by Don Vialoux, Timingthemarket.ca

Mr. Vialoux on BNN’s Market Call Today

Following are links to yesterday’s appearance:

http://www.bnn.ca/Video/player.aspx?vid=847789 Market outlook

http://www.bnn.ca/Video/player.aspx?vid=847807

http://www.bnn.ca/Video/player.aspx?vid=847811

http://www.bnn.ca/Video/player.aspx?vid=847814 Past picks

http://www.bnn.ca/Video/player.aspx?vid=847816

http://www.bnn.ca/Video/player.aspx?vid=847821

http://www.bnn.ca/Video/player.aspx?vid=847823

http://www.bnn.ca/Video/player.aspx?vid=847829 Top picks

Trader’s Corner

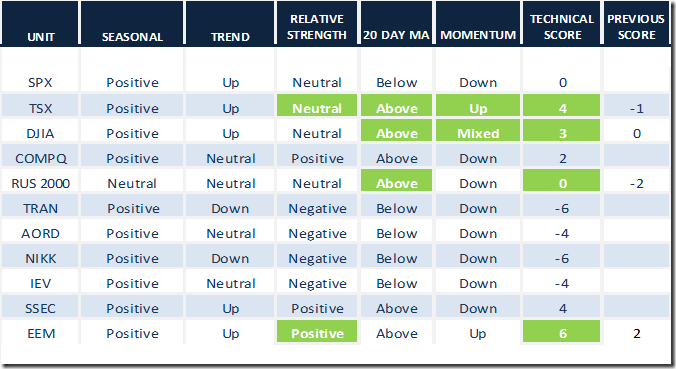

Daily Seasonal/Technical Equity Trends for April 12th 2016

Green: Increase from previous day

Red: Decrease from previous day

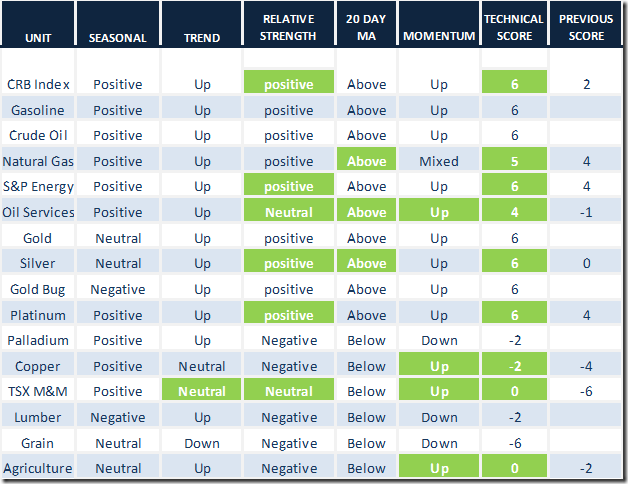

Daily Seasonal/Technical Commodities Trends for April 12th 2016

Green: Increase from previous day

Red: Decrease from previous day

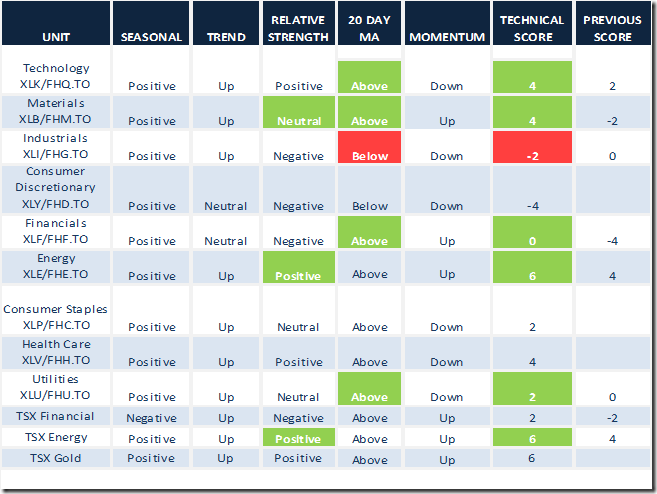

Daily Seasonal/Technical Sector Trends for March April 12th 2016

Green: Increase from previous day

Red: Decrease from previous day

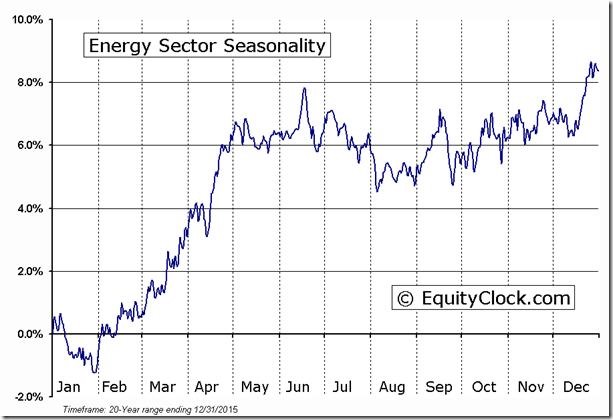

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Interesting Charts

Technical action by S&P 500 stocks was exceptionally bullish yesterday: 15 stocks broke resistance and 5 stocks broke support (Hasbro, TripAdvisors, Electonic Arts, Xilinx and Alliance Data Systems). Most of the bullish technical action occurred in the energy sector. Breakouts included Apache, Anadarko, Chesapeake, Chevron, Denbury Resources, EOG Resources, Murphy, Nabors, Newfield Exploration, Oneok, Range Resources, Spectra Energy and Schlumber. The S&P Energy Index broke 476.10 to resume an intermediate uptrend. Strength relative to the S&P 500 Index has turned positive.

Ditto for the U.S. Oil and Gas Exploration ETF: XOP

Strength in U.S. energy stocks was triggered by a breakout by crude oil above resistance at $42.49 per barrel to extend an intermediate uptrend.

Canadian energy stocks quickly caught the wave. Canadian energy stocks breaking resistance yesterday included Canadian Natural Resources, Suncor, Cenovus, Crescent Point and Peyto. The TSX Energy Index broke above to extend an intermediate uptrend.

Adrienne Toghraie’s “Trader’s Coach” Column

|

|

Trading from your Strengths

By Adrienne Toghraie, Trader’s Success Coach

Peter Drucker, one of the world’s leading management consultants and writers, wrote that good managers walk into a room of various personalities and talents and work with the strengths of those in the room. They identify the resources of these individuals and have them use the best part of themselves to make the team work.

A good trader does the same with managing himself. He recognizes good choices for his trading that play to his strengths:

· The strategy he is going choose

· The time frame he is going to work with

· The amount of money he will use for his inventory

· The hours he will trade with real money

· The risk he is willing to take on each trade

He should not only look at what will:

· Be the most prestigious

· Make him the most amount of money

· Be the easiest or fastest

· Be the choice of some other trader with dissimilar resources

· Be a black box system

Let’s look at strategies and the type of person who is suited to each strategy.

Investor trader

This is a person who perhaps likes the fundamentals of trading. Likes to look at the history of a company or commodity and does not want to be tied to decisions on a regular basis.

Swing trader

This is someone who is more comfortable making daily choices and does not want to be tied to a computer. He might have a full time job and only wants to spend a couple of hours a day trading.

Day trader

This is someone who needs the stimulation of making more decisions in a day and loves the process of watching a screen and managing a trade on a minute-to-minute basis.

Of course, there are those traders who mix and match these types of trading and have various levels of commitment in time, number of trades and percentage that will be traded at any given time.

Then there are those traders who are more suited for other types of trading:

Trading for an institution

This type of person must have a high education, connections or have proven themselves to be a highly skilled trader on their own. They like working with large amounts of money, can work in a corporate environment and are consistent.

Trading in a prop house

This is a good place for someone who can work with someone else’s rules and does not have enough money of their own. Very often they do have to put up the capital for their education with the prop house before they are given any money.

Money manager trader

This is a person who has good management skills, is a good salesman, or hires a good salesman and prefers to work with other people’s money. Money managers must have the skill of working with clients and is preferably risk adverse.

Money management is another consideration for a trader

A trader needs money to manage his finances, money for running his trading business as well as an inventory of money to trade. Based on the financial part of his business plan, he should decide when is the right time to let go of his full time job. He should only decide this after he has shown to himself that he is consistent in earning a living from his profits and has at least six months of living expenses in the bank.

Of course, there are those who are more conservative and will not trade until they build up more of a nest egg. Then there are those who throw caution to the wind and trade with every penny they have. The latter very seldom will make it without someone helping him financially.

Time and energy will make the difference in commitment choices

Trading time must be high-energy time if a trader wants to get the best out of himself. Making good choices in how you take care of your mind and body will determine how much high-energy time you have in a day. Also, other commitments of family, friends, work and other activities are energy time grabbers and must be considered for the type of trading that a trader can do successfully.

Calculated risk will make the difference in how fast you grow your capital

A trader must decide how much he is comfortable in risking with the strategy he has chosen to trade to receive its highest rewards. Then he has to see if he can manage that type of risk psychologically.

Conclusion

When a trader makes his initial choices for the direction he wants for his trading career, he needs to consider his strengths and weaknesses. Working with the resources he already has will give him an advantage to becoming a skilled and profitable trader in the shortest amount of time.

Adrienne’s Free Webinars

Adrienne presents free webinars on the discipline of trading

Email Adrienne@TradingOnTarget.com

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca