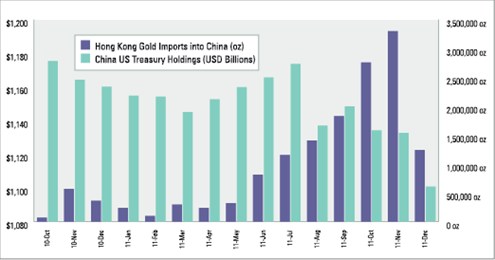

This is likely why China reduced its US Treasury exposure by $32 billion in the month of December (See Figure 1).7 This is also why China, which produced 360 tonnes of gold internally last year, also imported an additional 428 tonnes in 2011, up from 119 tonnes in 2010.8 This may also be why China's copper imports hit a record high of 508,942 tonnes in December 2011, up 47.7 percent from the previous year, despite the fact that their GDP declined at year-end.9 Same goes for their crude oil imports, which hit a record high of 23.41 million metric tons this past January, up 7.4 percent year-over-year.10 The so-called experts have a habit of downplaying these numbers, but it seems pretty clear to us: China isn't waiting around for next QE program. They are accelerating their move away from paper currencies and into hard assets.

Figure 1: China Hong Kong Gold Imports vs. US Treasury Holdings

Source: US Treasury, UBS

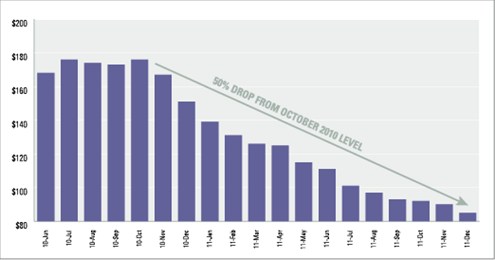

China is not alone in this trend either. Russia has reportedly cut its US Treasury exposure by half since October 2010 (See Figure 2). Not surprisingly, Russia was also a big buyer of gold in 2011, adding approximately 95 tonnes to its gold reserves, with 33 tonnes added in the fourth quarter alone.11 It's not hard to envision higher gold prices if the rest of the non-G6 countries follow-suit.

Figure 2: Russia US Treasury Holdings ($BN)

Source: Zerohedge.com

The problem with central bank intervention is that it never works out as planned. The unintended consequences end up cancelling out the short-term benefits. Back in 2008, when the Fed introduced zero percent interest rates, everyone thought it was a great policy. Four years later, however, and we're finally beginning to appreciate the complete destruction it has wreaked on savers. Just look at the horror show that is the pension industry today: According to Credit Suisse, of the 341 companies in the S&P 500 index with defined benefit pension plans, 97 percent are underfunded today.12 According to a recent pension study by Seattle-based Milliman Inc., the combined deficit of the 100 largest defined-benefit plans in the US increased by $236.4 billion in 2011 alone.13 The main culprit for the increase? Depressed interest rates on government bonds.14

Let's also not forget the public sector pension shortfalls, which are outright frightening. In Europe, unfunded state pension obligations are estimated to total

$39 trillion dollars, which is approximately five times higher than Europe's combined gross debt.15 In the United States, unfunded pension obligations increased by $2.9 trillion in 2011. If the US actually acknowledged these costs in their deficit calculations, their official 2011 fiscal deficit would have risen from the reported $1.3 trillion to $4.2 trillion.16 Written the long way, that's a deficit of $4,200,000,000,000,… in one year.

There is unfortunately no economic textbook to guide us through these strange times, but common sense suggests we should be extremely wary of the continued maneuvering by central banks. The more central banks print to save the system, the more the system will rely on their printing to stay solvent - and you cannot solve a debt problem with more debt, and you cannot print money without serious repercussions. The central banks are fueling a growing distrust among the creditor nations that is forcing them to take pre-emptive actions with their currency reserves. Individual investors should take note and follow-suit, because it will be a lot easier to enjoy the "Year of the Central Bank" if you own things that can actually benefit from all their printing, as opposed to things that can only be destroyed by it.

1 Board of Governors of the Federal Reserve System (November 30, 2011) "Coordinated central bank action to address pressures in global money markets".

http://www.federalreserve.gov. Retrieved February 15, 2012 from: http://www.federalreserve.gov/newsevents/press/monetary/20111130a.htm

2 Jenkins, Patrick and Oakley, David (January 30, 2012) "Banks set to double crisis loans from ECB". Financial Times. Retrieved February 15, 2012 from:

http://www.ft.com/intl/cms/s/0/09ab9542-4b6d-11e1-b980-00144feabdc0.html

3 Telegraph Staff (February 9, 2012) "Bank of England restarts QE with £50bn stimulus". The Telegraph. Retrieved February 16, 2012 from:

http://www.telegraph.co.uk/finance/economics/9071622/Bank-of-England-restarts-QE-with-50bn-stimulus.html

4 Fujikawa, Megumi and Ito, Tatsuo (February 14, 2012) "Bank of Japan Surprises by Easing, Setting Price Goal". Wall Street Journal. Retrieved February 17, 2012 from:

http://online.wsj.com/article/SB10001424052970204883304577222063451464968.html?_nocache=1329249611524&user=welcome&mg=id-wsj

5 Zeng, Min (February 10, 2012) "Fed's 'Operation Twist' Tangles Treasury Trade". Wall Street Journal. Retrieved February 15, 2012 from:

http://online.wsj.com/article/SB10001424052970203315804577211303042416034.html

6 Wroughton, Lesley and Hughes, Krista (January 18, 2012) "IMF seeks more funds". Reuters. Retrieved February 14, 2012 from:

http://www.reuters.com/article/2012/01/18/us-imf-resources-idUSTRE80H0VU20120118

7 Mackenzie, Michael (February 15, 2012) "China anticipates Fed quantitative easing". Financial Times. Retrieved February 16, 2012 from:

http://www.ft.com/intl/cms/s/0/27a221be-57e4-11e1-b089-00144feabdc0.html#axzz1mSKyDrxw

8 Hook, Leslie (February 7, 2012) "China gold imports from HK surged in 2011". Financial Times. Retrieved February 14, 2012 from:

http://www.ft.com/intl/cms/s/0/d26cd2d6-518d-11e1-a99d-00144feabdc0.html#axzz1mH8V3yyg

9 Hook, Leslie (January 10, 2012) "China's copper imports hit record". Financial Times. Retrieved February 15, 2012 from:

http://www.ft.com/intl/cms/s/0/e8e76eda-3b68-11e1-a09a-00144feabdc0.html#axzz1mSKyDrxw

10 Bloomberg News (February 20, 2012) "China January Oil Imports Rise to Record 23.41 Million Tons". Bloomberg. Retrieved February 20, 2012 from:

http://www.businessweek.com/news/2012-02-13/china-january-oil-imports-rise-to-record-23-41-million-tons.html

11 World Gold Council (February 16, 2012) "Gold Investment Trends". World Gold Council. Retrieved February 17, 2012 from:

http://www.gold.org/investment/research/regular_reports/gold_demand_trends/

12 Scheyder, Ernest and Mincer, Jilian (January 26, 2012) "Analysis: Pension shortfalls a stark corporate challenge". Reuters. Retrieved February 15, 2012 from:

http://www.reuters.com/article/2012/01/26/us-corporate-pensions-idUSTRE80P03720120126

13 Milliman, Inc. (January 6, 2012) "Milliman analysis: Bad year for pensions ends badly". Milliman, Inc. Retrieved February 15, 2012 from:

http://www.milliman.com/news-events/press/pdfs/pfi-december-2011.pdf

14 Philips, Matthew and Campbell, Dakin (February 2, 2012) "Banks, Pensions are Squeezed as Fed's Low Rates Erode Profits". Bloomberg. Retrieved February 16, 2012 from: http://www.bloomberg.com/news/2012-02-02/banks-pensions-are-squeezed-as-fed-s-low-rates-erode-profits.html

15 Christie, Rebecca and Woodifield, Peter (January 11, 2012) "Europe's $39 Trillion Pension Risk Grows as Economy Falters". Bloomberg. Retrieved February 16, 2012 from: http://www.bloomberg.com/news/2012-01-11/europe-s-39-trillion-pension-threat-grows-as-regional-economies-sputter.html

16 Lawrence, Bryan R. (December 28, 2011) "The dirty secret in Uncle Sam's Friday trash dump". Washington Post. Retrieved February 14, 2012 from:

http://www.washingtonpost.com/opinions/the-dirty-secret-in-uncle-sams-friday-trash-dump/2011/12/28/gIQArtWMNP_story.html