by Michael Nairne, Tacita Capital

“Buy and hold” is not an effective strategy for risk conscious investors. Any portfolio’s asset mix will drift from its strategic target as asset prices move differentially in response to changing economic and market forces. Over time, the higher return assets will comprise a larger proportion of the portfolio and distort its return and risk dimensions from those originally constructed.

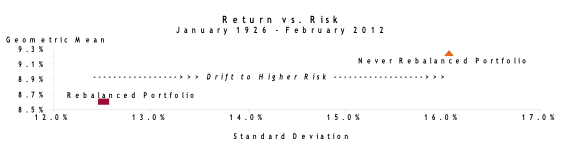

Sound portfolio management is founded on “buy and rebalance”. Rebalancing involves selling the asset classes that have done relatively well to buy those assets that have lagged in order to restore the portfolio’s target mix. Rebalancing is vital in risk management since it ensures that a portfolio’s risk dimensions stay within an investor’s defined tolerance limits. This is illustrated in the following graph which compares the return and risk of a portfolio comprised of 40% US bonds and 60% US stocks which was rebalanced annually (in red) to those of the same portfolio that was never rebalanced (in orange).

The rebalanced portfolio experienced much lower risk while the never rebalanced portfolio drifted into a much riskier asset weighting dominated by stocks. Its return was lower but that is because it avoided the escalating risk of the never rebalanced portfolio. Critically, the rebalanced portfolio had better risk-adjusted performance .

Rebalancing has a second vital role in a portfolio. Rebalancing is a source of diversification return that arises from the contrarian act of selling assets that have appreciated on a relative basis and buying the lagging assets in order to restore the weights of the target asset mix of a particular investment strategy.

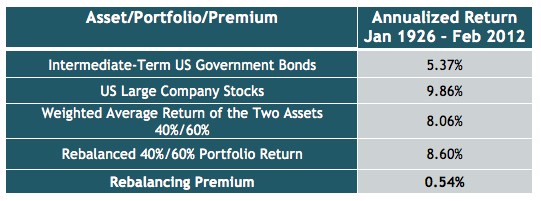

A return premium is created by the disciplined act of regularly “selling high and buying low” while maintaining the risk profile of the portfolio. It can be calculated by comparing the return of a rebalanced portfolio to the weighted average geometric return of the assets which comprise the portfolio . An example of the rebalancing premium is illustrated in the following table which sets out the returns of the individual assets in the 40% bond/60% stock portfolio, the weighted average return of the two assets, the return of the rebalanced portfolio and the rebalancing premium.

The rebalanced portfolio had an annualized return of 8.60% compared to the weighted average return of 8.06% for the two assets that comprise the portfolio. Rebalancing resulted in an annualized return premium of 0.54%.

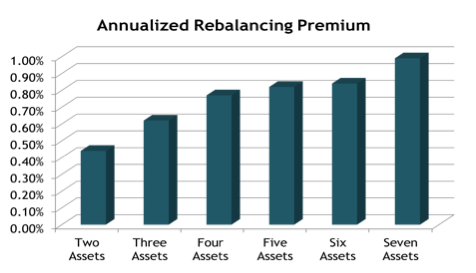

The rebalancing premium can be increased by adding more assets when they exhibit the right blend of volatility and covariance (i.e. tendency to move in tandem) with the overall portfolio - the more volatile the assets added and the lower their covariance, the higher the rebalancing premium. This is illustrated in the following graph which portrays the annualized rebalancing premium for the period January 1972 to January 2012 that resulted from sequentially adding asset classes to a two asset portfolio comprised initially of 40% US bonds and 60% US stocks. The assets added in order are: international stocks, US small value stocks, Canadian stocks, US REITs, and finally gold .

The rebalancing premium more than doubled - from 0.44% to 0.99% - as assets were added. It increased initially as international stocks increased rebalancing opportunities. Then, the addition of volatile small cap value stocks had a large premium as its wide return swings created an even greater rebalancing effect. Adding real estate and commodity-biased Canadian stocks also increased the premium. Finally, adding gold which is very volatile and has a low covariance to other assets had a particularly large premium as there were frequent opportunities for substantive rebalancing.

Earning the rebalancing premium is easier in theory than in practice. Selling winners to buy losers seems to go against human nature. In fact, the vast majority of investors either don’t rebalance or don’t rebalance as frequently as they should .

That’s too bad. Rebalancing earns a return premium while maintaining the risk profile of a portfolio – to paraphrase Scott Willenbrock, rebalancing adds a “free dessert” to the “free lunch” served by diversification. Serious investors need to stay seated long enough at the investing table to enjoy both.

Footnotes:

1. Bond and stock returns are from Ibbotson’s intermediate-term government bond and large company stock series. Rebalancing is undertaken on an annual basis.

2. Although not shown, the rebalanced portfolio had a higher Sharpe Ratio, Sortino Ratio and M-Squared Ratio.

3. Booth, D.G., Fama, E.F., Diversification Returns and Asset Contributions, Financial Analysts Journal, Vol. 48, No.3, p. 26–32, May/June 1992. Booth and Fama define the incremental return from a rebalanced portfolio compared to the weighted average asset compound return as the “diversification return”.

4. Willenbrock, Scott, Diversification Return, Portfolio Rebalancing, and the Commodity Return Puzzle, Financial Analysts Journal, Vol. 67, No. 4, pp. 42-49, July/August 2011. Willenbrock states that “the diversification return is the difference between the geometric average returns of both a rebalanced portfolio of volatile assets and a balanced portfolio of hypothetical assets with the same weights and geometric average returns as the true assets but zero volatility.” Practically, the latter term is the weighted average geometric return of the assets comprising the portfolio.

5. All return data is from Morningstar Encorr. The asset classes are based on the following indices: international stocks - MSCI EAFE; US small value stocks - Fama-French Small Value; Canadian stocks - S&P/TSX Capped Composite in US$; US REITs - FTSE NAREIT All Equity REIT; and gold - London Fix Gold PM US$. Proportions added vary but are based on practical weighting considerations. Rebalancing is undertaken on an annual basis.

6. AllianceBernstein Investment Research and Management Asset Allocation Research 2005. Findings of a nationwide telephone survey of 1000 investors.

www.tacitacapital.com

Tacita Capital Inc. (“Tacita”) is a private, independent family office and investment counselling firm that specializes in providing integrated wealth advisory and portfolio management services to families of affluence. We understand the challenges of affluence and apply the leading research and best practices of top financial academics and industry practitioners in assisting our clients reach their goals.

Tacita research has been prepared without regard to the individual financial circumstances and objectives of persons who receive it and is not intended to replace individually tailored investment advice. The asset classes/securities/instruments/strategies discussed may not be suitable for all investors and certain investors may not be eligible to purchase or participate in some or all of them. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives.

Tacita recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial advisor.

Tacita research is prepared for informational purposes. Neither the information nor any opinion expressed constitutes a solicitation by Tacita for the purchase or sale of any securities or financial products. This research is not intended to provide tax, legal, or accounting advice and readers are advised to seek out qualified professionals that provide advice on these issues for their individual circumstances.

Tacita research is based on public information. Tacita makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. We have no obligation to inform any parties when opinions, estimates or information in Tacita research changes.

All investments involve risk including loss of principal. The value of and income from investments may vary because of changes in interest rates or foreign exchange rates, securities prices or market indexes, operational or financial conditions of companies or other factors. There may be time limitations on the exercise of options or other rights in securities transactions. Past performance is not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized. Management fees and expenses are associated with investing.