Bond Tug-of-War – KEY TAKEAWAYS

- Lingering uncertainty over Greece, U.S. economic growth, and the Fed may continue to create a tug-of-war on bond prices that will likely continue to lead to a low-return environment.

- We believe additional bond market strength is likely limited.

by Anthony Valeri, Investment Strategist, LPL Financial

The bond market tried to end the month of May on a high note but did not quite make the mark. The last 10 days of May 2015 witnessed fairly steady improvement in high-quality bond prices after a difficult five weeks, but it was still not enough to offset losses for the month. The broad Barclays Aggregate Bond Index still finished 0.24% lower in May and posted consecutive monthly declines for the first time since the last two months of 2013.

However, unlike late 2013, we do not expect a repeat of the 2014 bond rally that followed, but rather a continuation of the tug-of-war on prices that has been evident so far in 2015. The first day of June 2015 was a reminder of the push-and-pull on bond prices as the Institute for Supply Management’s (ISM) Manufacturing Survey report was stronger than expected. The ISM result appeared to contrast with growing fears about second quarter 2015 economic growth and led some Wall Street economists to boost their expectations of growth for the second quarter.

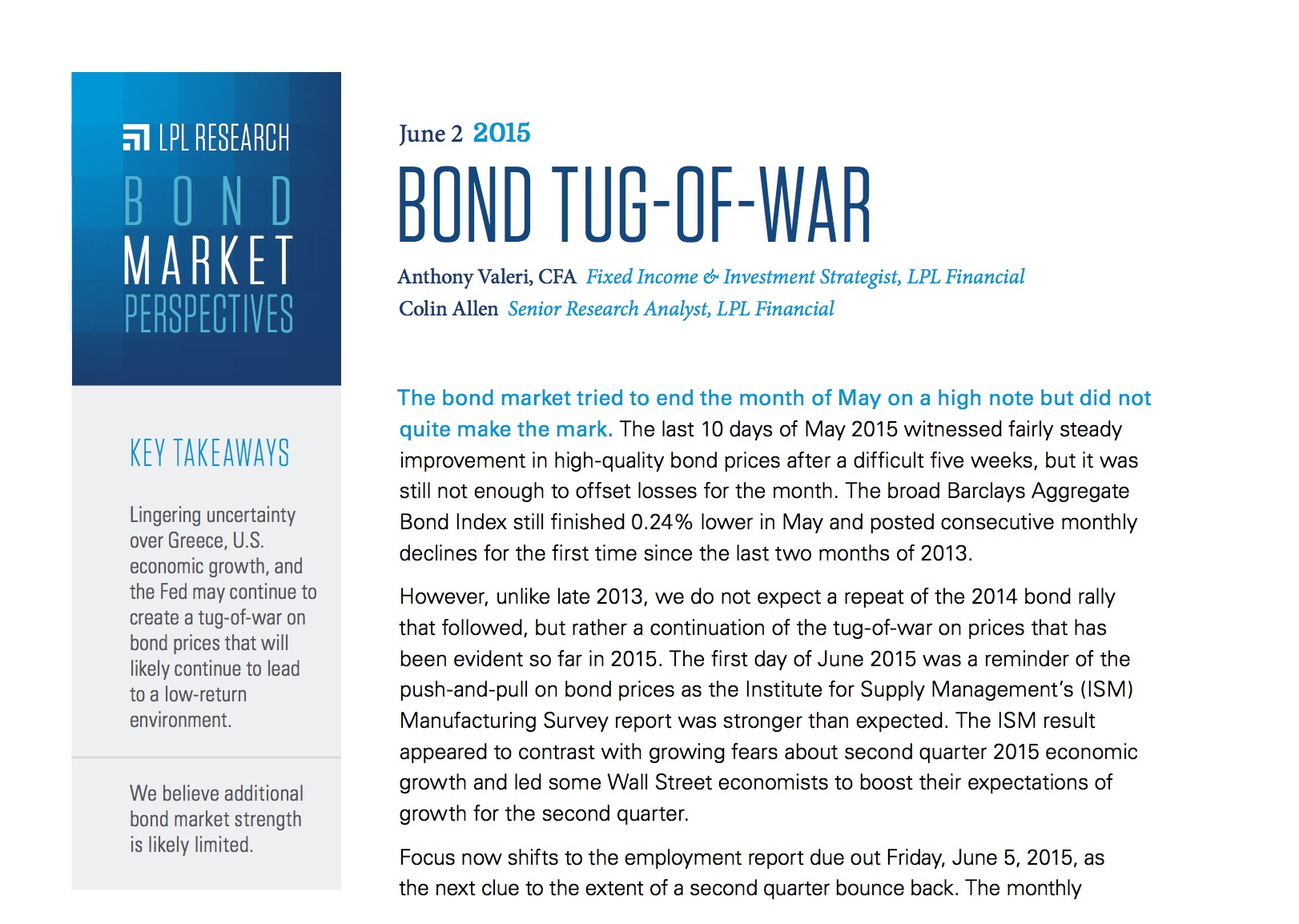

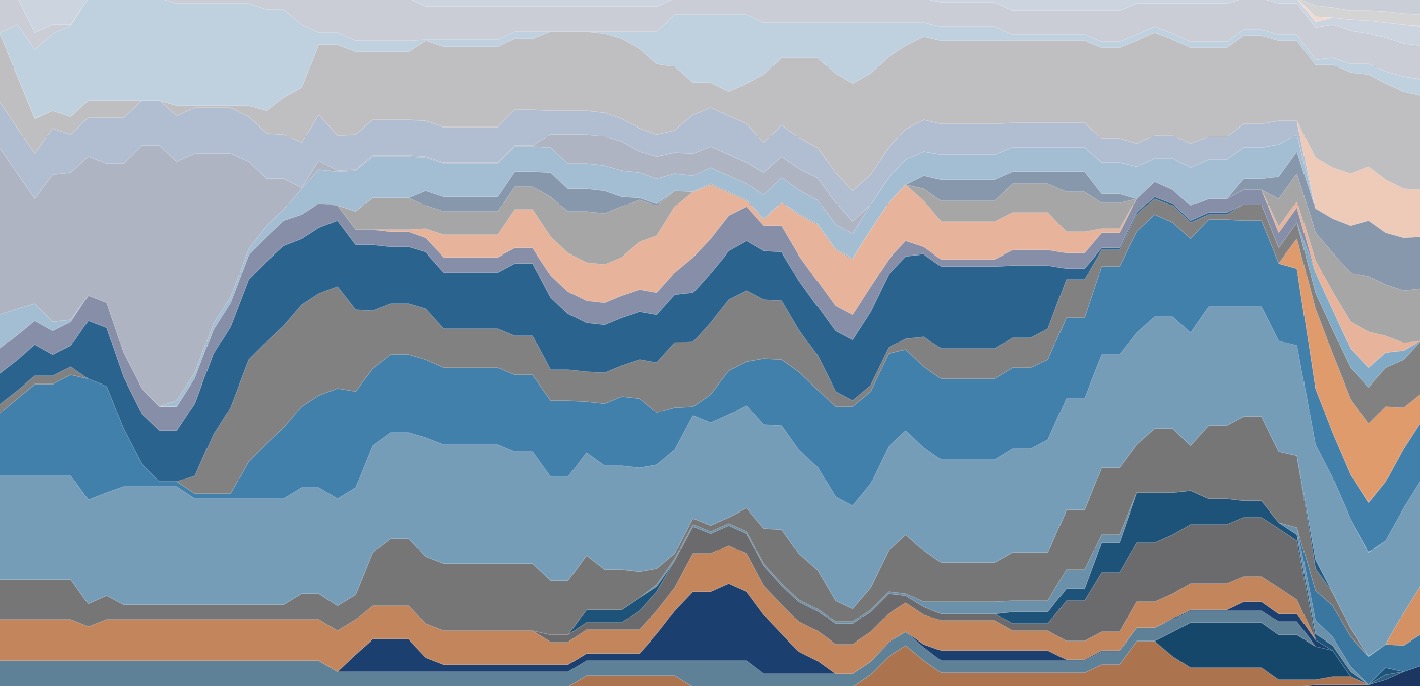

Focus now shifts to the employment report due out Friday, June 5, 2015, as the next clue to the extent of a second quarter bounce back. The monthly employment report and bond prices and yields have moved in sync over the past several months [Figure 1]. While far from an exact relationship, bond yields and monthly total payrolls have, directionally, moved together, with stronger monthly payrolls corresponding with higher yields and vice versa. For the December 2014 jobs report, which was released in early January, the 10-year Treasury yield may have overshot to the downside but the directional relationship still held. Current bond yields already reflect an anticipated gain of just over 200,000 in total payrolls. Bond prices and yields may take their cues from monthly payrolls, either surging notably above or falling substantially below the consensus forecast of 227,000.

Despite bond yields and monthly jobs gains moving in tandem, changes to bond yields have been relatively limited. The 10-year Treasury yield has fluctuated within a range of approximately 1.7% to 2.3% since late 2014. Friday’s jobs report is just one factor in the push and pull on bond prices. Others include:

· Greece. Friday, June 5, 2015, also marks the date of a key Greek payment to the International Monetary Fund (IMF) (see our Weekly Market Commentary, “The Greek Drama,” June 1, 2015). Without a resolution between the Greek government and Eurozone and International Monetary Fund (IMF) officials before then, Greece may default, as it likely does not have sufficient cash to make the payment. An agreement will pave the way for additional bailout payments and alleviate a cash crunch. Throughout 2015, Treasury prices have been both pressured and supported by the progress of Greek negotiations, as a default may boost demand for high-quality assets such as Treasuries. Even if a last minute deal is reached, an agreement is likely to merely postpone potential default risks and challenges to the European financial system. On a positive note, the European economy and financial system is much better prepared to handle a Greek default now, and Greek creditors consist almost exclusively of central banks and the IMF, not private investors.

· Economic growth. Just as expectations for second quarter growth were beginning to fall below 2% for the second quarter, a strong ISM report on manufacturing activity, released Monday, June 1, 2015, led to forecasts being revised higher. While we continue to believe the economy could grow at a 3% pace over the remainder of 2015, data remain inconclusive on the extent of a bounce back from a depressed first quarter.

· Federal Reserve (Fed) rate hikes. Much of the good news about a delay and slower pace of rate hikes is largely priced into the bond market, as measured by fed fund futures. A first rate hike is almost fully priced in for December 2015, but a first rate increase is still a coin flip probability for September.

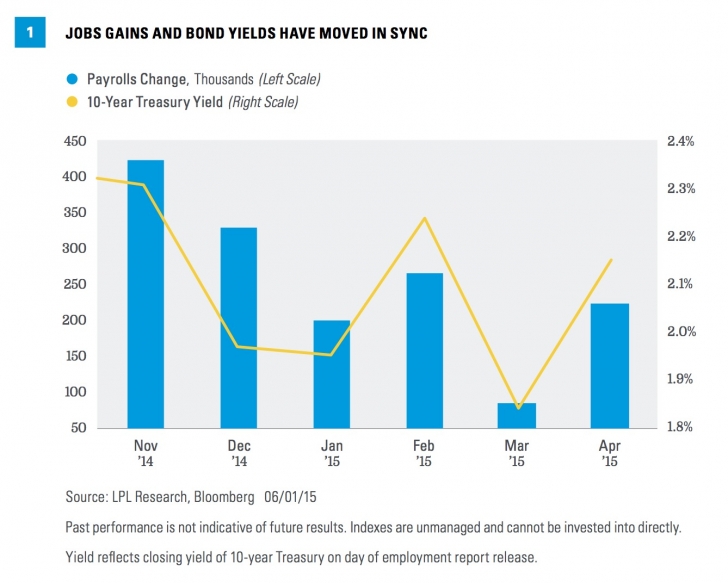

Lingering uncertainty over the above-mentioned issues may continue to create a tug-of-war on bond prices that will likely continue to lead to a low-return environment [Figure 2]. High-quality bond prices declined in May but year-to-date performance is still positive. Lower-rated bonds may continue to benefit from their higher yields and less sensitivity to interest rates.

Lingering uncertainty over the above-mentioned issues may continue to create a tug-of-war on bond prices that will likely continue to lead to a low-return environment [Figure 2]. High-quality bond prices declined in May but year-to-date performance is still positive. Lower-rated bonds may continue to benefit from their higher yields and less sensitivity to interest rates.

2. HIGH-QUALITY BOND PRICES DECLINED FOR A SECOND STRAIGHT MONTH, BUT STILL POSITIVE YEAR TO DATE

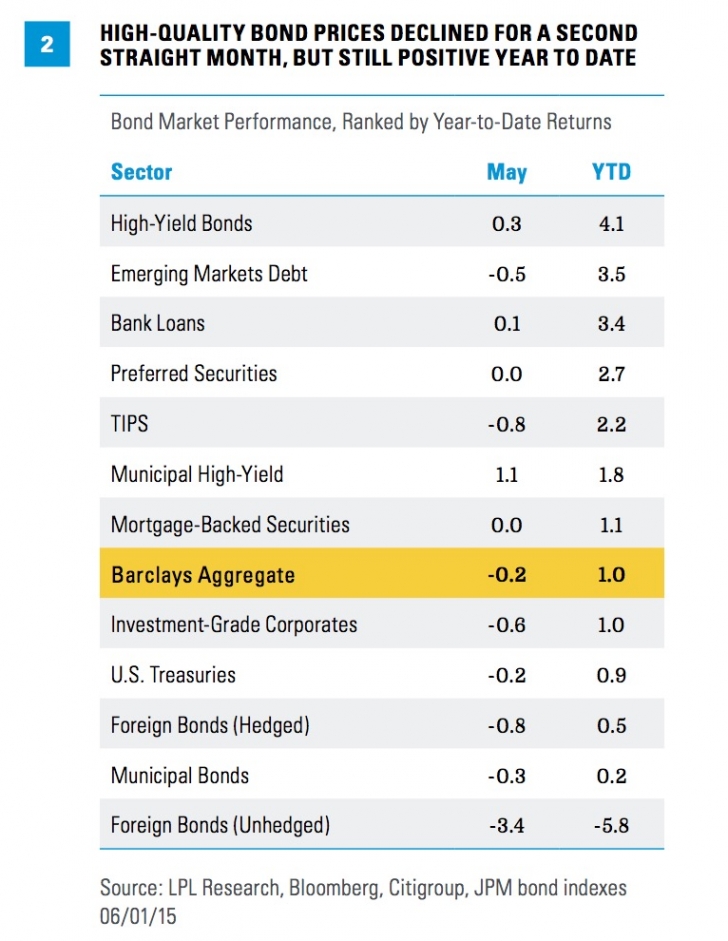

Inflation expectations, both domestically and in Europe, trended lower in May, but the year-to-date trend is clearly higher [Figure 3]. Wage data in the May employment report may dictate whether inflation expectations rebound. A fourth consecutive higher than expected reading on core consumer prices (which exclude food and energy) and an increase in the prices paid component of the ISM survey appear to have halted the decline, but they do not explain the notable drop in inflation expectations during May.

A continued decline in inflation expectations, which would support bond prices, would likely require weaker economic data, starting with Friday’s jobs report, indications the Fed will wait beyond the start of 2016 to raise interest rates, or contagion risks from a potential Greek default. We view each as unlikely and therefore believe additional bond strength is likely limited, leading to a continued tug-of-war on bond prices and a low-return environment.

Read/Download the complete report below:

Copyright © Anthony Valeri, Investment Strategist, LPL Financial

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Investing in foreign fixed income securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with foreign market settlement. Investing in emerging markets may accentuate these risks.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency).

Barclays U.S. High-Yield Loan Index tracks the market for dollar-denominated floating-rate leveraged loans. Instead of individual securities, the U.S. High-Yield Loan Index is composed of loan tranches that may contain multiple contracts at the borrower level.

The Barclays U.S. Corporate High-Yield Index measures the market of USD-denominated, noninvestment-grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below, excluding emerging market debt.

The Barclays U.S. Corporate Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate, taxable corporate bond market.

The Barclays U.S. Mortgage Backed Securities (MBS) Index tracks agency mortgage backed pass-through securities (both fixed rate and hybrid ARM) guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC)

The Barclays U.S. Municipal Index covers the USD-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds.

The Barclays Municipal High Yield Bond Index is comprised of bonds with maturities greater than one-year, having a par value of at least $3 million issued as part of a transaction size greater than $20 million, and rated no higher than ‘BB+’ or equivalent by any of the three principal rating agencies.

The Barclays U.S. Treasury Index is an unmanaged index of public debt obligations of the U.S. Treasury with a remaining maturity of one year or more. The index does not include T-bills (due to the maturity constraint), zero coupon bonds (strips), or Treasury Inflation-Protected Securities (TIPS).

The Citi World Government Bond Index (WGBI) measures the performance of fixed-rate, local currency, investment-grade sovereign bonds. The WGBI is a widely used benchmark that currently comprises sovereign debt from over 20 countries, denominated in a variety of currencies, and has more than 25 years of history available. The WGBI provides a broad benchmark for the global sovereign fixed income market. Sub-indexes are available in any combination of currency, maturity, or rating.

The JP Morgan Emerging Markets Bond Index is a benchmark index for measuring the total return performance of international government bonds issued by emerging markets countries that are considered sovereign (issued in something other than local currency) and that meet specific liquidity and structural requirements.