**NEW** As part of the ongoing process to offer new and up-to-date information regarding seasonal and technical investing, we are adding a section to the daily reports that details the stocks that are entering their period of seasonal strength, based on average historical start dates. Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

- No stocks identified for today.

The Markets

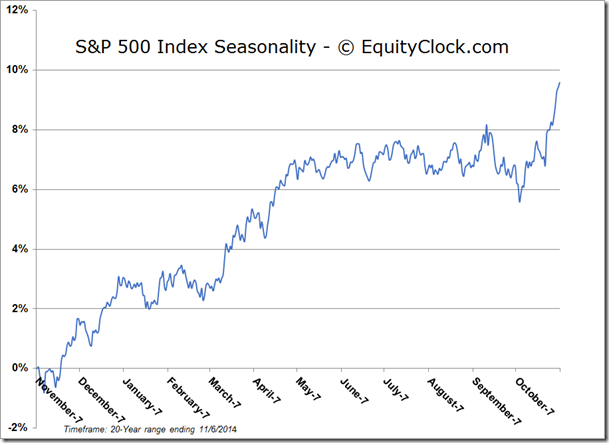

Stocks continued to push higher on Thursday, influenced by positive comments from ECB President Mario Draghi who expressed his commitment to support the Eurozone economy through monetary policy. The S&P 500 Index and Dow Jones Industrial Average once again charted new all-time closing highs. Stocks remain overbought, but have yet to show significant signs of peaking. Major moving averages for many of the US equity benchmarks have once again turned higher, implying positive trends across multiple timescales. Looking from a seasonal perspective, although equity markets remain in a period of strength that runs through April of next year, two short-term periods of moderate weakness are ahead. Each period typically occurs during option expiration week in November and December, leading to average declines in equity market indices and a pickup in volatility. The S&P 500 Index has averaged a loss of a mere 0.03% during November’s option expiration week with an equal tendency of gains and losses over the past 60 years. November’s option expiration date is later than usual this year, falling on the 21st of the month. Past occurrences of a November 21st expiration date have averaged a loss on the S&P 500 Index of 1.16% in the week leading up to the event. Another factor can fuel weakness during these two short-term periods: tax-loss selling. Investors have until the end of the year to offset taxable gains from winning positions by selling their losers, of which there could be many given the struggles in energy and small-cap stocks over the last few months. Given the overbought conditions in equity markets, a retracement of some magnitude amongst equity benchmarks seems inevitable; the timing of the retracement remains up for debate.

| November Expiration Week Returns | |

| Friday prior to Options Expiration | S&P 500 Index Returns |

| 11/15/13 | 1.56% |

| 11/16/12 | -1.45% |

| 11/18/11 | -3.81% |

| 11/19/10 | 0.04% |

| 11/20/09 | -0.19% |

| 11/21/08 | -8.39% |

| 11/16/07 | 0.35% |

| 11/17/06 | 1.47% |

| 11/18/05 | 1.10% |

| 11/19/04 | -1.17% |

| 11/21/03 | -1.43% |

| 11/15/02 | 1.69% |

| 11/16/01 | 1.64% |

| 11/17/00 | 0.13% |

| 11/19/99 | 1.86% |

| 11/20/98 | 3.36% |

| 11/21/97 | 3.74% |

| 11/15/96 | 0.93% |

| 11/17/95 | 1.24% |

| 11/18/94 | -0.19% |

| 11/19/93 | -0.60% |

| 11/20/92 | 1.00% |

| 11/15/91 | -2.61% |

| 11/16/90 | 1.08% |

| 11/17/89 | 0.74% |

| 11/18/88 | -0.54% |

| 11/20/87 | -1.48% |

| 11/21/86 | 0.56% |

| 11/15/85 | 2.27% |

| 11/16/84 | -2.09% |

| 11/18/83 | -0.72% |

| 11/19/82 | -1.80% |

| 11/20/81 | 0.03% |

| 11/21/80 | 1.43% |

| 11/16/79 | 2.25% |

| 11/17/78 | -0.37% |

| 11/18/77 | -0.68% |

| 11/19/76 | 2.70% |

| 11/21/75 | -1.58% |

| 11/15/74 | -4.00% |

| 11/16/73 | -1.35% |

| 11/17/72 | 1.55% |

| 11/19/71 | -0.55% |

| 11/20/70 | 0.42% |

| 11/21/69 | -2.83% |

| 11/15/68 | 1.76% |

| 11/17/67 | 0.66% |

| 11/18/66 | -0.83% |

| 11/19/65 | -0.33% |

| 11/20/64 | 1.26% |

| 11/15/63 | -1.38% |

| 11/16/62 | 2.35% |

| 11/17/61 | 0.77% |

| 11/18/60 | -0.09% |

| 11/20/59 | 0.21% |

| 11/21/58 | -0.73% |

| 11/15/57 | 0.45% |

| 11/16/56 | -1.29% |

| 11/18/55 | 0.66% |

| 11/19/54 | -0.27% |

| Average Return: | -0.03% |

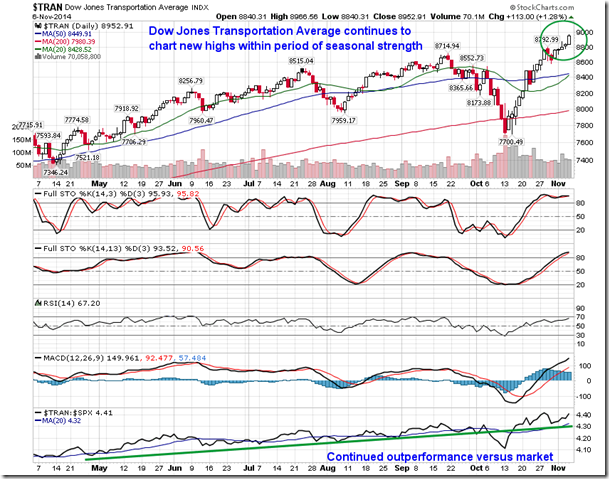

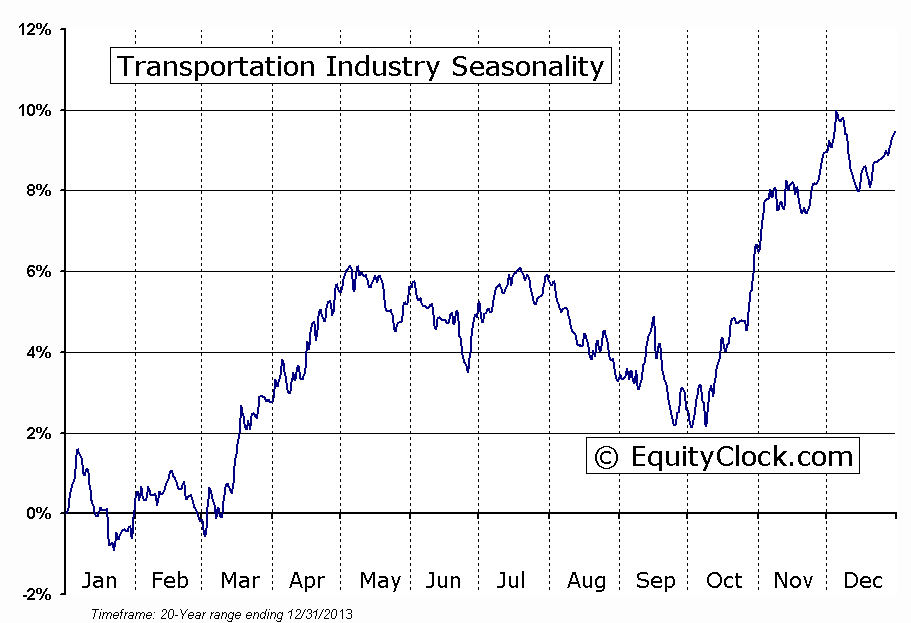

One of the equity benchmarks that charted a new all-time high during Thursday’s session was the Dow Jones Transportation Average, which has outperformed the broad market all year. Lower energy prices and the increase in demand to ship both goods and people through the holidays influence this highly successful seasonal trade. Readers may recall that the Dow Jones Transportation ETF (IYT) was our “Top Pick” on BNN’s Market Call in mid-September with the suggestion to pick it up on weakness into the first half of October. The trade, along with the broad market, allowed for particularly appealing entry points this year, declining to around its 200-day moving average in the first half of the month and gaining upwards of 15% thereafter. The sector reaches a seasonal peak anywhere between now and early December, just as Oil prices reach a seasonal low; the next period of seasonal strength runs from late January through April. The Transportation Average remains overbought, but has yet to show signs of peaking.

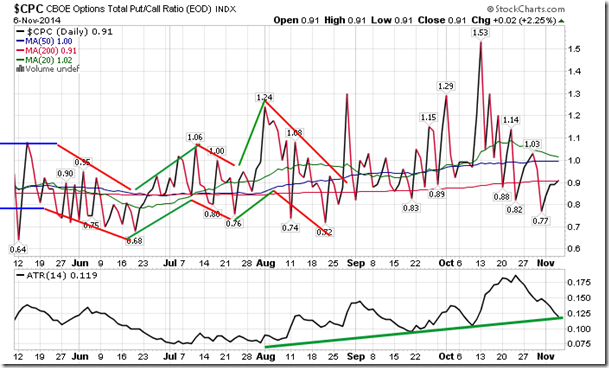

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.91. In a sentiment survey for the week ending November 5th, the American Association of Individual Investors recorded 52.7% of respondents as being bullish on the stock market for the next six months, the highest level of the year. The percent of respondents declaring themselves bearish came in at 15.1%, the lowest level since July 14, 2005. From a contrarian standpoint, bullish extremes, such as this past survey suggest, typically give reason to be cautious of equities as too many investors lean too far in a positive direction, exhausting upside momentum as fewer incremental buyers are left to support the market. Coincidentally, the S&P 500 Index was lower in the three months following the bullish extreme in 2005.

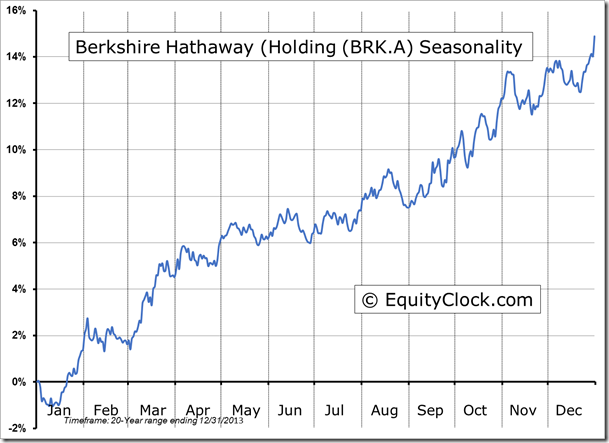

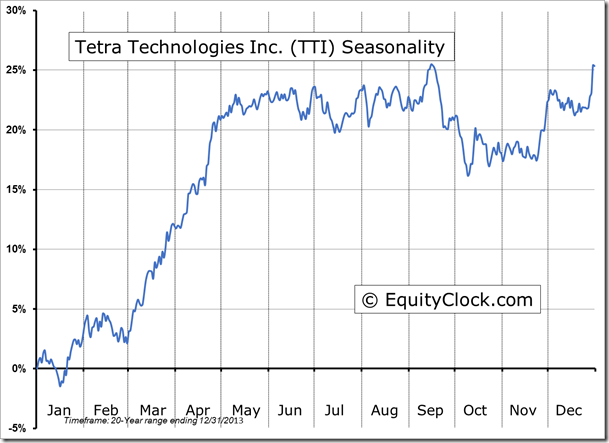

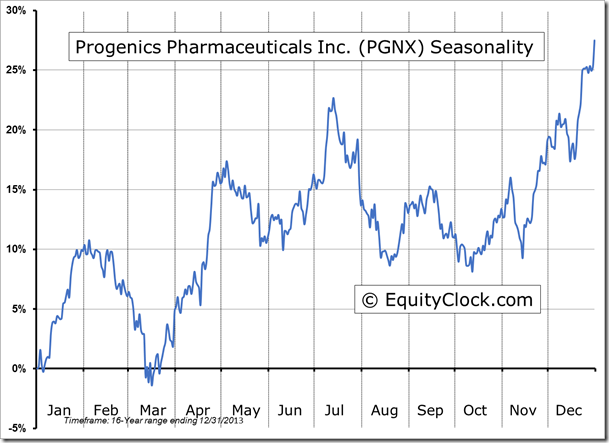

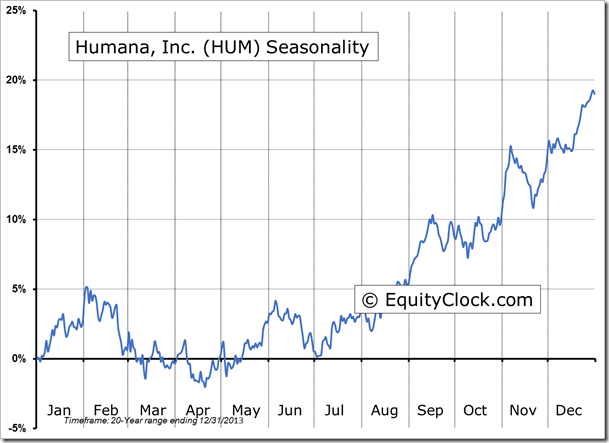

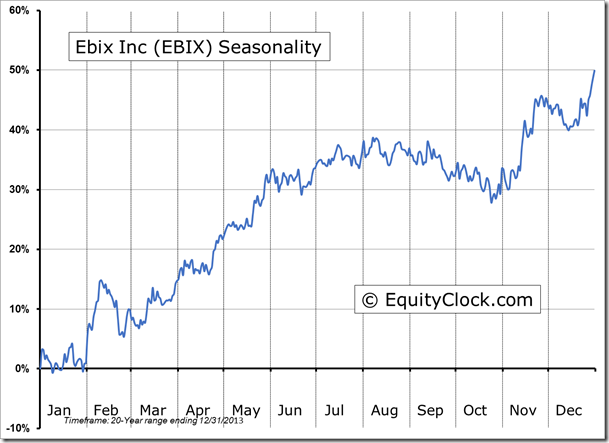

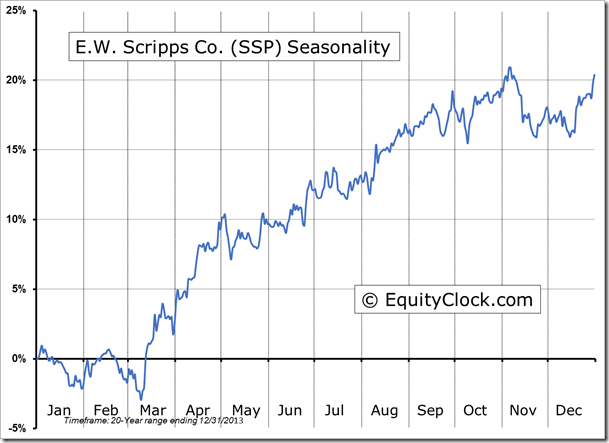

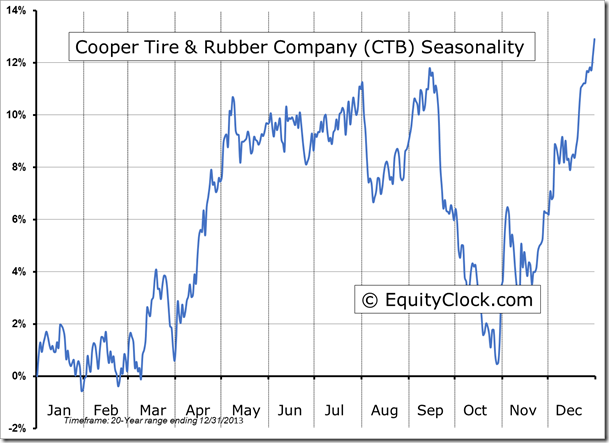

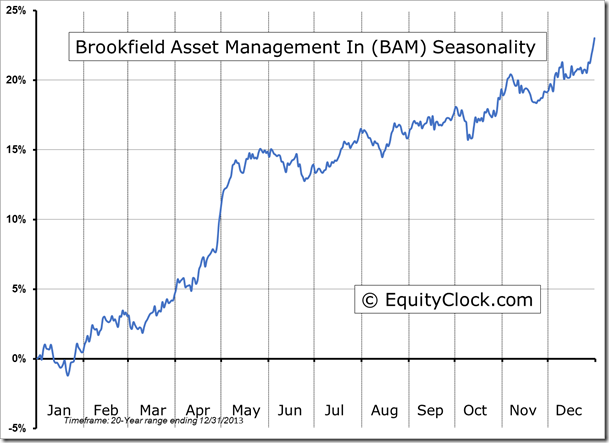

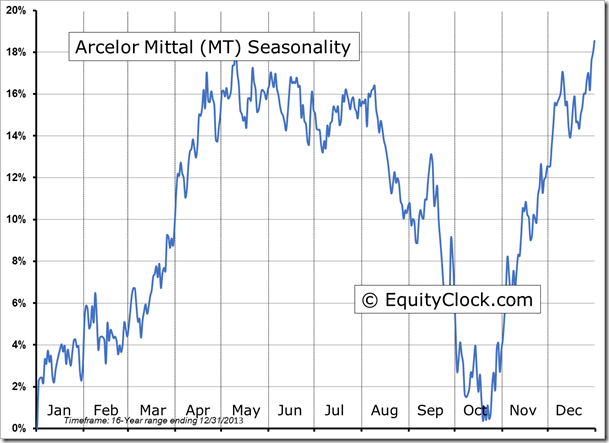

Seasonal charts of companies reporting earnings today:

S&P 500 Index

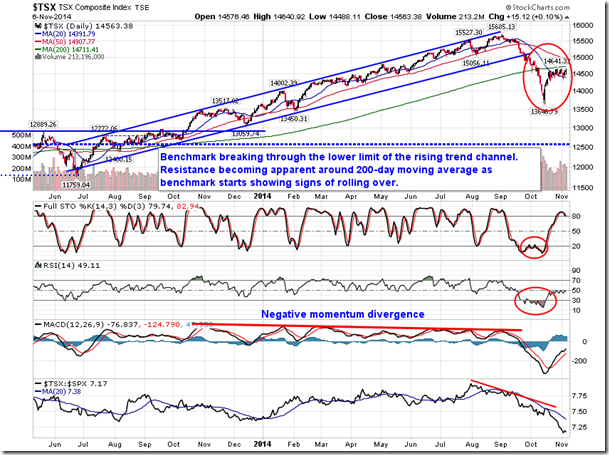

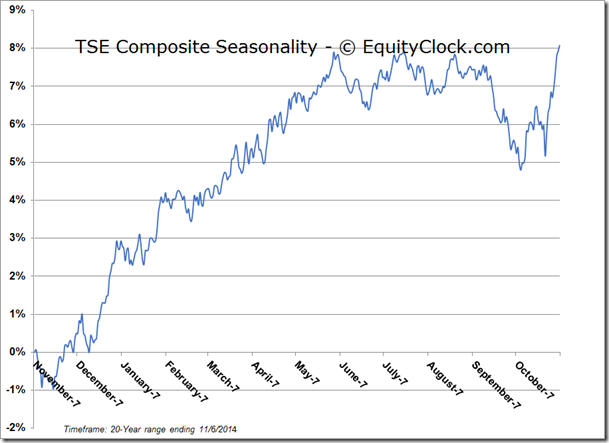

TSE Composite

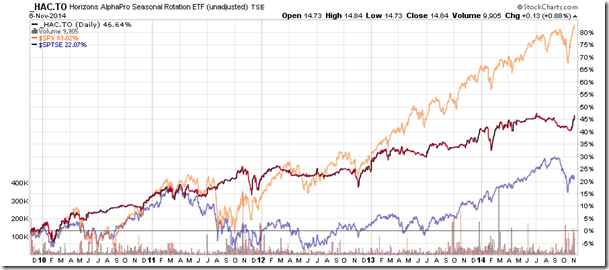

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $14.84 (up 0.88%)

- Closing NAV/Unit: $14.84 (up 0.88%)

Performance*

| 2014 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 3.78% | 48.4% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.