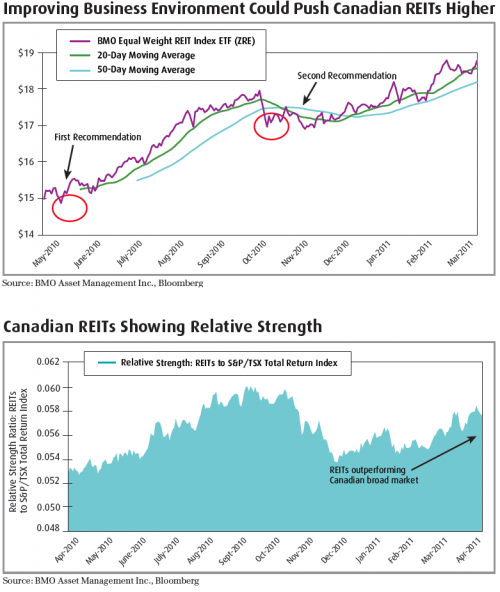

Though REIT s are traditionally interest rate sensitive and the prospects of the Bank of Canada raising rates are asymmetrically favourable to them electing to drop rates we continue to recommend overweighting this sector. Some investors were expecting a rate hike by this point coming into the new year. A strengthening loonie continues to serve as the major obstacle for the Canadian central bank as too high a Canadian dollar can choke off its exporting industry. In the event that interest rates do rise, we don’t envision quick successive rate hikes as there are no real concerns of inflation in Canada. Additionally, as economic fundamentals in Canada continue to improve and remain the best amongst G7 nations, better business conditions should prove favourable for both commercial and residential real estate.

Potential Investment Opportunity:

- BMO Equal Weight REIT Index (ZRE)

3) Precious Metals. Once again, we’re back on the precious metal train, which was our favourite trade of 2010. However, now we view precious metals favourably for slightly different reasons. Last year, we were attracted to gold as we believed investors would gravitate towards it as hedge against the euro, given the sovereign debt concerns of Portugal, Italy, Ireland, Greece and Spain. Additionally, the safe haven qualities of precious metals were attractive given investor concerns of a double-dip recession in 2010. This year, we believe precious metal investments will outperform, particularly in the back half of the year as investors become increasingly concerned about inflation.

Although the U.S. Federal Reserve (“Fed”) continues to claim there is no inflation with CPI currently at 2.7% year-over-year (y/y), the real concern is whether they can make that claim when economic conditions further improve. Currently, the massive increase in money supply has not yet led to major inflationary problems as most of this capital has not been loaned out by the banks. With tighter credit checks and weak business conditions, investors have not had incentive to apply for loans, as evidenced by the significant drop in the velocity of M2 money supply measure illustrated below. Should business sentiment improve and the Fed not be able to effectively remove stimulus measures, the velocity of money can very quickly accelerate, which compounded by the money multiplier effect could potentially lead to inflation scares. This should prove positive for precious metals.