by Corey Hoffstein, Newfound Research

Highlights:

• Many factors result in investment returns that differ from the academic view of long-run averages.

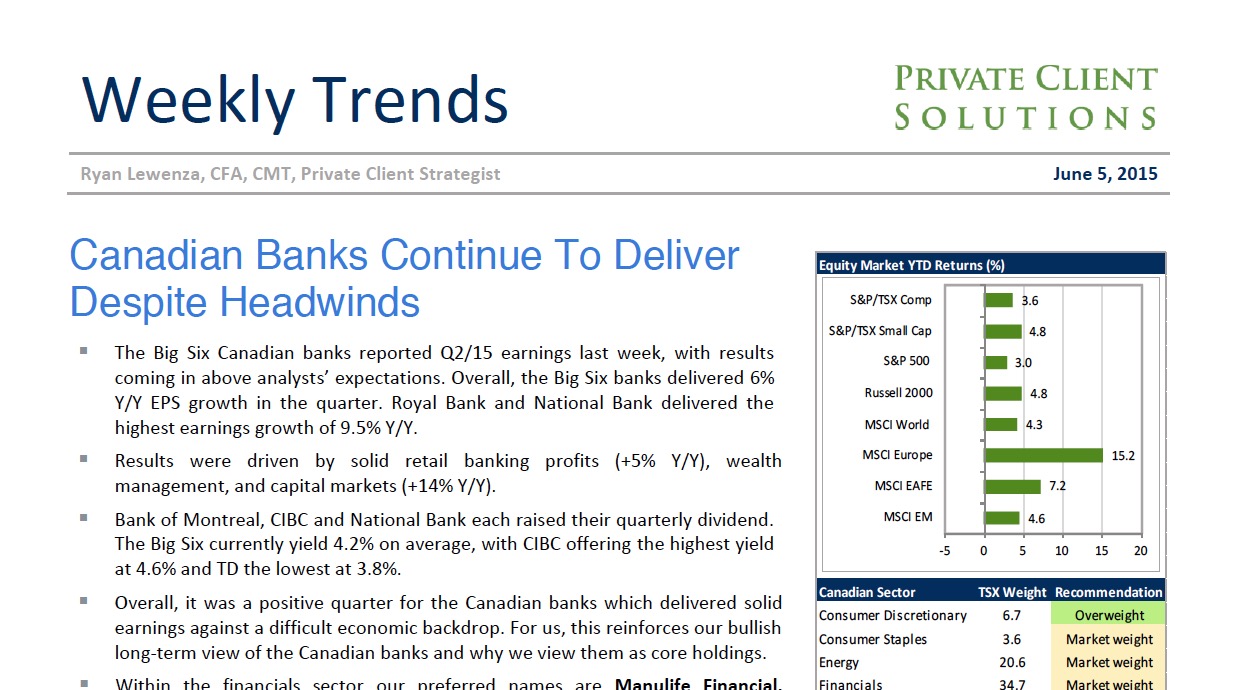

• Diversification is not the “free lunch” it is often made out to be; return generators are often replaced by risk mitigators in an asset allocation scheme.

• Decreasing bond return potential and increasing global asset correlations makes diversification potentially costlier and less effective simultaneously.

• By smoothing out volatility (and the emotional reaction to it), tactical asset allocation may enable investors to carry more risk generating assets within their portfolio, which can lead to increased total return over their investment lifecycle.

Read/Download the complete report below: