by Doug Drabik, Fixed Income, Raymond James

Prior to the quantitative easing (QE) programs set forth by the Federal Reserve, their balance sheet was roughly $915 billion (December, 2007). Following the monetary easing policy and scheduled large open market purchases, the Fed’s balance sheet has ballooned to $4.5 trillion. The Fed ran these programs between 2008 and 2015 but they are not the only central bank involved. The People’s Bank of China, Bank of Japan, European Central Bank and Swiss National Bank are among current active open market purchasers. The significance is large as the global aggregate has surpassed $19 trillion. To put this in perspective, that is roughly the size of the entire US gross domestic product (GDP).

The Fed’s balance sheet does not act like that of any local Bank. The Fed deposits or credits the bank accounts of the organization that sold the bond, in essence “creating” new cash that is now in the system and can be used by the commercial banks to lend. This expansion policy is meant to generate business through loans at lower interest rates ultimately expecting businesses to grow, hire and/or prosper in the process.

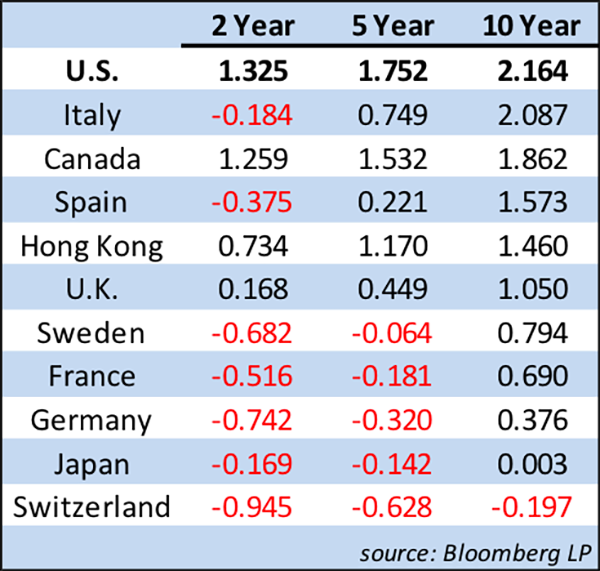

As these activities have developed, many global effects are playing a role including global interest rate disparity. The US rates remain significantly higher providing for continued demand for US bonds and a continued flow of real money into US markets. The cost of capital continues to be subdued but has fostered an unusual circumstance of accommodative/expansionary policy with modest yet continued growth coupled with little or no inflation. The excessive amount of cash persists in seeking yield with few choices boasting returns meeting investor expectations. Is the lack of return pushing investors to disproportionately allocate assets to riskier alternatives?

The upcoming Fixed Income Quarterly (FIQ) will dive deeper into many current key factors influencing the yield curve and thus influencing investors’ actions including: central bank influence (printing money), inflation, demographics and interest rate disparity. Some of these influences can while others may not be able to be controlled. While the global central banks continue to pump money into the markets, there is sufficient reason to believe that interest rates may remain low for the foreseeable future.What is most important is that you don’t allow these powerful distractions to deter long-term investment strategy by swaying from appropriate asset allocations that protect assets regardless of interest rate volatility.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Copyright © Raymond James