by Philip Murphy, VP, North American Equities, S&P Dow Jones Indices

Since the U.S. presidential election, headlines touting small-cap performance have almost invariably cited the Russell 2000. As impressive as that index’s return has been, S&P DJI has a little engine that persistently wins the small-cap race—the S&P SmallCap 600®. Outperformance of the S&P SmallCap 600 versus the Russell 2000 primarily has to do with two factors: 1) the negative Russell reconstitution effect and 2) our little engine does not try pulling too many low-quality stocks up the hill. It focuses on a manageable trainload of liquid, higher-quality names, staying clear of micro-caps that trade by appointment and other low-quality stocks. In a future post, my colleague Aye Soe will discuss the quality effect in greater detail.

Like the S&P MidCap 400®, the S&P SmallCap 600 is governed by the same methodology as the S&P 500®. Liquidity, free float, and financial viability criteria are identical for all three. The only difference between their respective rules are the market cap guidelines for new entrants. Currently, candidates for entry into the S&P SmallCap 600 must have a market cap between USD 400 million and USD 1.8 billion. The Russell 2000 is not nearly as selective, relying on a mechanical market cap ranking to determine index constituency and extending far into micro-cap territory.

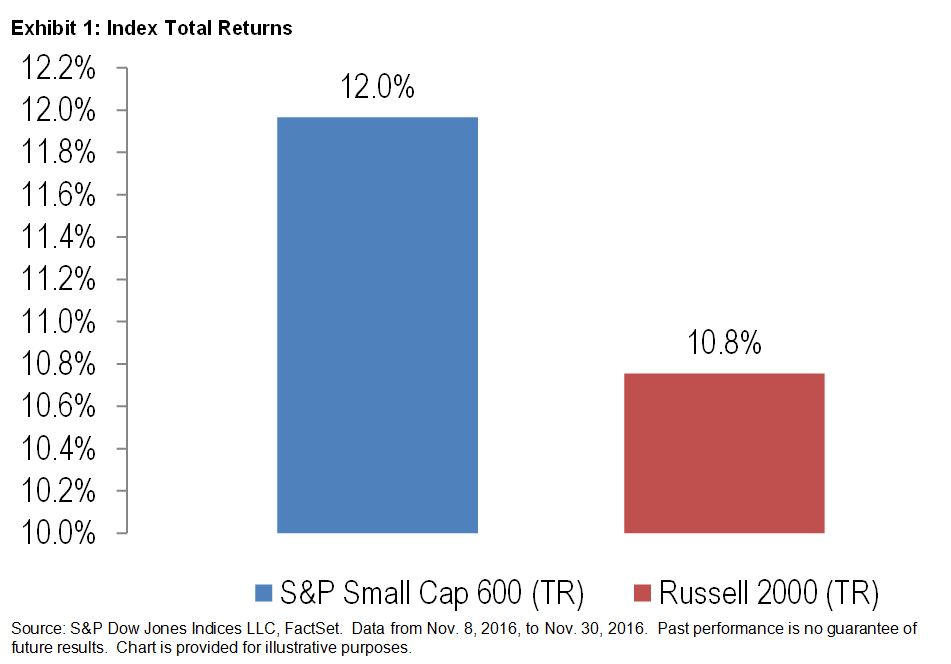

The structural differences between the S&P SmallCap 600 and Russell 2000 have resulted in favorable relative performance for the S&P SmallCap 600. For example, if we look at the returns of the 16 trading days from election day (Nov. 8, 2016) through Nov. 30, 2016, the S&P SmallCap 600 finished ahead of the Russell 2000 by 1.2% (see Exhibit 1).

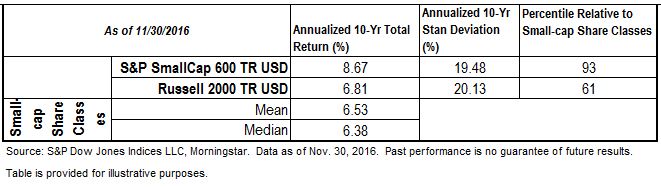

Of course, 16 days is an insufficient period from which to draw any conclusions. Still, in the long run, the S&P SmallCap 600 has historically outshined the Russell 2000—as well as most active small-cap managers (see Exhibit 2).

Exhibit 2: Annualized 10-Year Total Returns of Active Small-Cap Blend Mutual Fund Share Classes and Small-Cap Benchmarks

The implications for small-cap market participants are straightforward. First, indexing small-cap equities works very effectively. Market participants, advisors, and fiduciaries may want to consider active fees in light of the historical evidence in favor of indexing. The notion that it only works in more efficient market segments like large caps is a myth. Second, the index one selects for access to certain investment spaces or for benchmarking active managers important matters (a lot). Selecting the Russell 2000 historically resulted in: 1) less return per unit of risk than could have been achieved with the S&P SmallCap 600, or 2) a lower hurdle for expensive active managers to gain outsized fees—more often than not for underperformance. In short, it is advisable to remember the Little Engine That Could when implementing small-cap exposure.

This article is a publication of S&P Dow Jones Indices LLC. © S&P Dow Jones Indices LLC 2016. S&P® is a registered trademark of S&P Financial Services LLC. Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. S&P Dow Jones Indices LLC is not an investment advisor. This publication is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold a security, nor is it considered to be investment advice.

Copyright © S&P Dow Jones Indices