by Don Vialoux, EquityClock.com

The Bottom Line

Most major equity indices around the world moved sharply lower last week. Greatest influences remain growing evidence of a second wave of the coronavirus (negative) and possible approval of a vaccine (positive). Look for continuation of volatile, choppy world equity markets until at least U.S. Presidential Election Day on November 3rd (and possibly longer if results of the election are contested). See Notes for the Wolf on Bay Street below for background.

Observations

The VIX Index (better known as the Fear Index) showing volatility by the S&P 500 Index remained elevated last week.

Ditto for VXN showing volatility by the NASDAQ 100 Index

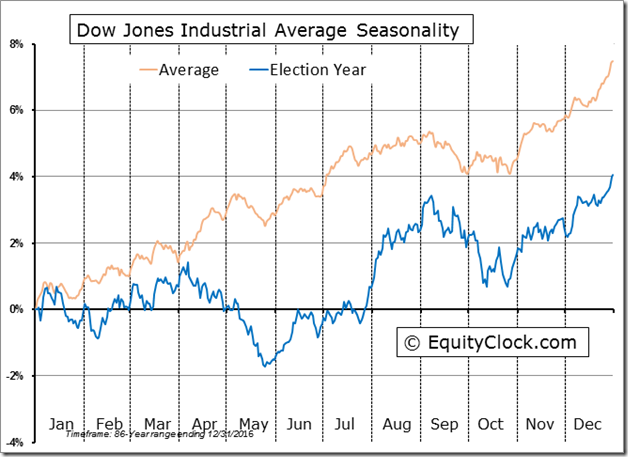

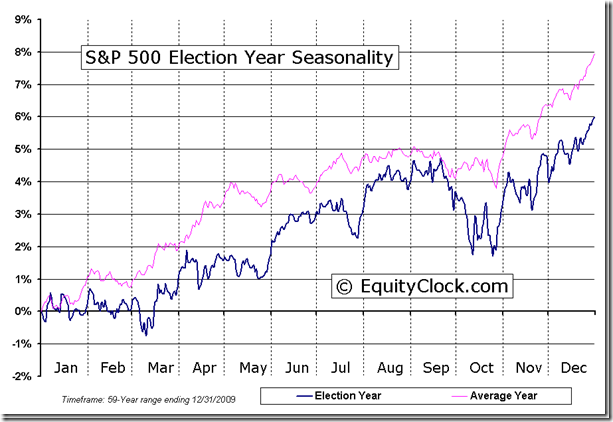

The Dow Jones Industrial Average and S&P 500 Index during U.S. Presidential Election years are following their historic trend. They move lower from early September to the third week of October followed by a move higher after the election.

Medium term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 50 day moving average) moved lower again last week. It changed from intermediate overbought to intermediate oversold and is trending down. See Barometer chart at the end of this report.

Medium term technical indicator for Canadian equity markets also moved lower last week. It changed from intermediate neutral to intermediate oversold and is trending down. See Barometer chart at the end of this report.

Short term short term momentum indicators for U.S. markets/commodities/sectors (20 day moving averages, short term momentum indicators) moved lower last week

Short term momentum indicators for Canadian markets/sectors moved lower last week

Year-over-year 2020 consensus earnings and revenue declines by S&P 500 companies ebbed again last west. According to www.FactSet.com, third quarter earnings are expected to fall 9.8% (versus a decline of 16.5% last week) and revenues are expected to slip 2.1% (versus previous decline of 3.1%). Fourth quarter earnings are expected to drop 11.2% (versus previous decline of 11.6%) and revenues are expected to decline 0.5% (versus 1.0% last week). Earnings for all of 2020 are expected to fall 15.5% (versus previous decline of 16.7%) and revenues are expected to decline 2.3% (versus previous decline of 2.6%).

Consensus estimates for earnings and revenues by S&P 500 companies turn positive on a year-over-year basis in the first quarter of 2021. According to www.FactSet.com earnings in the first quarter of 2021 are expected to increase 14.5% (versus previous 14.3% increase) and revenues are expected to increase 3.4% (versus previous 3.1%). Earnings in the second quarter are expected to increase 44.2% (versus previous increase of 44.1%) and revenues are expected to increase 13.7% (versus previous increase of 13.5%. Earnings for all of 2021 are expected to increase 23.0% (versus previous increase of 24.2%) and revenues are expected to increase 7.9%.

Presidential Election Polls following the debates did not change significantly implying that Biden likely will win on November 3rd or shortly thereafter. U.S. equity markets already are anticipating a Biden win. The real political battle is for control over the Senate. The Republicans currently control the Senate with a 52/48 majority. However, one third of current seats are on the ballot on November 3rd and the Republicans currently hold about 2/3 of these seats: Many are hotly contested. The latest polls indicate a gain of three seats by the Democrats. If majority control of the Senate flips to the Democrats, an immediate downside move by U.S. equity markets is expected.

Economic News This Week

September Construction Spending to be released at 10:00 AM EST on Monday is expected to increase 1.0% versus a gain of 1.4% in August.

October Manufacturing ISM to be released at 10:00 AM EST on Monday is expected to increase to 55.6 from 55.4 in September.

September Factory Orders to be released at 10:00 AM EST on Tuesday are expected to increase 1.0% versus a gain of 0.7% in August.

U.S. October Trade Deficit to be released at 8:30 AM EST on Wednesday is expected to slip to $66.10 billion from $67.10 billion in September

Canadian October Trade Deficit to be released at 8:30 AM EST on Wednesday is expected to ease to $2.00 billion from 2.45 billion in September.

October Non-Manufacturing ISM to be released at 10:00 AM EST on Wednesday is expected to remain unchanged from September at 57.8.

FOMC Interest Rate Decision is released at 2:00 PM EST on Thursday. Rate is expected to remain unchanged at 0.25%. Conference call is offered at 2:30 AM EST.

U.S. October Non-farm Payrolls to be released at 8:30 AM EST on Friday are expected to increase to 700,000 from 661,000 in September. October Unemployment Rate is expected to slip to 7.7% from 7.9% in September. October Average Hourly Earnings are expected to increase 0.2% versus a gain of 0.1% in September.

Canadian October Employment to be released at 8:30 AM EST on Friday is expected to versus a gain of 378,200 in September. October Unemployment Rate is expected to rise to 9.7% from 9.0% in September.

Selected Earnings News This Week

Frequency of quarterly reports by S&P 500 companies has passed its peak with 64% of companies reporting to date: 86% of reports to date have exceeded consensus earnings estimates and 81% have exceeded consensus revenue estimates. Another 126 companies are scheduled to report this week. Frequency of reports by TSX 60 companies reaches a peak this week.

Trader’s Corner

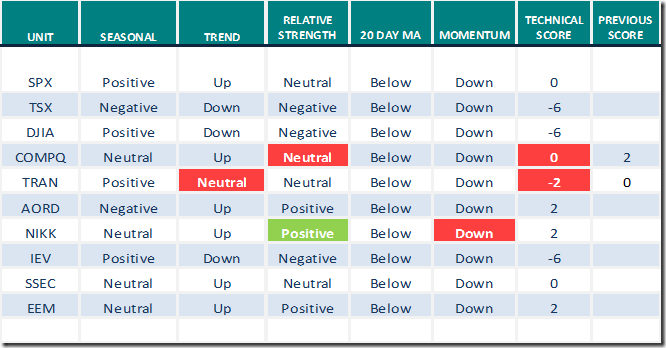

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for October 30th 2020

Green: Increase from previous day

Red: Decrease from previous day

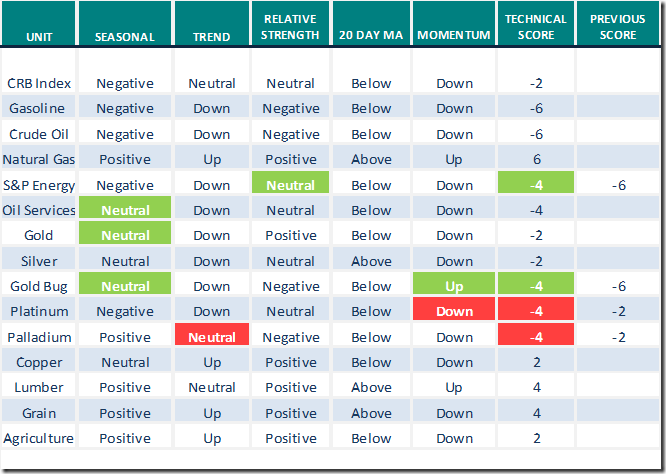

Commodities

Daily Seasonal/Technical Commodities Trends for October 30th 2020

Green: Increase from previous day

Red: Decrease from previous day

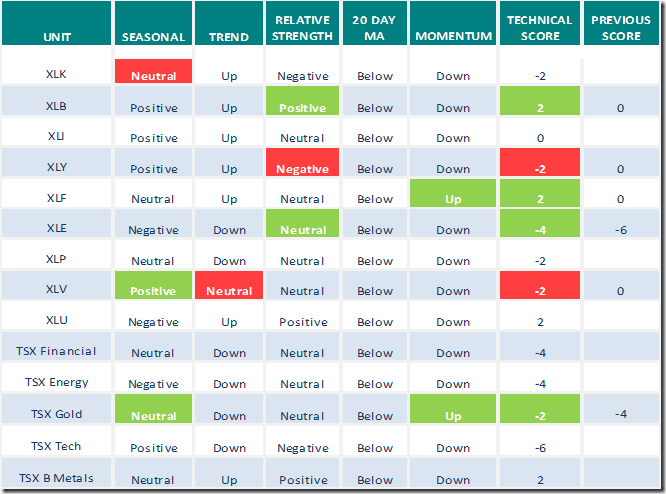

Sectors

Daily Seasonal/Technical Sector Trends for October 30th 2020

Green: Increase from previous day

Red: Decrease from previous day

Notes for The Wolf on Bay Street Interview

The following notes were developed prior to an interview with Wolfgang Klein and Jack Hardill released on Saturday evening on Corus Radio 640:

North American equity markets are following their traditional seasonal pattern prior to a U.S. Presidential election:

· Weakness from early September

· An intermediate low just before Election day

· A strong advance between Election day to Inauguration Day in the third week in January

Weakness this year in North American equity markets have been recorded despite the release of better than consensus third quarter corporate earnings reports. Approximately 50% of S&P 500 companies and 25% of TSX 60 companies have reported to date: Over 80% of reporting companies have reported higher than consensus revenues and earnings. Unless a company reported “blow out” results, their equity price moved lower. Traders took profits on news.

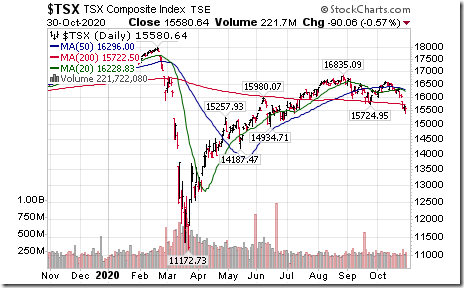

Notably weaker was the TSX Composite Index. On Wednesday, the Index completed a double top pattern by moving below 15,745.

What are most likely possible outcomes for the U.S. elections? Four possibilities from best to worst for North American equity markets are:

· Trump wins and the Senate remains in Republican control

· Biden wins and the Senate remains in Republican control

· Biden wins and control of the Senate flips to the Democrats (i.e. the so called Blue Wave) with Democrats gaining a “super majority”

· Biden wins and results are contested in the courts.

History shows that the strongest 12 week period for U.S. equity market indices in the four year U.S. Presidential cycle has been between Presidential Election Day and Inauguration Day. Since 1952, the S&P 500 Index advanced in 11 of 17 periods. Average gain per period was 2.6%. excluding one important event in 2008.

A word of caution: losses during the 6 losing periods out of 17 were small except on one occasion, the year Obama was first elected President in 2008. During that period, the S&P 500 Index plunged 17.4%.after Obama and the Democrats won a “super majority” including control of the Senate and House of Representative. Obama proposed a higher tax on companies and individuals when he entered the White House. Equity markets responded accordingly before he gained control in the third week in January 2009.

What about this time? Biden has proposed a higher tax on companies and individuals (including tax treatment of capital gains as regular income). If Biden and the Democrats win a “super majority”, U.S. equity markets could come under significant technical pressure after Election Day.

What to do as a Canadian equity investor.

Rebalance equity portfolios before the end of the year regardless of the U.S. Presidential Election result. Most North American equity holdings have developed a “K” pattern on the charts since start of the COVID pandemic in mid-March

· Most equity prices moved sharply lower from mid-March to May

· Most equity prices recovered approximately half of their decline by June

· Equities that benefitted from the virus continued moved higher (e.g. technology stocks) and equities that were hurt by the virus moved flat to lower (e.g. energy, airline and other service stocks)

Timing for a vaccine for the general population remains uncertain. Preferred strategy is to liquidate holdings with a loss for tax purposes before the end of the year that have been negatively impacted by COVID 19.

Look for investment opportunities outside of North America. Far East economies and equity markets are expected to benefit first from recovery following their COVID 19 shutdowns (e.g.China ETFs such as XCH, ZCH, South Korea ETFs, Taiwan ETFs and Japan related ETFs).

Accumulate North American equities that will benefit from a recovery in Far East economies. Their recovery is expected to boost demand for North American commodities including base metals, lumber, grains and fertilizer.

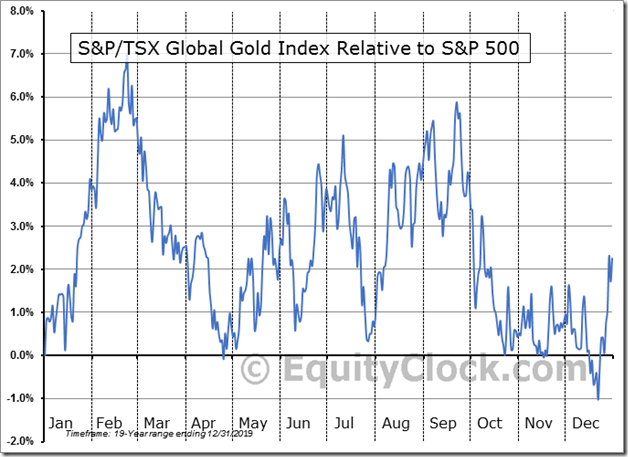

Consider an investment in gold and gold equities near the end of the year. Seasonal influences turn positive on a real and relative basis in mid –December for a seasonal trade to the end of February. An extension of COVID infections into next year will place strains on the stability of world currencies. Precious metal prices are expected to respond accordingly.

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes for Friday October 30th

Healthcare SPDRs (XLV) moved below $100.77 completing a double top pattern.

Biotech ETF (BBH) moved below $151.52 completing a Head & Shoulders pattern.

Hong Kong iShares moved below $21.51 setting an intermediate downtrend.

Check Point (CHKP), a NASDAQ 100 stock moved below $114.89 completing a double top pattern.

Activision (ATVI), a NASDAQ 100 stock moved below $75.68 extending an intermediate downtrend.

Medtronic (MDT), an S&P 100 stock moved below intermediate support at $100.30

Adobe (ADBE), a NASDAQ 100 stock moved below $519.60 completing a double top pattern.

Boeing (BA), a Dow Jones Industrial Average stock moved below $145.02 extending an intermediate downtrend.

Regeneron (REGN), a NASDAQ 100 stock moved below $540.00 extending an intermediate downtrend.

Goldman Sachs (GS), a Dow Jones Industrial Average stock moved below $185.87 extending an intermediate downtrend.

Home Depot (HD), a Dow Jones Industrial Average stock moved below $262.81 completing a double top pattern.

American Express (AXP), a Dow Jones Industrial Average stock moved below $89.21 setting an intermediate downtrend.

eBay (EBAY), a NASDAQ 100 stock moved below $47.44 extending an intermediate downtrend.

Canadian Technology iShares (XIT) moved below $37.40 extending an intermediate downtrend.

BCE (BCE), a TSX 60 stock moved below $53.54 setting an intermediate downtrend.

S&P 500 Momentum Barometer

The Barometer slipped 3.01 on Friday and plunged 37.68 last week to 30.46. The Barometer moved from intermediate overbought to intermediate oversold on a move below 40.00 and has yet to show signs of bottoming.

TSX Momentum Barometer

The Barometer slipped 3.79 on Friday and plunged 28.43 last week to 28.44. The Barometer moved from intermediate neutral to intermediate oversold on a move below 40.00 and has yet to show signs of bottoming.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

|

|

|

|

This post was originally publised at Vialoux's Tech Talk.