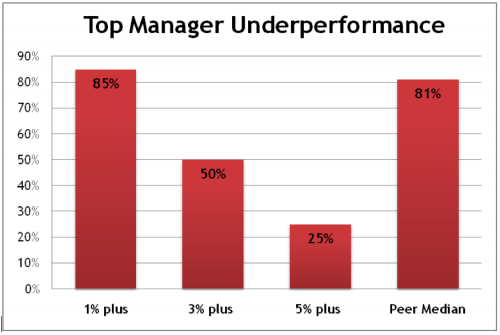

Baird recently released a report[i] on the historic performance of top mutual funds which, as of December 31, 2010, had outperformed their respective benchmarks by one percentage point or more on an annualized basis over the prior 10-year period and with less volatility. As illustrated in the following graph, they found that over at least one 3-year rolling period approximately 85% of these managers underperformed their benchmarks by one percentage point or more while 50% underperformed by three percent points or more. 25% underperformed by five percentage points or more while 81% underperformed the median performance of their peers for at least one three year period.

A study[ii] by DiMeo Schneider & Associates of top quartile funds for the 10-year period ended December 31, 2009 produced similar findings. They found that 85% of the top funds spent at least one 3-year period in the bottom half of their peer group while an remarkable 62% spent at least one 5-year stretch in the bottom half.

Of course, identifying top active managers in hindsight is a world apart from picking them with foresight. A litany of academic studies[iii] indicate that performance is not persistent; that past performance alone is not predictive of future performance. Hence, should an investor have a compelling qualitative rationale for investing with a particular active manager, she or he will still need to be patient when the inevitable performance droughts occur. This, of course, adds to the risk of using active managers as it will be difficult to determine whether such underperformance is transient or the regression to mediocrity that afflicts most active managers.

Droughts in asset class and manager performance are inevitable. As farmers long ago learned, the keys to successfully contending with this harsh reality are diversification, patience and a commitment to long-term results.

Appendix I

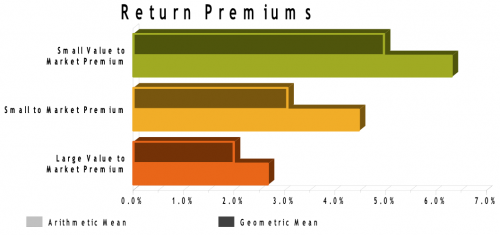

Source: Return premiums are based on the following total return indices calculated for the period July 1927 to February 2011: Large Value to Market Premium is based on the Fama French Large Value Index minus the S&P 500 (Ibbotson Extended Version); Small to Market Premium is based on the Ibbotson Small Stock Index minus the S&P 500 (Ibbotson Extended Version); Small Value to Market Premium is based on the Fama French Small Value Index minus the S&P 500 (Ibbotson Extended Version).

Tacita Capital Inc. (“Tacita”) is a private, independent family office and investment counselling firm that specializes in providing integrated wealth advisory and portfolio management services to families of affluence. We understand the challenges of affluence and apply the leading research and best practices of top financial academics and industry practitioners in assisting our clients reach their goals.

Tacita research has been prepared without regard to the individual financial circumstances and objectives of persons who receive it and is not intended to replace individually tailored investment advice. The asset classes/securities/instruments/strategies discussed may not be suitable for all investors and certain investors may not be eligible to purchase or participate in some or all of them. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives. Tacita recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial advisor.

Tacita research is prepared for informational purposes. Neither the information nor any opinion expressed constitutes a solicitation by Tacita for the purchase or sale of any securities or financial products. This research is not intended to provide tax, legal, or accounting advice and readers are advised to seek out qualified professionals that provide advice on these issues for their individual circumstances.

Tacita research is based on public information. Tacita makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. We have no obligation to inform any parties when opinions, estimates or information in Tacita research changes.

All investments involve risk including loss of principal. The value of and income from investments may vary because of changes in interest rates or foreign exchange rates, securities prices or market indexes, operational or financial conditions of companies or other factors. There may be time limitations on the exercise of options or other rights in securities transactions. Past performance is not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized. Management fees and expenses are associated with investing.

[i] Baird’s Advisory Research Services, The Truth About Top-Performing Money Managers, Robert W. Baird & Co. Incorporated (2011), http://www.rwbaird.com/bolimages/Media/PDF/Whitepapers/Truth-About-Top-Performing-Money-Managers.pdf

[ii] DiMeo Schneider & Associates. LLC, The Next Chapter in the Active versus Passive Debate (2010 Update), (Chicago, Illinois, March 2010), http://www.dimeoschneider.com/documents/Research-the-next-chapter-in-the-active-versus-passive-debate-%282010-update%29-189.pdf

[iii] See for example - Allen, D., T. Brailsford, R. Bird, and R. Faff. 2003. A Review of the Research on the Past Performance of Managed Funds. ASIC REP 22, Australian Securities and Investment Commission.

Copyright © Michael Nairne, Tacita Capital