by Blaine Rollins, CFA, 361 Capital

The stroll into solid year-end performance numbers just became a bit more challenging. While the markets continue to hope for signs of corporate tax relief, those plans may have been dramatically altered last week. First, the Senate released their tax work showing a delay in corporate income tax cuts until 2019 which was not welcome news. Then, news emerged that the Alabama Senate seat would be going into play possibly stripping the GOP to a one-seat advantage in the Senate unless an alternate write-in candidate can quickly be found for the December 12th election. So not only does Congress need to agree on a tax bill that won’t increase debt over 10 years, but they also need a bill that can pass all GOP Senators. This is a very tall order. The Thanksgiving recess starts on Friday so enjoy watching Congress get yelled at on Twitter by the POTUS for the next week and throughout the Thanksgiving holiday week.

The news out of Washington and Alabama threw the U.S. Dollar, Bonds, Small Caps and even Bank Stocks into reverse last week. While politics were mostly to blame, there have been several other factors that are brewing in the background:

– The U.S. yield curve continues to flatten

– U.S. junk bonds are underperforming

– Saudi Arabia and Iran remain at odds

– British PM Theresa May is quickly losing confidants

– Bitcoin just took another 30% digger

In isolation, any one of these events would be easily absorbed by the markets. But add them to meeting expectations for tax reform in Washington and this stroll could become a tightrope walk. But as always, it is best to be focused the fundamentals behind your own investments and if they continue to trend well then your assets should perform and everything else could remain a sideshow.

To receive this weekly briefing directly to your inbox, subscribe now.

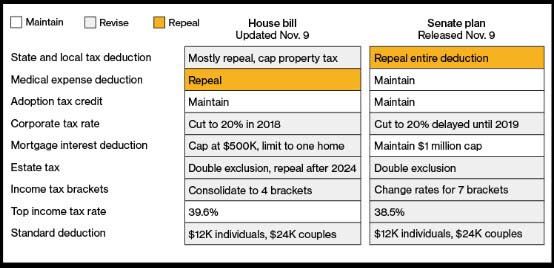

Here are the House and Senate tax reform plans…

They might seem similar at first glance but there are some very big differences: state and local tax deduction, medical expense deduction, corporate income tax timing and mortgage interest deduction sizing. These are not easy items to agree on.

(Bloomberg)

And even if they agree to horse trade on the above items, the bill will still need to find another $1+ trillion to keep it from violating the Senate rules…

Senate Republicans aim to pass their tax bill along party lines, without any support from Democrats, and that requires them to use a process called reconciliation.

But to pass a tax-cut bill through reconciliation, Senate rules say, the legislation cannot add to the debt after 10 years. The Senate GOP tax bill would add to the debt after 10 years, and officials have to come up with a way to address this, or the bill will essentially be disqualified from becoming law.

That leaves them with some unpopular choices. They can decide to have major parts of the tax-cut package expire after 10 or fewer years, or they can add some tax increases that would not kick in until the late 2020s, assuming Congress will eventually vote to reverse the hikes.

“If they thought they had the solution, it would have been in the [bill] already,” said Douglas Holtz-Eakin, a conservative economist and former director of the Congressional Budget Office.

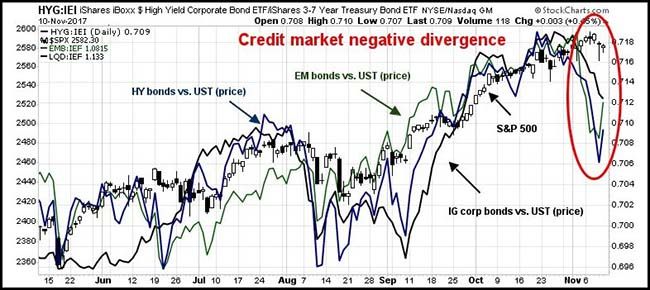

Many of us have been watching the breakdown in junk bonds too closely…

(@HumbleStudent)

A big reason for the significant pullback in the junk bond ETFs has been due to some of the largest issuers printing poor earnings or negative corporate news items…

The weakness in the high-yield asset class accompanies a slight drawdown in US equity markets with the S&P 500 0.2 per cent lower for the week, the first time it has had a weekly decline since September. The fragility has been exacerbated by lacklustre quarterly results by some of the largest high-yield bond issuers, which are often among the biggest holdings of the popular ETFs and can create broader selling pressures in the asset class, investors said. Debts sold by Frontier Communications, CenturyLink, Community Health Systems and Sprint have dropped more than 7 cents on the dollar this month. The average high-yield bond has dropped by a penny on the dollar over the same time. “There is a real pronounced weakness in a few sectors that [is] driving a lot of it,” said Jerry Cudzil, head of credit trading at TCW. “There has been a real lack of willingness of investors to hold on to securities after an earnings miss . . . and it is more pronounced in the last week than it has been in quite some time.” Redemptions from junk bond funds quickened in the past week and $2.5bn has been pulled out of the asset class over the past month, according to flows tracked by EPFR.

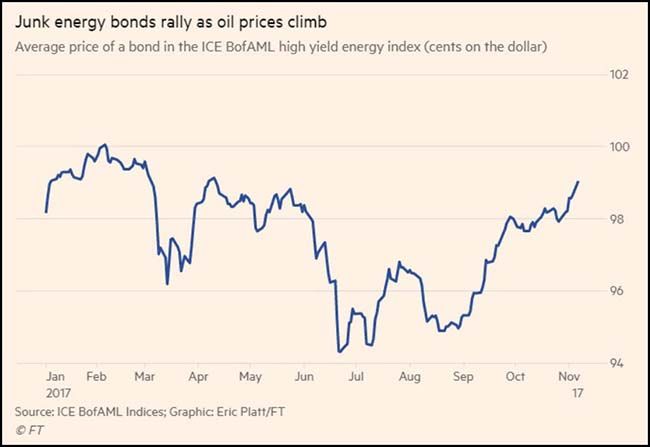

Energy high yield has actually been outperforming…

For the first time in years, Energy junk bonds have been benefiting the indexes and ETFs. If the individual issues mentioned above could stabilize and energy debt rallies as oil prices continue to gain, then maybe this junk bond weakness will be temporary. For the first time in years, Energy junk bonds have actually been recently benefiting the indexes and ETFs. If the individual issues mentioned above could stabilize and energy debt rallies as oil prices continue to gain, then maybe this junk bond weakness will be temporary.

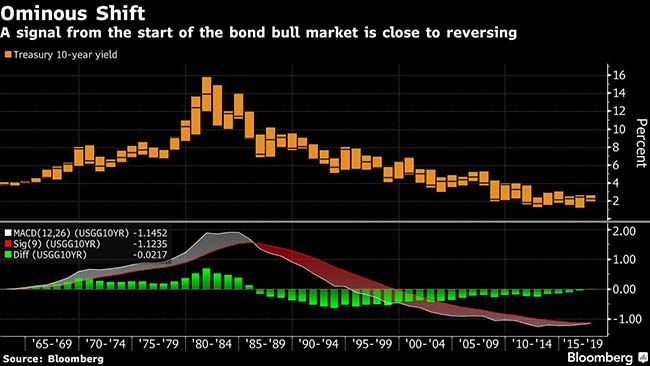

One very big market that looks like it is turning higher…

Bond yields itself continue to look like they are coming to the end of their 35-year run. There will be many more implications of a sustained rise in Treasury yields if the new trend is up.

(Bloomberg)

Speaking of the potential for inflation and higher interest rates…

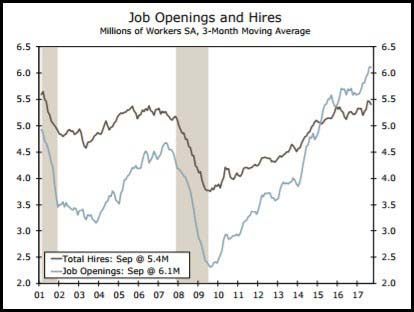

What a great time to be looking for a job.

(Wells Fargo Economics Group)

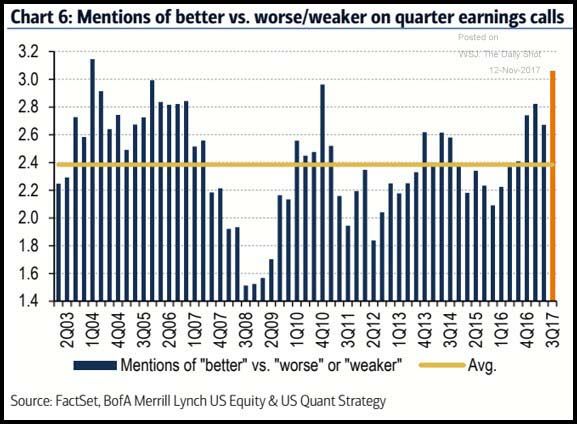

Some further earnings comments from several different industries last week strongly suggest why bond yields could be moving higher…

“If I look at all of my end markets, if I look at all the key markets I serve, for oil and gas to powered to chemical to pharmaceutical, the mining – even mining is doing well for us right now… We’re seeing a pretty good momentum” —Emerson (Industrial)

“We are continuing to see good business environment for our products worldwide…Our inventories at Microchip as well as the distributors are towards the low end of our normal range. We are continuing to slowly add incremental capacity at various bottlenecks.” —Microchip (Semis)

“We’re, I think, certainly encouraged by the improving market conditions as we look forward. The market, obviously, is continuing to rebalance nicely. Inventories are moving towards the five-year average, and we are watching the market closely for opportunities.” —EOG (Oil & Gas)

“The good news is…the price movement has gotten very constructive lately. And we…can see a price now where we could actually have some free cash flow next year pretty soon” —Apache (Oil & Gas)

A good chart summarizing the better/worse mentions of the conference calls…

(WSJ/Daily Shot)

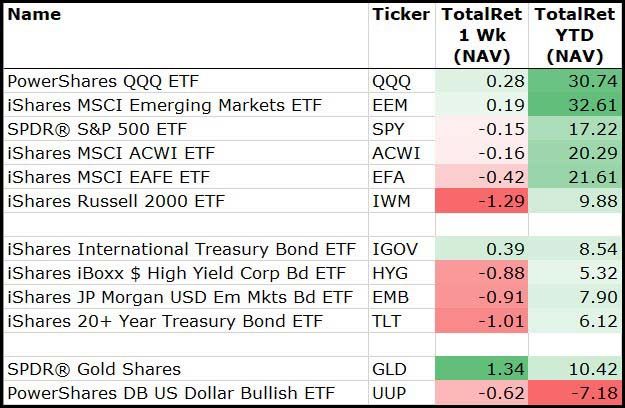

For the week, the slip of tax reform progress hit the most sensitive assets: the U.S. Dollar, Bonds and Small Cap stocks…

(11/10/17)

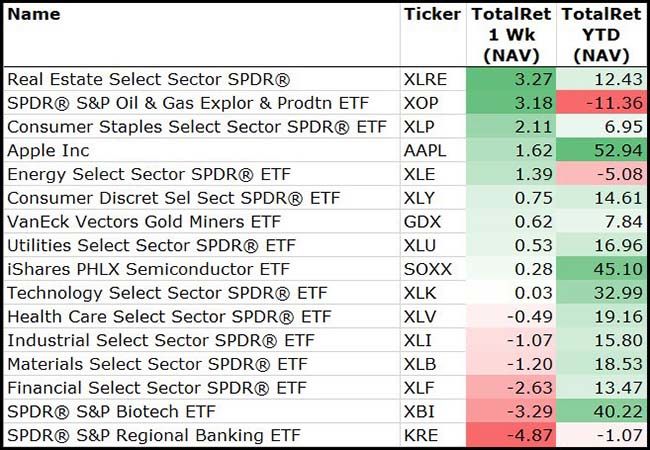

Among sectors, Energy outperformed with the advance in crude oil…

Banks were a surprising underperformer showing that the flattening yield curve was more concerning to investors than the overall rise in interest rates.

(11/10/17)

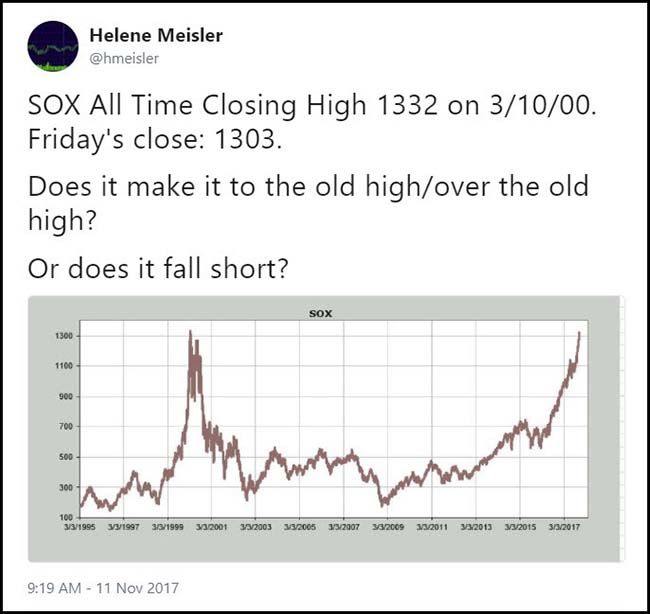

Welcome back, my good friend. It has been way too long…

I still do not understand why portfolio managers choose to be so overweight Financials…

I look at this chart and think that owners of bank/lending stocks should be very happy that they are keeping pace with the market. Credit quality is not going to get better. The fight for expenses and competition is not going to get easier. So unless the yield curve steepens, you are going to have an extremely difficult time outperforming.

(@AndrewThrasher)

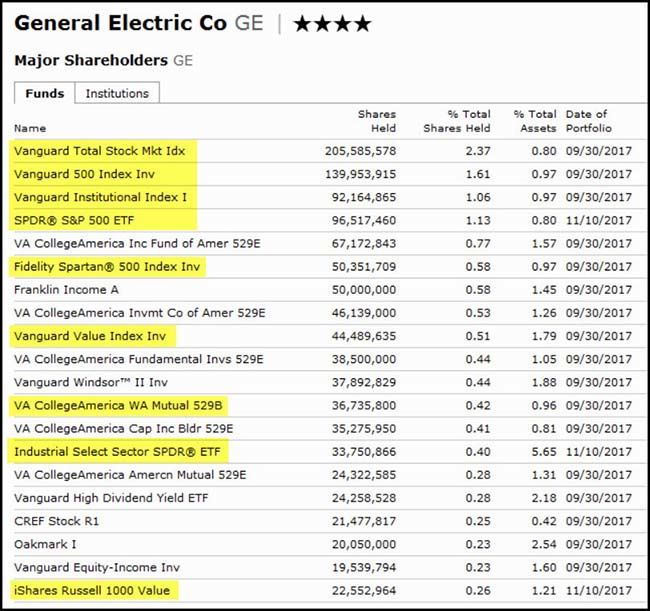

GE has fallen 35% this year. So who still owns the stock?

GE stock has underperformed the S&P 500 for about 18 years now. It’s weight in the S&P 500 is now just under 1%. As you would guess, active managers have pulled back from owning the stock. The top shareholders as of today appear to be the passive and index funds. Of course if the company draws up a better plan and begins to execute on it, the active portfolio managers will be back to participate in the upside.

(Morningstar)

At what point does Amazon bid for the Macy’s Thanksgiving Day parade?

The Cincinnati-based department operator reported another quarter of shrinking sales as fewer and fewer Americans head to malls to do their shopping, opting instead for the convenience and lower prices offered by online merchants. Like-for-like sales, a key industry metric, fell 4 per cent in the three months to end of October. The drop was steeper than the 2.9 per cent decline Wall Street was expecting and came on top of a 3.3 per cent drop in the year ago period. It also marks the 11th straight quarter that the gauge has languished in negative territory.

Macy’s is the giant proxy for retail mall economics, so continue to lower your expectations for values…

Weakness in the mall sector dragged valuations lower across the entire commercial real estate market in October, according to a report by real estate research firm Green Street Advisors.

Green Street’s Commercial Property Price Index, which covers property owned by real estate investment trusts, declined 1% to 125.5 in October from September, the sharpest month-over-month drop since the financial crisis.

Commercial property prices generally have been trending higher since June 2009, when the Green Street index bottomed at 61.2, as an improving economy fueled demand and low interest rates made property yields attractive.

But valuations of many second-tier malls have been sliding in recent months as some retailers struggle to keep up with fast-changing consumer tastes and heightened competition from e-commerce.

Mall valuations fell 6% in value in October from a month earlier and by 11% in the past 12 months, according to Green Street’s index for that sector.

(WSJ)

Alternative Headline: Don’t Get Frozen by Cold Consultants…

(Fundfire)

Really, two years of EM outperformance and the consultants want to call out for caution?

When I look at this long term chart of EM vs. Large Cap US, I have a very different conclusion.

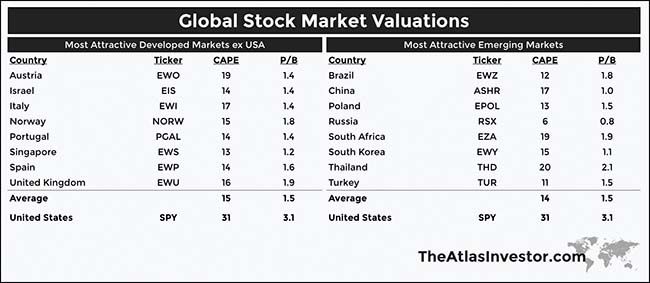

Then when I look at the relative valuations of International vs. U.S., I draw even more conclusions…

(@TihoBrkan)

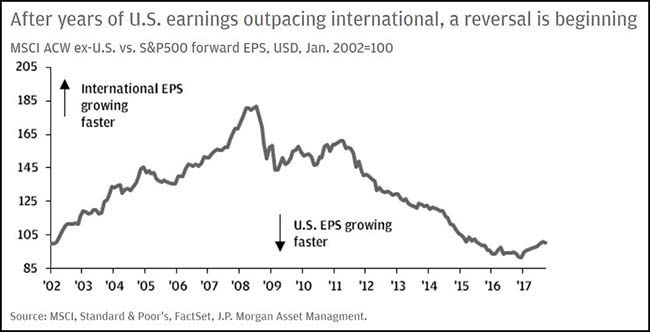

And I am not the only one. Here is JPMorgan’s thoughts on International equities…

There are four strong arguments why international equities should continue delivering over the next few years: growth, earnings, valuations and currencies. First, the global economy is finally growing again, with over 90% of economies accelerating. Crucially, the U.S. is already in the ninth year of its expansion, while other countries are still in early stages. Second, this economic improvement is showing up in corporate profits, with international earnings now growing faster than those in the U.S. Third, the valuation argument also points to more upside abroad, with international close to the cheapest it has been relative to the U.S. in fifteen years. Lastly, the currency has gone from a headwind to a tailwind for international returns as a result of a weaker U.S. dollar this year, likely only the beginning of a longer move down.

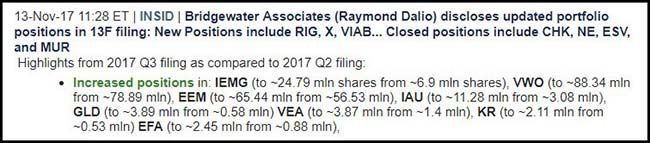

And here are the recent portfolio shifts by one of the largest hedge funds…

That looks like a $1B increase in EM equity exposure just among their largest holdings.

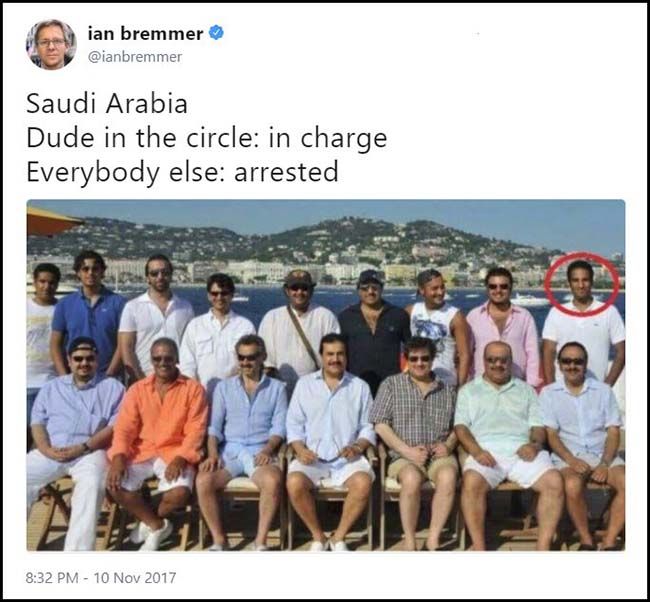

Could be an interesting photo option for the Saudi Arabia holiday card…

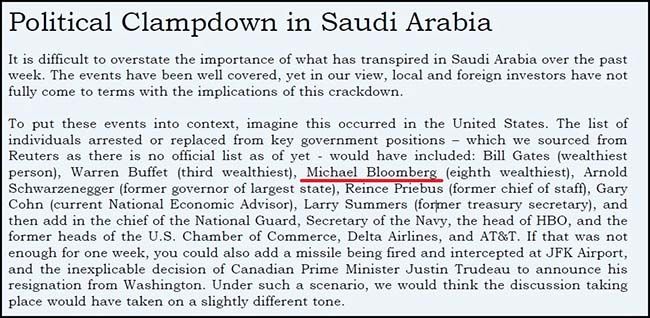

If you have a difficult time relating to who all of the people in the picture are, here is a good parallel…

@tracyalloway: If the U.S. did the same as Saudi Arabia, they would have rounded up Bill Gates, Warren Buffet, and Michael Bloomberg (!). @JeanPaulPigat of Lighthouse Research puts the Saudi purge into a U.S. perspective:

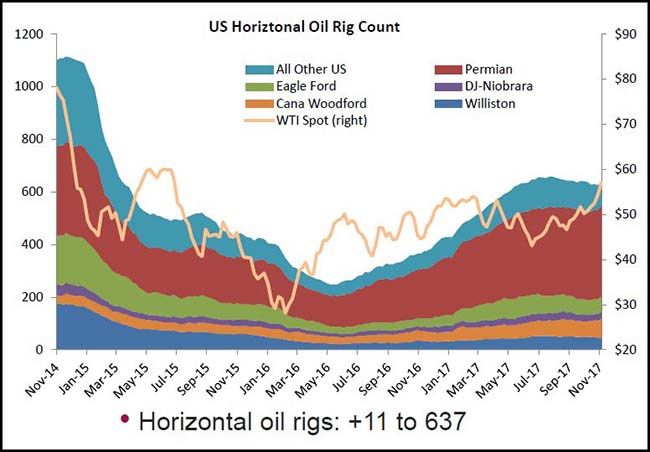

Oil prices up, oil rig counts up…

Bob Lutz, the former head of GM, thinks you have five years left to sell your automobile…

It saddens me to say it, but we are approaching the end of the automotive era.

The auto industry is on an accelerating change curve. For hundreds of years, the horse was the prime mover of humans and for the past 120 years it has been the automobile.

Now we are approaching the end of the line for the automobile because travel will be in standardized modules…

The vehicles, however, will no longer be driven by humans because in 15 to 20 years — at the latest — human-driven vehicles will be legislated off the highways.

The tipping point will come when 20 to 30 percent of vehicles are fully autonomous. Countries will look at the accident statistics and figure out that human drivers are causing 99.9 percent of the accidents.

Of course, there will be a transition period. Everyone will have five years to get their car off the road or sell it for scrap or trade it on a module.

With the economy so strong, I was surprised to see this. Peak running?

Road races have hit the wall. The number of finishers in events in the United States has fallen from a peak of about 19 million in 2013 to just over 17 million in 2016.

High fees, a glut of race options and competition from other fitness activities have shrunk the fields at many races.

“It’s possible we got too big too fast,” said Rich Harshbarger, the chief executive of Running USA, an industry group. Road races saw 300 percent growth in the number of finishers from 1990 to 2013, with a concentrated boom from 2008 to 2013. As participation recedes, Harshbarger expects some races to fold.

“We’ve still seen supply outstrip demand, and I think that’s going to change next year,” Harshbarger added.

(NY Times)

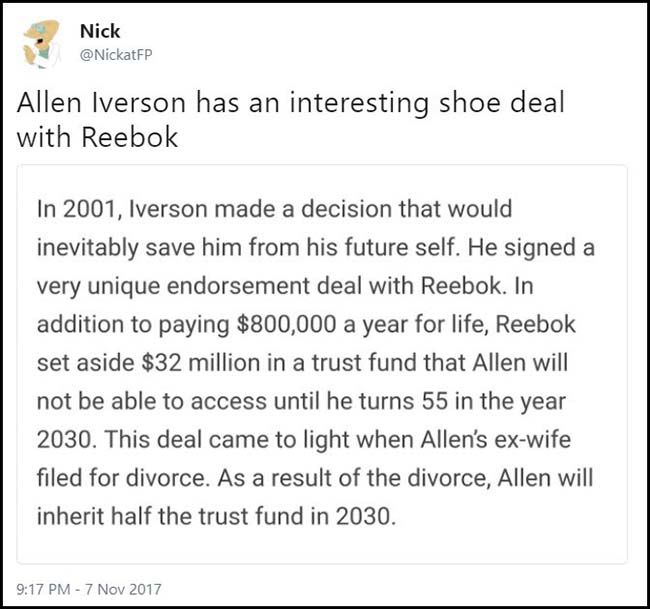

This contract needs no explanation…

Finally, before you run that Twitter thought out to 280 characters, I’d encourage you to reflect on the following…