Upcoming US Events for Today:

- New Home Sales for October will be released at 10:00am. The market expects 387K versus 389K previous.

- Weekly Crude Inventories will be released at 10:30am.

- The Fed’s Beige Book will be released at 2:00pm.

Upcoming International Events for Today:

- German Consumer Price Index for November will be released at 8:00am EST. The market expects a year-over-year increase of 1.9% versus an increase of 2.0% previous.

- Japan Retail Sales for October will be released at 6:50pm EST. The market expects a year-over-year decline of 0.6% versus an increase of 0.4% previous.

The Markets

Equity benchmarks ended lower on Tuesday following comments from Senate Majority Leader Harry Reid who indicated that very little progress has been made to divert the so-called “fiscal cliff.” Still, the senate democrat remains confident that a solution will be reached prior to the end of year deadline. That concluding remark gave little confidence to nervous investors who placed more weight on the fact that substantial progress is not being achieved. Fiscal cliff fears offset earlier gains attributed to better than expected economic data pertaining to durable orders, housing, and consumer confidence. So this mix of strong economic data and fiscal cliff fears is causing investors to pause once again, a scenario which may continue until one of these two factors change.

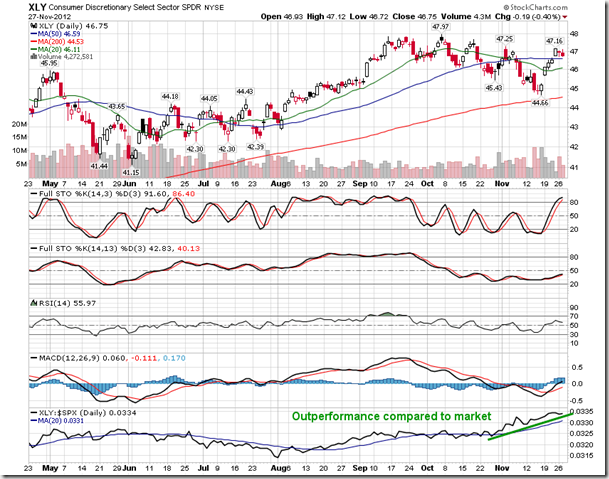

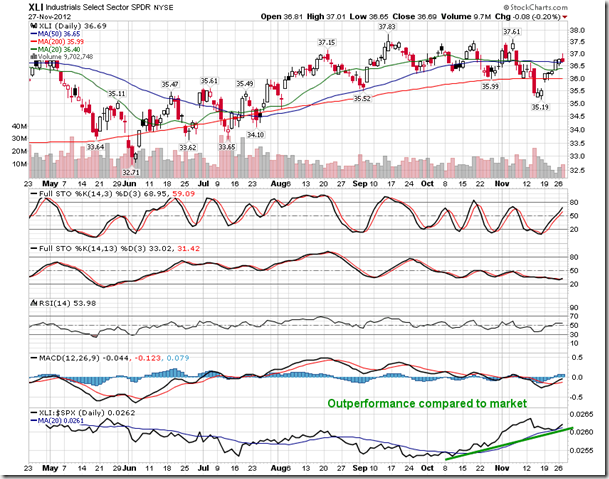

Despite investor caution, cyclical sectors continue to outperform. Consumer Discretionary, Materials, and Industrials have remained stronger than the broad market. Technology is even showing signs of joining that list of outperformers based on the activity over recent days. Defensive sectors, such as Consumer Staples, Health Care, and Utilities, are realizing flat to negative relative performance compared to the S&P 500, suggesting that investors are not becoming risk averse in the midst of extreme uncertainties, a characteristic of a market exhibiting a bullish bias.

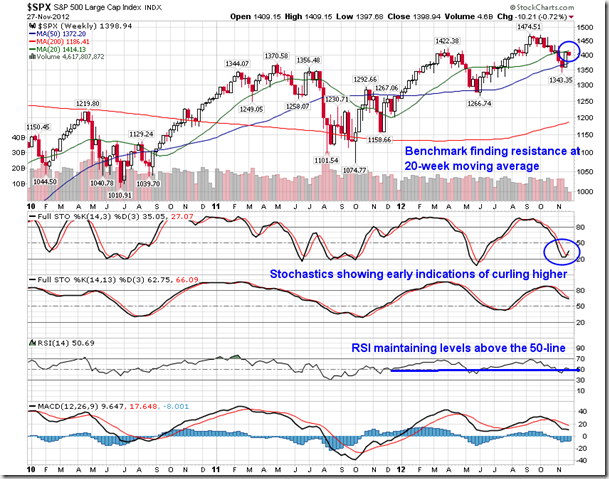

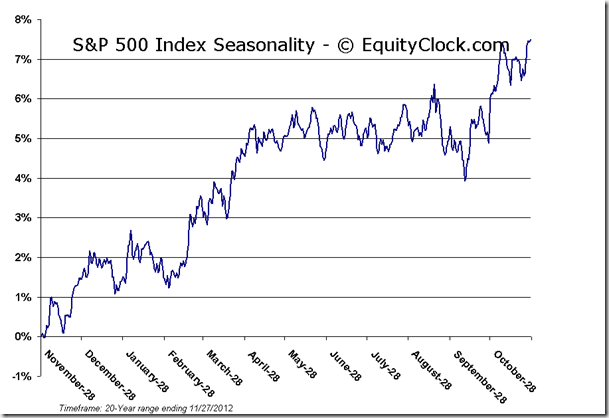

Momentum indicators for the S&P 500 continue to show signs of improvement, rebounding from significantly oversold territory that had been achieved around two weeks ago. Volumes remain very subdued, both during positive and negative sessions. The large cap benchmark has found resistance around the 100-day moving average, or 20-week moving average as depicted in the chart below. Stochastics on the weekly chart are also showing early signs of rebounding from near oversold levels while RSI maintains levels above the 50-line, both of which implies a certain amount of bullishness remains in this market.

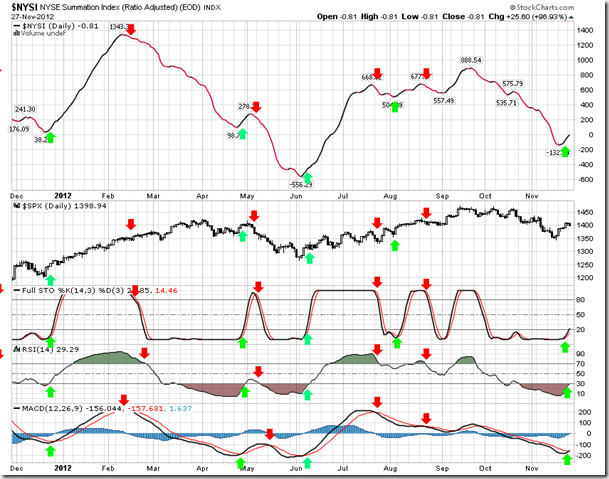

An interesting equity buy signal is becoming apparent with respect to the NYSE Summation Index. Momentum indicators for the index had recently become substantially oversold and are now rebounding, producing bullish crossovers, which have generally provided early indication of a positive move for equities ahead. Keep in mind, however, that even though the indicator has generally provided some very appropriate buy and sell signals, false indications have also been revealed, as was the case with with some of the summer “whipsaws.” The index serves as one of many tools that investors can refer to, but, as with anything, should not be used in isolation.

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.85.

Chart courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

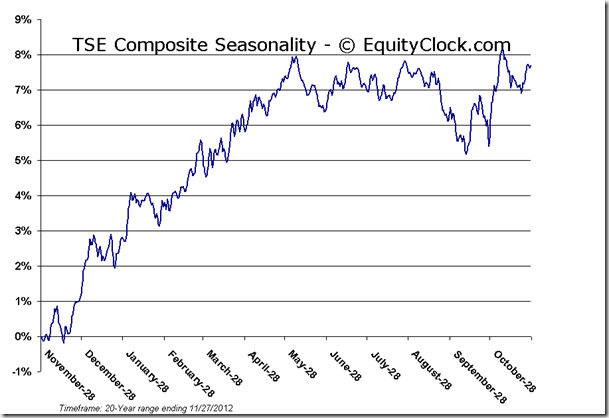

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $12.49 (up 0.08%)

- Closing NAV/Unit: $12.46 (down 0.37%)

Performance*

| 2012 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 2.30% | 24.6% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.