by Jennifer Thomson, Gavekal Capital

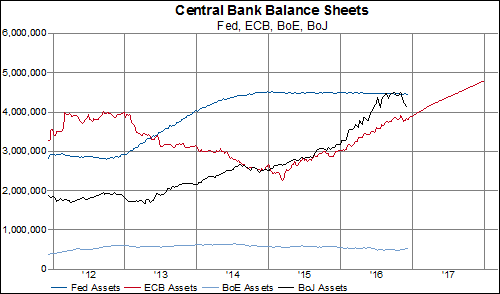

Fun fact of the day: the ECB’s decision to extend its asset purchase program to the end of 2017, albeit at a slightly slower pace than the current €80B per month, puts it on track to surpass the Fed’s current $4.4B level of assets sometime around next August (all else equal):

For reference, the current level of assets on the ECB’s balance sheet represents about one third of euro area GDP while Fed assets currently represent just a quarter of U.S. GDP.

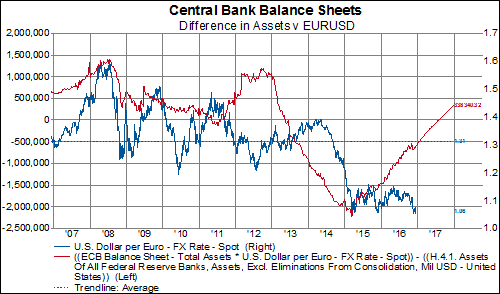

The last time the absolute level of assets at the ECB exceeded those of the Fed (red line, below) was in early 2013, back when the euro traded nearer its long-term average exchange rate of 1.31:

In light of the ECB’s obviously more generous monetary policy, investors intuitively anticipate a further weakening of the euro (to, and below, parity) next year. The above chart would seem to argue the opposite (with a lag of course), if these historical relationships are any guide.

Copyright © Gavekal Capital