by Kathy Jones, Senior Vice President, Head of Fixed Income Strategies, Schwab Center for FInancial Research

As the elections approach, many investors are wondering what the outcome will mean for the bond market. There are many major policy decisions that will influence the outlook—trade, energy, taxes and budget deficits, and pandemic relief. However, it’s difficult to assess how these issues will be addressed post-election, and even more unpredictable how the market will react.

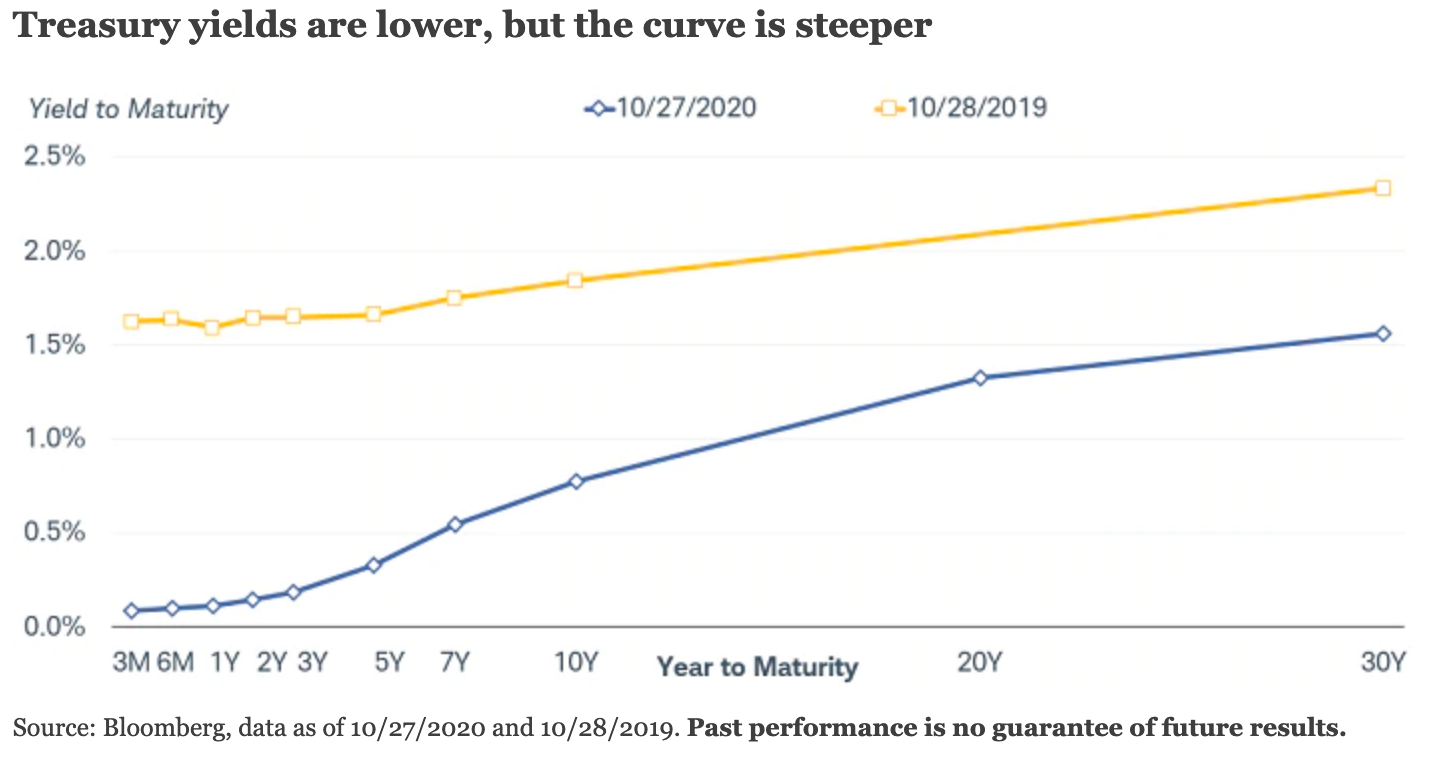

Consequently, we would avoid making any major changes to fixed income portfolios based on the elections, but we will be keeping a close eye on the fiscal stimulus talks because those have the potential to have the biggest influence on the bond market. In general, we believe it’s likely that some sort of fiscal aid package will be passed after the election, but the size, timing and specifics are up in the air. To some extent, the upward trend in long-term bond yields over the past few months and steeper yield curve suggest that the market has already begun to price in some improvement in the economy during 2021.

Instead of focusing too closely on the uncertainties ahead, we suggest focusing on the factors that we can assess with some certainty. Federal Reserve policy is one of those factors. The Fed has indicated very clearly that it a) will keep its policy rate near zero until inflation rises and/or the unemployment rate returns to pre-pandemic levels; b) has put in place programs and facilities to help support markets; and c) is planning to continue its bond-buying program.

With the Fed anchoring the federal funds rate near zero and expanding its balance sheet, our view is that interest rates are likely to remain lower for longer. There may be a modest rise in 10-year Treasury yields toward the 1% region on the back of a fiscal stimulus package, but it will likely be limited by ongoing low inflation and Fed policies.

Look for coupon income—cautiously

With yields near zero or negative in many markets and likely to remain that way for at least a few years, bonds with higher coupons may become more attractive. We suggest investors focus on earning current coupon income while protecting against unexpected risks, such as another downturn in the economy or inflation. Coupon payments can provide a degree of certain income, barring a default.

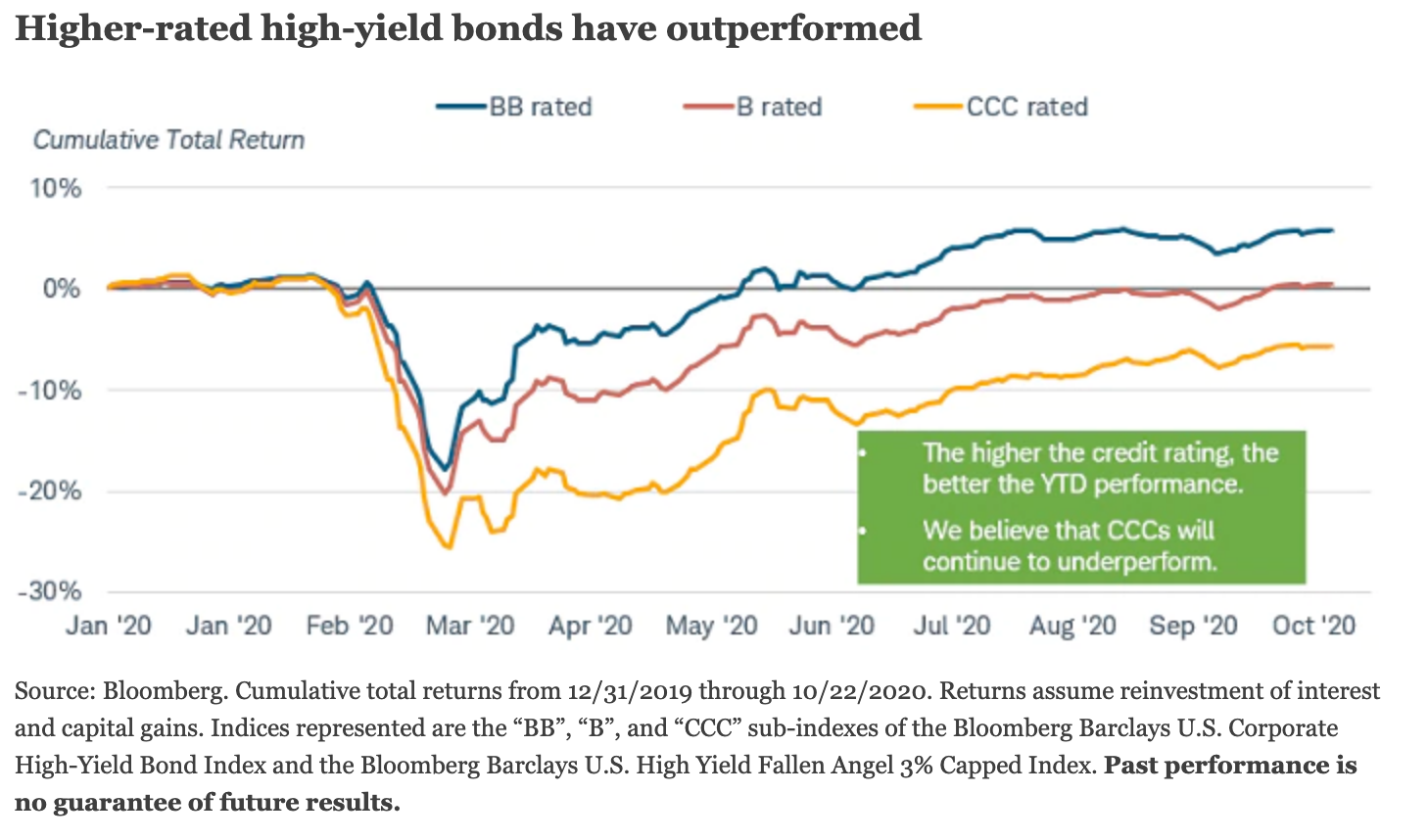

Highly rated investment-grade corporate and municipal bonds with lower risk of default or downgrade should fare better in an uncertain economy than riskier bonds with below-investment-grade ratings. Some exposure to high-yield corporate bonds may be appropriate for a small allocation, but we would suggest avoiding the lowest-rated bonds within the high-yield market. To date, bonds rated BB and higher have performed much better than lower-rated bonds, a trend we believe is likely to continue.

Similarly, in the municipal bond market, we favor keeping the bulk of a portfolio in bonds rated AA or higher. The elections could result in policies that aid lower-rated bonds, but we don’t believe it’s wise to speculate on how policy may evolve for lower-rated issuers. On the surface, higher tax rates should be supportive to municipal bond prices, but tax policy proposals made on the campaign trail are often changed when the legislation is drawn. Taxable municipal bonds might also be attractive for some investors because the average credit quality tends to be higher than in the corporate bond market, while yields are similar.

For investors with a higher risk tolerance, an allocation to emerging-market bonds and preferred securities can help increase current income and potential returns. However, we would limit the amount allocated to these more aggressive asset classes to no more than 20% of an overall portfolio.

Stay adaptable

While we believe our “up in credit quality” strategy should help reduce volatility for investors, there is still potential for unexpected negative surprises. We can’t entirely eliminate risk, but we can take steps to mitigate risks ranging from the potential for a double-dip recession to surging inflation. Our view is that it makes sense to hold some Treasuries to mitigate the risk of an economic downturn or steep drop in stock prices and also some Treasury Inflation-Protected Securities (TIPS) to hedge the risk of inflation.

In sum, the elections are likely to create short-term volatility, but we suggest trying to ignore the noise. We’re staying focused on the Federal Reserve because it has such a major influence on the bond market, and looking for opportunities to generate income while mitigating risk. When times are uncertain, holding a broadly diversified portfolio can be one of the smartest strategies for investors.

Copyright © Schwab Center for FInancial Research