The Huddle: Strategies for Range Bound Markets

by Bob Simpson, Synchronicity Performance Consultants

Managing investment portfolios, when markets are range bound, is much different than when we are experiencing trending markets, like we have experienced since 2012.

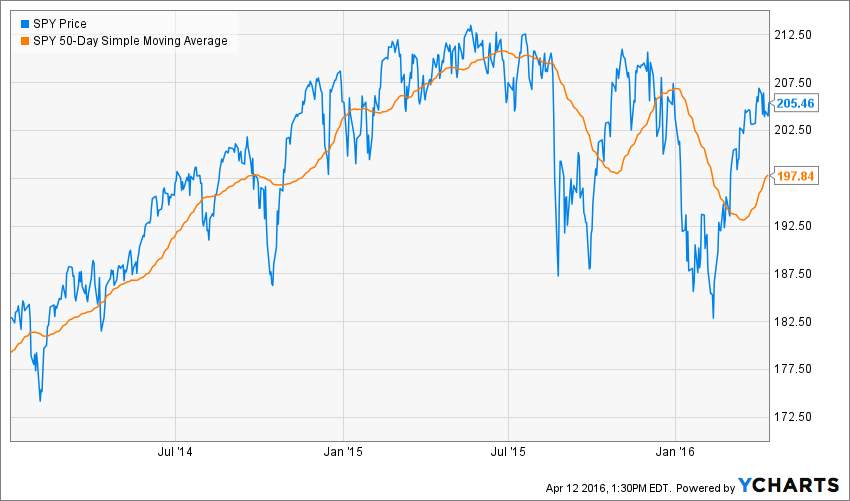

The S&P 500 (SPY) has been trapped in a trading range bound by 187 to 212.50 since the summer of 2014.

Technical tools, like longer-term moving averages are of little use to us as they have turned sideways.

In a trading range, you need to tighten up your moving averages. Here is what a 50 day moving average looks for SPY:

You may even want to tighten that up to a 20 day:

The key is to identify which moving average is "working" . Technical analysis is a bit of a game of ambulance chasing. Enough people follow moving averages, especially the 200-day MA and when there is a break, there is a flurry of buying or selling. Most of the price movement is just volatility in the price people are willing to pay for earnings. Earnings, after all, are only reported quarterly. I will discuss this more closely in a future post.

In a range bound market, you simply need to identify which moving average is working and determine when to buy and sell.

For more details and a similar analysis of Canadian equities, bonds and the Canadian Dollar, watch the video below.