by Don Vialoux, Timingthemarket.ca

Economic News This Week

December Case-Shiller 20 City Home Price Index to be released at 9:00 AM EST on Tuesday is expected to increase 5.8% on a year-over-year basis versus a gain of 5.8% in December

February Consumer Confidence to be released at 10:00 AM EST on Tuesday is expected to slip to 97.3 from 98.1 in January.

January Existing Home Sales to be released at 10:00 AM EST on Tuesday are expected to drop to 5.23 million units from 5.46 million units in December.

January New Home Sales to be released at 10:00 AM EST on Wednesday are expected to slip to 523,000 units from 544,000 units in December.

Weekly Jobless Claims to be released at 8:30 AM EST on Thursday are expected to increase to 270,000 from 262,000 last week.

January Durable Goods Orders to be released at 8:30 AM EST on Thursday are expected to increase 2.0% versus a decline of 5.0% in December. Excluding Transportation, January Durable Goods Orders are expected to increase 0.4% versus a decline of 1.0% in December.

Second estimate of Fourth Quarter Real GDP to be released at 8:30 AM EST on Friday is expected to slip to an annual rate of 0.4% from the previous estimate of 0.7%.

January Personal Income to be released at 8:30 AM EST on Friday is expected to increase 0.3% versus a gain of 0.3% in December. January Personal Spending is expected to increase 0.3% versus no change in December.

February Michigan Sentiment to be released at 10:00 AM EST on Friday is expected to slip to 91.0 from 92.0 in January.

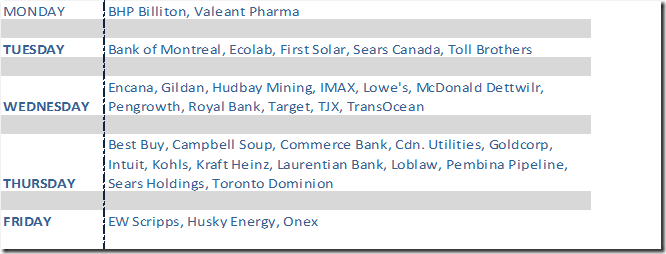

Earnings News This Week

StockTwits Reports Released on Friday @EquityClock

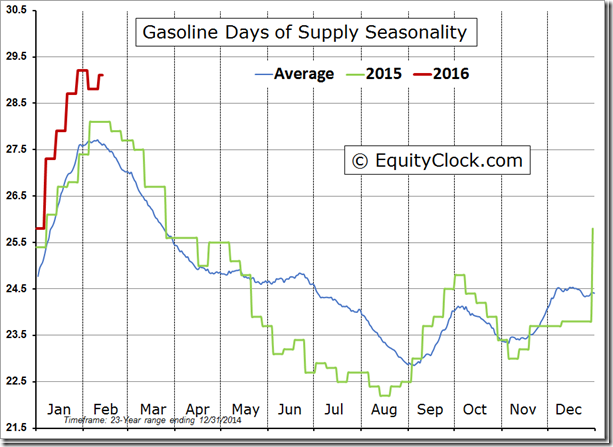

Gasoline days of supply continuing to suggest a topping process, despite the build in inventories.

Technical action by S&P 500 stocks to 10:00 AM: Quiet. Breakout: $AMAT. Breakdown: $NFX

The Bottom Line

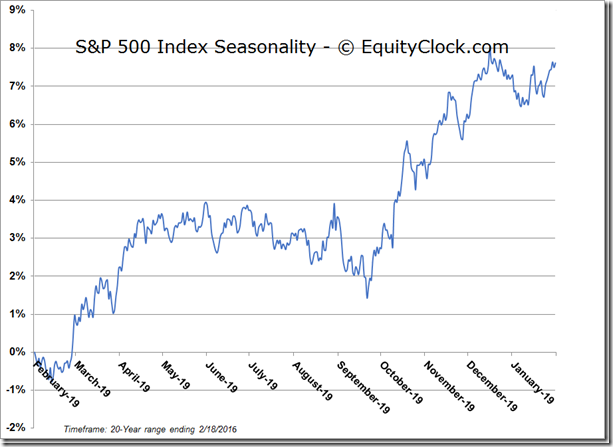

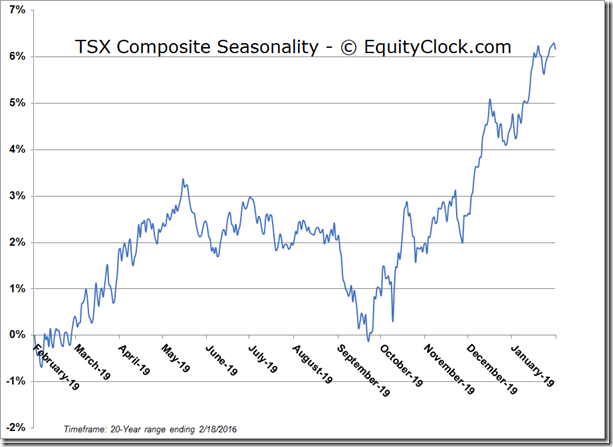

Current intermediate uptrend started by major equity indices and sectors on January 21st continues. The Dow Jones Industrial Average already is up 6.9% and the TSX Composite Index already is up 11.1% since their lows on January 21st However, most equity indices and sectors already are short term overbought after breaking above short term base building patterns. Seasonal influences for North American equity markets on average resume positive this week following a 7 week hiatus. Preferred strategy is to accumulate equities on weakness. Economically sensitive sectors with positive seasonal influences are preferred (e.g. Materials, Industrials, Consumer Discretionary, Energy in the U.S. Energy, Base Metals, and Financials in Canada. Outside of North America, European and Emerging Market ETFs also are attractive

Equity Indices

Daily Seasonal/Technical Equity Trends for February 19th 2016

Green: Increase from previous day

Red: Decrease from previous day

Calculating Technical Scores

Technical scores are calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

Higher highs and higher lows

Intermediate Neutral trend: Score 0

Not up or down

Intermediate Downtrend: Score -2

Lower highs and lower lows

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower.

S&P 500 Index gained 53.00 points (2.84%) last week. Intermediate trend remains down. The Index moved above its 20 day moving average. Short term momentum indicators continue to trend up.

Percent of S&P 500 stocks trading above their 50 day moving average jumped last week to 44.00% from 27.20%. Percent remains in an intermediate uptrend.

Percent of S&P 500 stocks trading above their 200 day moving average increased last week to 31.00% from 25.00%. Percent continues to recover from an intermediate oversold level.

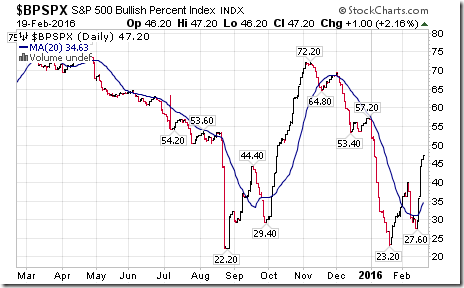

Bullish Percent Index for S&P 500 jumped last week to 47.20% from 29.80% and moved above its 20 day moving average. Intermediate trend is up.

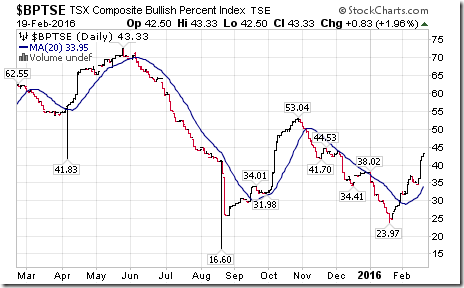

Bullish Percent Index for TSX Composite stocks jumped last week to 43.33% from 34.58% and remained above is 20 day moving average. The Index remains in an intermediate uptrend.

The TSX Composite Index jumped 432.18 points (3.49%) last week. Intermediate trend changed to up from down on a move above 12.826.74 (Score: 2). Strength relative to the S&P 500 Index remains positive (Score: 2). The Index moved back above its 20 day moving average (Score: 1). Short term momentum indicators are trending up (Score: 1), but are overbought. Technical score improved last week to 6 from 0.

Percent of TSX stocks trading above their 50 day moving average increased last week to 58.58% from 32.08%. Percent remains in an intermediate uptrend.

Percent of TSX stocks trading above their 200 day moving average increased last week to 32.64% from 23.33%. Percent remains in an intermediate uptrend.

Dow Jones Industrial Average gained 418.15 points (2.62%) last week. Intermediate trend changed to up from down on a brief move above 16,510.98. Strength relative to the S&P 500 Index remains positive. The Average moved above its 20 day moving average. Short term momentum indicators are trending up, but are overbought. Technical score improved last week to 6 from -2

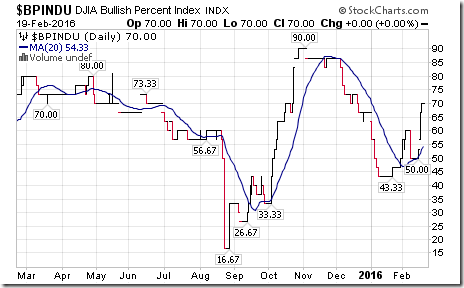

Bullish Percent Index for Dow Jones Industrial Average stocks increased last week to 70.00% from 50.00% and remained above its 20 day moving average. The Index is in an intermediate uptrend, but is approaching overbought levels.

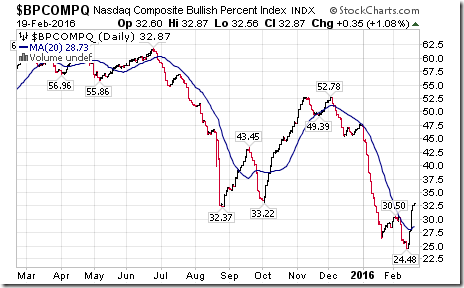

Bullish Percent Index for NASDAQ Composite Index increased last week to 32.87% from 25.29% and moved above their 20 day moving average. The Index has reached an intermediate bottom at an oversold level.

NASDAQ Composite Index gained 166.92 points (3.85%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Index moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to -2 from -6.

The Russell 2000 Index gained 38.02 points (3.91%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Index moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to -2 from -6.

The Dow Jones Transportation Average gained 237.26 points (3.37%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index remained positive. The Average remained above its 20 day moving average. Short term momentum indicators are trending up. Technical score remained last week at 2.

The Australia All Ordinaries Composite Index added 191.70 points (3.98%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index remained Neutral. The Index moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 0 from -4

The Nikkei Average jumped 1,014.56 points (6.79%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index remained negative. The Average remained below its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to -4 from -6

Europe iShares gained $1.05 (2.91%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index remained neutral. Units moved above their 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 0 from -4

The Shanghai Composite Index gained 96.53 points (3.49%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remained neutral. The Index moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 0 from -4.

Emerging Markets iShares gained $0.92 (3.14%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index remains positive. Units moved above their 20 day moving average. Short term momentum indicators are trending up. Technical score improve to 2 from -2

Currencies

The U.S. Dollar Index added 0.67 (0.70%) last week. Intermediate trend remained down. The Index remained below its 20 day moving average. Short term momentum indicators are trending up.

The Euro dropped 1.25 (1.11%) last week. Intermediate trend remained up. The Euro remains above its 20 day moving average. Short term momentum indicators are trending down.

The Canadian Dollar added US 0.38 cents (0.53%) last week. Intermediate trend remains down. The Canuck Buck remains above its 20 day moving average. Short term momentum indicators are trending up.

The Japanese Yen added 0.45 90.51) last week. Intermediate trend remains up. The Yen remains above its 20 day moving average. Short term momentum indicators are trending up, but are overbought and showing early signs of rolling over.

Commodities

Daily Seasonal/Technical Commodities Trends for February 19th 2016

Green: Increase from previous day

Red: Decrease from previous day

The CRB Index slipped 0.73 points (0.45%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index turned negative on Friday. The Index dropped below its 20 day moving average on Friday. Short term momentum indicators are trending up. Technical score dropped last week to -4 from -3.

Gasoline dropped $0.07 per gallon (6.80%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remained neutral. Gas fell below its 20 day moving average. Short term momentum indicators are trending up. Technical score slipped last week to -2 from -1.

Crude Oil added $2.73 per barrel (9.41%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index changed to neutral from negative. Crude moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 0 from -6.

Natural Gas dropped $0.17 per MBtu (8.63%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remained negative. “Natty” remained below its 20 day moving average. Short term momentum indicators are trending down and are oversold, but have yet to show signs of bottoming. Technical score remained at -6.

The S&P Energy Index added 10.07 points (2.42%) last week. Intermediate trend changed to up from down on a brief move above 434.70. Strength relative to the S&P 500 Index remained positive. The Index remained above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 6 from 0.

The Philadelphia Oil Services Index jumped 8.33 points (6.23%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remained neutral. The Index moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 0 from -4

Gold dropped $7.20 per ounce (0.58%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remained positive. Gold remained above its 20 day moving average. Short term momentum indicators are trending down. Technical score slipped last week to 4 from 6.

Silver dropped $0.42 per ounce (2.66%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remained positive. Silver remained above its 20 day moving average. Short term momentum indicators are trending down. Technical score slipped last week to 4 from 6. Strength relative to Gold changed to negative from neutral.

The AMEX Gold Bug Index dropped 4.86 points (2.97%) last week. Intermediate trend remained up. Strength relative to the S&P 500 Index remained positive. The Index remained above its 20 day moving average. Short term momentum indicators are trending down. Technical score last week slipped to 4 from 6. Strength relative to Gold remained positive.

Platinum dropped $11.90 per ounce (1.24%) last week. Intermediate trend remained neutral. Relative strength remained positive. Trades above its 20 day MA. Momentum: Downtrend.

Palladium dropped $24.45 per ounce (4.67%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index changed to neutral from positive. PALL dropped below its 20 day moving average. Short term momentum indicators are trending down. Score: -4

Copper added $0.05 per lb. (2.46%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains positive. Copper remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 2 from -2.

The TSX Metals & Mining Index jumped 58.53 points (20.07%) last week. Intermediate trend changed to up from down on a move above 310.37. Strength relative to the S&P 500 Index remained positive. The Index remained above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 6 from 5

Lumber added $14.60 (5.89%) last week. Trend remained neutral. Relative strength remained positive. Lumber remained above its 20 day MA. Short term momentum: Uptrend.

The Grain ETN added $0.39 (1.29%) last week. Intermediate trend remained down. Strength relative to the S&P 500 changed to negative from positive. Units remained below their 20 day MA. Short term momentum indicators are trending up. Score dropped to -4 from -2

The Agriculture ETF added $0.99 (2.32%) last week. Intermediate trend changed to up from down on a move above $44.40. Strength relative to the S&P 500 Index changed to neutral from positive on Friday. Units remained above their 20 day moving average. Short term momentum indicators were trending up. Technical score increased last week to 4 from -2

Interest Rates

Yield on 10 year Treasuries was unchanged last week. Intermediate trend remained down. Yield remained below its 20 day moving average. Short term momentum indicators are trending up.

Price of the long term Treasury ETF slipped $0.51 (0.39%) last week. Intermediate trend remained up. Price remained above its 20 day moving average.

Other Issues

The VIX Index dropped 4.88 (19.21%) last week. Intermediate trend remained up. The Index dropped below its 20 day moving average.

Economic news this week is expected to be mixed.

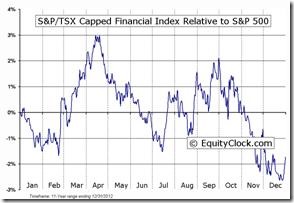

Intermediate technical indicators for most equity markets and sectors continue to recover from intermediate oversold level. Economic sensitive sectors with favourable seasonality generally are outperforming the S&P 500 Index with the exception of the financial sector. Short term technical indicators generally are overbought, but have yet to show signs of peaking.

Technical action last week by individual S&P 500 equities was decidedly bullish. 72 S&P 500 stocks broke above intermediate resistance levels while only 2 broke support.

Reporting of fourth quarter results for S&P 500 stocks are winding up while reporting of results for TSX companies are peaking. Canadian focus is on the Canadian banks. According to FactSet, 87% of S&P 500 companies have reported to date: 68% reported above consensus earnings and 48% reported above consensus sales. On a year-over-year basis, fourth quarter earnings on a blended basis dropped 3.6% and sales fell 3.7%. 78 companies have issued negative first quarter guidance and 19 companies have issued positive guidance. Another 48 S&P 500 companies and one Dow Industrial company are scheduled to release results this week.

Consensus estimates for S&P 500 earnings and sales in 2016 continue to slip lower, but continue to show a recovery in the second half. Consensus earnings on a year-over-year basis are expected to show a decline of 6.5% in the first quarter, a drop of 1.1% in the second quarter, a gain of 5.1% in the third quarter and 10.0% in the fourth quarter.

Seasonal influences for the S&P 500 Index and TSX Composite Index turn positive this week.

Daily Seasonal/Technical Sector Trends for February 19th 2016

Unit Seasonal Trend Relative 20 Day Momentum Tech Prev Strength MA Score Score

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following are examples:

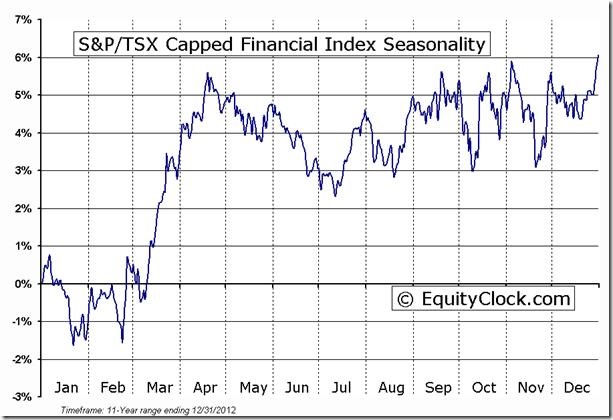

Interesting Seasonality Chart

Seasonality of TSX Financials has a history of turning positive following release of fiscal first quarter results by Canada’s banks (most are reporting this week).

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2019/08/8cb006a32750c6ad1d2123e0c7021695.png)

![clip_image002[7] clip_image002[7]](https://advisoranalyst.com/wp-content/uploads/2019/08/101246c7347f064363b194fc1d5ce0fe.png)

![clip_image002[9] clip_image002[9]](https://advisoranalyst.com/wp-content/uploads/2019/08/95d098c9eeb1463ab677dbab05bbf01a.png)