Canadian Banks Continue To Deliver Despite Headwinds

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

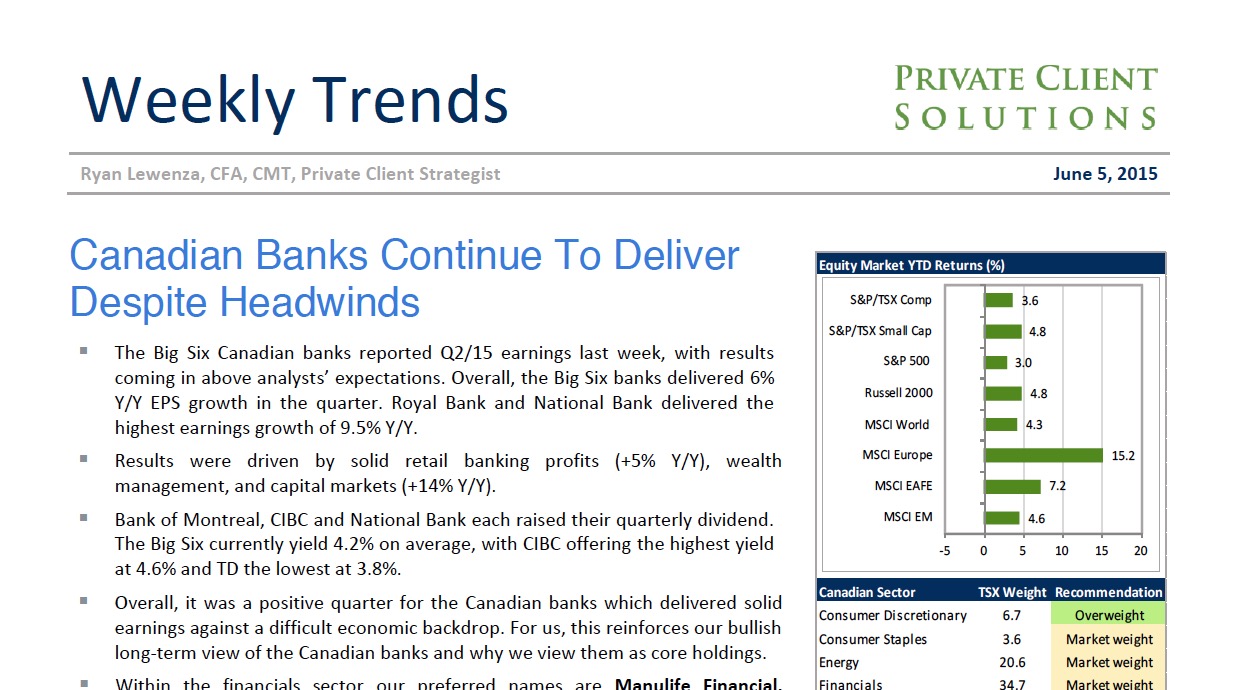

• The Big Six Canadian banks reported Q2/15 earnings last week, with results coming in above analysts’ expectations. Overall, the Big Six banks delivered 6% Y/Y EPS growth in the quarter. Royal Bank and National Bank delivered the highest earnings growth of 9.5% Y/Y.

• Results were driven by solid retail banking profits (+5% Y/Y), wealth management, and capital markets (+14% Y/Y).

• Bank of Montreal, CIBC and National Bank each raised their quarterly dividend. The Big Six currently yield 4.2% on average, with CIBC offering the highest yield at 4.6% and TD the lowest at 3.8%.

• Overall, it was a positive quarter for the Canadian banks which delivered solid earnings against a difficult economic backdrop. For us, this reinforces our bullish long-term view of the Canadian banks and why we view them as core holdings.

• Within the financials sector our preferred names are Manulife Financial, Element Financial and Royal Bank, which we believe are positioned to outperform the sector.

Read/Download the complete report below: