Excerpts from Stock World Weekly:

The major indexes closed lower this [last] week. We had been anticipating a rest in the “fake” rally, and wrote in last week's newsletter, Under Pressure, “We’re feeling cashy and cautious again. Looking over the last two and a half weeks, the Dow has done nothing, the Russell has done nothing, the S&P has only gone up a little. The Nasdaq is up a lot - but we know that is largely due to one company, Apple Inc.!

Phil’s short term trade ideas have been mostly bearish. (We included a section on Phil’s put buying adventure in last week’s newsletter.) We've been expecting a correction and wonder if this is the beginning of a significant move down.

Discussing his view of the Treasury and stock markets going into next week, Lee Adler wrote to his subscribers,

“The markets face another week on relatively easy street in terms of Treasury supply.

“Even though the Treasury is auctioning a big slug of longer term paper, it is paying down bills. Thursday will see a cash paydown to the market, and the big note and bond settlement a week from Monday will see only $23 billion in new paper, which is about half of the usual mid month supply hit. The government has benefited from a surge in tax receipts toward the end of March and in early April. If that continues through April 15, then overall, April will be a light month supply wise.

“The market only had about 40 minutes to react to the expected weak jobs report in the stock index futures. The reaction wasn't what I expected. I had thought that a bad jobs report would be like ringing the bell for Pavlov's dogs as traders salivate in anticipation of the next treat [more quantitative easing] from their handler, Ben. The guys trading the futures didn't agree with me, and they dumped.

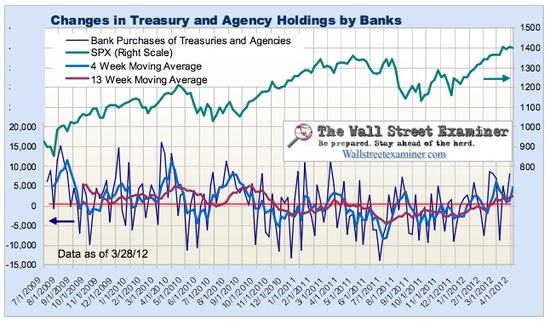

“Holding down yields during note and bond auction week is Job One for the government and its co-cartel members the Primary Dealers [firms which buys government securities directly from a government, with the intention of reselling them to others], who still hold record long positions in their longer term Treasury portfolios (chart above).

"So I think the Primary Dealers will be happy to have more bad news to keep the cash flowing into the government bond market. With no big economic releases coming this week, the best way to do that is to shake the stock market tree.

“The public is still buying bonds like mad and the markets are getting renewed help from the foreign central banks and the commercial banks in the last 2 weeks. That could underpin a return to a bullish tone for stocks once the big Treasury auctions are out of the way on Thursday. All in all, the pattern looks weak for stocks and strong for bonds early in the week, with Thursday afternoon shaping up as an opportune time for reversal." (Explore Wall Street Examiner's Professional Edition – try it risk free for 30 days!)

Ryan Vlastelica shares our worries that the market has been running up too far too fast. He wrote, “Since October, estimates for first-quarter earnings growth have tumbled while the S&P 500 has surged. With the earnings season starting next week, the outlook is not as sunny as in previous quarters.

“Investors will assess whether slower growth is priced into the U.S.stock market, or if the S&P 500's retreat from Monday's four-year high is the start of a larger decline - if results disappoint.

“After the S&P 500's rise of about 30 percent since October, there is concern that buying interest is not strong enough to drive further gains, particularly after soft March U.S. employment figures were released on Friday... (chart by Yahoo)

"Friday's nonfarm payrolls (NFP) report was a disappointment, with just 120,000 jobs added in March, short of expectations for a gain of 203,000 jobs. Stock futures fell 1 percent in a shortened session, with the cash market closed entirely.” (Wall Street Week Ahead: Will earnings spark further declines?)

The weakness in NFP may, rather than sending the market down, revive hopes for another QE, thereby raising share prices. This market is singing, “what’s good is bad, what’s bad is good, you find out when you reach the top, you’re on the bottom.” (Bob Dylan) We will see.

Tim of The Psy-Fi Blog explained why he believes this is a dangerous market. It has something to do with the scientific method (read the whole article to discover what):

“I think there’s danger for anyone executing anything other than the suggested default option of a low cost, globally diversified, occasionally rebalanced portfolio. Active private investors are engaged in an arm’s race with the securities industry and most of the big guns are facing the wrong way. The problem is that darned scientific method, which is why there's also never been a more dangerous time to invest...

“The idea that we’re in an arms race against a better equipped, better funded and far less moral enemy isn’t one that most private investors take on, but they should. Despite our manifest deficiencies we aren’t without our own weapons – the behavioral weaknesses of the financial industry itself. We can fight a successful guerrilla war by refusing to engage in a pitched battle on their terms: trade rarely, go where they don’t go and never, ever believe you have to react in seconds or even minutes and hours. When High Frequency Trading algorithms can execute faster than you can blink you’re wasting your time, your money and throwing away your intellectual advantage: faster is not better.” (Why There’s Never Been A More Dangerous Time To Invest)

From the PSW Strategies Section

Phil and PSW members post numerous trade ideas during the day in the chat section. Selling (options), doubling down, scaling in, rolling forward... These are a few of the methods that are commonly mentioned.

The following is a detailed example of a trade idea by Phil. This strategy can be applied to buying any stock that you want to own as a long-term holding. (Note: Microsoft is trading lower now, at 31.38 on 4-9.):

“If you REALLY like a stock and REALLY want to own it at the net price – then why not sell a put on that stock? Let's say I like Microsoft (MSFT). I could buy 100 shares for $32.29 and just cover it by selling a Jan 2014 $30 call at $4.90, for net entry of $27.39. I make $2.61 if the shares get called away. Very dull.

“I could also just sell the Jan 2014 $27 put for $2.50. Then I make (keep) the $2.50 if MSFT is over $27 at expiration – better but not thrilling. My net entry is $24.50, if the shares get put to me. That’s the difference between the price of the stock if it gets put to me, $27, and the money I collected from selling the put, $2.50, i.e., net $24.50.

“I could also buy the Jan 2013 $25/30 bull call spread (bcs) for $4. If I sell a Jan 2014 put against this bcs, I would collect $2.50, bringing my cost go down to a net $1.50 in cash ($4 for the bcs minus the $2.50 collected from selling the put).

My upside is $3.50 if MSFT holds $30 to Jan 2013 AND holds $27 to Jan 2014...

“Bull call spreads are NOT good for cashing out early in general as you get locked into the trade if you don't have good margin (and good timing to use it with). You are far LESS likely to make quick money on a straight bull call spread, but it depends on what underlying you select. Mostly, a bull call spread is about burning premium – you sell more than you buy and it helps to have the stock move in your favor, of course.

“In the MSFT example above, the net delta on the bull call spread is just $0.22 so a $5 move up in MSFT (15%) is barely going to make you $1. On the bright side, a $5 move against you will only cost you $1, and that means you have plenty of time to react before the net drops 50% and makes it too difficult to roll, which is why we like these – they need less hedging...”

Discussing the markets, Phil wrote, “If you UNDERSTAND why something is happening, rather than panicking with the herd – you can calmly jump in and take advantage of opportunities when they present themselves...

“Who wants a market that goes up and up and up – where's the sport? Even the Nasdaq finally blew its 15-week winning streak and that helped us decide to stay bearish going into yesterday's [Thursday’s] close. I simply don't see anything in particular to be bullish about at the moment.”

For more on our strategies for buying stocks at a discount, go to Strategies for Buying Stocks.

Click here for a free trial to Stock World Weekly

Disclaimer

Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results. We make no representations that the techniques used in our rankings or selections will result in or guarantee profits in trading. Further, our analyses are based on third-party data, which we cannot guarantee as to adequacy, accuracy, completeness or timeliness. We accept no responsibility for any loss arising for use of these materials.

Hypothetical or simulated performance results have certain limitations unlike an actual performance report. Simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under or over compensated for the impact, if any, of certain market factors such as lack of liquidity. Simulated trading programs in general are also subject to the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.