance making me more cautious—even allowing for the support of an improving growth outlook.

We continue to favour very select securities, industries and market segments within the high-yield and floating rate loans and the emerging markets debt space. The operative word is select: both high-yield and emerging markets debt are likely to experience more pressure, especially if the rise in US bond yields should extend more significantly to the short-end of the curve. In a first clear sign of stress, the exchange rates of the more vulnerable emerging markets have already weakened. Both the Fed and the European Central Bank (ECB) have reiterated their reassurance that monetary policy will remain supportive, but markets may be challenging central bank credibility. Given the underlying strength of the economy, I think widening spreads will offer opportunities in short duration fixed income assets in the coming weeks. Finally, I would expect the US dollar to come under frequent bouts of pressure as this scenario plays out.

*****