Lessons from the Farm

by Michael Nairne, Tacita Capital

Farmers know all about droughts. Droughts occur in nearly all climates and impair all types of crops. They are unpredictable, yet are recurring and can last for years. Likewise, performance droughts abound in the world of investing.

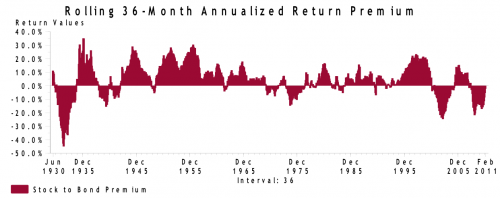

Stocks, for example, outperformed intermediate-term government bonds in the U.S. by an average annualized 6.1% from July 1927 through February 2011. However, as illustrated in the following graph - which depicts the 36-month rolling annualized return of the S&P 500 less the return of intermediate-term government bonds, that is, the stock to bond return premium - there has been extended performance droughts when this premium goes negative as stocks underperform bonds.

The major stock performance droughts are concentrated in periods of economic and monetary turbulence such as the 1930’s, the 1970’s and the last several years. The droughts also appear in most recessions and are particularly acute in times of lofty stock valuations such as the late 1960’s and early 2000’s.

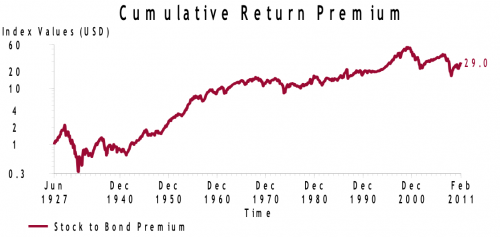

Stock’s performance droughts are even more severe when the time taken to recover from prior underperformance is considered. The following graph depicts the cumulative return premium earned by stocks over bonds starting in July 1927. Over the entire period, $1.00 invested in stocks grew 29 times greater than $1.00 invested in intermediate-term government bonds. However, stocks massively underperformed bonds from late 1929 to mid-1932 and their cumulative return didn’t overtake bonds again until 1950. Stocks have also cumulatively underperformed bonds since 2000.

Farmers diversify their crops to help cope with droughts. Similarly, investors, particularly retirees, need to diversify their portfolios with both bonds and equities to mitigate the impact of the inevitable performance droughts of stocks.

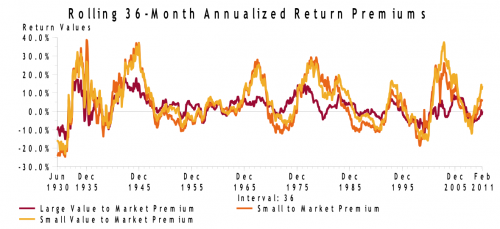

Investors can also seek return premiums within the equity market itself. Large company value and small company stocks have outperformed the broad stock market by an annualized 2.7% and 4.5% respectively since July 1927. Small company value stocks have returned a significant annualized premium of 6.3% to the overall market. More details on these historic premiums are set out in Appendix I.

Yet, as can be seen in the following graph which depicts their rolling 36-month performance, these premiums are earned very sporadically. Repeated performance droughts, some of an extended duration, exist for these segments of the stock market. Large company value stocks, for example, underperformed the broad market during the 1930’s as well as during the growth stock boom of the 1990’s. This premium (in dark brown) also frequently goes negative during recessions including the recent global credit crisis.

As depicted above in the lighter shades, the small company-to-market and small value-to-market premiums are very volatile and “streaky”; periods of strong outperformance are followed by prolonged performance droughts. Small company value stocks, for example, underperformed the broad stock market for nearly seven years in the 1950’s.

Farmers enduring a drought need to be patient and so do investors pursuing these premiums via index funds. Their portfolios likely need some level of broad equity market exposure to stabilize performance during the inevitable droughts of value or small company stocks.

Investors using active managers face an additional source of performance droughts. Managers who have historically outperformed their benchmarks and their peers also have had prolonged periods of relative underperformance.