Muni Investors: It’s Time to Quit Smoking Tobacco (Bonds) - Context

by Fixed Income AllianceBernstein

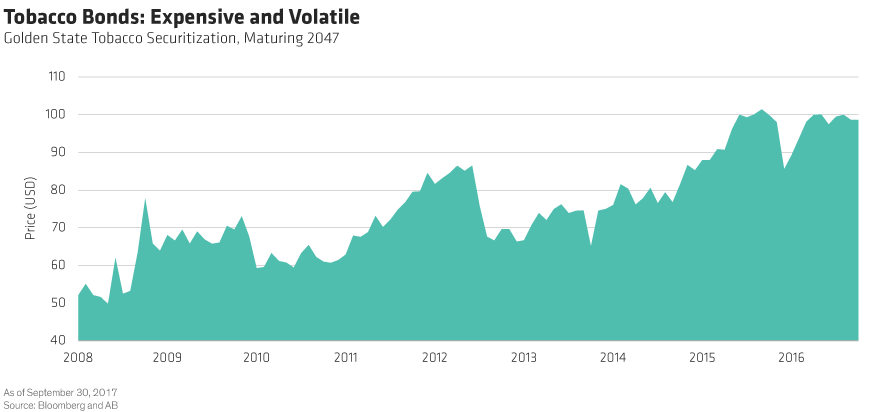

Cigarettes come with warning labels. Tobacco bonds should, too. These securities are highly volatile, and at current prices they have nowhere to go but down. There are healthier alternatives in the high-yield municipal bond market.

Tobacco bonds grew out of a landmark settlement with tobacco companies that awarded states billions of dollars a year, in perpetuity, in compensation for the healthcare costs of smoking. Many states decided to securitize their share of the payments by issuing bonds backed by the settlement revenue. This provided them with money up front for their immediate budget needs, which they would repay with interest to bondholders over time.

Over the years, tobacco bonds have become an important part of many municipal bond strategies. They account for nearly a quarter of the high-yield muni market, and over the past three years, they have outperformed stocks by 3% annualized. That’s largely because of high investor demand for a liquid sector in a market where supply has been limited.

But tobacco bonds are nearly as volatile as the equity market, and almost twice as volatile as the rest of the high-yield muni market. They’re also expensive. Three years ago, prices were practically at fire-sale levels, as the following Display illustrates. Today, they’re approaching par. At these prices, we doubt that investors are being adequately compensated for their risk.

Cigarettes: Hazardous to Your Health and Your Portfolio

What makes tobacco bonds risky? Simply this: their payments are based on cigarette consumption. Anything that affects demand for cigarettes and cigarette shipments—for better or for worse—affects the pricing of tobacco bonds.

That’s worth thinking about, because federal, state and local governments have been working hard for years to discourage smoking by proposing nicotine limits in cigarettes, higher tobacco taxes, regulations on indoor smoking and other measures. The result: smoking has been on the decline for decades—a trend that’s likely to continue. Altria’s third-quarter earnings showed that sales of its flagship Marlboro cigarettes were down 3.9% this year through September and 6.2% in the third quarter alone. California’s recently adopted $2-per-pack cigarette tax may have contributed to the quarterly sales decline.

The rise of e-cigarettes is also important, as the settlement payments to states do not include proceeds from e-cigarettes, nicotine gum, pipe tobacco and other noncigarette revenue.

Should declines in smoking and cigarette revenue accelerate, some tobacco bonds may be vulnerable to default. If these securities were trading at a steep discount, that might be a risk worth taking. But at today’s elevated prices, the potential reward just doesn’t justify the risk.

Want to Avoid Risk? Stay Active.

Here’s something else to keep in mind: investors who use passive strategies to access the high-yield muni market are locking in hefty exposure to tobacco bonds. Why? Because passive strategies simply replicate a broad market index, and tobacco bonds, as we’ve already seen, account for a large share of the high-yield muni market.

The answer, of course, isn’t to give up on high-yield munis altogether. There’s plenty of value in this part of the market, much of it in less volatile sectors such as senior living facilities and hospitals, and exposure can add income potential. But the best way to access high-yield munis is with an actively managed strategy. This allows investors and their managers to tactically underweight or overweight a particular sector and single out attractively valued securities within sectors.

Municipal bonds are a bedrock of an investor’s overall asset allocation, and careful security selection and hands-on management are essential ingredients to success. Overexposure to volatile and overvalued securities can make it harder to preserve capital. That’s why we think it’s time for muni investors to think about cutting down on tobacco.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein

_d2 (002).png)