by Don Vialoux, TechTalk

Pre-opening Comments for Wednesday November 28th

U.S. equity index futures are lower this morning. S&P 500 futures were down 5 points in pre-opening trade. Fiscal Cliff concerns continue to weigh on equity markets.

Costco added $3.49 to $100.00 after announcing a special $7.00 per share dividend payable before the end of the year.

American Eagle Outfitters gained $1.46 to $20.85 after reporting higher than consensus third quarter earnings

AK Steel added $0.01 to $3.80 after Dahlman Rose upgraded the stock from Sell to Hold.

IAMGold (IMG $11.77) is expected to open higher after HSBC upgraded the stock from Neutral to Overweight.

Sherwin Williams (SHW $157.15) is expected to open lower after Nomura downgraded the stock from Buy to Neutral.

Deutsche Bank changed its opinion on selected oil service stocks. Nabors was upgraded to a Buy. Seadrill and Rowan were downgraded from Buy to Hold.

Technical Watch

Costco Wholesale Corp. (NASDAQ:COST) – $100.00 added 3.6% after the company announced a special $7.00 per share dividend payable before the end of the year. The stock has a positive technical profile. Intermediate trend is up. Support is at $93.57 and resistance is at its all-time high at$104.13. The stock remains above its 200 day moving average, moved above its 20 day moving average yesterday and is expected to open above its 50 day moving average. Short term momentum indicators are trending up. Strength relative to the S&P 500 Index turned positive in mid-October. Seasonal influences are positive into December. Preferred strategy is to accumulate the stock at current or lower prices.

10 year seasonality chart on Costco

Interesting Charts

Fiscal cliff concerns impacted equity markets yesterday. Weakest U.S. equity index was the Dow Jones Industrial Average, an index that is most heavily weighted in companies with international operations.

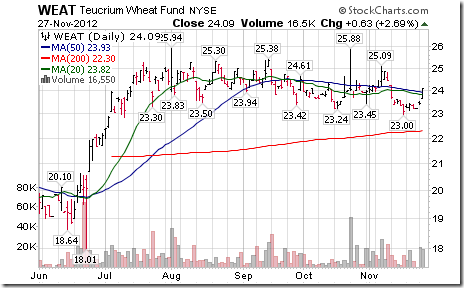

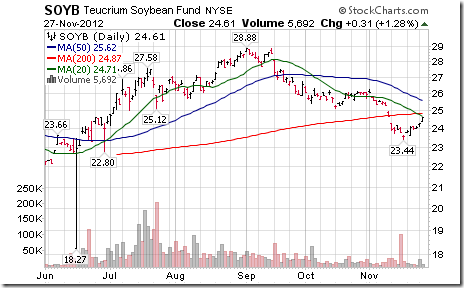

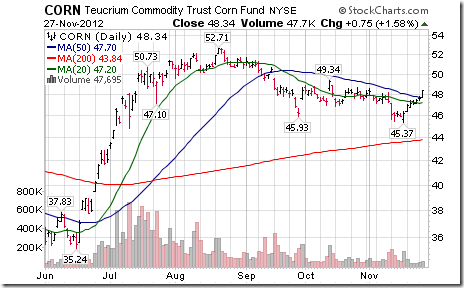

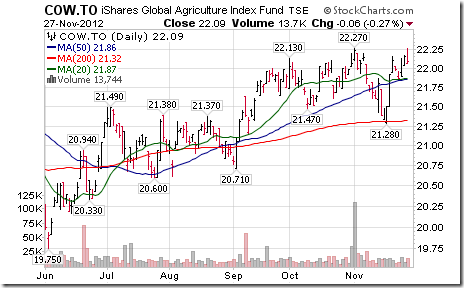

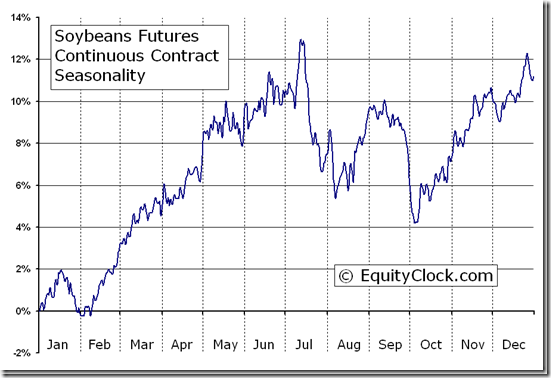

News about growing drought conditions in the U.S. , lower than expected available grain for export by Russia, Ukraine and Australia combined with rising demand by China is having an impact on grain prices. ‘Tis the season for grain prices to move higher!

Higher grain prices is good news for Agriculture equities and related ETFs

Keith Richard’s Blog

This week’s blog looks at a few factors that paint a near-termed bullish picture. I’ve also covered a couple of interesting looking charts, including china’s Shanghai Composite Index. Visit www.smartbounce.ca for details.

Adrienne Toghraie’s “Trader’s Coach” Column

Psychology of Handling Change

By Adrienne Toghraie, Trader’s Success Coach

During these challenging times I have been asked in various ways, “How can I get excited about making the kind of changes in my life that are necessary at this time?” It is natural that people have a resistance to change because it takes a retraining of their whole neurological system to take on a new set of skills and habits. Most people find comfort in the familiarity of their every day life and only venture out for the unusual in small doses. For a trader whose world has turned upside down, this generally means that his performance in trading will suffer as well.

Feeling cursed

Marco had a right to feel cursed. His wife, Janet, lost her high paying job, which allowed him to be a trader. Marco was laid off from being an engineer, but was happy to make the transition to full time trading. He was showing promise in his trading when everything in his life started to fall apart. Marco found out that Janet was having an affair with her boss. The boss’ wife gave her husband an ultimatum to have Janet fired. Eventually, Marco lost his wife when the ex-boss decided he could not live without her.

Marco’s son, from a previous marriage, was stealing and selling drugs to keep his cocaine habit going. And to top off Marco’s predicament, his house went up in flames in the Santa Barbara fires before he had a chance to sell it. Now he is living with his sister and his son is in rehab. I received a call from Marco, who I knew from his attending one of my seminars. Like the typical trader, in spite of all of his problems, all he wanted to talk about was how to make his trading work for him again.

While others who have called about dealing with change do not have as dramatic a story as Marco, an increasing number of traders are calling me about how to deal with problems related to change.

Here are some of the steps I have given those who have sought my help to handle difficult times where they must change:

· Make a plan as if you were someone else who had all of your good characteristics, talents and resources, but did not have the resistance to change.

(When you operate from a different perspective, you will not have to deal with the emotions that create the resistance)

· Within that plan, have specific easy steps that you can accomplish immediately.

(Easy steps will give you the momentum toward the more difficult steps)

· Enlist people in your life to assist you with carrying out your plan.

(People love to help and feel useful if you do not ask for something that will make them feel uncomfortable)

· Organize your environment.

(This helps you with focus)

· Take a trip in your mind to the end of your life. Look back to this moment in time and see how you not only survived but also thrived in making good choices leading to the life you want to live.

(This gives your neurology a path and creates in you a part that will seek out opportunity)

· Go back to your Trading Business Plan and revisit your rules that have worked for you. If your rules are no longer working, then seek out the help of a Trading Coach. If you cannot follow good rules, then seek out the assistance of a Trader’s Coach.……………………

(From this new foundation you can rebuild your strategy and yourself)

· If you must work to support yourself in another profession, then trade full time for only one to two hours a day.

(I know a number of traders who earn more money from their full time 2 hour a day trading profession then they do from their 8 hour job)

Conclusion

The only way to become unstuck and give up difficult circumstances is by taking the initiative to make changes. If your emotions, the feeling of being cursed and not knowing which way to turn are holding you back, then seek out help. You will only make the situation worse by not doing anything. Remember, that taking action as a result of a well-defined plan will lead you toward the changes necessary to have a fulfilling life.

Adrienne’s Online Master Class

Saturday, December 8th from 10:00 am – 2:00 pm (NY time) – $300 (early enrollment discount)

Call 919-851-8288 or Email Adrienne@TradingOnTarget.com

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices.

To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Soybeans Futures (S) Seasonal Chart

Water Equities and Water ETFs

Growing demand for available world water resources is having an impact on water equities and related ETFs.

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

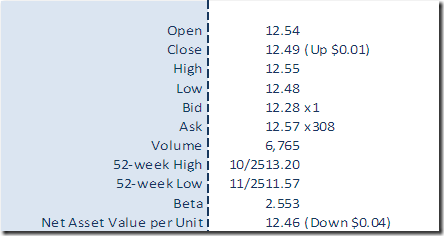

Horizons Seasonal Rotation ETF HAC November 27th 2012

Copyright © TechTalk

![clip_image001[1] clip_image001[1]](https://advisoranalyst.com/wp-content/uploads/HLIC/95a81eaffc84d354e52515d6bd3bdd7c.png)

![clip_image003[1] clip_image003[1]](https://advisoranalyst.com/wp-content/uploads/HLIC/57c95e642b0fa5f765b5d82ad95c232d.png)