Canada Market Radar (April 23, 2012)

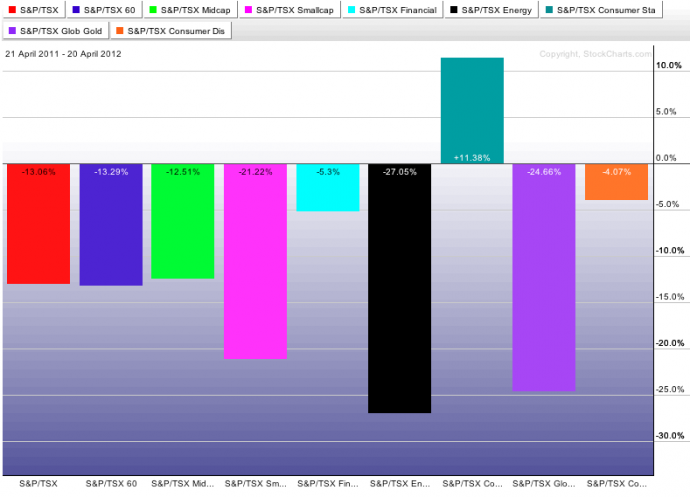

Major TSX Groups - One Year

Major TSX Groups - Year-to-Date

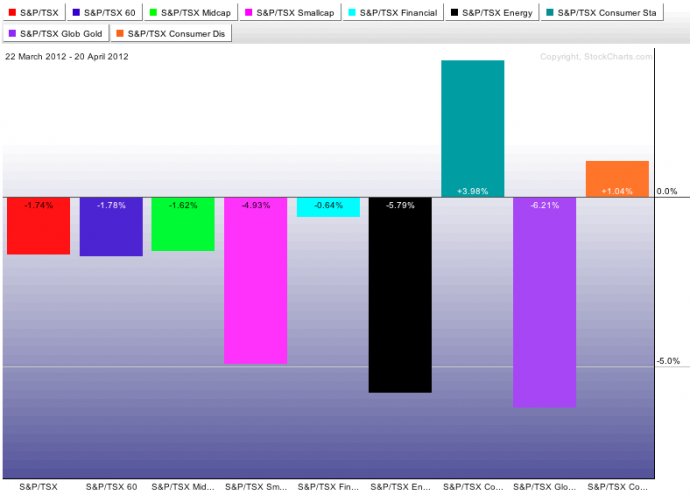

Major TSX Groups - Month Ending April 20

Strengths

Carney Says Canadian Economy Almost Back to Full Capacity - Bloomberg

Carney, speaking in an interview with the Canadian Broadcasting Corp., said the country’s underlying inflation rate has firmed in the last several months and the central bank expects the economy to grow at “above trend” rates in 2012 and 2013.

http://www.bloomberg.com/news/2012-04-21/carney-says-canadian-economy-almost-back-to-full-capacity.html

Canada should be firing on all cylinders by next year, report says - The Globe and Mail

The report pointed ominously to a “persistence” of excess supply of labour – in recent months, and for the near future. And that’s in spite of a monster job creation month in March, when 82,300 jobs were added. Indeed, the economy has now recovered all of the 430,000 jobs lost in the recession and added an additional 180,000. But Scotia Capital economist Derek Holt said the monthly “body count” of jobs is less important than what’s happening to paycheques. He said Canadians are barely keeping up with inflation. “People are not making anything beyond putting gas in their car, filling their grocery carts and heating their homes,” he said. Bank of Canada Governor Mark Carney expects the so-called output gap to close sometime early next year.

http://www.theglobeandmail.com/report-on-business/economy/canada-should-be-firing-on-all-cylinders-by-next-year-report-says/article2406874/

Weaknesses

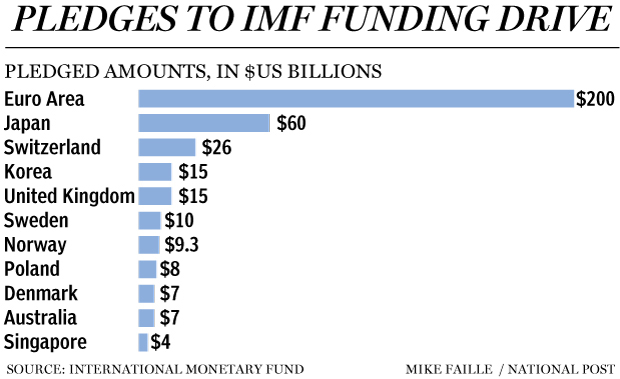

Canada in the minority opposing more IMF firepower - The Globe and Mail

Mr. Flaherty fought the creation of that international firewall until the end – and kept on fighting after the matter was settled at meetings of G20 finance ministers and central bank governors on Thursday and Friday. At a press conference Friday evening, Mr. Flaherty kept up his months-long attack on the bigger members of the euro zone, repeating that they haven’t done enough on their own to deserve international help. “They need to step up to the plate and overwhelm this issue with their own resources,” Mr. Flaherty said. “There are adequate resources in Europe to address these issues and they ought to be employed.”

http://www.theglobeandmail.com/report-on-business/international-news/canada-in-the-minority-opposing-more-imf-firepower/article2409991/

Opportunities

Investors are the casualties in a booming oil patch - The Globe and Mail

Confidence in Canada’s energy sector is being shaken by a host of issues making investors unsure about the payoff from Alberta’s boom. The reasons for worry are many and varied, but they collectively point to a deeper issue. Faith in Canada’s energy business is eroding. Those who once viewed the oil sands in particular as a glittering money factory suddenly have important new reasons to be skeptical. Despite the vast sums pouring into Alberta and Saskatchewan oil fields, the earning power of the sector is being strained, and its ability to fund its growth while also spinning big profits is now under question. That challenge is critical, since success for the energy sector’s development is key to Canada’s overall economic performance

http://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/investors-are-the-casualties-in-a-booming-oil-patch/article2409657/

Threats

Canada Dollar Rises Most in 7 Weeks on Carney Statement - Bloomberg

Canada’s dollar appreciated by the most since March against its U.S. counterpart as the prospects for higher interest rates attracted buyers. The Canadian currency had its largest gains versus the yen and Brazil’s real after Bank of Canada Governor Mark Carney said the removal of economic stimulus may be “appropriate,” given stronger growth and inflation.

http://www.bloomberg.com/news/2012-04-21/canada-dollar-rises-most-in-7-weeks-on-carney-statement.html

Canada March Consumer Price Index Report - Bloomberg

Consumer prices rose 1.9% between March 2011 and March 2012, following a 2.6% increase in February. This 0.7 percentage point difference was largely the result of slower year-over-year increases in prices for food and energy. Food prices rose 2.2% in the 12 months to March, following a 4.1% increase in February. This slower increase was the result of a month-over-month decline in food prices in March 2012, while a year earlier food prices had been on the rise.

http://www.bloomberg.com/news/2012-04-20/canada-march-consumer-price-index-report-text-.html

High oil prices threatened by ... high oil prices - The Globe and Mail

The fivefold increase in oil prices over the past decade has created boom times in Alberta, in North Dakota and in crude-producing regions across the globe, but the era of $100-a-barrel oil may be sowing the seeds of its demise. Oil-consuming nations, such as the United States and China, have become preoccupied with security of supply, amid predictions of “peak oil” in which the global energy industry will have trouble keeping pace with rising demand.

http://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/high-oil-prices-threatened-by-high-oil-prices/article2409670/