by Jeffrey Saut, Chief Investment Strategist, Raymond James

I have written before how fantasy football is one of my favorite hobbies. For an analytical, data-obsessed sports fan like myself, it doesn’t really get any better than diving into statistics to try to draft a team of players that will beat my friends and win the trophy at the end of the season (and yes, we do have a real trophy). The origins of fantasy football can be traced all the way back to 1962, but the once fringe pastime has really exploded in popularity over the last 15 years as the internet has made it much easier to get stats, create leagues, and connect players together. The Fantasy Sports Trade Association estimates that 59.3 million people in the United States and Canada will play fantasy sports in 2017, and football is, by far, the most popular sport. The FSTA’s research also uncovered some interesting and somewhat surprising data points about the characteristics of those millions of players:

- 66% male/34% female

- Average age: 38.6

- College degree or more: 66%

- Have a household income of $75k+: 51%

- Have full-time employment: 67%

- Average annual spending per fantasy player (age 18+): $556

If you do the math, that means people are spending almost $33 billion of their hard-earned money on a game that actually has the word “fantasy” in the title, and if that’s not a sign that the economy is doing ok, I don’t know what it is.

Of course, I’m not just talking about fantasy football here because it’s been a slow week in the financial markets (although it has been). There are many parallels between creating a winning team and creating a winning investment portfolio, and some of the same skills translate to success in both disciplines:

- Valuation plays a big part – part of the keys to success in both is identifying those situations where the “market” may be overvaluing or undervaluing specific players or stocks.

- Past performance is not a guarantee of future returns, but it is true that the top players and stocks often stay strong for years.

- Mistakes and unexpected hiccups will occur along the way – maybe one of your top draft picks gets injured or one of your top stocks releases disappointing earnings results. Flexibility and the ability to regularly reevaluate are crucial.

- Takes maintenance over time to really find success – it’s said that fantasy football championships aren’t won at the draft because there are still plenty of decisions to be made throughout the season. Similarly, one’s investment goals aren’t met when first picking a portfolio. It requires modifications over time as situations change.

- Developing a personal strategy that works for you is one of the keys to success. Do you take on more risk by drafting a guy (buying a stock) that may have a lot of upside but has a history of volatility (or no history in the case of a rookie or an IPO) or do you stick with the blue chip players (stocks) that may not have the high ceiling that they once did but should be more dependable on a regular basis and provide a steady return? The former strategy may be what it takes to beat out everyone and win a league (generate outsized returns), but the latter strategy may maximize one's chances at making the playoffs and at least having a chance to win it all (or maximizing the chance at achieving one's long-term goals).

In the spirit of the game and draft season, we decided to put together a “Fantasy Football Portfolio” that consists of a few investment ideas that could form the foundation of our “team.” The idea is supposed to be fun, but keep in mind these are all companies rated Strong Buy by our fundamental analysts, and we also tried to find situations where the charts are looking interesting as well. You may not want to actually create a portfolio out of the handful of stocks, but at least it may provide you with some ideas if you’re looking to put cash to work at some point soon. And just like you can’t pick all quarterbacks or all wide receivers in fantasy football, we tried to spread our picks out across several different asset classes and sectors to provide some level of diversification.

“QB”: The quarterback is the only player to touch the ball on every snap, so, naturally, they tend to score fairly consistently from week-to-week and have a relatively high floor. For our “quarterback,” we looked for a stock in our Strong Buy-rated coverage universe that had a history of consistency (even though future consistency is certainly not guaranteed) and came up with Republic Services Inc. (RSG/$64.37/Strong Buy). Its trend over the last few years has been up, and, when combined with a decent dividend, feels like a good core holding for our team.

“RB”: The running backs are the fantasy football workhorses, with potential for big gains but also slightly risky due to injury concerns, shared workload, and the occasional game when going up against a great run defense. For purposes of our portfolio, we looked for stocks with nice upside potential but that may require taking on a little more risk. Salesforce.com (CRM/$94.10/Strong Buy) has been pretty volatile the last couple of years, but is currently breaking out to new highs at a time when not many stocks are, so we’ll put that in one RB slot. And for the other, Alibaba Group Holdings Ltd. (BABA/$171.74/Strong Buy). BABA has performed very well over the last year and retains upside potential, but it’s also extremely overbought right now and there’s a threat of some reversion to the mean.

“WR”: Except for a handful of top guys each year, wide receivers are usually pretty boom or bust since they’re going to touch the ball less than the quarterback and running backs on a weekly basis. They can win you a week but can also put up a low point total that can severely limit your chances for success. In the stock market, these are the high risk/high reward companies that can really help you beat the averages if you catch one right, but you also must cut the positions quickly if they start to go south on you. For our “wide receivers,” we’ll take: Applied Optoelectronics Inc. (AAOI/$62.30/Strong Buy), a high-flying stock since the first half of 2016 that has now pulled back from over $100 to possible support above $60; Flexion Therapeutics (FLXN/$24.48/Strong Buy), which has also been very volatile over the last few months, but has recently been showing better technical action; and Antero Resources Corporation (AR/$19.68/Strong Buy), which is near its lowest level in the past couple of years, but last week bettered the highs of the previous two weeks in a possible sign of buying support.

“TE”: Tight ends, in the modern game, function mostly as bigger, slightly slower receivers, and they generally have less upside than running backs and wide receivers in fantasy football. Basically, we’re looking here for a large cap stock that has a history of providing consistent returns (though, once again, future returns are never guaranteed in the markets or in fantasy football). Equinix Inc. (EQIX/$466.19/Strong Buy) is a $36 billion company that remains in a clear uptrend, pays a decent dividend, and seems to fit our requirements.

“Def/K”: For our purposes here, we’ll cheat a little bit and combine the team defenses, special teams, and kickers since these are positions on your fantasy football roster that are rarely going to win you your league, but that can provide consistent returns in each matchup if selecting correctly. We’ll take Dollar General Corporation (DG/$77.67/Strong Buy), which seems to have broken its downtrend last week, and Weyerhaeuser Co. (WY/$31.70/Strong Buy), which has been range-bound the last couple of years but maintains a good dividend yield and may be nearing support just above $30.

So, those are the players on our “team,” though, of course, you’ll want to make sure they fit into your “team” before pulling the trigger and “drafting” them. We also maintain some restraint right now when it comes to the overall markets since the averages haven’t really provided clear signs of the low being made, but, of course, there may be individual attractive situations that justify being a little more aggressive.

Overall, not much has really changed since last Monday’s comments, with the S&P 500 right about in the middle of its trading range over the last two weeks. We are being patient for now, though it’s starting to feel practically EVERYONE assumes the market is about to head down, even the bulls, like us, that have pointed out the long-term tailwinds still in place. We actually don’t recall seeing one near-term positive opinion across all our go-to research sources, which may mean sentiment has swung way too far in the negative direction (or maybe we just have really good research sources). U.S. equity funds have also seen 10 straight weeks of outflows, according to Bank of America Merrill Lynch, the longest such streak since 2004. Remember, though, the major averages can sometimes correct “in time” rather than “in price” and perhaps that’s what we’re experiencing right now considering the S&P 500 really hasn’t gone anywhere since the beginning of June. Under the surface of the market, however, individual stocks have been correcting, with the percentage of stocks on the NYSE above their 50-day moving averages shrinking from 75% on July 19 to 39% on August 17. Stocks in the S&P 500 were also down an average of 12.5% from their 52-week highs on Friday August 18 and that number has not really improved much since then despite the S&P 500, itself, closing up last week.

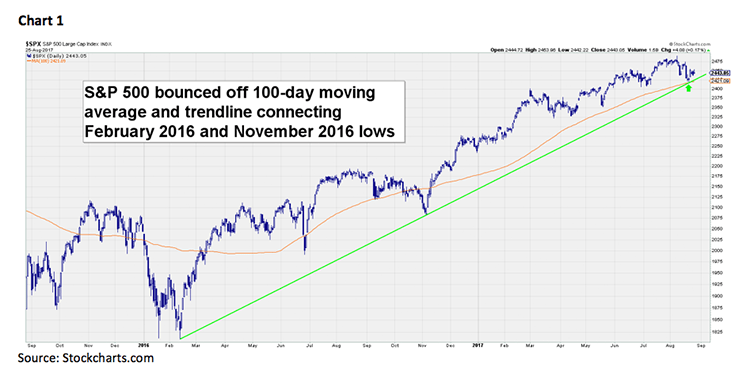

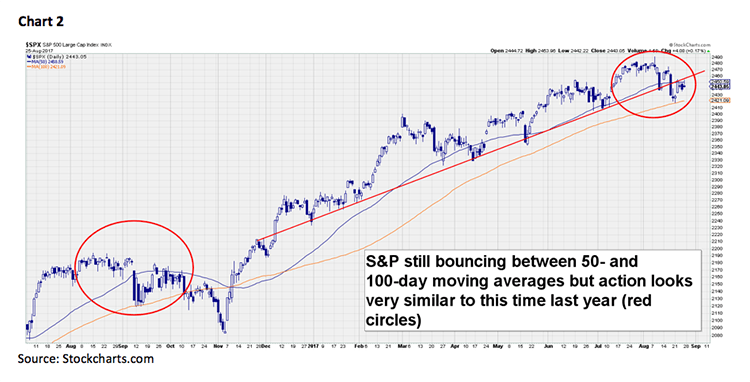

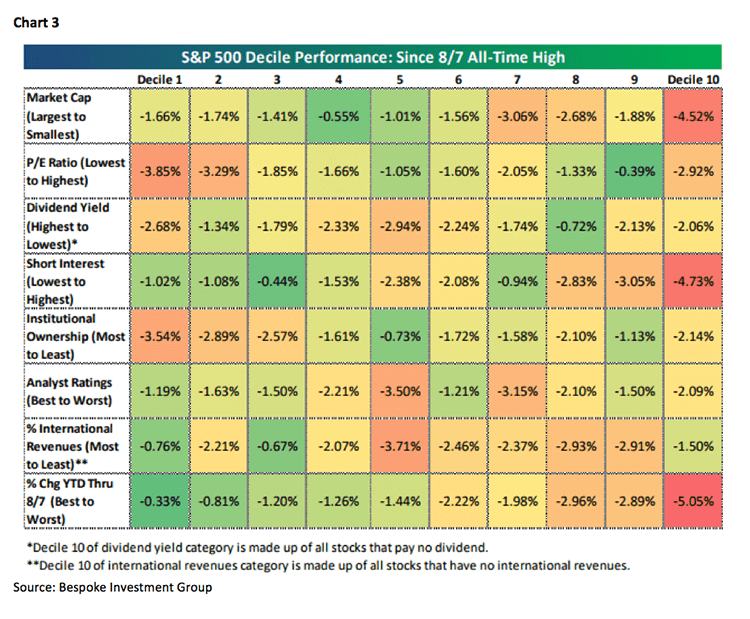

The call for this week: When we add everything up, the near-term picture appears to remain neutral. Not enough damage has been done to throw up major red flags or break the intermediate-term trend (see chart 1 on the next page), and, as mentioned, sentiment does seem to already be rather negative right now. However, the nearer-term S&P 500 support line was broken last week and the index remains below its 50-day moving average, supporting at least some caution. The action is reminiscent of what we experienced around this time last year, as an August slowdown in U.S. stocks eventually turned into a mild two-month down-move that took us into the pre-election low (see chart 2). Breadth indicators and measures of demand also did not really pick up last week despite the higher finish and Bespoke Investment Group notes that since the S&P 500 made its last closing high on August 7, stocks with the most institutional ownership have noticeably underperformed, possibly signaling the smart money has been exiting lately (see decile chart 3 on page 5). The week before Labor Day is often rather quiet and light on volume, so, if that should happen this week, any moves should probably be taken with a grain of salt. Yet, the economic calendar is actually fairly busy, culminating in the Friday jobs report, which will provide some news worth monitoring. The damage from Hurricane Harvey will be assessed as well, with gasoline futures surging to a two-year high while oil prices are actually down (we’re still thinking of our friends in Texas and hope everyone is doing ok). All in all, it’s a very similar story to the last two weeks; we remain cautious, but do not advise you to get bearish.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

The opinions offered by Mr. Saut should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your Raymond James Financial Advisor.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.

Copyright © Raymond James