by Fixed Income Team, AllianceBernstein

We think the intersection of hope and fear offers opportunity across asset classes and market segments. Tapping into it, however, requires in-depth research and a discerning eye. Waiting for a clarion bell to ring before deploying capital might leave investors a step behind.

Key Takeaways

- Investors are wrestling with concerns over stubborn inflation, faster-than-expected economic growth and a tight labor market. We expect normalization to continue, though the path won’t likely be a smooth one.

- As equity markets catch their breath, we expect fundamentals to come under greater scrutiny, which we think will open up opportunities in both different equity styles and low-volatility stocks—for more risk-aware investors.

- After a whirlwind first quarter, interest rates ultimately settled in higher across most of the yield curve, neutralizing tighter credit spreads in corporate bonds. On an all-in basis, we believe current yields and low bond prices could drive solid return potential.

Standing at the Intersection of Hope and Fear

In the first quarter of 2024, most major equity market indices rallied to all-time highs on the growing potential of an artificial intelligence (AI) revolution. In contrast, longer-term interest rates pushed higher as investors scaled back expectations of interest-rate cuts this year. Bond markets ended up mixed, with credit holding up fairly well but Treasury bonds softened by rising rates.

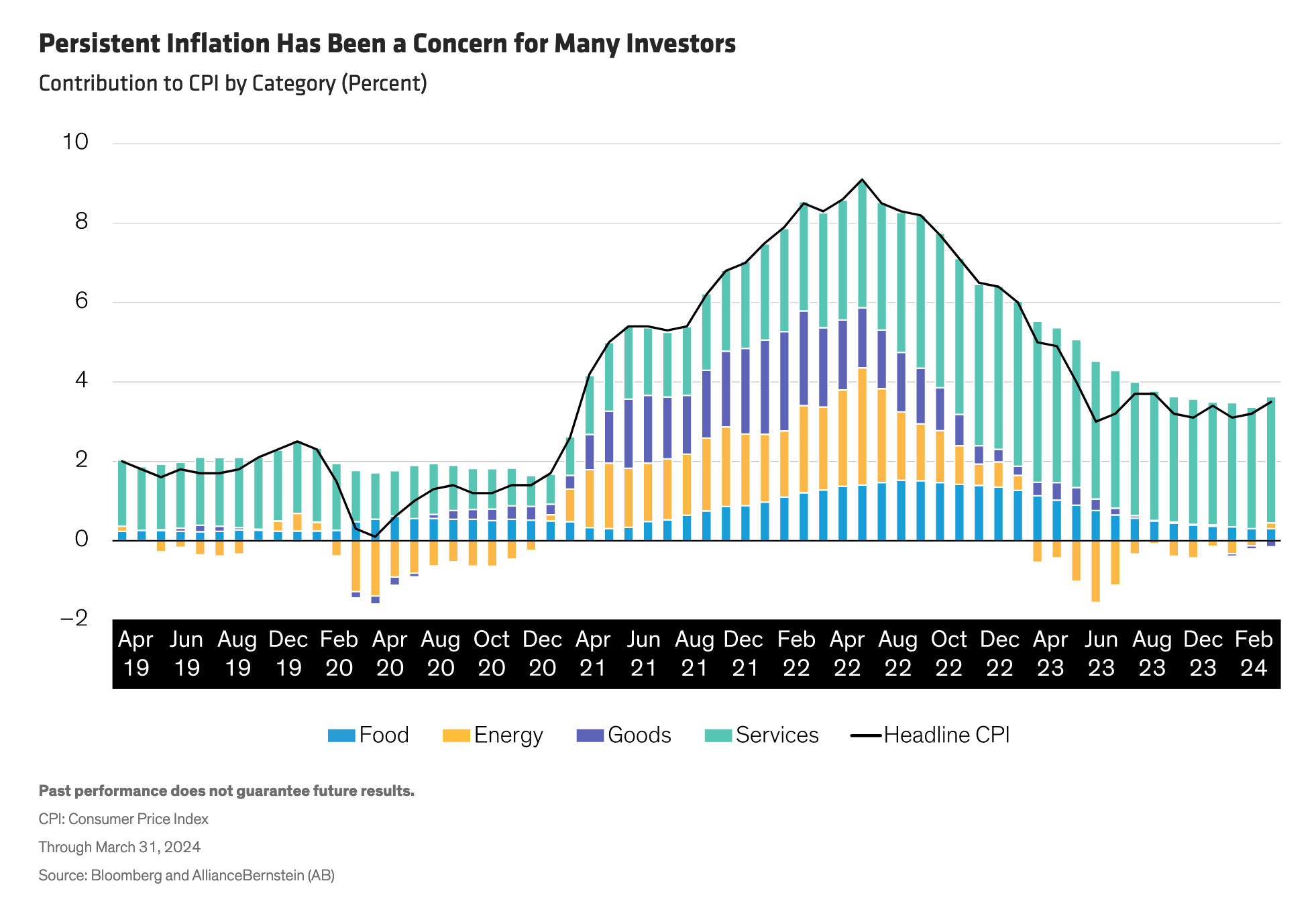

Investors are wrestling with three big concerns. The first is inflation that remains above target (Display). Even though some components have moderated, services inflation has stayed stubbornly high—notably transportation. However, we see a path for further inflation moderation ahead. There are concerns over economic growth, too—in this case, that it’s too fast. Yes, numbers have surprised to the upside, but softening consumer spending and thinning savings suggest moderation ahead.

Then there’s the tight labor market. The overall unemployment rate remains low and job openings elevated, though we’ve seen them measurably decline as the economy approaches normalization—a trend we expect to continue. And, in our view, cooling inflation can coexist with a tighter labor market.

What lies ahead?

We expect normalization to continue in inflation and growth. Markets may not be happy that cold water was poured on their expectations for rate cuts, with the Fed urging caution about their timing and size. However, the central bank has options—it can leave rates up to temper inflation or cut them to continue on the path to normalization. We think one thing is for sure: that path won’t be a smooth one.

Equity Fundamentals Should Come Under More Scrutiny

Equity multiple expansion in the S&P 500 hasn’t been bothered by higher rates or a largely uneventful earnings season. Return concentration in a few big stock names has remained a headline for many popular indices, but we did see dispersion start to show among the Magnificent Seven highfliers.

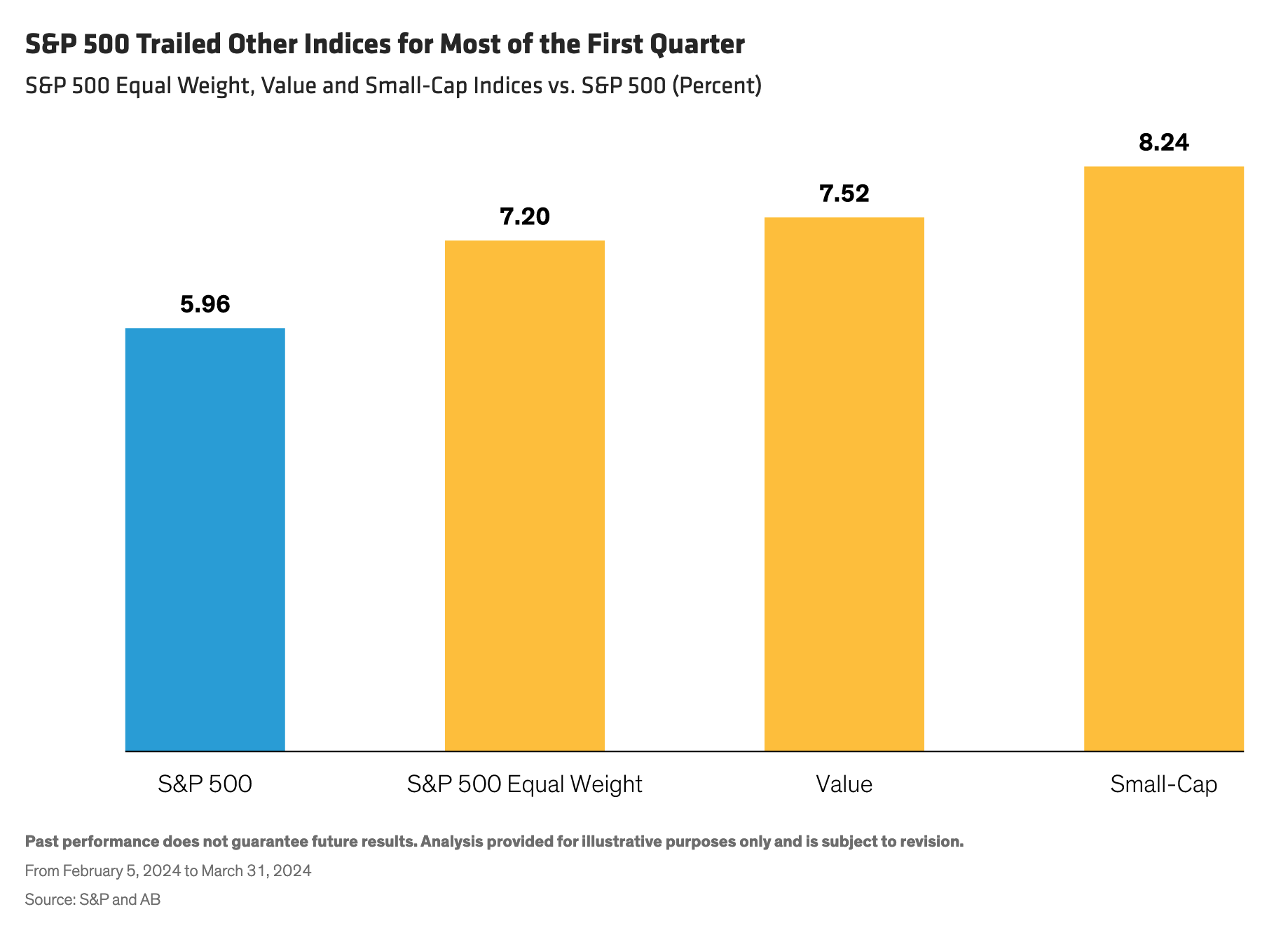

Also, other market segments—notably value and small-caps—outpaced the broad index for much of the first quarter (Display). And there was a reversal of fortune for more speculative areas such as nonprofitable tech names and most shorted stocks, which have lagged year to date.

S&P 500 Trailed Other Indices for Most of the First Quarter

Past performance does not guarantee future results. Analysis provided for illustrative purposes only and is subject to revision.

From February 5, 2024 to March 31, 2024

Source: S&P and AB

As markets catch their breath, we expect fundamentals to come under greater scrutiny, which we think will open up quality opportunities in a number of areas. Continued capital spending in AI holds promise in the growth space, which we think extends beyond one semiconductor company, embracing segments such as software and information-technology consulting.

Within the value universe, we also see compelling potential at a discount, given the continuing trend of on shoring supply chains as well as spending on critical areas such as cybersecurity and energy security. In combination, total spending growth on these three areas as a percentage of global gross domestic product (GDP) growth is expected to rival the amount spent on cloud computing over the past decade.

For risk-averse investors, low-volatility stocks seem to be an interesting option. Within this cohort, we think several areas represent fertile ground from a valuation perspective—mainly defensive sectors such as utilities, healthcare and consumer staples.

Higher Bond Yields Create Solid Return Potential

After a whirlwind first quarter, interest rates ultimately settled in higher across most of the yield curve, neutralizing tighter credit spreads in corporate bonds. So on an all-in basis, as we see it, current yields and low bond prices could drive solid return potential for bond investors.

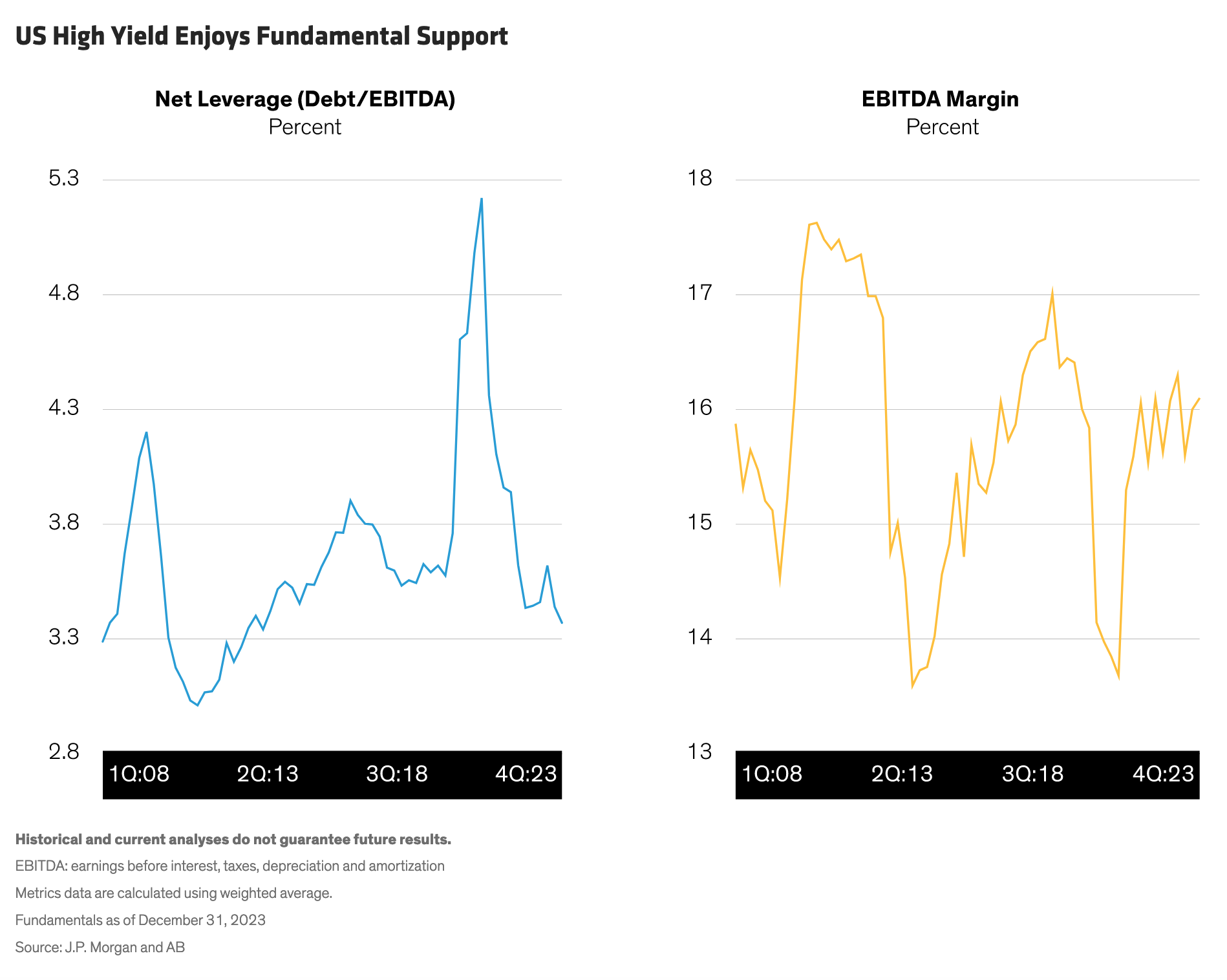

High-yield bonds remain attractive, given their sizable yield and fundamental strength—evidenced by relatively low debt levels and strong cash-flow margins (Display). But it’s important to be selective; we perceive better risk-adjusted return potential among B- and BB-rated issuers. Other attractive segments include emerging-market US dollar–denominated corporates and select mortgage-backed securities.

US High Yield Enjoys Fundamental Support

Historical and current analyses do not guarantee future results.

EBITDA: earnings before interest, taxes, depreciation and amortization

Metrics data are calculated using weighted average.

Fundamentals as of December 31, 2023

Source: J.P. Morgan and AB

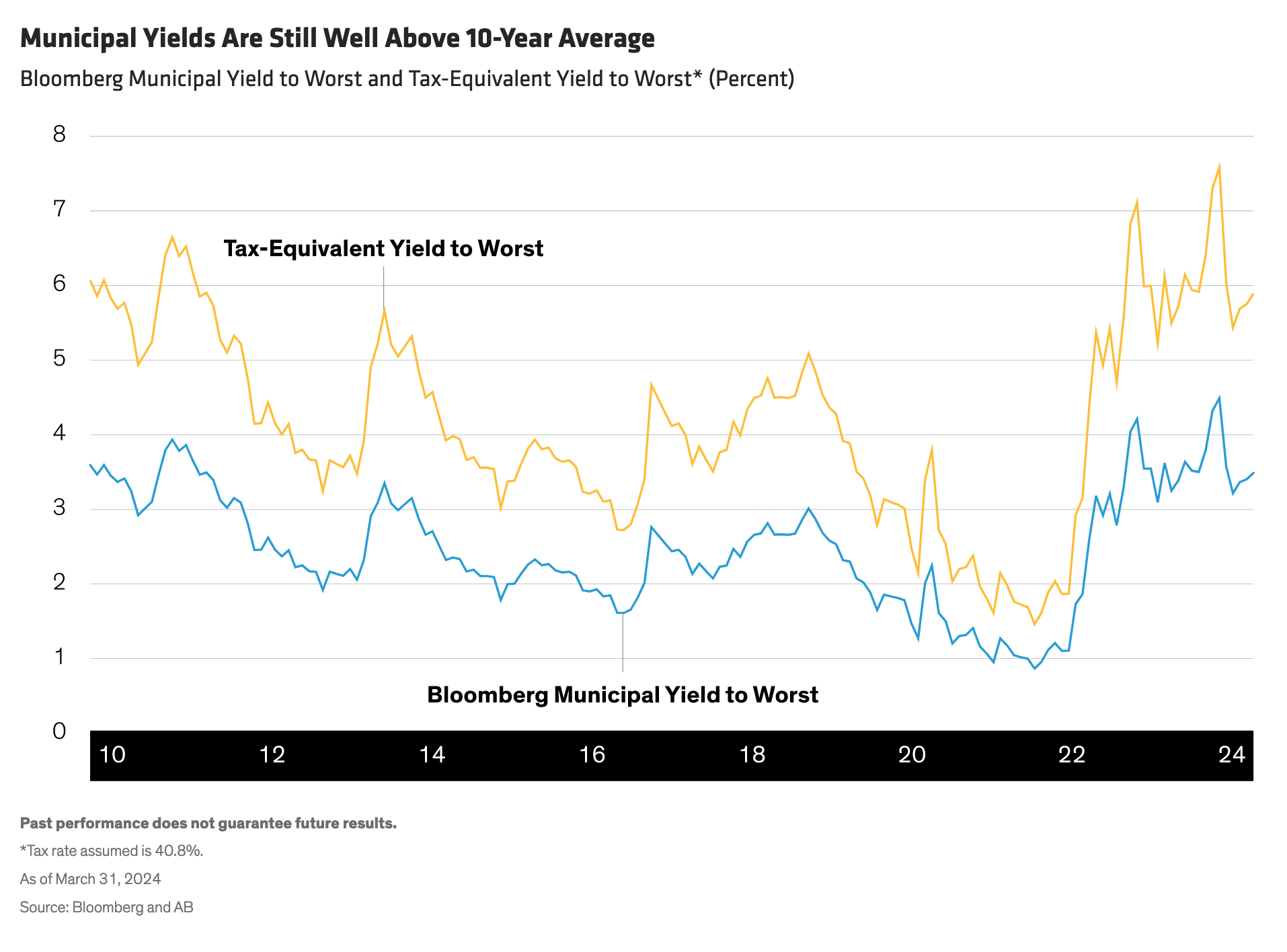

In the municipal bond market, strong demand has reduced credit spreads, though yields remain well above their 10-year average (Display). Given the macro outlook and technical backdrop, we think a modest duration overweight makes sense, as does capitalizing on high short-term yields and a steeper yield-curve slope in the 12- to 20-year maturity range.

Municipal Yields Are Still Well Above 10-Year Average

Past performance does not guarantee future results.

*Tax rate assumed is 40.8%.

As of March 31, 2024

Source: Bloomberg and AB

The Big Picture

As we see it, the intersection of hope and fear offers opportunity, and it’s not confined to one asset class or market segment. Uncovering that potential, however, requires sound research and a discerning eye—zeroing in on the areas with the best risk-adjusted return potential.

Of course, there’s a timing element to taking advantage of this opportunity, because valuations aren’t set in stone. As the market reveals opportunity, others will seek it out. Waiting for a clarion bell to ring before deploying capital could leave investors a step behind.

Copyright © AllianceBernstein